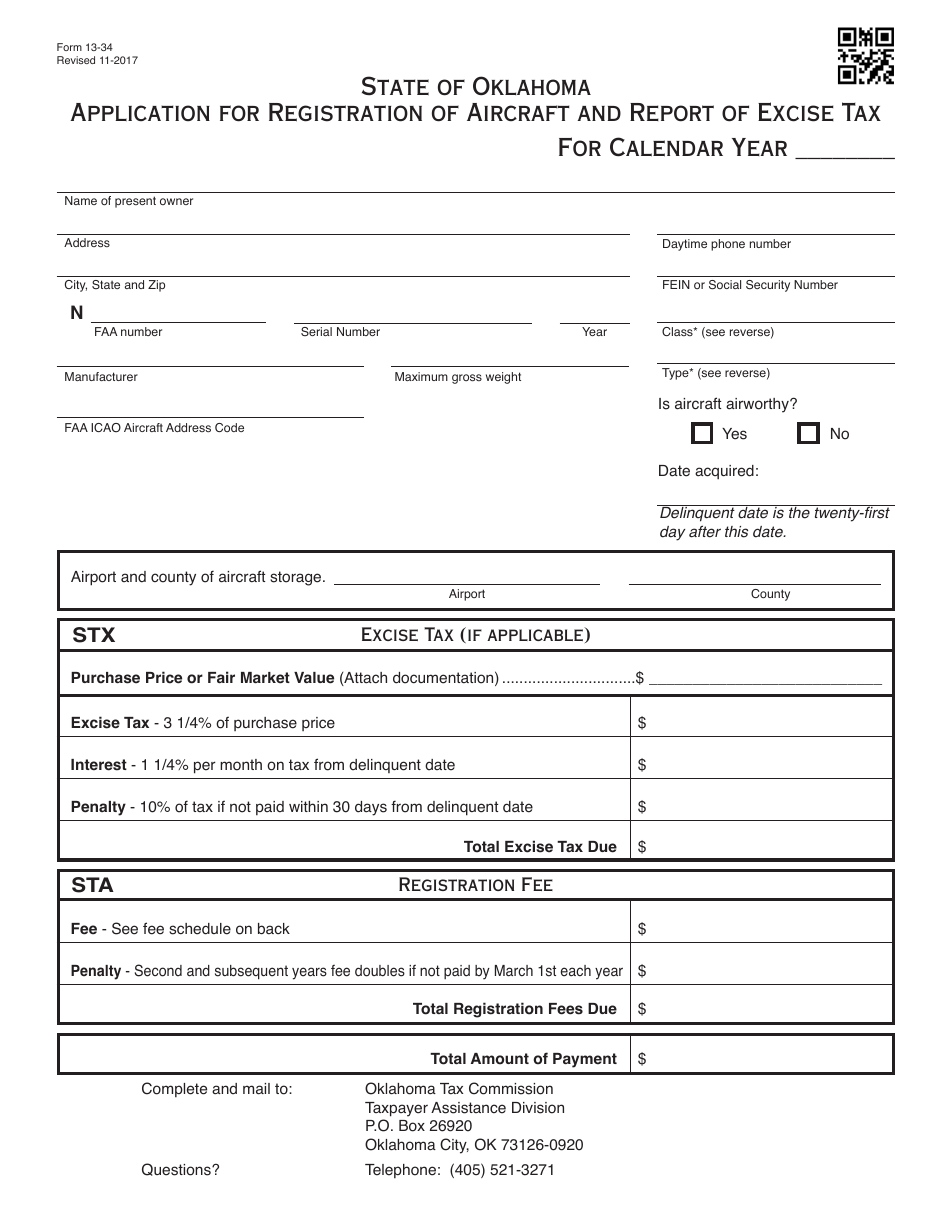

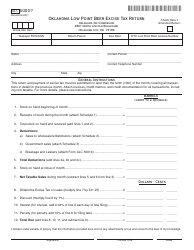

OTC Form 13-34 Application for Registration of Aircraft and Report of Excise Tax - Oklahoma

What Is OTC Form 13-34?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 13-34?

A: OTC Form 13-34 is the Application for Registration of Aircraft and Report of Excise Tax for the state of Oklahoma.

Q: What is the purpose of OTC Form 13-34?

A: The purpose of OTC Form 13-34 is to register an aircraft and report excise tax in the state of Oklahoma.

Q: Who needs to file OTC Form 13-34?

A: Anyone who wants to register an aircraft and report excise tax in the state of Oklahoma needs to file OTC Form 13-34.

Q: Is there a deadline for filing OTC Form 13-34?

A: Yes, OTC Form 13-34 must be filed within 30 days of the aircraft being brought into Oklahoma.

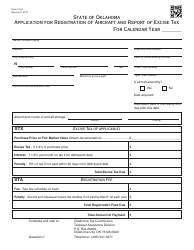

Q: What information is required on OTC Form 13-34?

A: OTC Form 13-34 requires information about the aircraft, including its make, model, and identification numbers, as well as information about the owner and operator.

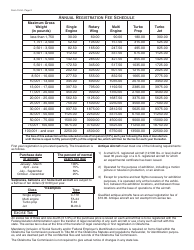

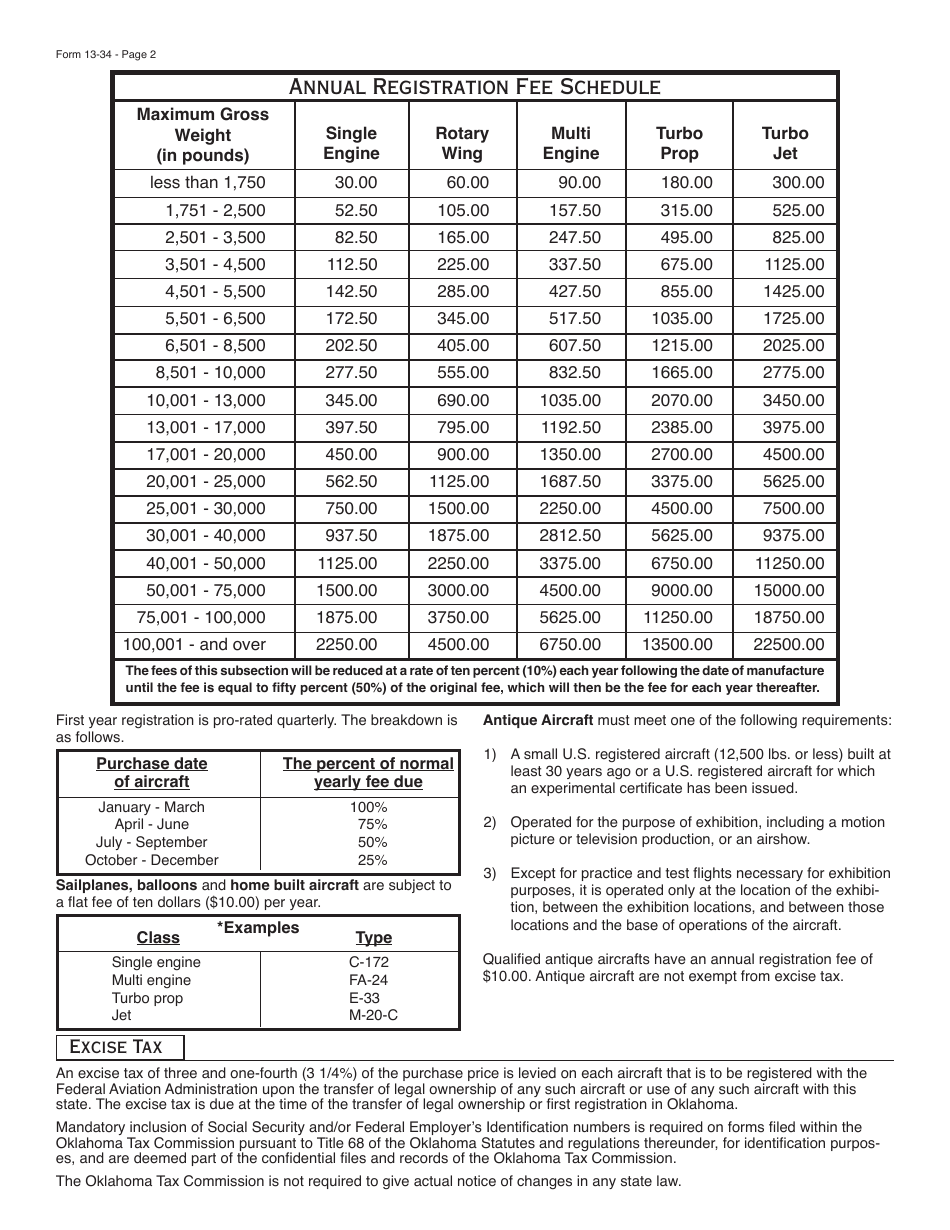

Q: Are there any fees associated with filing OTC Form 13-34?

A: Yes, there are fees associated with filing OTC Form 13-34. The exact amount depends on the value of the aircraft.

Q: What happens after I file OTC Form 13-34?

A: After you file OTC Form 13-34, the Oklahoma Tax Commission will process the form and issue a certificate of registration for your aircraft.

Q: What if I need to make changes to my OTC Form 13-34?

A: If you need to make changes to your OTC Form 13-34 after it has been filed, you should contact the Oklahoma Tax Commission for instructions.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 13-34 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.