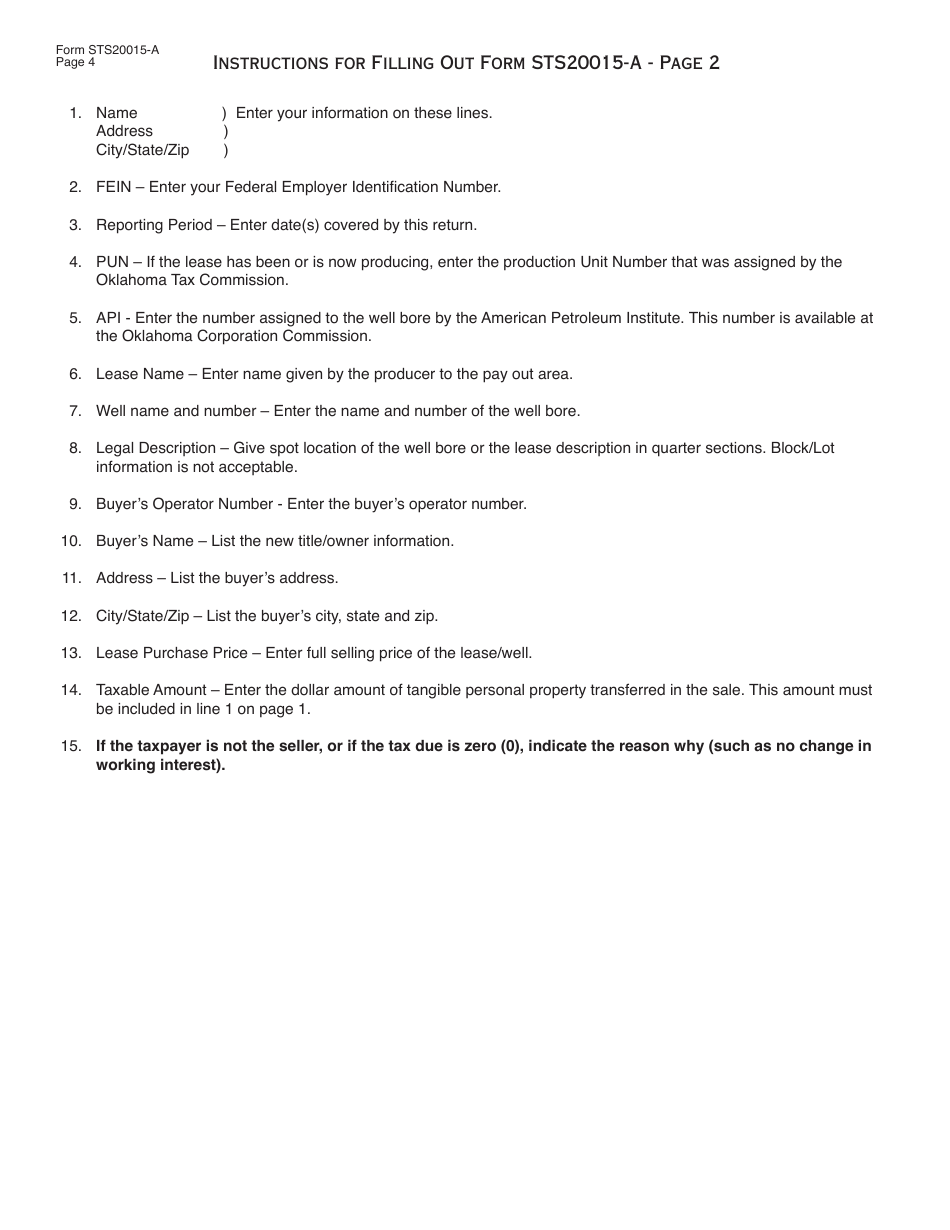

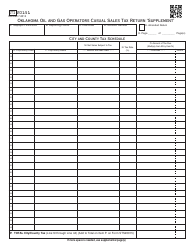

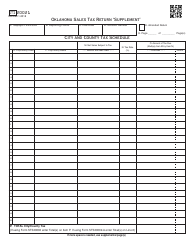

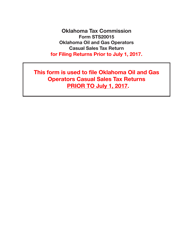

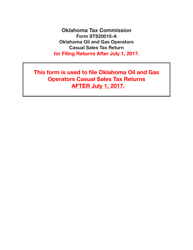

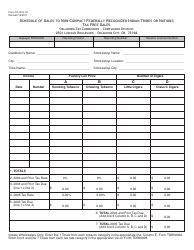

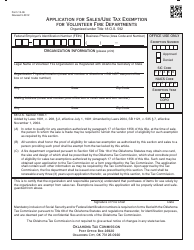

OTC Form STS20015-A Oklahoma Oil and Gas Operators Casual Sales Tax Return - Oklahoma

What Is OTC Form STS20015-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form STS20015-A?

A: OTC Form STS20015-A is the Oklahoma Oil and Gas Operators Casual Sales Tax Return.

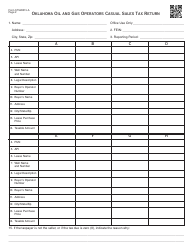

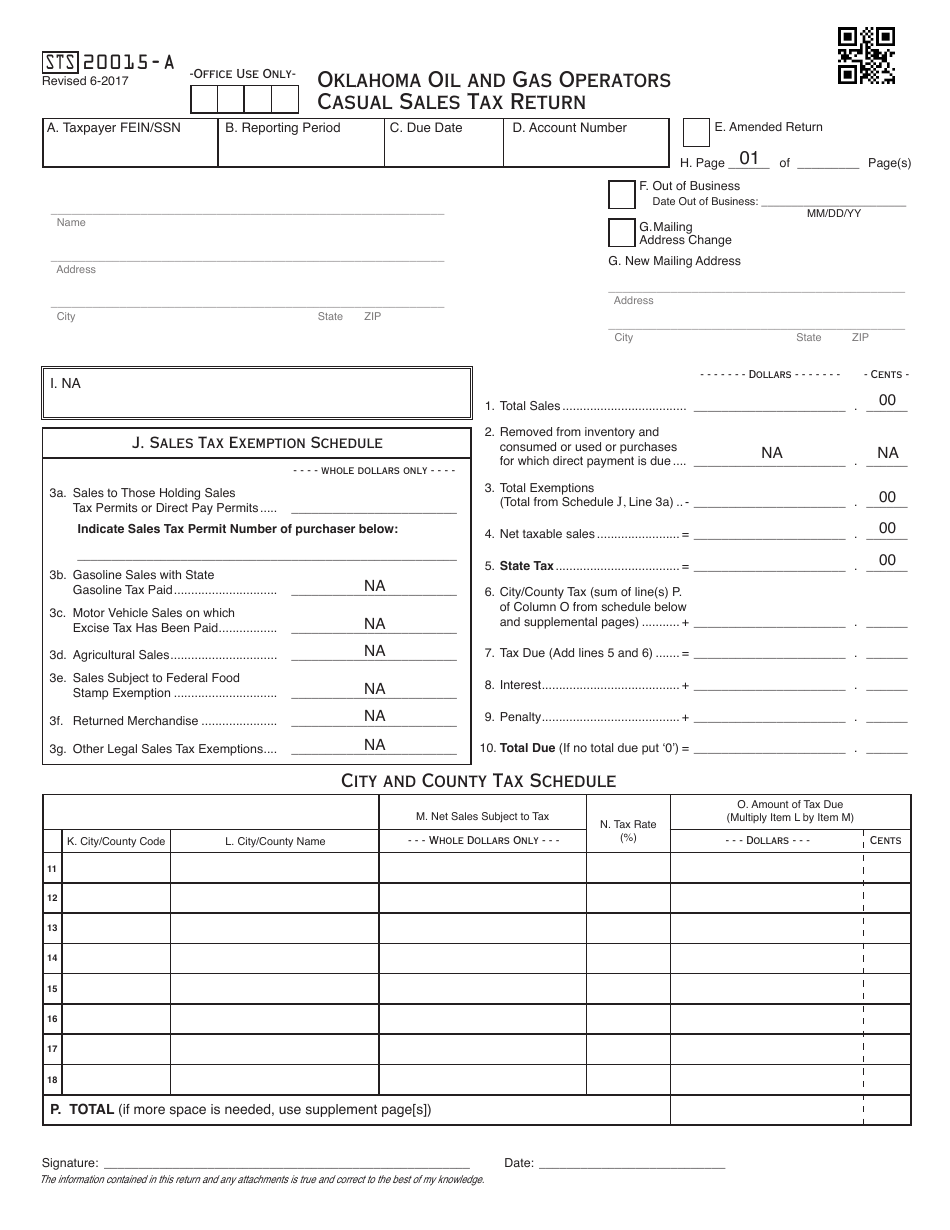

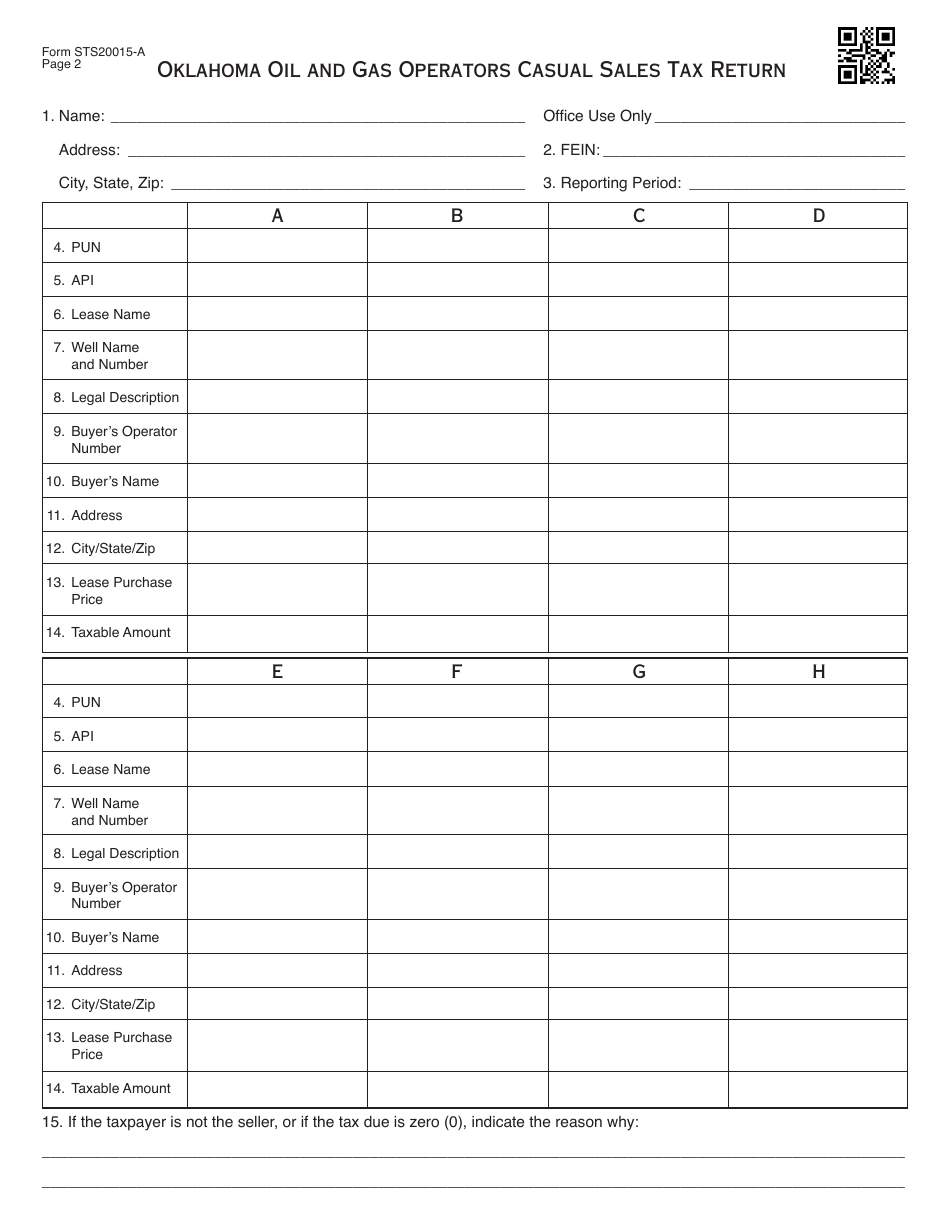

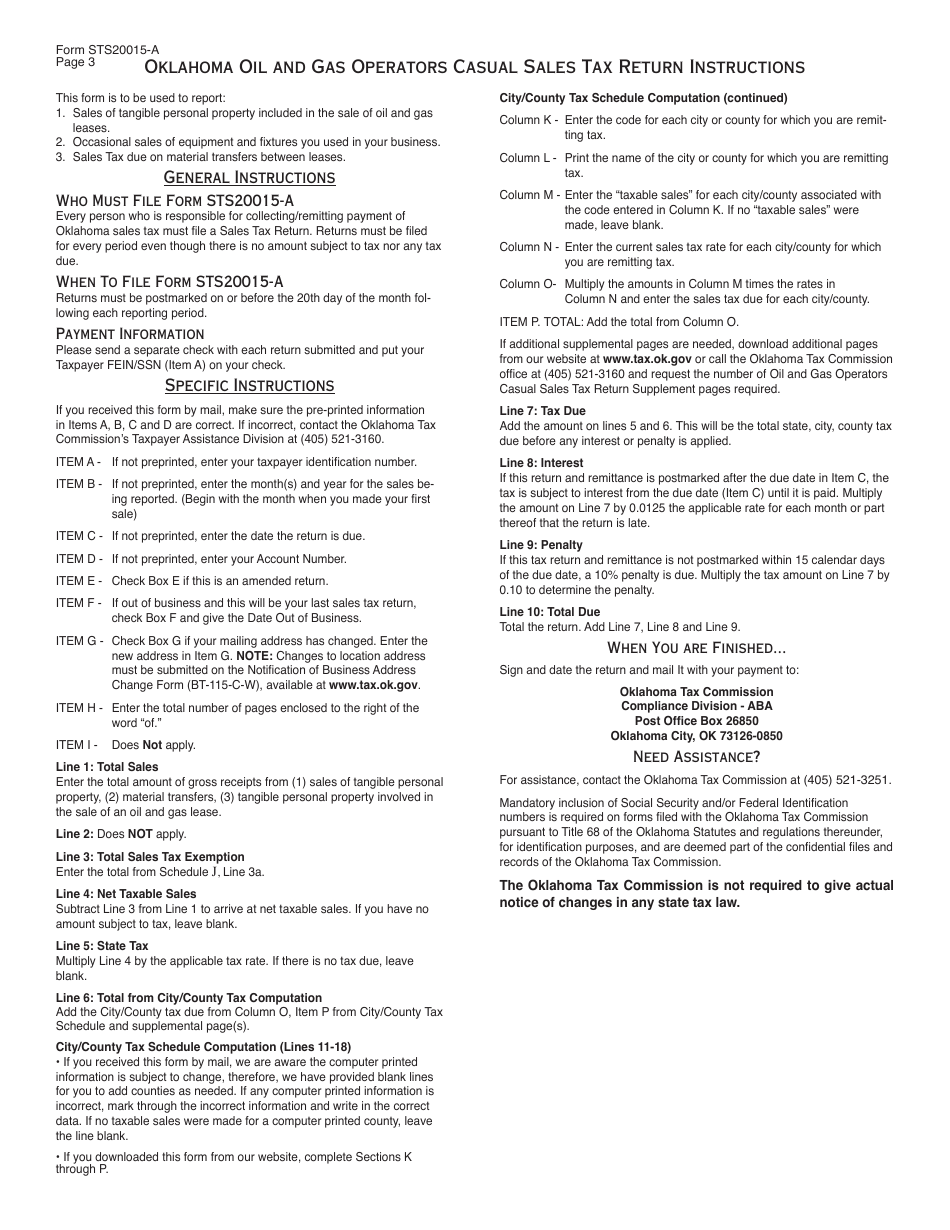

Q: Who is required to file OTC Form STS20015-A?

A: Oklahoma oil and gas operators who engage in casual sales are required to file this form.

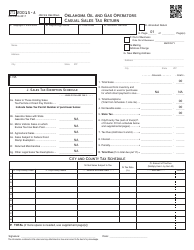

Q: What is the purpose of OTC Form STS20015-A?

A: The purpose of this form is to report and remit sales tax liabilities for casual sales made by oil and gas operators in Oklahoma.

Q: What is a casual sale?

A: A casual sale is a one-time or occasional sale of tangible personal property or taxable services that are not a part of the regular business activities of an oil and gas operator.

Q: When is OTC Form STS20015-A due?

A: OTC Form STS20015-A is due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing or non-filing of OTC Form STS20015-A?

A: Yes, penalties may apply for late filing or non-filing of OTC Form STS20015-A. It is important to submit the form on time to avoid penalties.

Q: Who should I contact for more information about OTC Form STS20015-A?

A: For more information about OTC Form STS20015-A, you can contact the Oklahoma Tax Commission directly.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form STS20015-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.