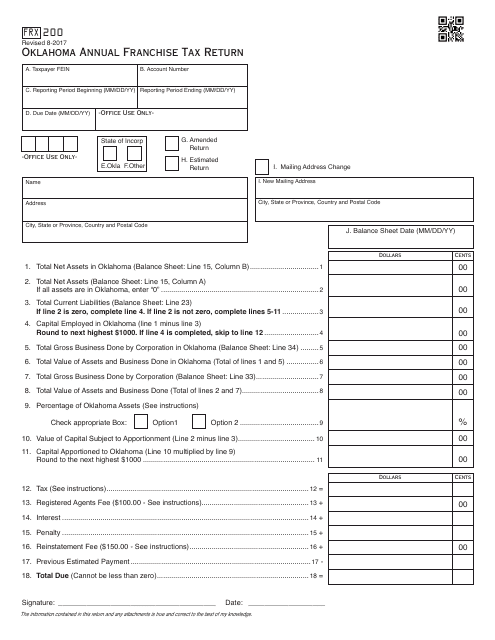

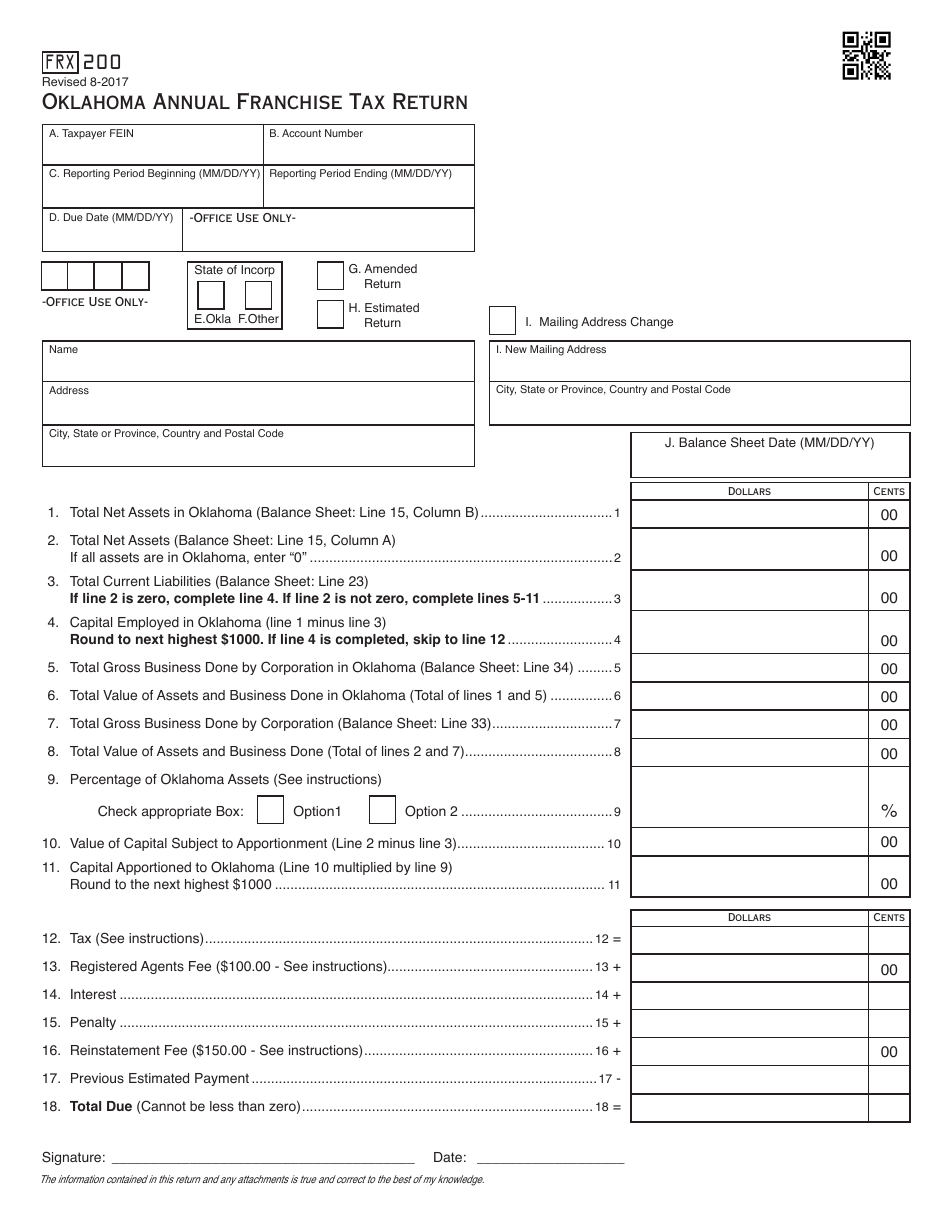

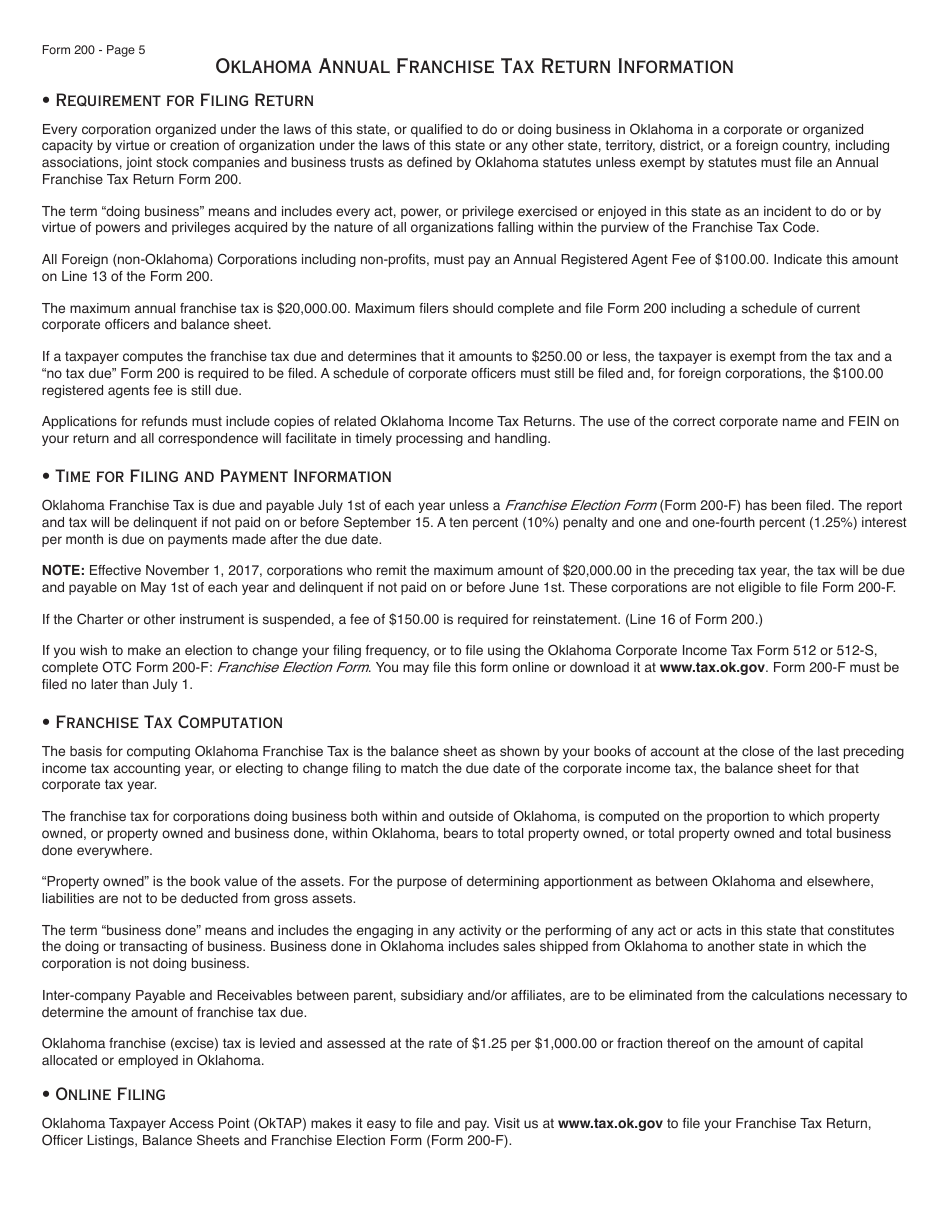

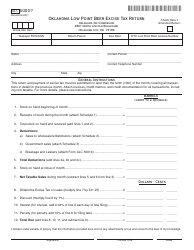

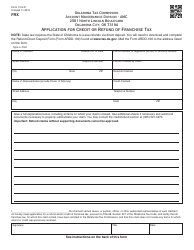

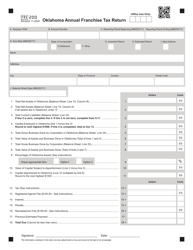

OTC Form FRX200 Oklahoma Annual Franchise Tax Return - Oklahoma

What Is OTC Form FRX200?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form FRX200?

A: The OTC Form FRX200 is the Oklahoma Annual Franchise Tax Return.

Q: Who needs to file the OTC Form FRX200?

A: Any business operating in Oklahoma that is subject to the state's franchise tax needs to file the OTC Form FRX200.

Q: What is the purpose of the OTC Form FRX200?

A: The purpose of the OTC Form FRX200 is to report and pay the annual franchise tax owed by businesses operating in Oklahoma.

Q: When is the deadline to file the OTC Form FRX200?

A: The deadline to file the OTC Form FRX200 is typically on or before July 1st of each year, although the specific deadline may vary.

Q: Are there any penalties for late filing or non-compliance with the OTC Form FRX200?

A: Yes, there may be penalties for late filing or non-compliance with the OTC Form FRX200, including possible fees and interest charges.

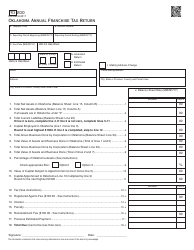

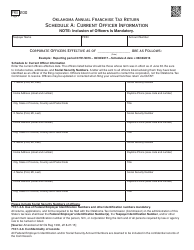

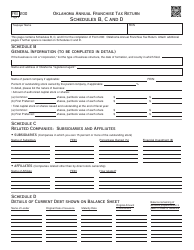

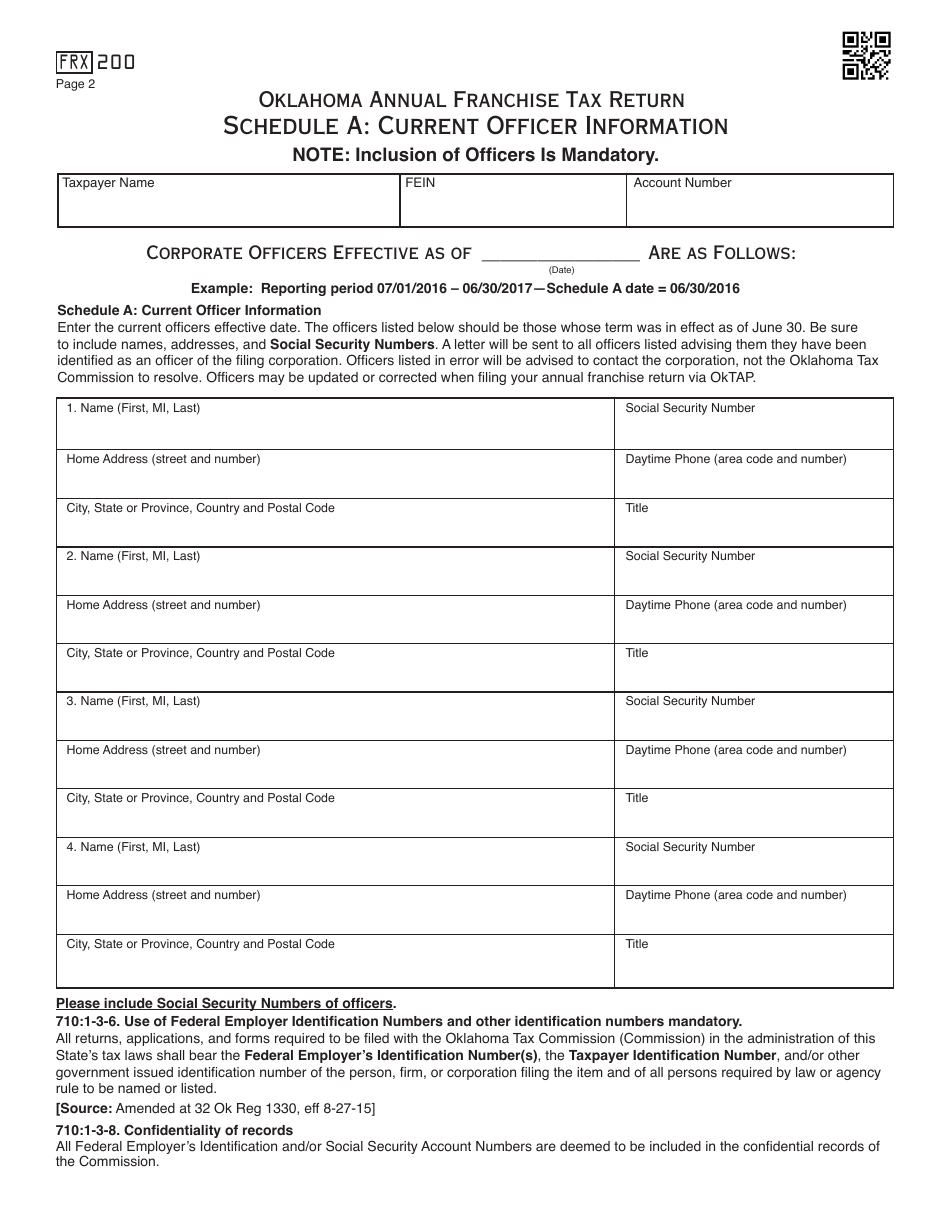

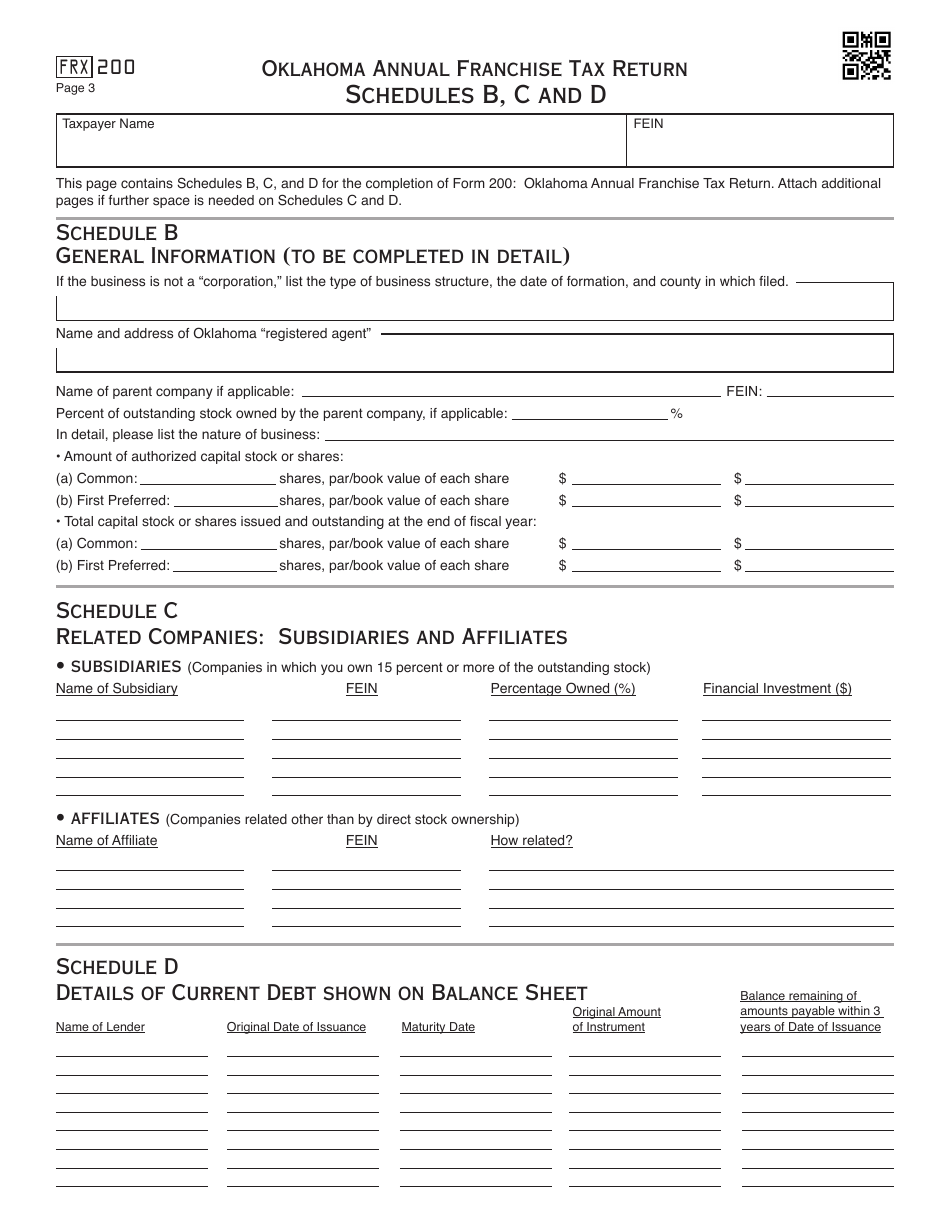

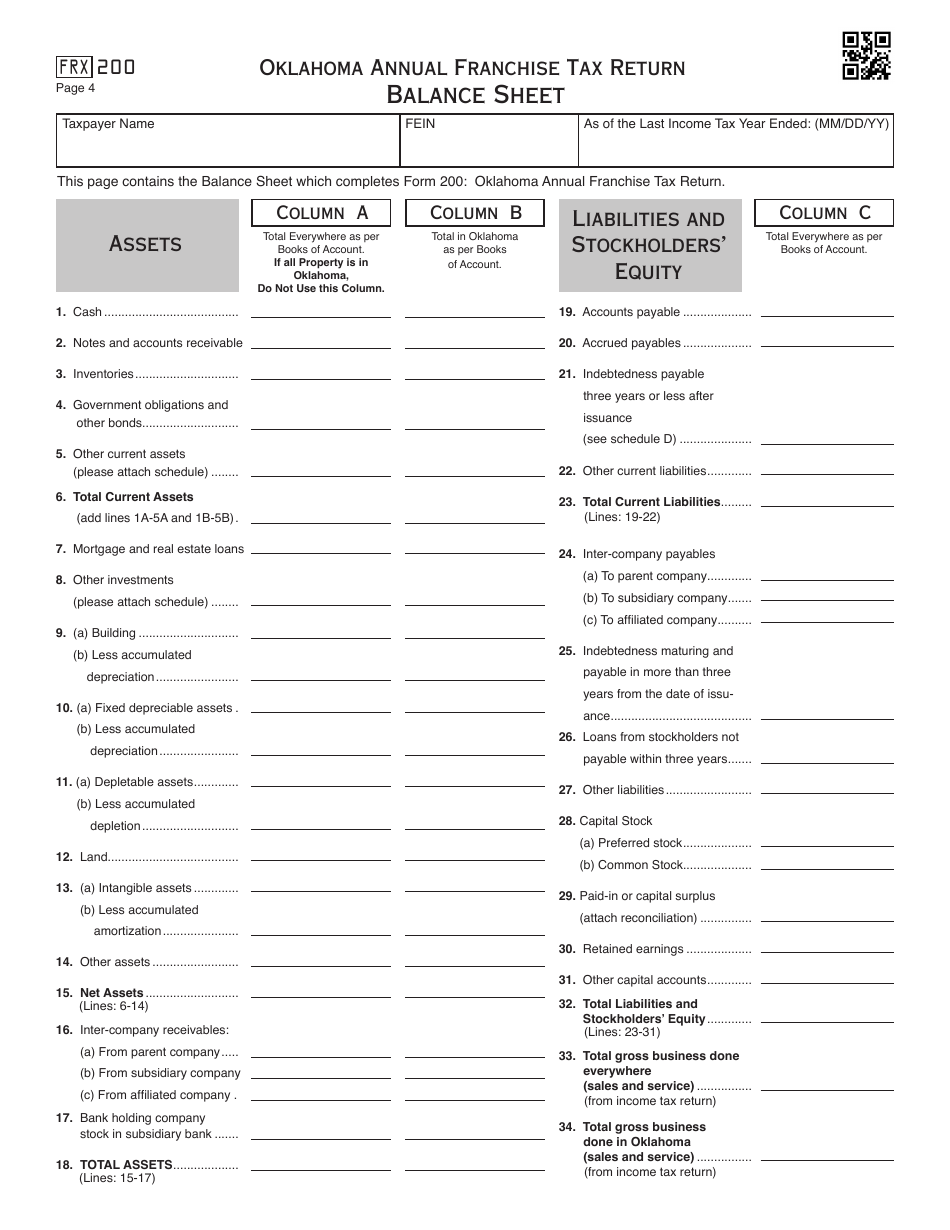

Q: What information do I need to complete the OTC Form FRX200?

A: To complete the OTC Form FRX200, you will need information about your business's income, assets, and other relevant financial details.

Q: Can I file the OTC Form FRX200 electronically?

A: Yes, you can file the OTC Form FRX200 electronically through the Oklahoma Taxpayer Access Point (OkTAP) system.

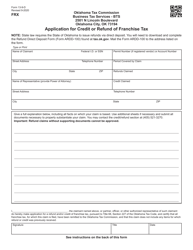

Q: Do I need to submit any supporting documents with the OTC Form FRX200?

A: Typically, you do not need to submit supporting documents with the OTC Form FRX200, but you should keep them on record in case of an audit.

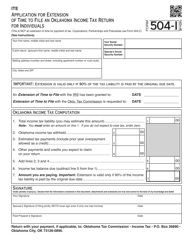

Q: Can I apply for an extension to file the OTC Form FRX200?

A: Yes, you can request an extension to file the OTC Form FRX200, but any taxes owed must still be paid by the original due date.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form FRX200 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.