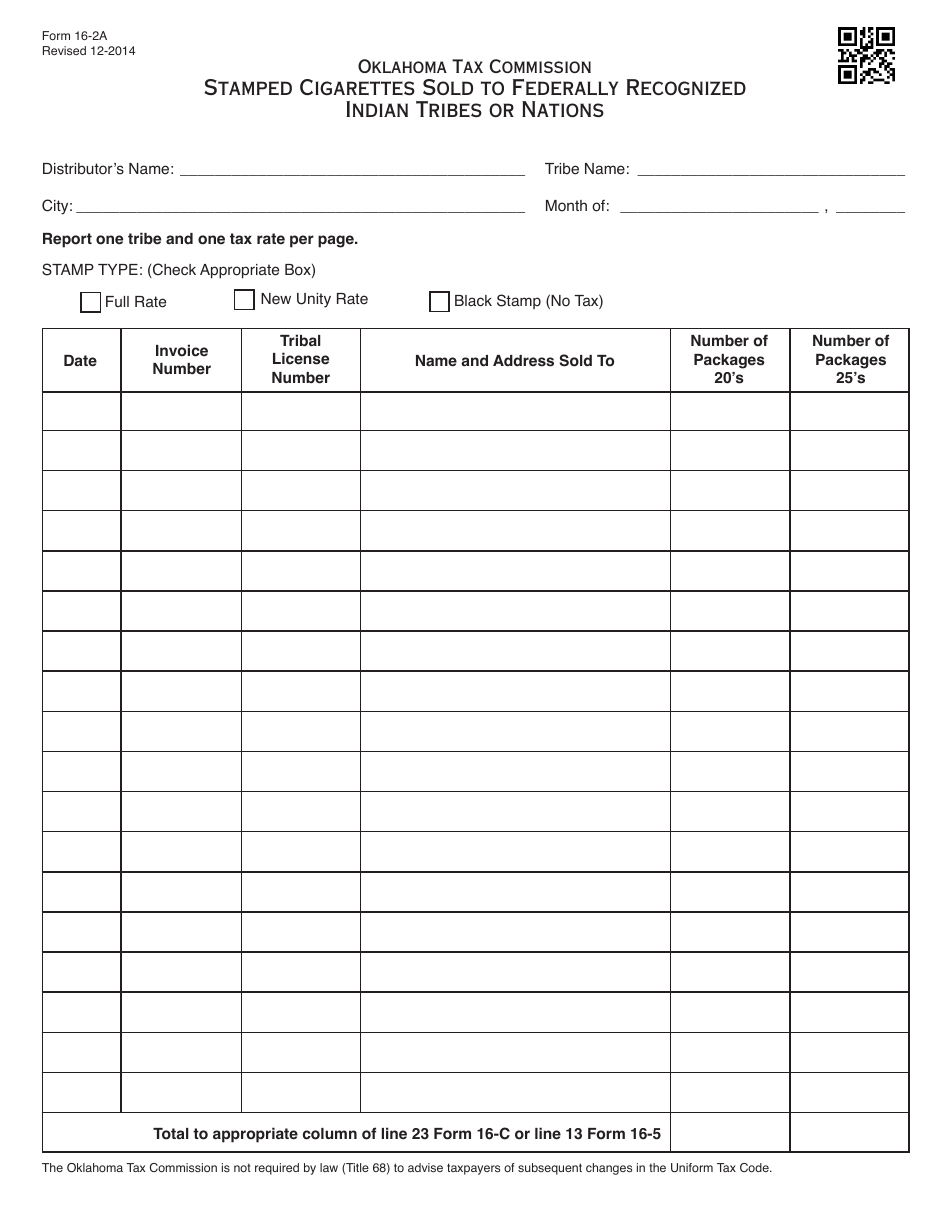

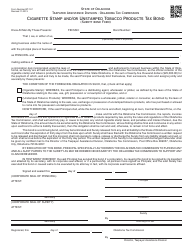

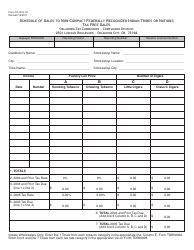

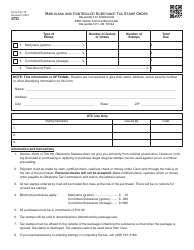

OTC Form 16-2A Stamped Cigarettes Sold to Federally Recognized Indian Tribes or Nations - Oklahoma

What Is OTC Form 16-2A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 16-2A?

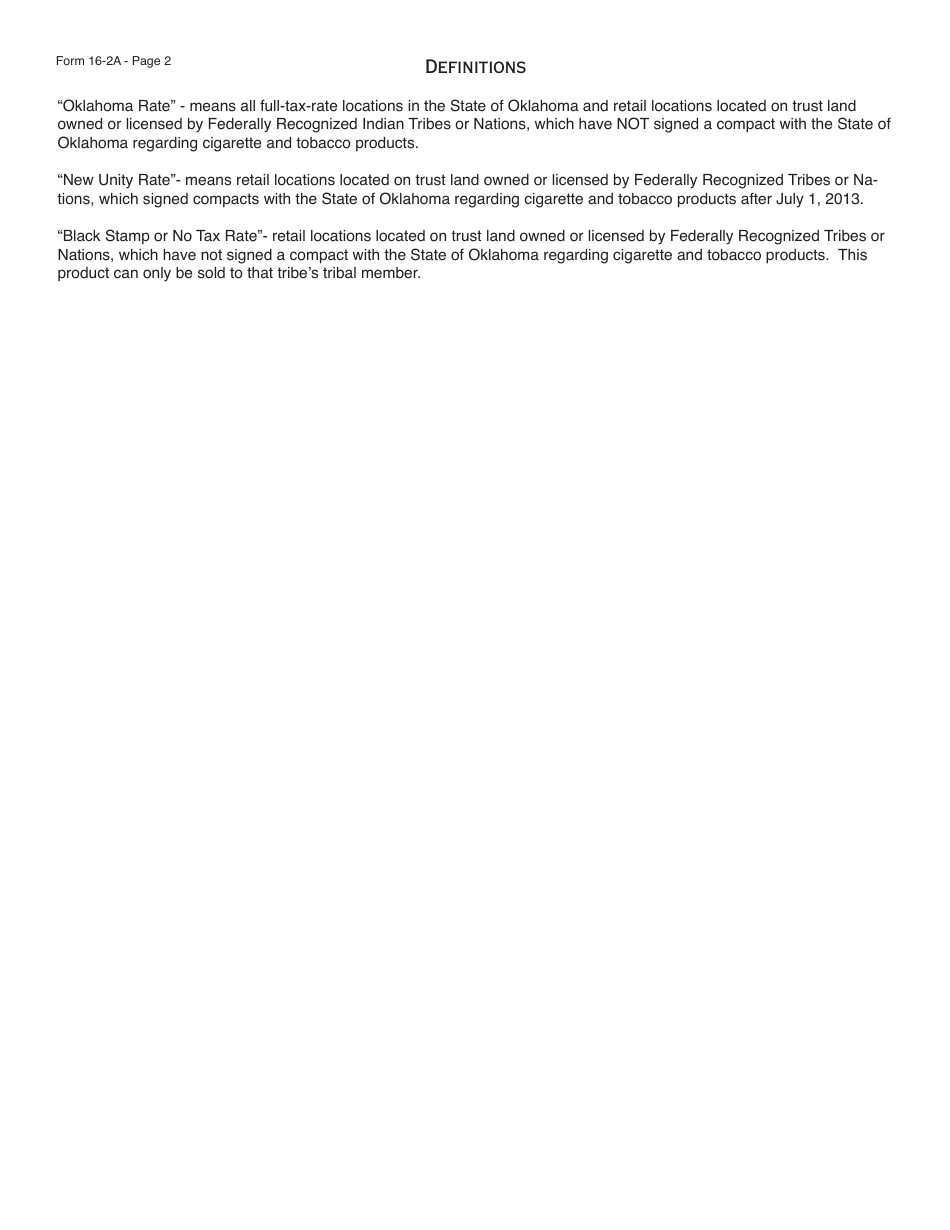

A: Form 16-2A is a document used for reporting the sale of stamped cigarettes to federally recognized Indian tribes or nations in Oklahoma.

Q: Who needs to use Form 16-2A?

A: Retailers who sell stamped cigarettes to federally recognized Indian tribes or nations in Oklahoma need to use Form 16-2A.

Q: What is the purpose of Form 16-2A?

A: The purpose of Form 16-2A is to report and document the sale of stamped cigarettes to federally recognized Indian tribes or nations in Oklahoma for tax purposes.

Q: Is Form 16-2A specific to Oklahoma?

A: Yes, Form 16-2A is specific to Oklahoma and is used for reporting cigarette sales to federally recognized Indian tribes or nations in the state.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 16-2A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.