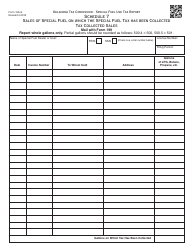

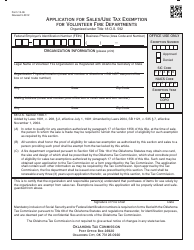

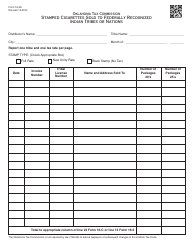

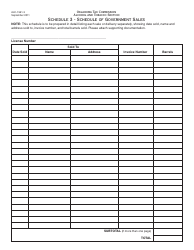

OTC Form 18-10-S-10 Schedule of Sales to Non-compact Federally Recognized Indian Tribes or Nations Tax Free Sales - Oklahoma

What Is OTC Form 18-10-S-10?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 18-10-S-10?

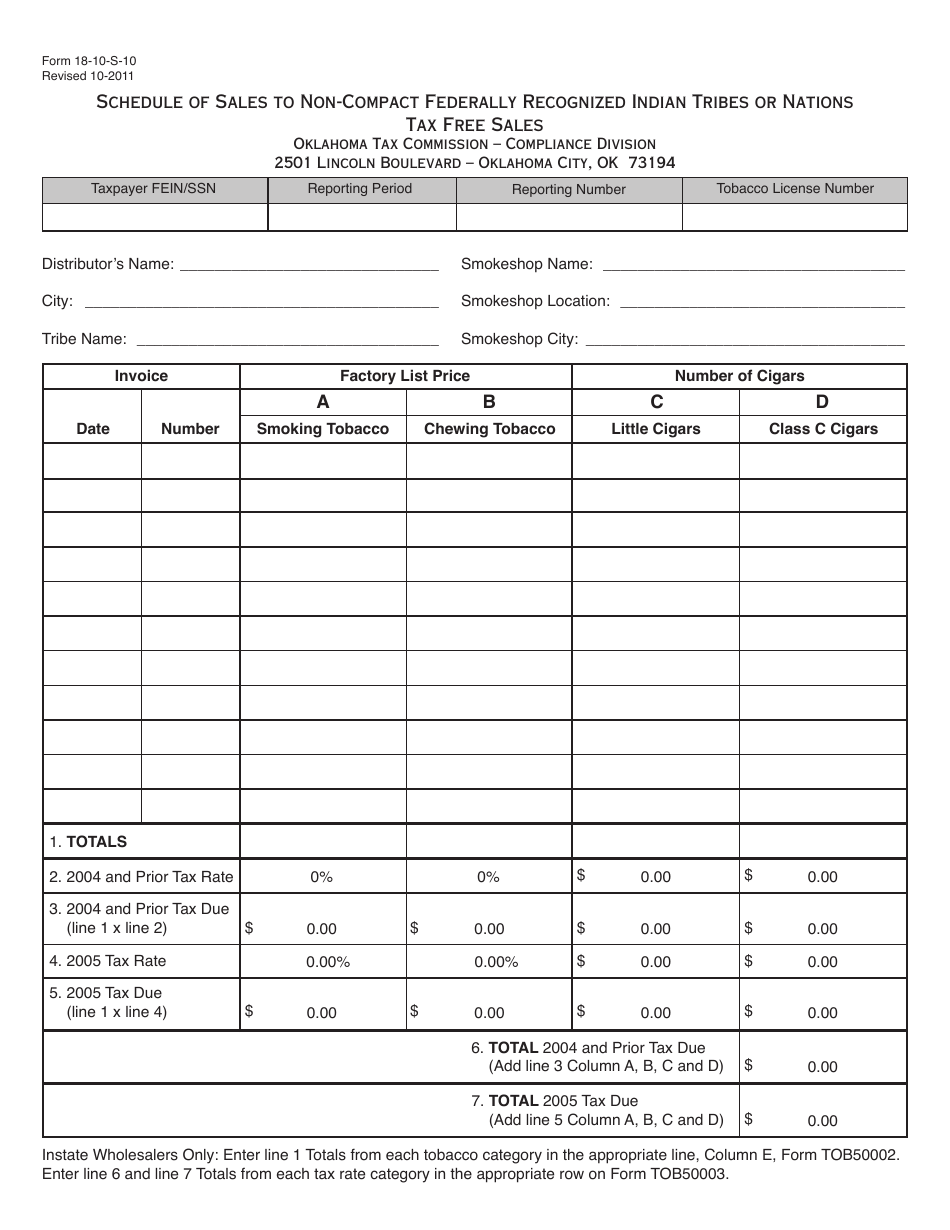

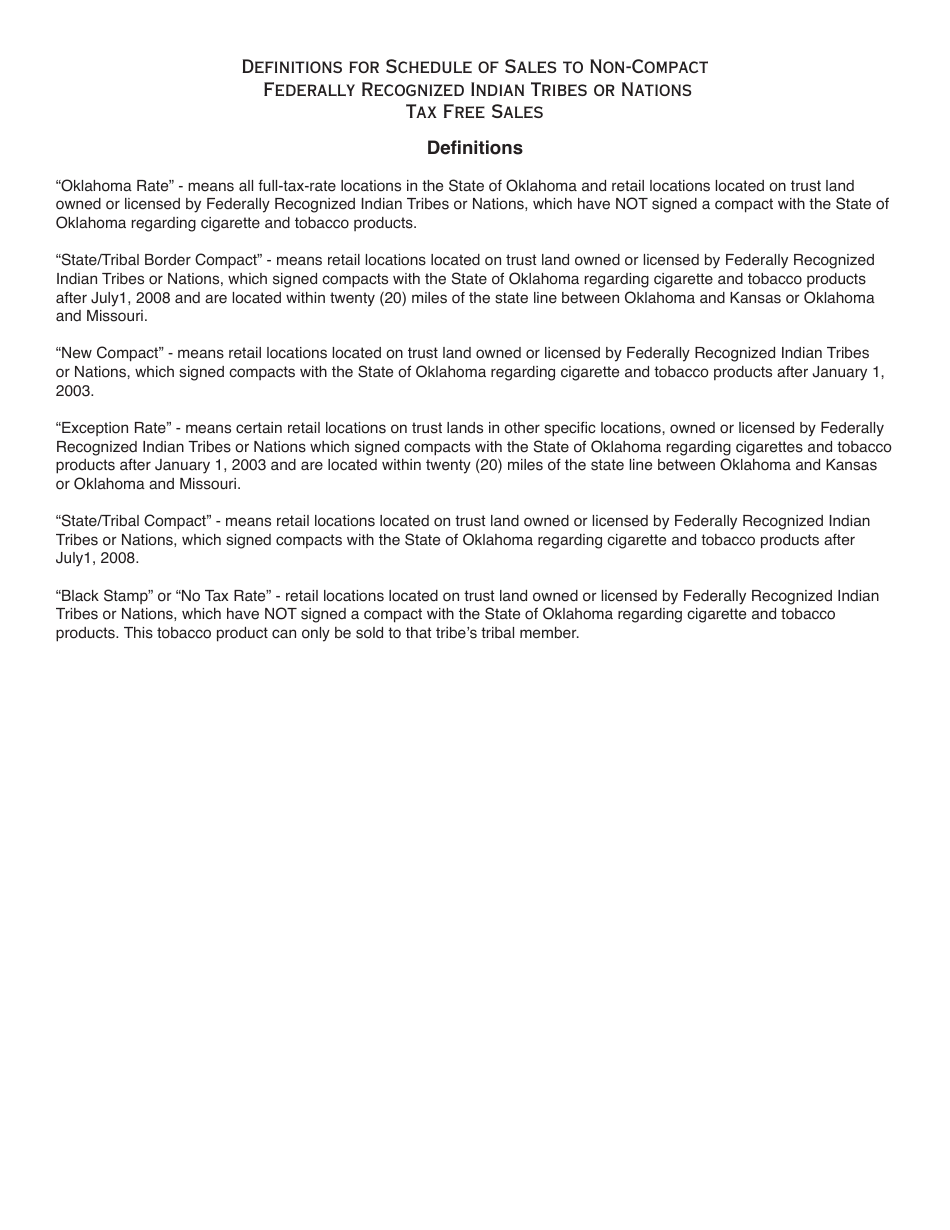

A: OTC Form 18-10-S-10 is a form used for reporting tax-free sales to non-compact Federally Recognized Indian Tribes or Nations in Oklahoma.

Q: Who needs to fill out OTC Form 18-10-S-10?

A: Businesses in Oklahoma that make tax-free sales to non-compact Federally Recognized Indian Tribes or Nations need to fill out this form.

Q: What is the purpose of OTC Form 18-10-S-10?

A: The purpose of this form is to report tax-free sales to non-compact Federally Recognized Indian Tribes or Nations in Oklahoma.

Q: What information is required on OTC Form 18-10-S-10?

A: The form requires information such as the name of the purchaser, date of the sale, type of items sold, and the total tax-free sale amount.

Form Details:

- Released on October 1, 2011;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 18-10-S-10 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.