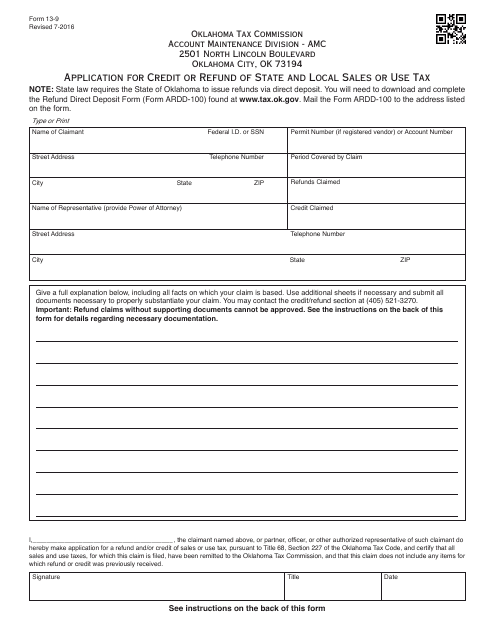

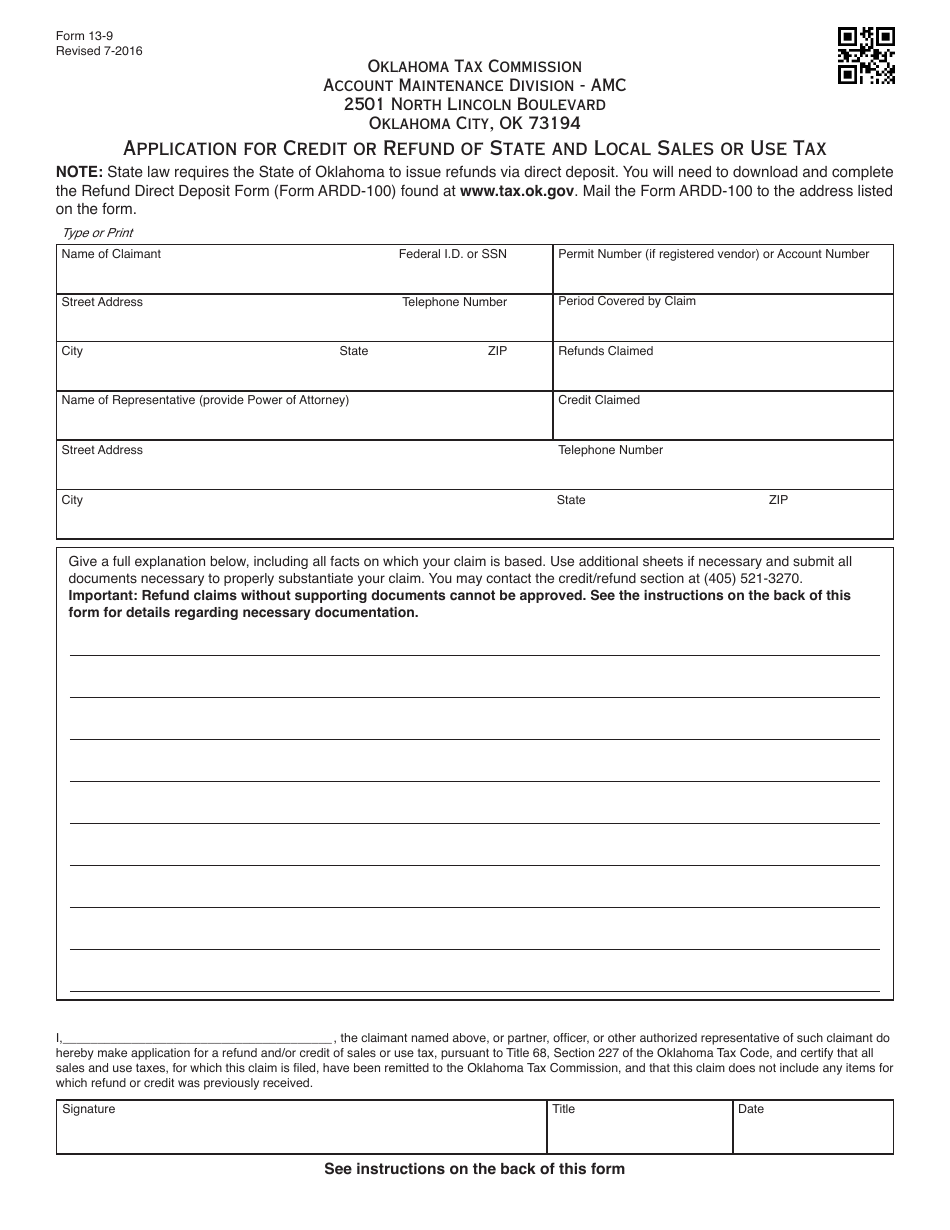

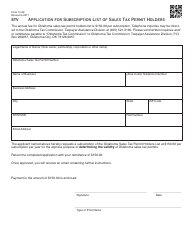

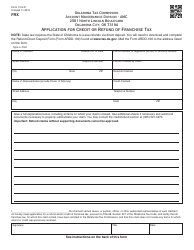

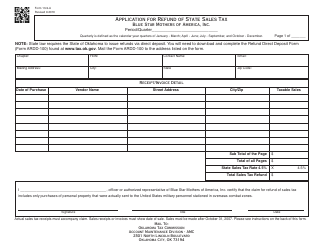

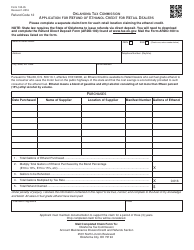

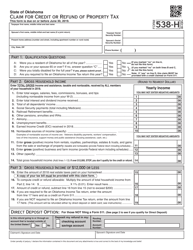

OTC Form 13-9 Application for Credit or Refund of State and Local Sales or Use Tax - Oklahoma

What Is OTC Form 13-9?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 13-9?

A: OTC Form 13-9 is an Application for Credit or Refund of State and Local Sales or Use Tax in Oklahoma.

Q: What is the purpose of OTC Form 13-9?

A: The purpose of OTC Form 13-9 is to apply for a credit or refund of state and local sales or use tax in Oklahoma.

Q: Who can use OTC Form 13-9?

A: Anyone who has paid excess state and local sales or use tax in Oklahoma can use OTC Form 13-9 to apply for a credit or refund.

Q: What information is required on OTC Form 13-9?

A: OTC Form 13-9 requires the taxpayer's identification information, details about the tax paid, and the reason for applying for a credit or refund.

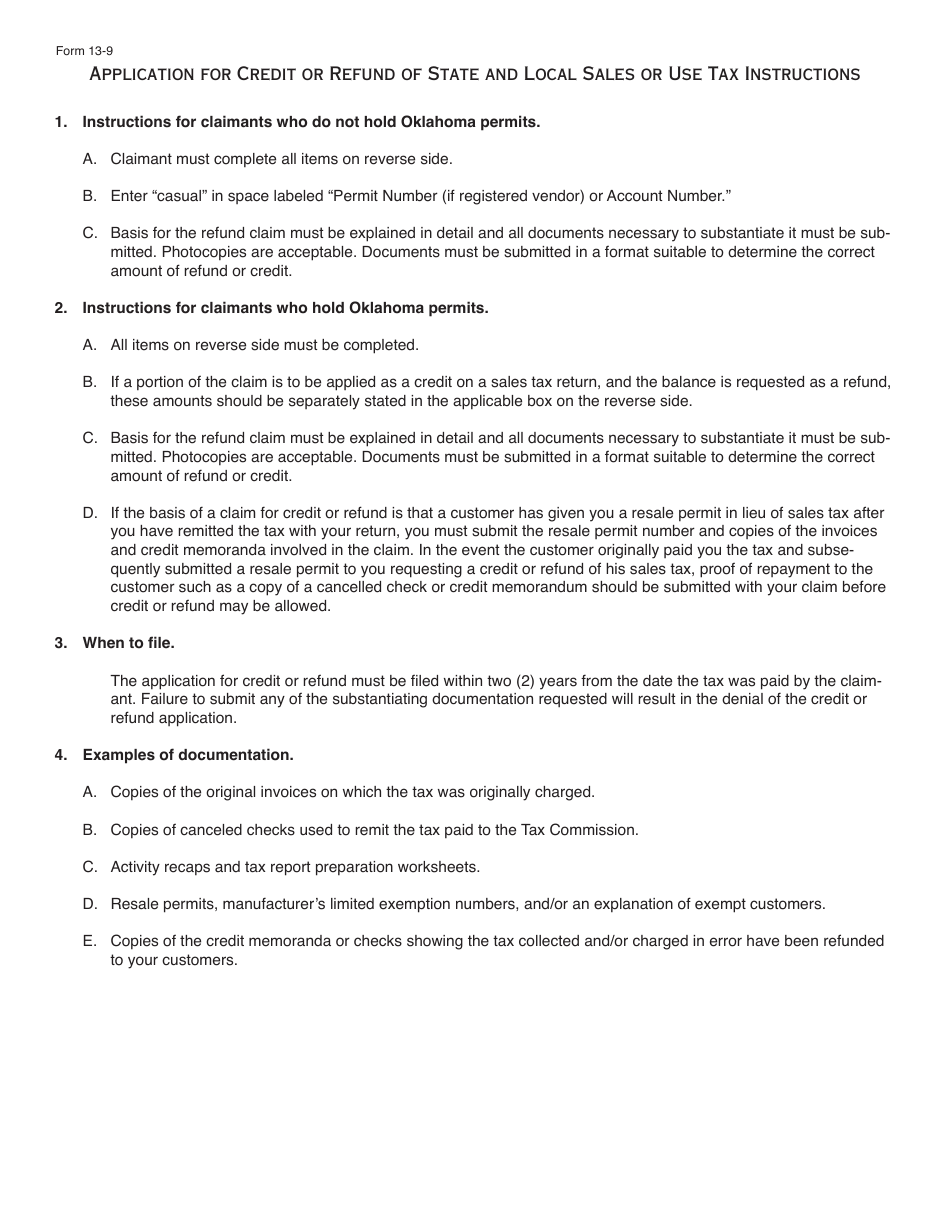

Q: Is there a deadline to submit OTC Form 13-9?

A: Yes, OTC Form 13-9 must be submitted within three years from the date the tax was paid.

Q: How long does it take to process OTC Form 13-9?

A: The processing time for OTC Form 13-9 varies, but it typically takes several weeks to several months.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 13-9 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.