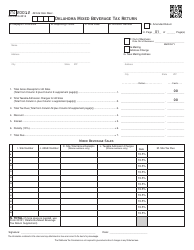

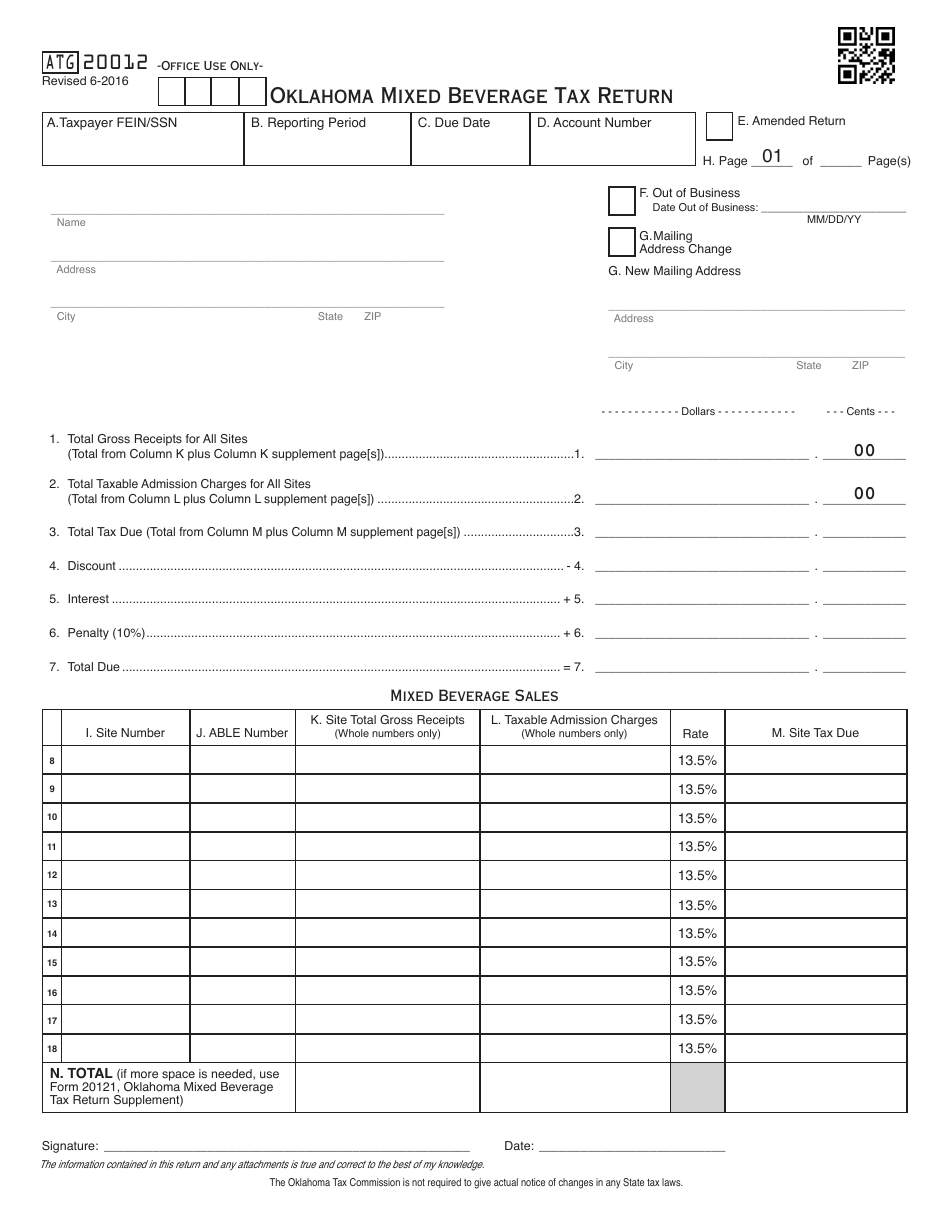

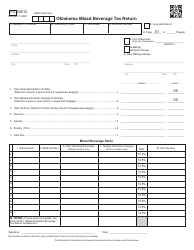

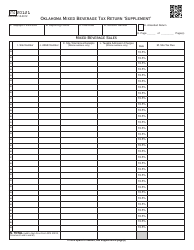

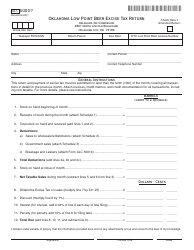

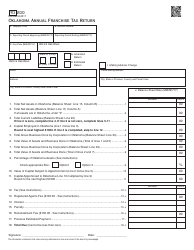

OTC Form ATG20012 Oklahoma Mixed Beverage Tax Return - Oklahoma

What Is OTC Form ATG20012?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

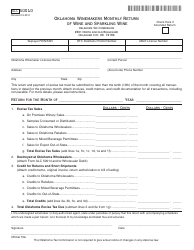

Q: What is OTC Form ATG20012?

A: OTC Form ATG20012 is the Oklahoma Mixed Beverage Tax Return.

Q: What is the purpose of OTC Form ATG20012?

A: The purpose of OTC Form ATG20012 is to report and remit mixed beverage taxes in Oklahoma.

Q: Who needs to file OTC Form ATG20012?

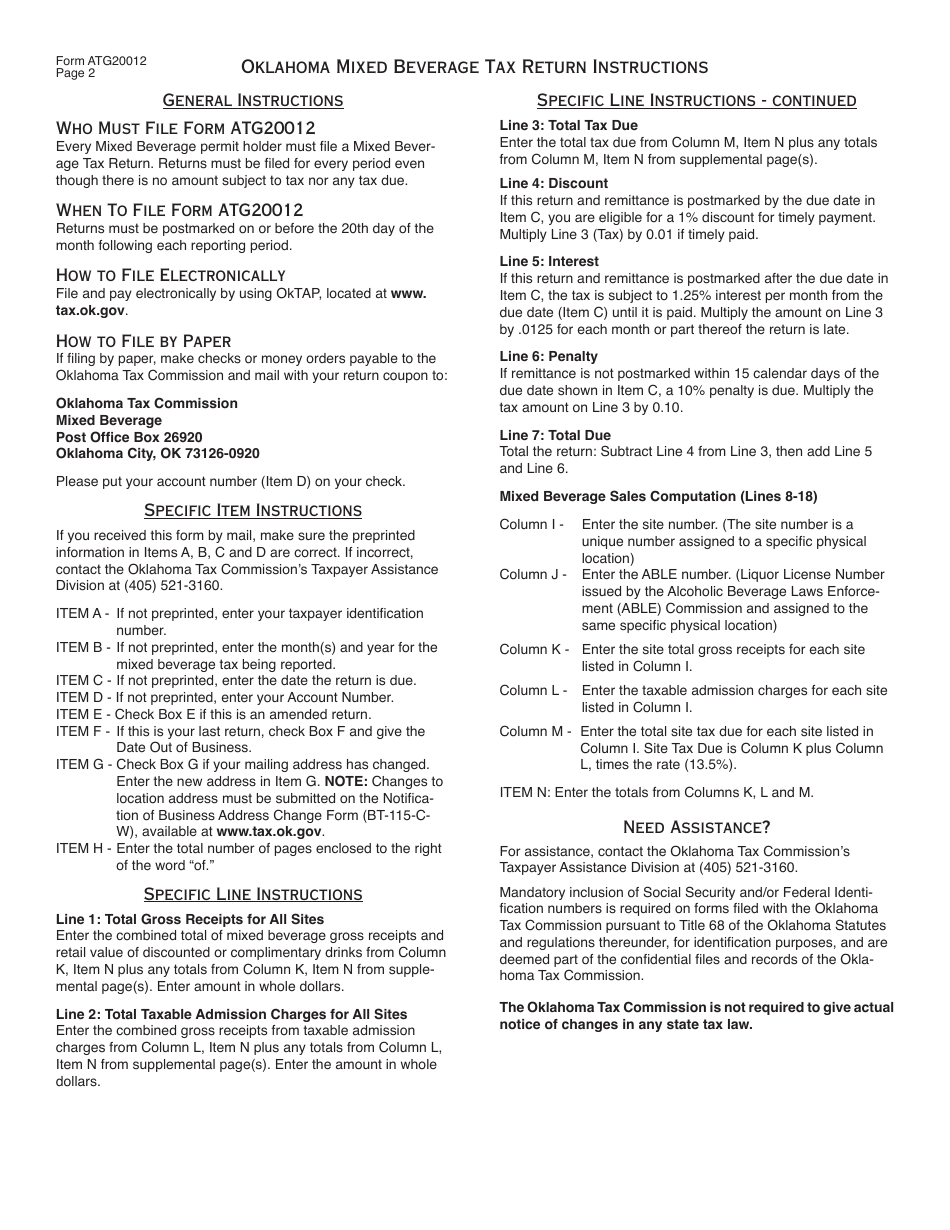

A: Any business that serves mixed beverages in Oklahoma needs to file OTC Form ATG20012.

Q: When is the deadline for filing OTC Form ATG20012?

A: The deadline for filing OTC Form ATG20012 is typically on the 20th of each month.

Q: What information is required on OTC Form ATG20012?

A: OTC Form ATG20012 requires information such as sales totals, tax calculations, and other details related to mixed beverage sales.

Q: How do I calculate the mixed beverage tax?

A: The mixed beverage tax is calculated based on a specific percentage (currently 9%) of the total sales of mixed beverages.

Q: Are there any penalties for late or incorrect filing of OTC Form ATG20012?

A: Yes, there may be penalties for late or incorrect filing of OTC Form ATG20012, including interest charges and potential legal action.

Q: What should I do if I have questions or need assistance with OTC Form ATG20012?

A: If you have questions or need assistance with OTC Form ATG20012, you should contact the Oklahoma Tax Commission directly.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form ATG20012 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.