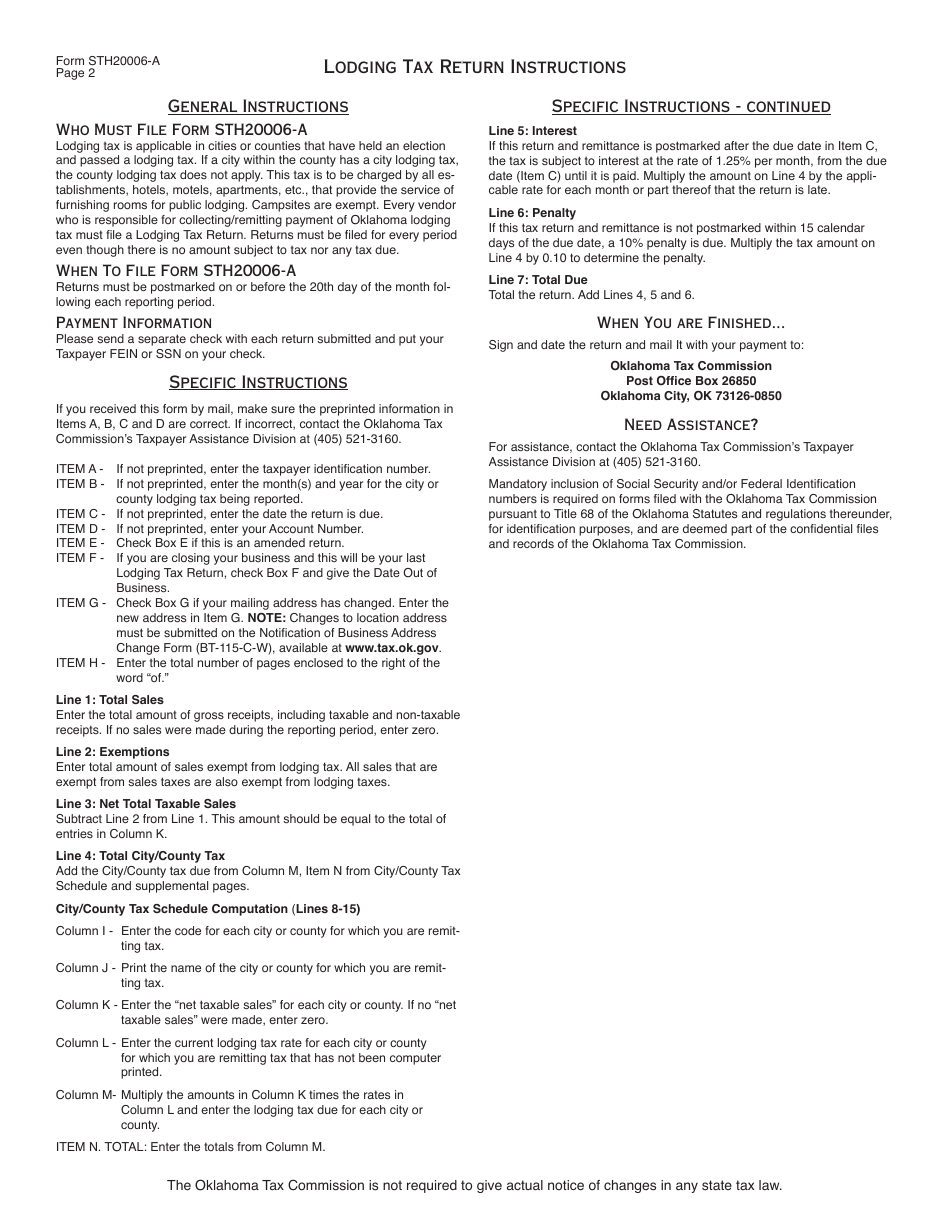

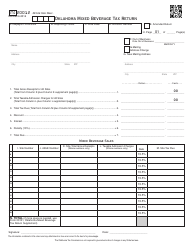

OTC Form STH20006-A Lodging Tax Return - Oklahoma

What Is OTC Form STH20006-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

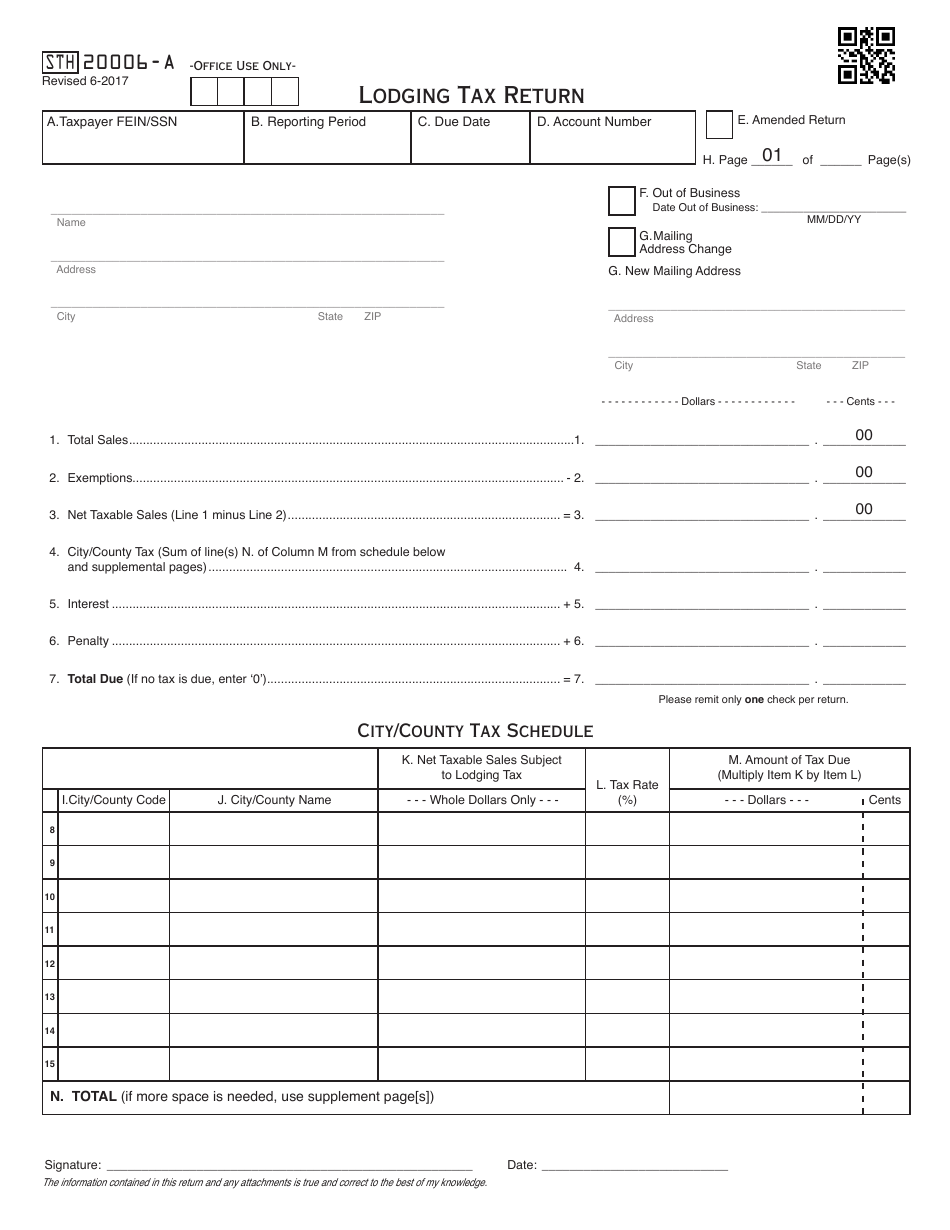

Q: What is OTC Form STH20006-A?

A: OTC Form STH20006-A is the Lodging Tax Return specific to Oklahoma.

Q: What is the purpose of OTC Form STH20006-A?

A: The purpose of OTC Form STH20006-A is to report and remit lodging taxes in Oklahoma.

Q: Who needs to file OTC Form STH20006-A?

A: Anyone who owns or operates a lodging establishment in Oklahoma is required to file OTC Form STH20006-A.

Q: What taxes are reported on OTC Form STH20006-A?

A: OTC Form STH20006-A is used to report and remit the lodging tax in Oklahoma.

Q: How often do you need to file OTC Form STH20006-A?

A: OTC Form STH20006-A must be filed on a monthly basis.

Q: When is OTC Form STH20006-A due?

A: OTC Form STH20006-A is due on the 20th day of the month following the reporting period.

Q: What happens if I don't file OTC Form STH20006-A?

A: Failure to file OTC Form STH20006-A or remit the lodging tax on time may result in penalties and interest.

Q: Is there any late filing penalty for OTC Form STH20006-A?

A: Yes, there is a late filing penalty for OTC Form STH20006-A. The penalty is based on the amount of tax due and the number of days the return is late.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form STH20006-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.