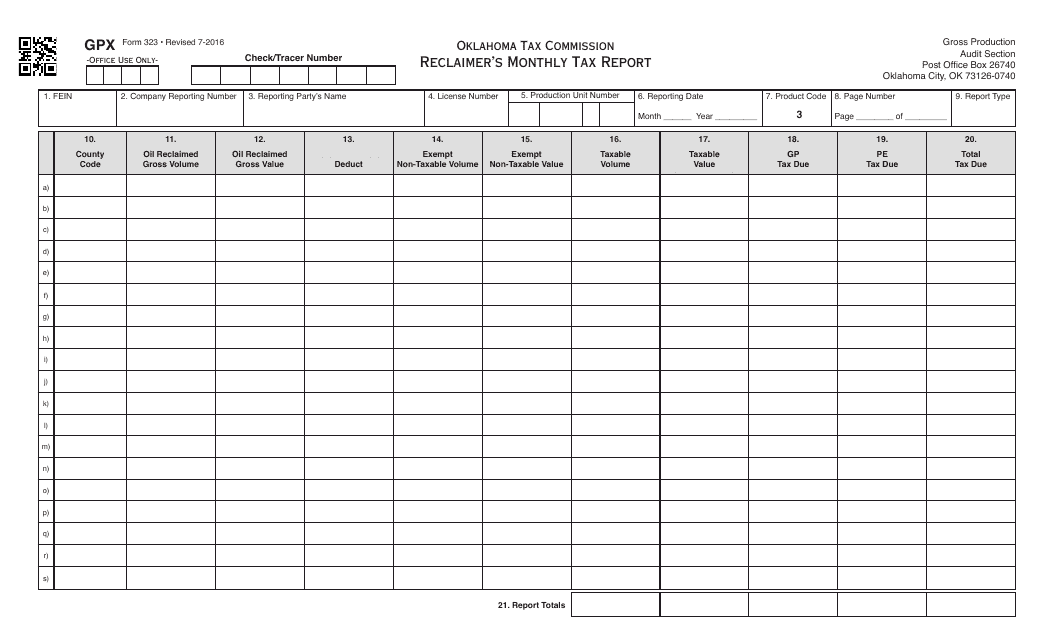

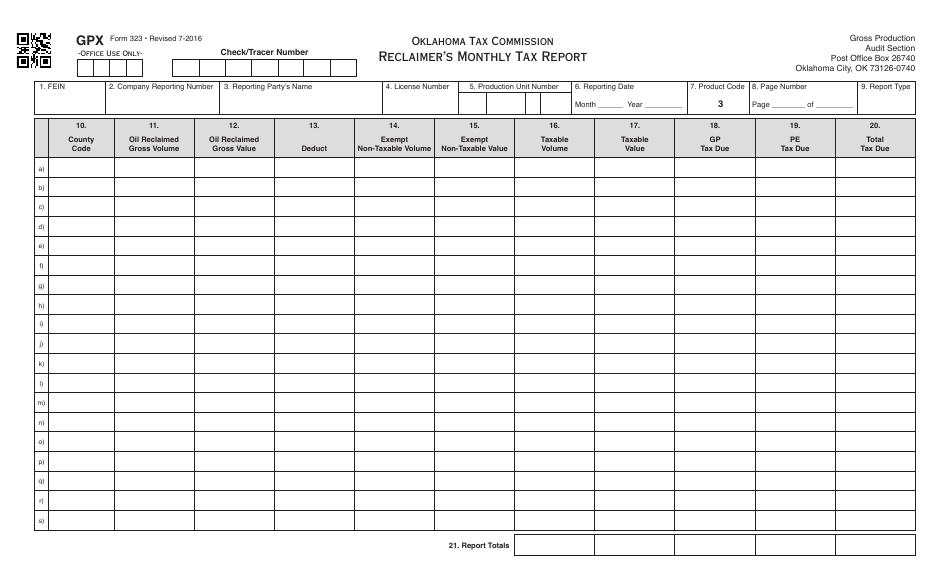

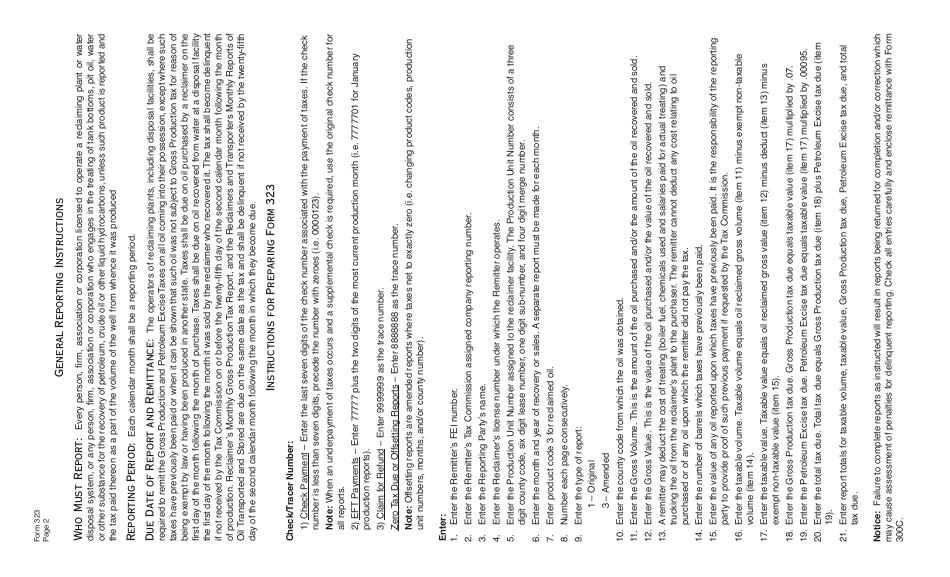

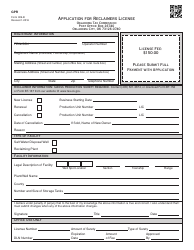

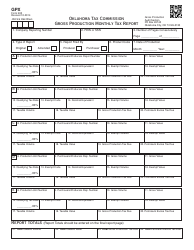

OTC Form 323 Reclaimer's Monthly Tax Report - Oklahoma

What Is OTC Form 323?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 323?

A: OTC Form 323 is the Reclaimer's Monthly Tax Report.

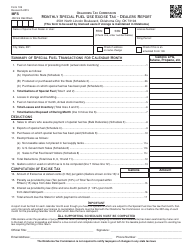

Q: What is the purpose of OTC Form 323?

A: The purpose of OTC Form 323 is to report and remit taxes for reclaimers in Oklahoma.

Q: Who needs to file OTC Form 323?

A: Reclaimers operating in Oklahoma need to file OTC Form 323.

Q: How often do reclaimers need to file OTC Form 323?

A: Reclaimers need to file OTC Form 323 on a monthly basis.

Q: What taxes are reported on OTC Form 323?

A: OTC Form 323 is used to report and remit the tax on the first sale or use of reclaimed materials in Oklahoma.

Q: What are the penalties for not filing OTC Form 323?

A: Penalties for not filing OTC Form 323 may include late fees, interest charges, and possible legal consequences.

Q: Are there any exemptions or deductions on OTC Form 323?

A: No, OTC Form 323 does not provide for any exemptions or deductions.

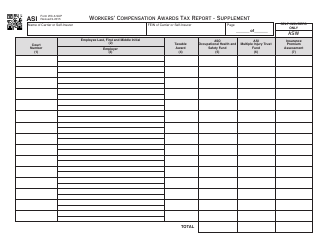

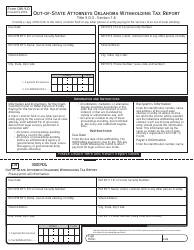

Q: What information is required to complete OTC Form 323?

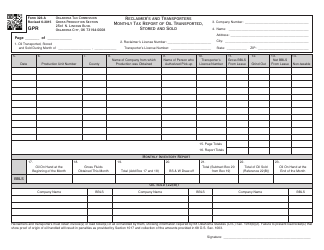

A: To complete OTC Form 323, reclaimers need to provide information about reclaimed materials, sales and use tax due, and other related data.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of OTC Form 323 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.