OTC Form 13-91-S Financial Statement - Oklahoma

What Is OTC Form 13-91-S?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 13-91-S?

A: OTC Form 13-91-S is a Financial Statement specific to the state of Oklahoma.

Q: Who needs to file OTC Form 13-91-S?

A: Anyone in Oklahoma who is required to submit a financial statement to the Oklahoma Tax Commission needs to file OTC Form 13-91-S.

Q: What is the purpose of OTC Form 13-91-S?

A: The purpose of OTC Form 13-91-S is to provide financial information to the Oklahoma Tax Commission for tax assessment and compliance purposes.

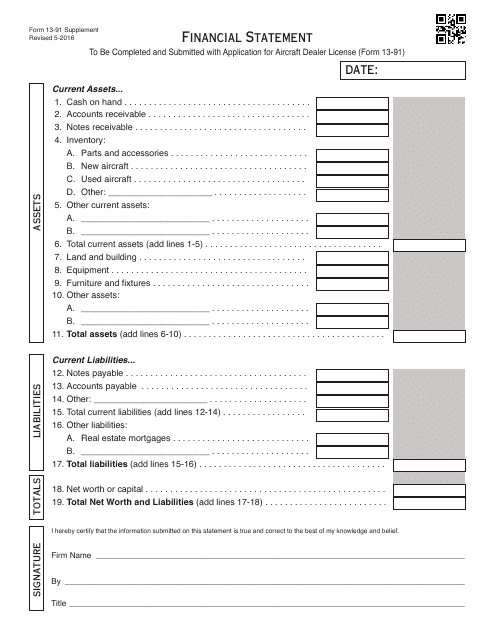

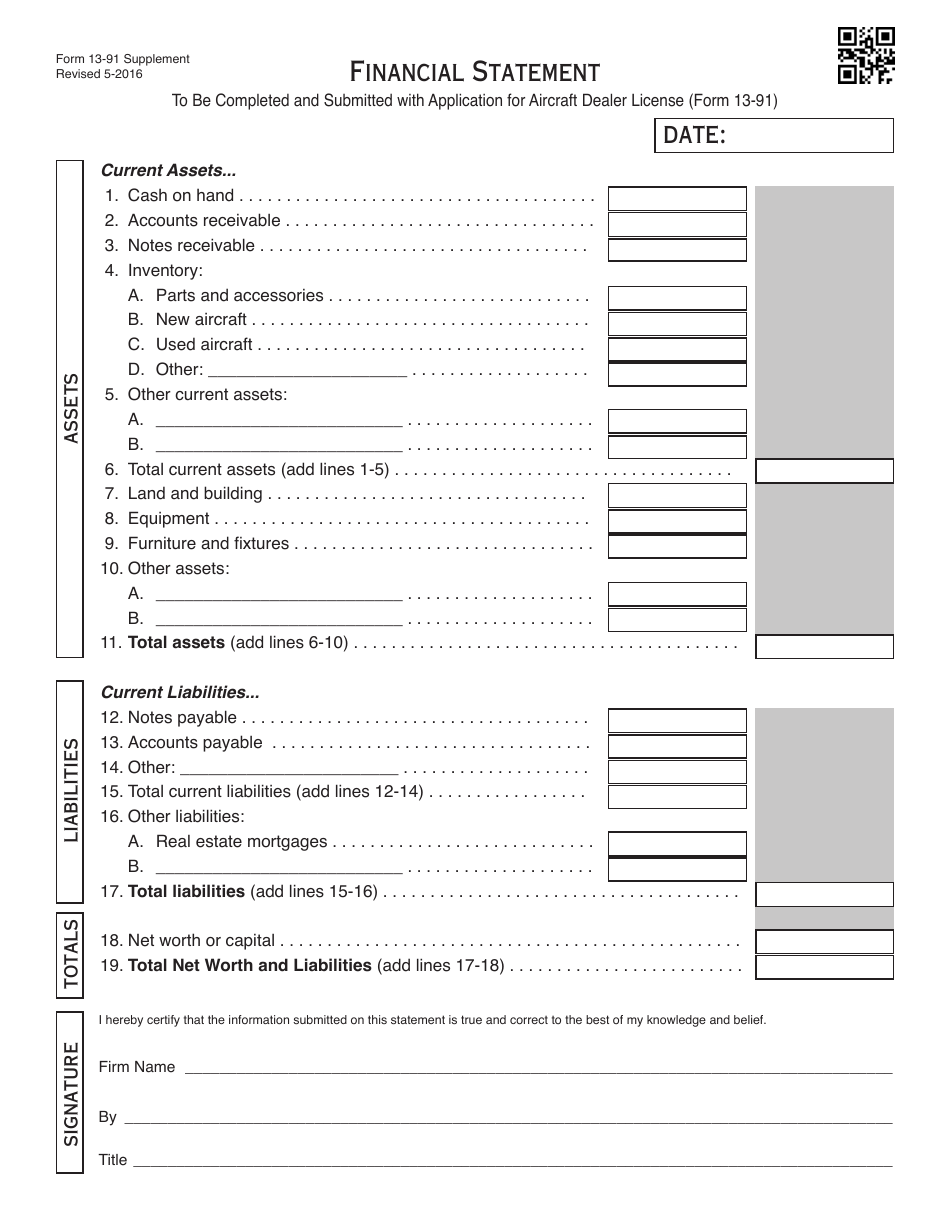

Q: What information is required on OTC Form 13-91-S?

A: OTC Form 13-91-S requires information such as income, expenses, assets, liabilities, and other financial details.

Q: When is the deadline for filing OTC Form 13-91-S?

A: The deadline for filing OTC Form 13-91-S is typically determined by the Oklahoma Tax Commission and may vary from year to year.

Q: Are there any penalties for late filing of OTC Form 13-91-S?

A: Yes, there may be penalties for late filing of OTC Form 13-91-S, which could include fines or interest on unpaid taxes.

Q: Is OTC Form 13-91-S only for individuals or can businesses also file it?

A: Both individuals and businesses in Oklahoma may be required to file OTC Form 13-91-S, depending on their tax obligations and requirements.

Q: Can I get assistance or guidance for completing OTC Form 13-91-S?

A: Yes, you can seek assistance or guidance for completing OTC Form 13-91-S from the Oklahoma Tax Commission or a qualified tax professional.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 13-91-S by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.