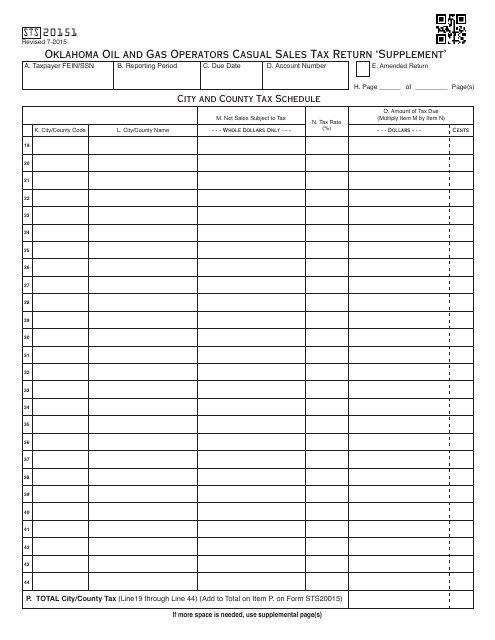

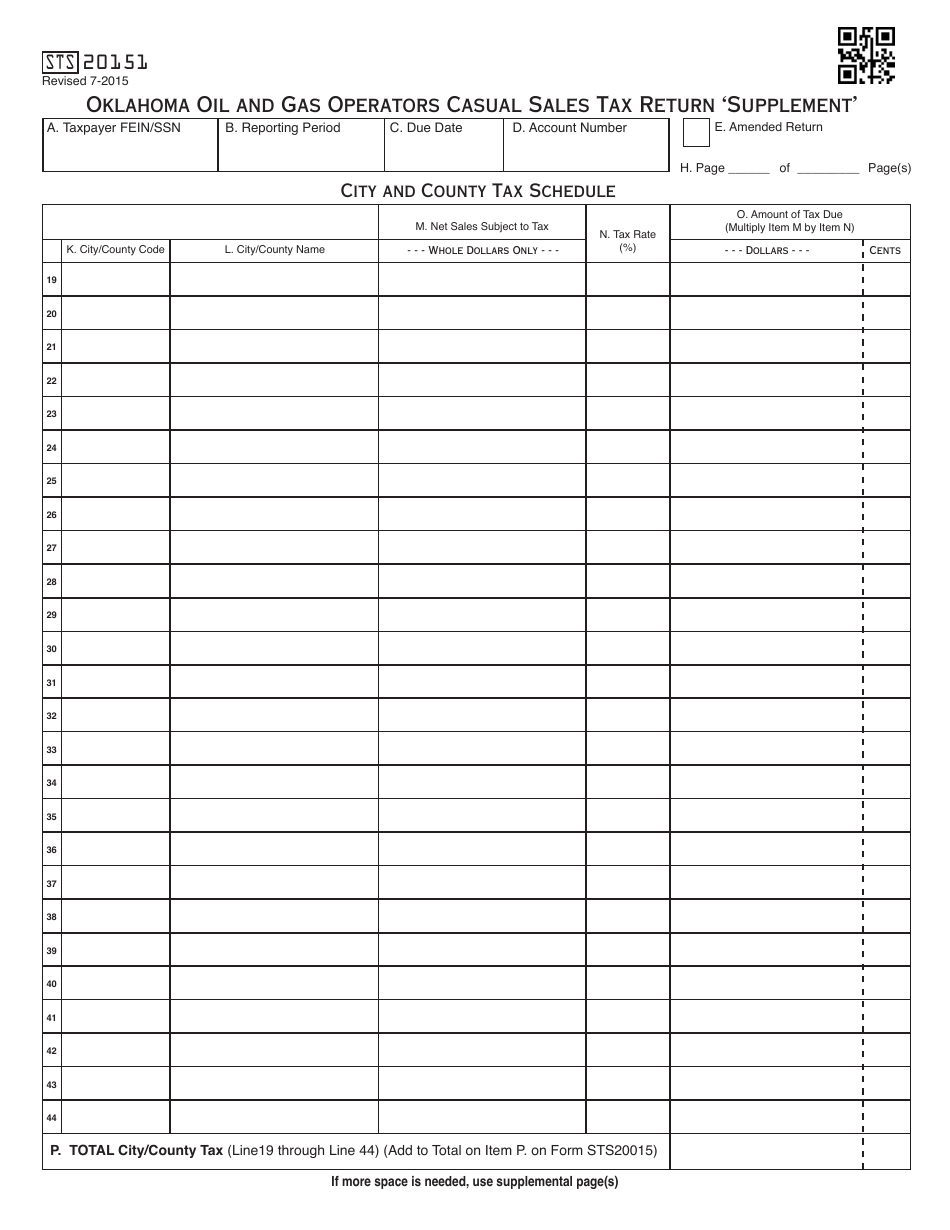

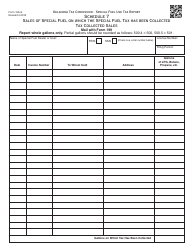

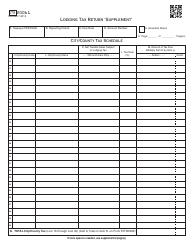

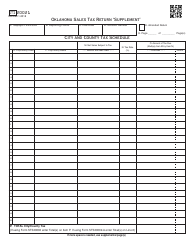

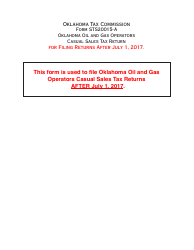

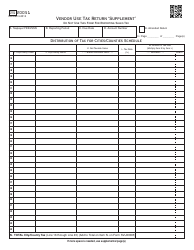

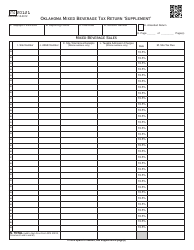

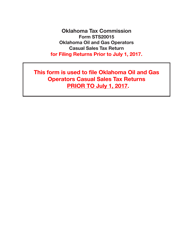

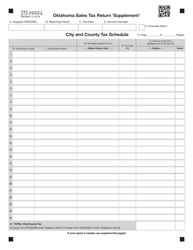

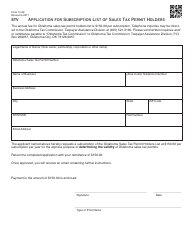

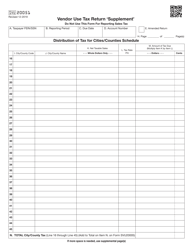

OTC Form STS20151 Oklahoma Oil and Gas Operators Casual Sales Tax Return 'supplement' - Oklahoma

What Is OTC Form STS20151?

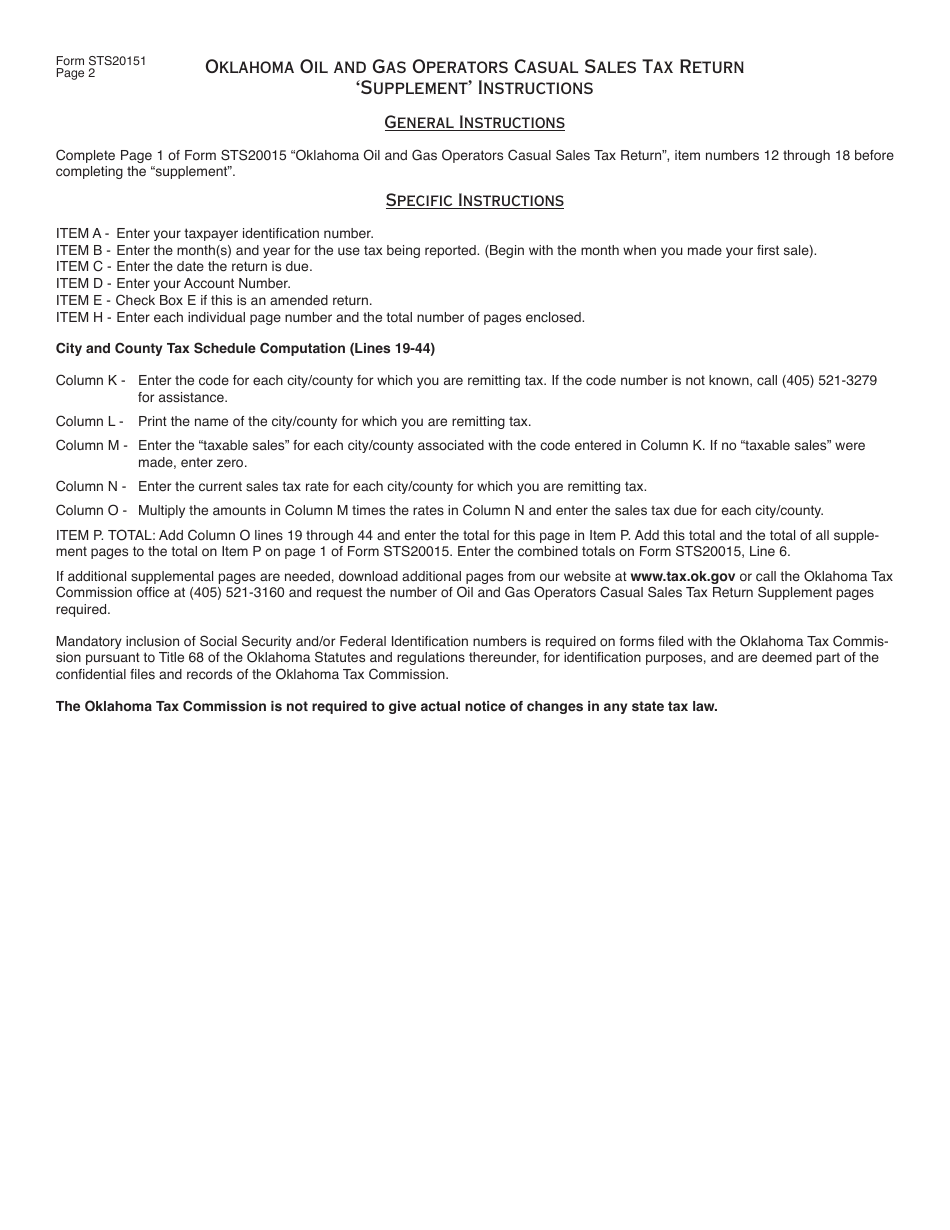

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form STS20151?

A: OTC Form STS20151 is the Oklahoma Oil and Gas Operators Casual Sales Tax Return supplement.

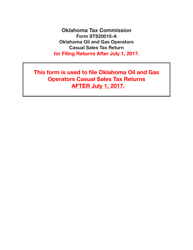

Q: Who is required to file OTC Form STS20151?

A: Oklahoma oil and gas operators who engage in casual sales are required to file OTC Form STS20151.

Q: What is the purpose of OTC Form STS20151?

A: The purpose of OTC Form STS20151 is to report and remit sales tax on casual sales made by Oklahoma oil and gas operators.

Q: What is a casual sale?

A: A casual sale is a one-time or occasional sale of tangible personal property by an Oklahoma oil and gas operator, and not part of their regular business operations.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form STS20151 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.