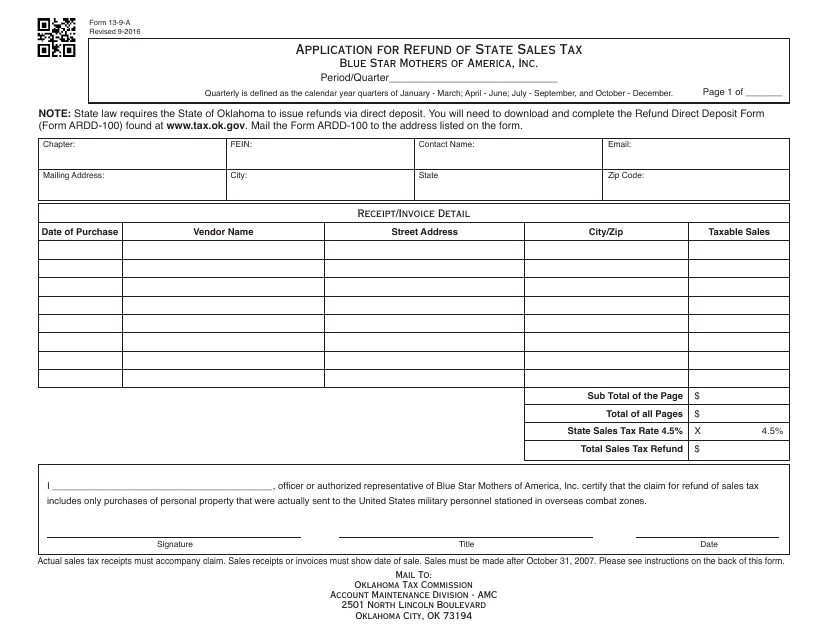

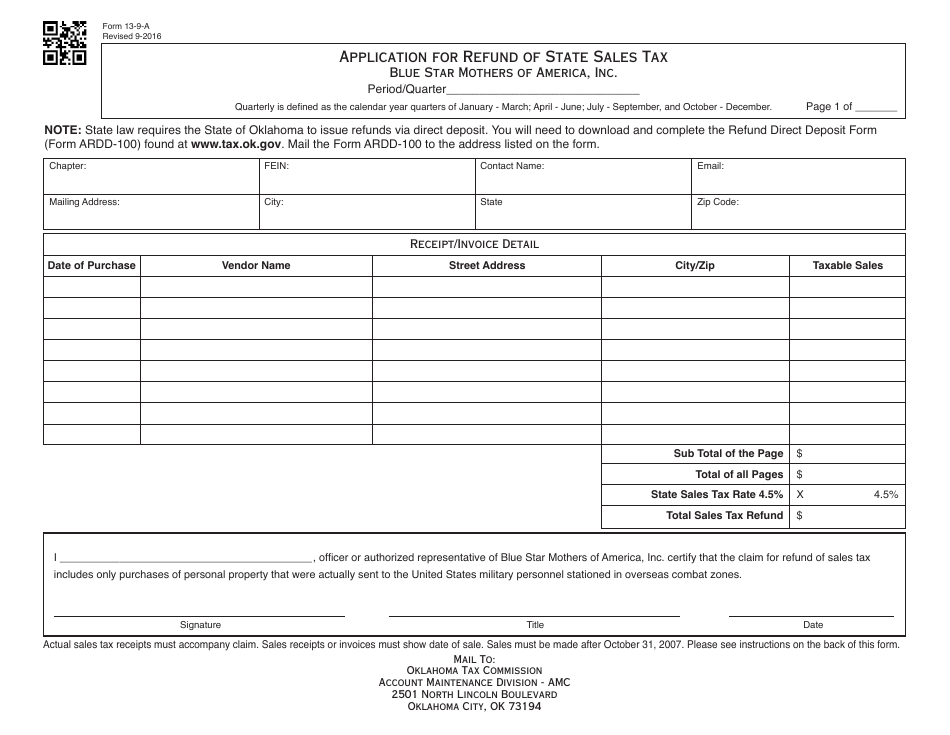

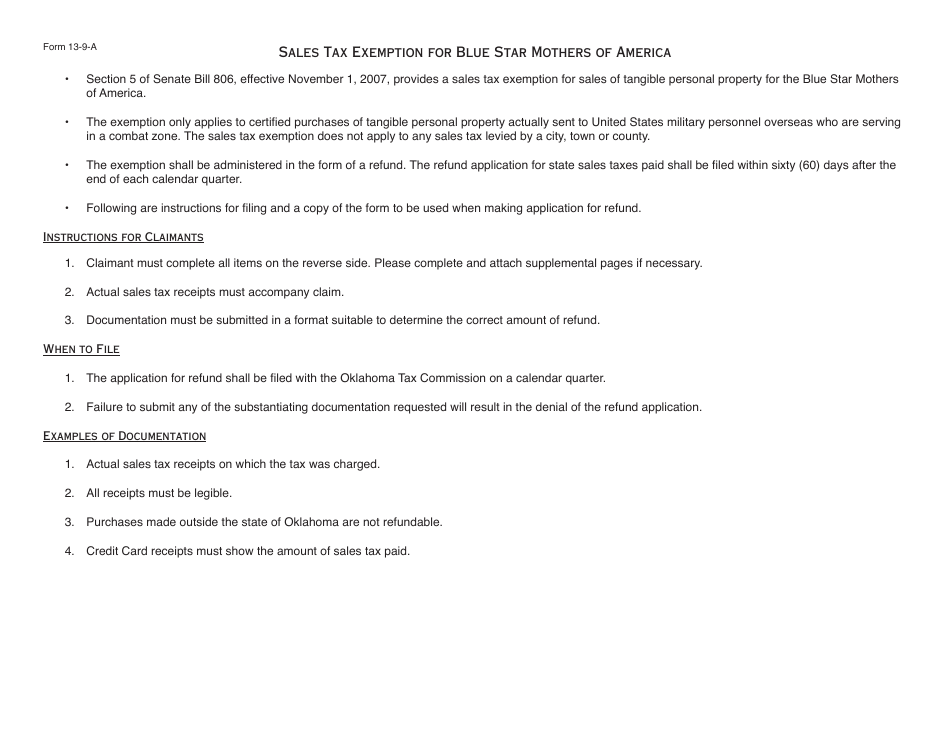

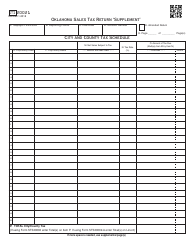

OTC Form 13-9-A Application for Refund of State Sales Tax - Oklahoma

What Is OTC Form 13-9-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

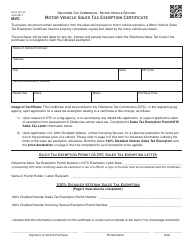

Q: What is the OTC Form 13-9-A?

A: The OTC Form 13-9-A is an application for refund of state sales tax in Oklahoma.

Q: Who can use the OTC Form 13-9-A?

A: Any individual or business that has overpaid state sales tax in Oklahoma can use this form to apply for a refund.

Q: What is the purpose of the OTC Form 13-9-A?

A: The purpose of this form is to request a refund of state sales tax that has been overpaid in Oklahoma.

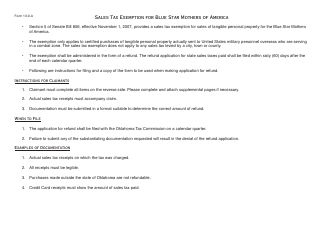

Q: How do I fill out the OTC Form 13-9-A?

A: You need to provide your personal or business information, details of the overpaid tax, and any supporting documentation to complete the form.

Q: Are there any deadlines for submitting the OTC Form 13-9-A?

A: Yes, you need to submit the form within three years from the date the tax was paid or the return due date, whichever is later.

Q: How long does it take to process the OTC Form 13-9-A?

A: The processing time may vary, but it generally takes around 8-12 weeks to receive a refund.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 13-9-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.