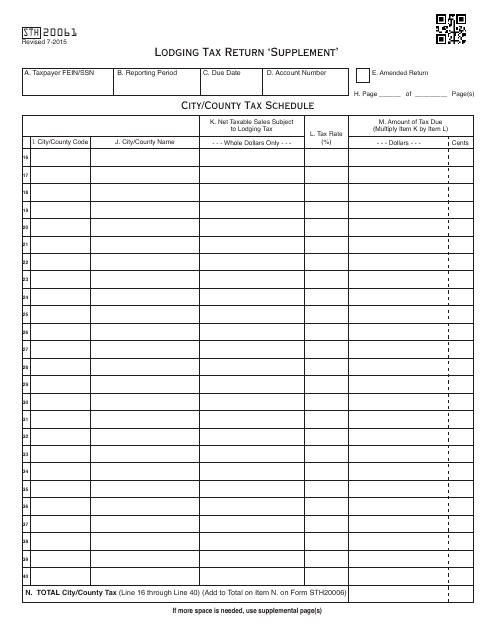

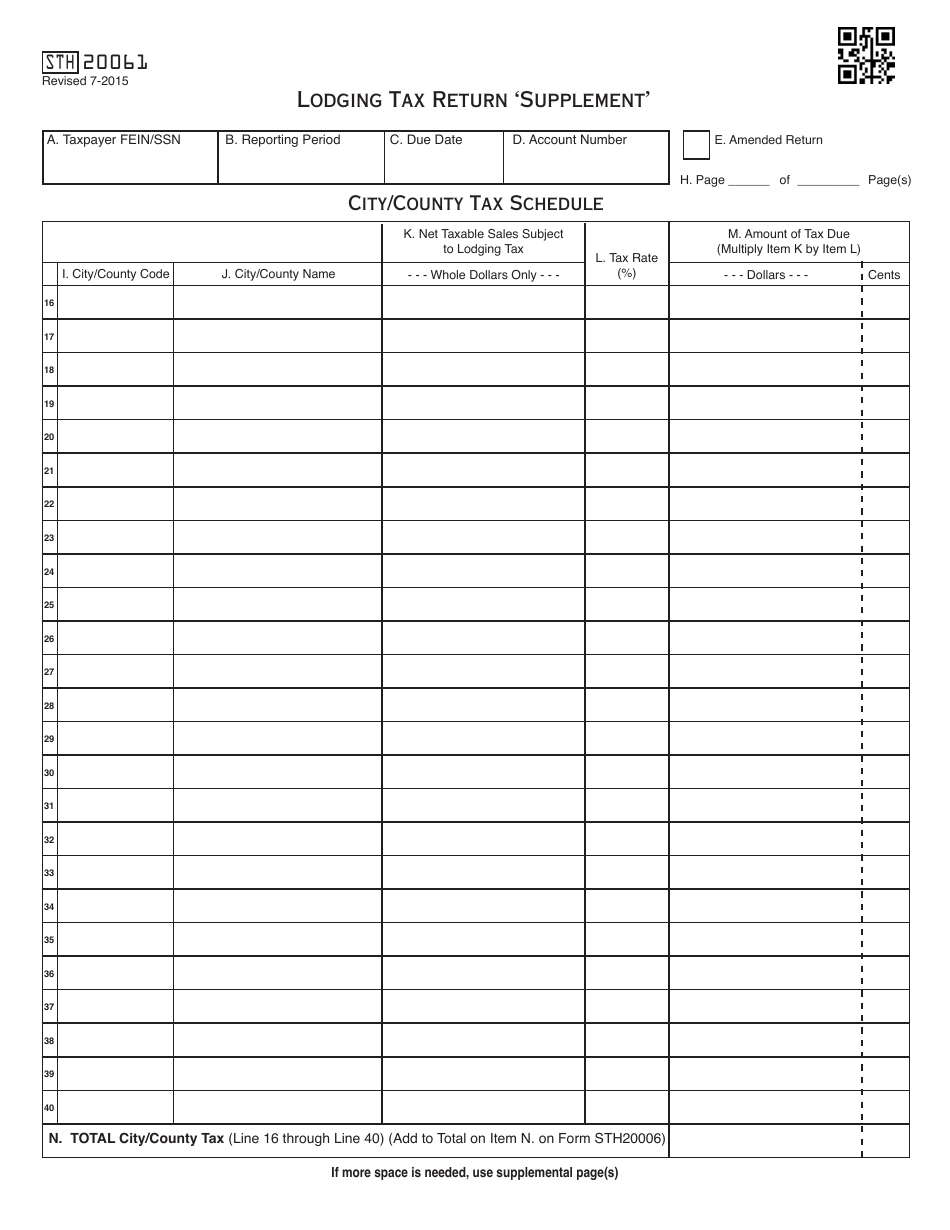

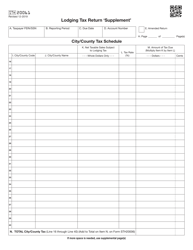

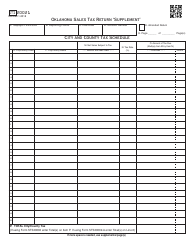

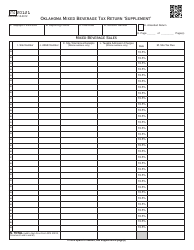

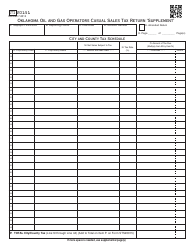

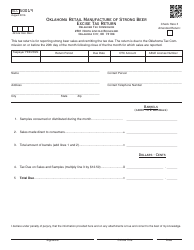

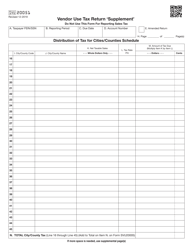

OTC Form STH20061 Lodging Tax Return 'supplement' - Oklahoma

What Is OTC Form STH20061?

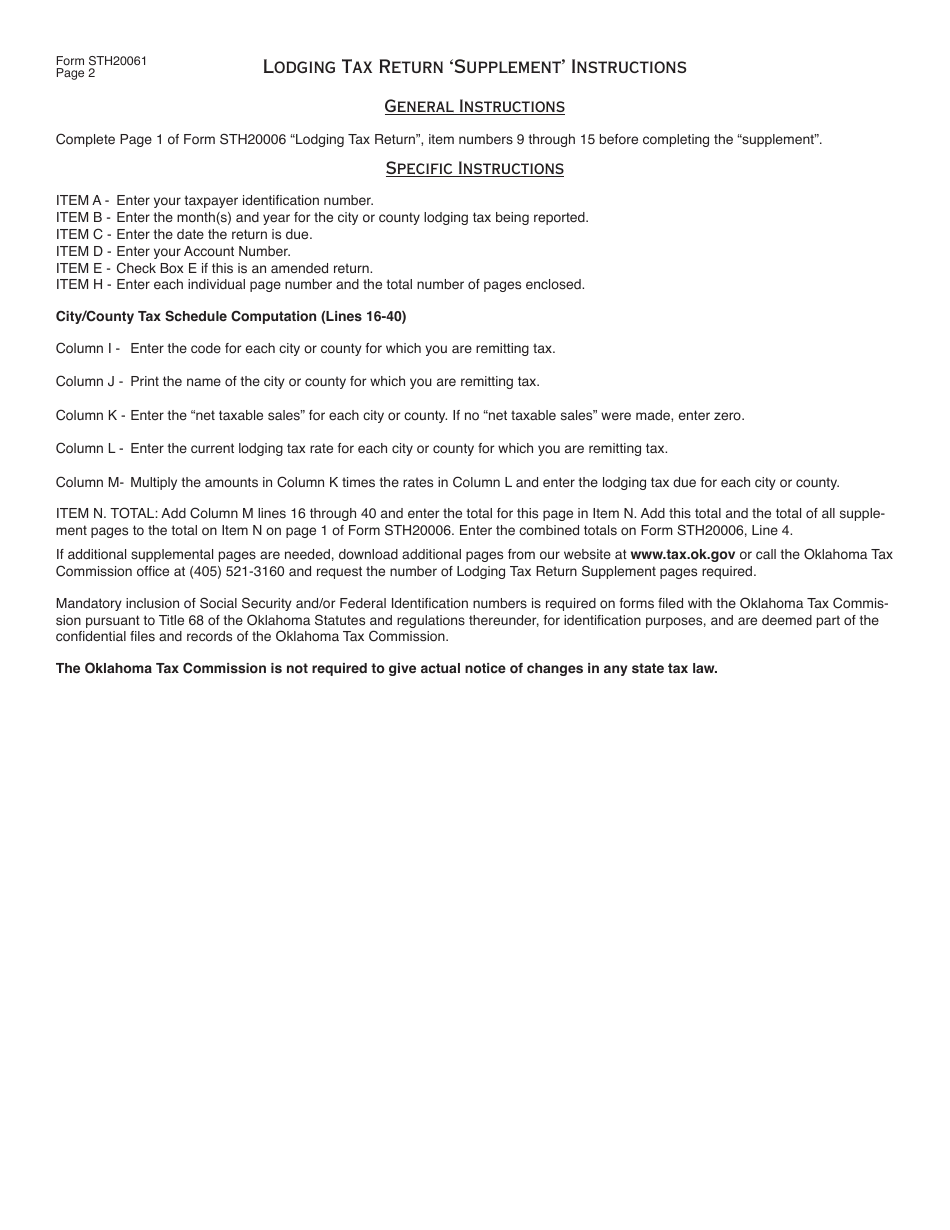

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form STH20061 Lodging Tax Return in Oklahoma?

A: The OTC Form STH20061 is a tax return form specific to lodging taxes in Oklahoma.

Q: What is the purpose of the OTC Form STH20061 Lodging Tax Return?

A: The purpose of this form is for businesses operating lodging establishments in Oklahoma to report and remit the appropriate lodging taxes to the Oklahoma Tax Commission.

Q: Do I need to file the OTC Form STH20061 if I don't own a lodging establishment in Oklahoma?

A: No, this form is specifically for businesses that operate lodging establishments in Oklahoma. If you do not own such a business, you do not need to file this form.

Q: When is the deadline for filing the OTC Form STH20061 Lodging Tax Return?

A: The deadline for filing this form is typically on the 20th day of the month following the reporting period. However, it's always best to double-check the specific due dates with the Oklahoma Tax Commission.

Q: Are there any penalties for not filing the OTC Form STH20061 Lodging Tax Return?

A: Yes, failing to file this form or submitting it late may result in penalties and interest charges imposed by the Oklahoma Tax Commission. It's important to comply with the filing requirements to avoid any penalties.

Q: What information do I need to complete the OTC Form STH20061 Lodging Tax Return?

A: You will typically need to provide information such as your business details, lodging revenue, and the amount of tax owed. The form may also require additional details specific to lodging establishments in Oklahoma.

Q: Can I claim any exemptions or deductions on the OTC Form STH20061 Lodging Tax Return?

A: The form may provide options to claim certain exemptions or deductions, depending on the specific circumstances of your lodging establishment. It's advisable to review the instructions provided with the form or consult a tax professional for guidance.

Q: How often do I need to file the OTC Form STH20061 Lodging Tax Return?

A: The frequency of filing this form will depend on the lodging taxes you owe and the instructions provided by the Oklahoma Tax Commission. It could be monthly, quarterly, or annually, so it's essential to understand your specific filing requirements.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form STH20061 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.