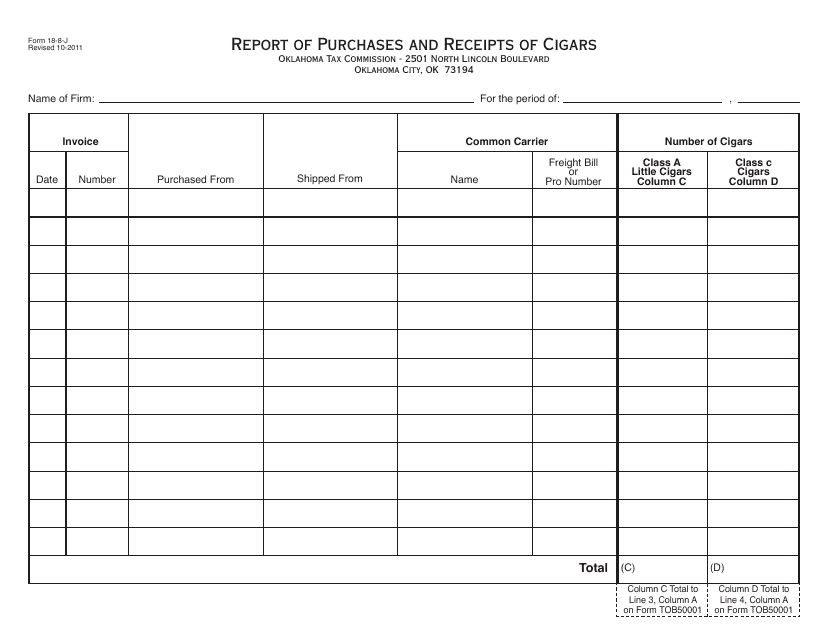

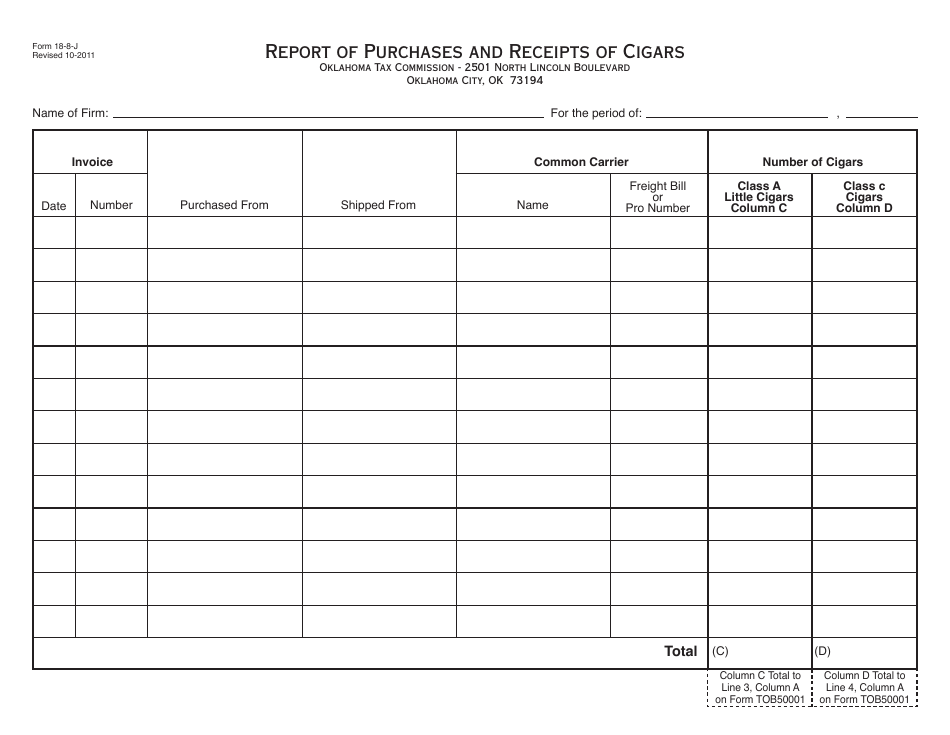

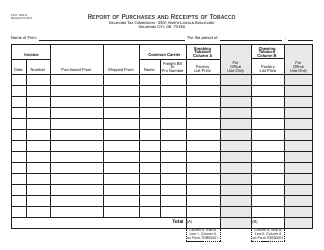

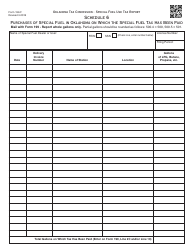

OTC Form 18-8-J Report of Purchases and Receipts of Cigars - Oklahoma

What Is OTC Form 18-8-J?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 18-8-J?

A: OTC Form 18-8-J is a report used for documenting purchases and receipts of cigars in Oklahoma.

Q: Who needs to submit OTC Form 18-8-J?

A: Businesses that buy or receive cigars in Oklahoma must submit OTC Form 18-8-J.

Q: What is the purpose of OTC Form 18-8-J?

A: The purpose of OTC Form 18-8-J is to track and regulate the distribution of cigars within Oklahoma.

Q: Is OTC Form 18-8-J specific to Oklahoma?

A: Yes, OTC Form 18-8-J is specific to reporting purchases and receipts of cigars in Oklahoma.

Form Details:

- Released on October 1, 2011;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 18-8-J by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.