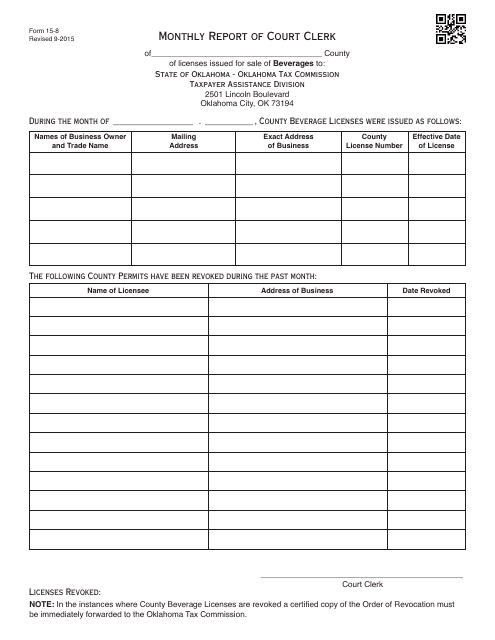

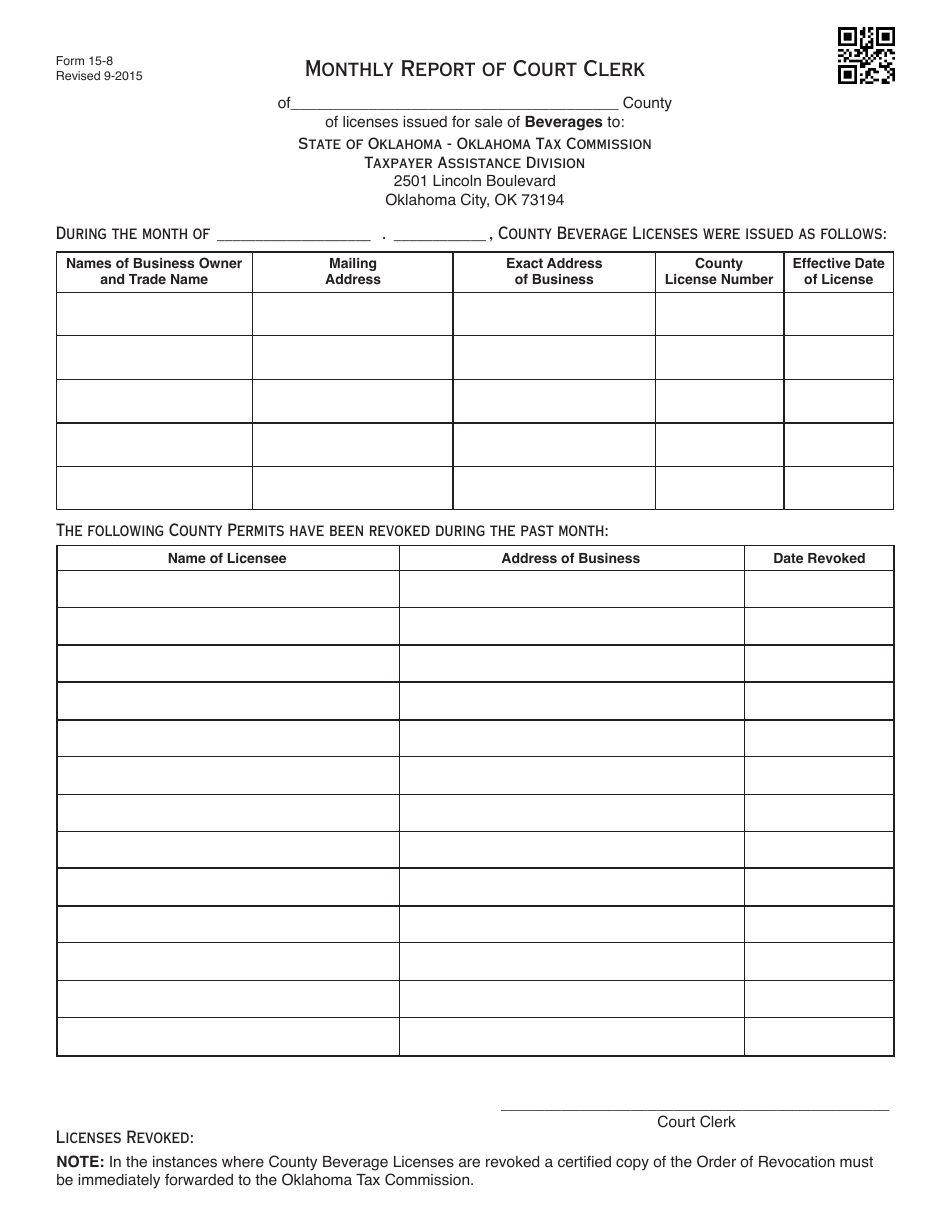

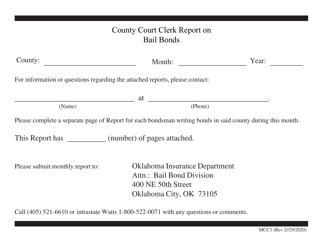

OTC Form 15-8 Monthly Report of Court Clerk - Oklahoma

What Is OTC Form 15-8?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 15-8?

A: OTC Form 15-8 is a monthly report of the court clerk in Oklahoma.

Q: Who is required to submit OTC Form 15-8?

A: Court clerks in Oklahoma are required to submit OTC Form 15-8.

Q: What does OTC stand for?

A: OTC stands for Oklahoma Tax Commission.

Q: What information is included in OTC Form 15-8?

A: OTC Form 15-8 includes information about court costs, fees, and fines collected by the court clerk.

Q: Is OTC Form 15-8 a monthly or annual report?

A: OTC Form 15-8 is a monthly report.

Q: What is the purpose of OTC Form 15-8?

A: The purpose of OTC Form 15-8 is to report court revenue and reconcile it with the Oklahoma Tax Commission.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 15-8 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.