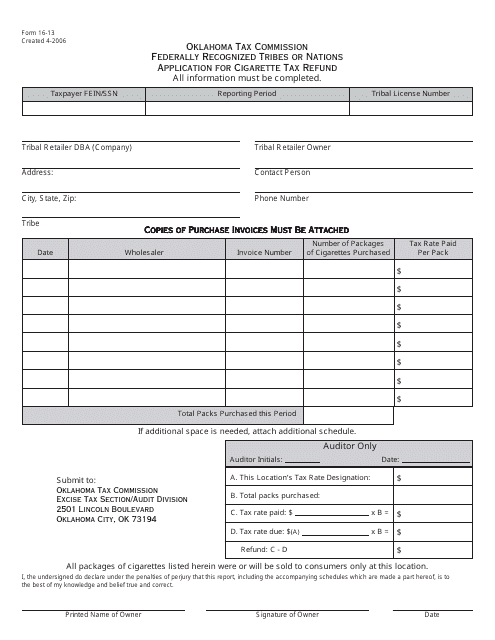

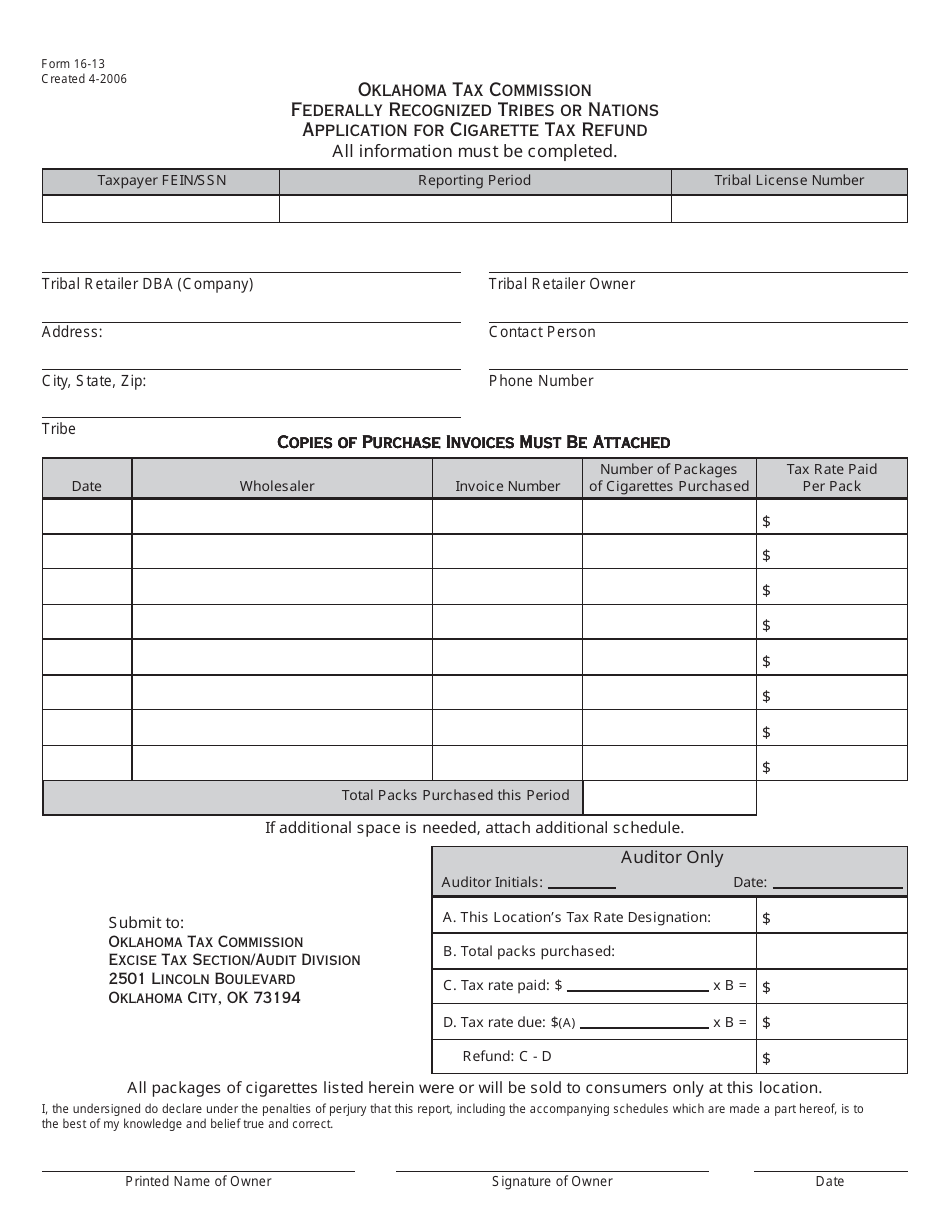

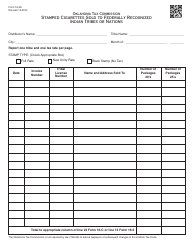

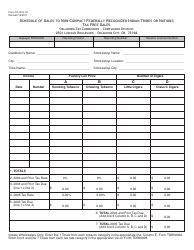

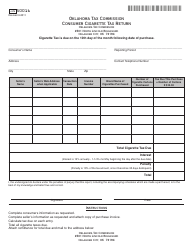

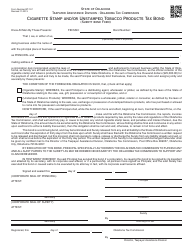

OTC Form 16-13 Federally Recognized Tribes or Nations Application for Cigarette Tax Refund - Oklahoma

What Is OTC Form 16-13?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 16-13?

A: OTC Form 16-13 is an application for Cigarette Tax Refund for federally recognized tribes or nations in Oklahoma.

Q: Who can use OTC Form 16-13?

A: Federally recognized tribes or nations in Oklahoma can use OTC Form 16-13.

Q: What is the purpose of OTC Form 16-13?

A: The purpose of OTC Form 16-13 is to apply for a cigarette tax refund for federally recognized tribes or nations in Oklahoma.

Q: What does the application process involve?

A: The application process involves completing and submitting OTC Form 16-13 to the Oklahoma Tax Commission.

Q: Is there a deadline for submitting OTC Form 16-13?

A: Yes, the deadline for submitting OTC Form 16-13 is the last day of the month following the end of the quarter for which the refund is being requested.

Form Details:

- Released on April 1, 2006;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 16-13 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.