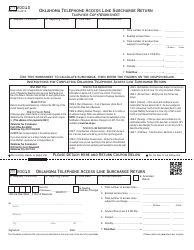

OTC Form 20013-A Oklahoma 9-1-1 Wireless Telephone Fee Return - Oklahoma

What Is OTC Form 20013-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 20013-A?

A: OTC Form 20013-A is a form used to file the Oklahoma 9-1-1 Wireless Telephone Fee Return.

Q: What is the purpose of OTC Form 20013-A?

A: The purpose of OTC Form 20013-A is to report and pay the 9-1-1 Wireless Telephone Fee owed to the state of Oklahoma.

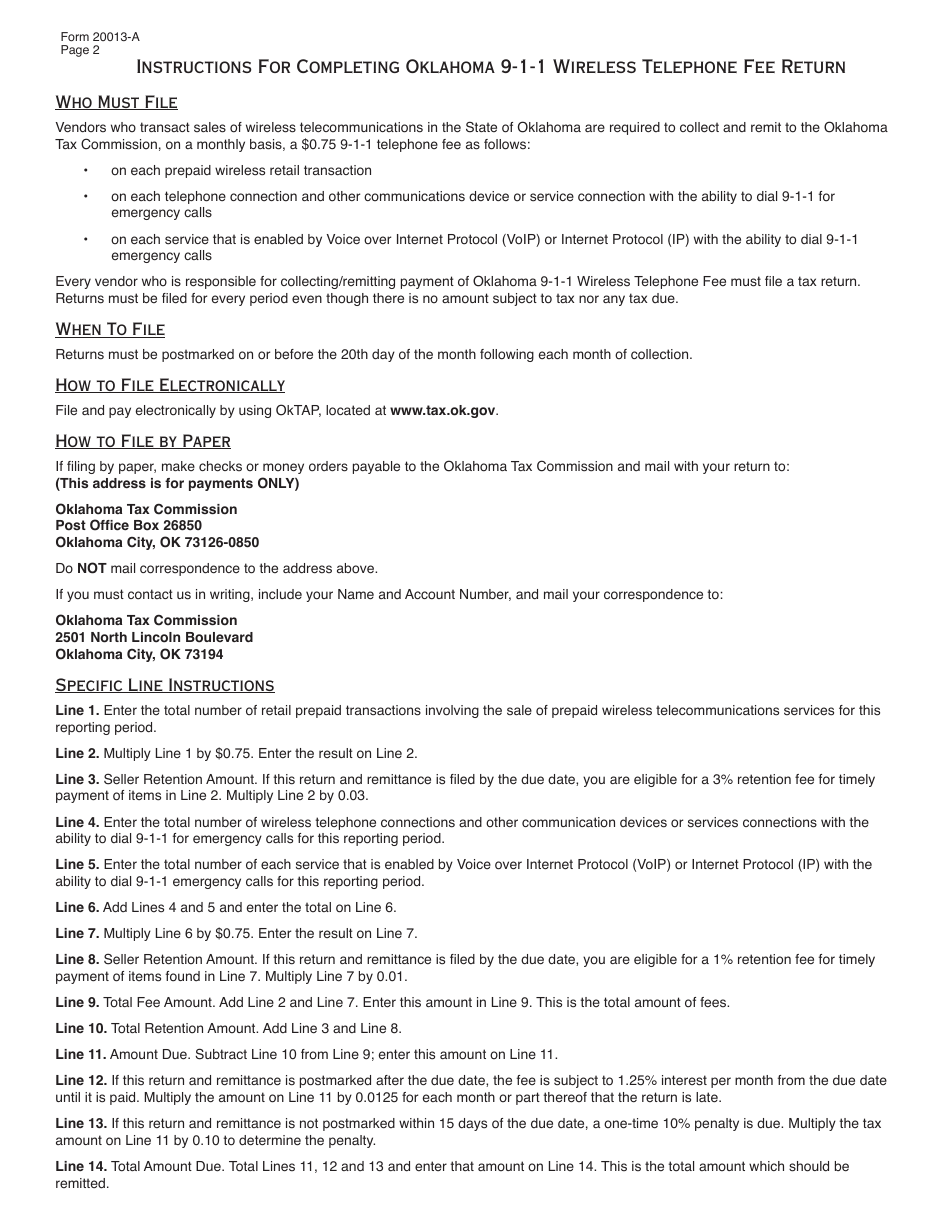

Q: Who needs to file OTC Form 20013-A?

A: Any entity that provides wireless telephone service in Oklahoma and collects the 9-1-1 Wireless Telephone Fee must file OTC Form 20013-A.

Q: When is the deadline to file OTC Form 20013-A?

A: OTC Form 20013-A must be filed and the fee must be paid on or before the 25th day of the month following the end of each calendar quarter.

Q: What happens if I fail to file OTC Form 20013-A?

A: Failure to file OTC Form 20013-A and pay the 9-1-1 Wireless Telephone Fee may result in penalties and interest charges.

Q: Can I pay the 9-1-1 Wireless Telephone Fee electronically?

A: Yes, the Oklahoma Tax Commission accepts electronic payment methods for the 9-1-1 Wireless Telephone Fee.

Q: What is the current rate for the 9-1-1 Wireless Telephone Fee?

A: The current rate for the 9-1-1 Wireless Telephone Fee is $1.00 per wireless telephone connection per month.

Q: Are there any exemptions to the 9-1-1 Wireless Telephone Fee?

A: Yes, there are exemptions for federal, state, and local government entities, as well as certain non-profit organizations.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 20013-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.