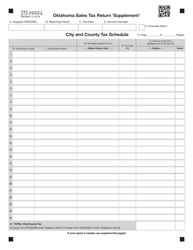

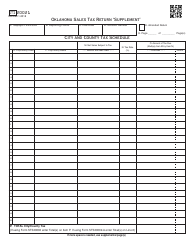

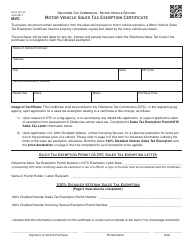

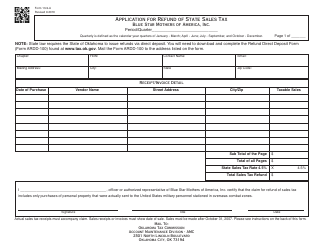

Packet E - Oklahoma Sales Tax Exemption Packet - Oklahoma

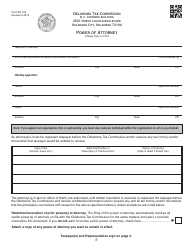

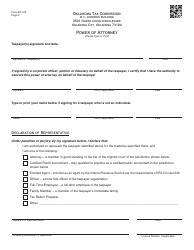

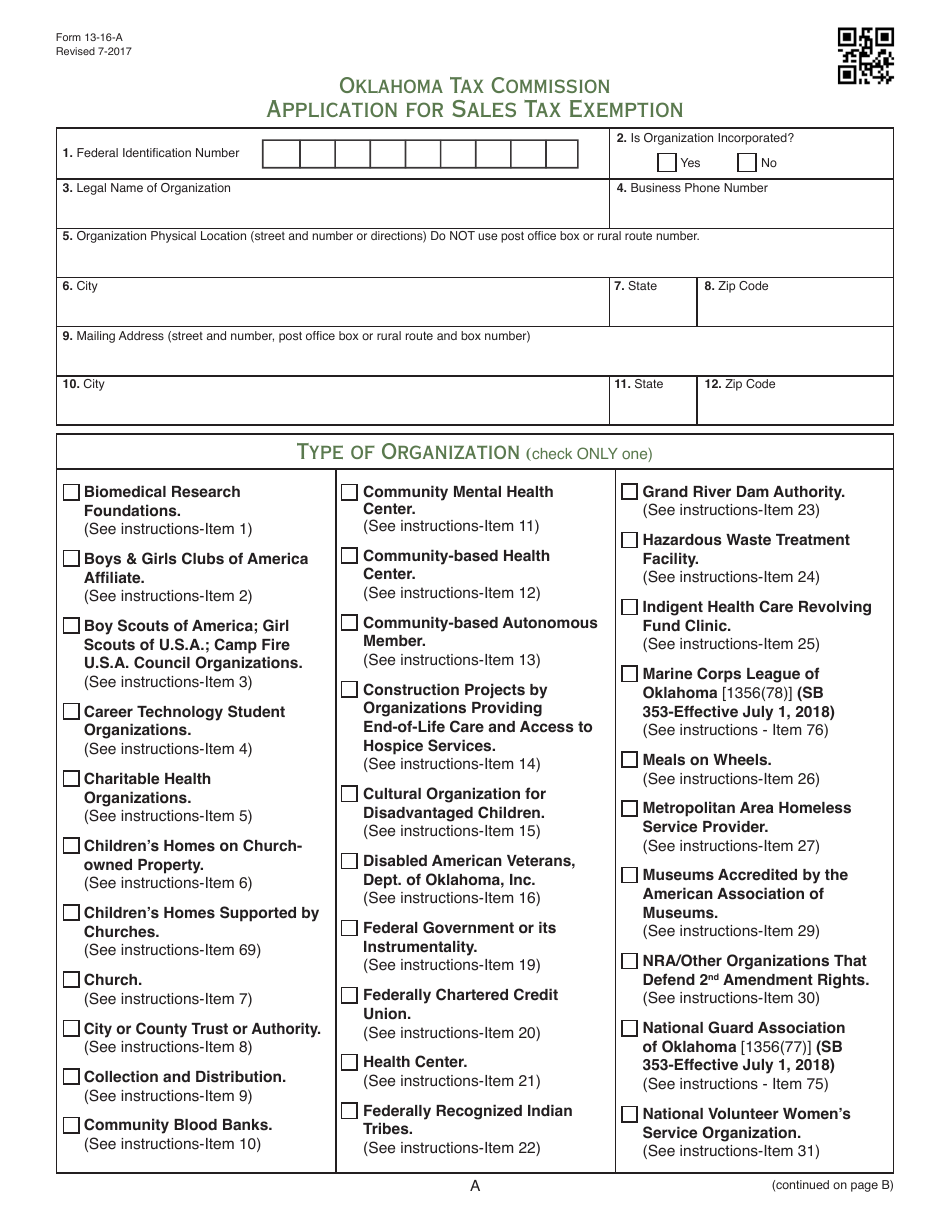

Packet E - Oklahoma Sales Tax Exemption Packet is a legal document that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma.

FAQ

Q: What is Packet E?

A: Packet E is the Oklahoma Sales Tax Exemption Packet.

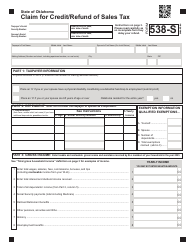

Q: What is the purpose of Packet E?

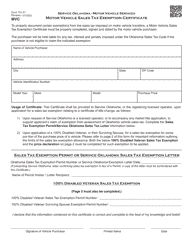

A: Packet E is used to claim sales tax exemption in Oklahoma.

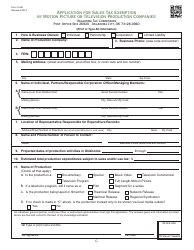

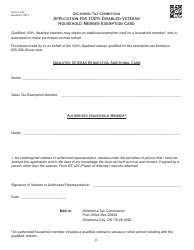

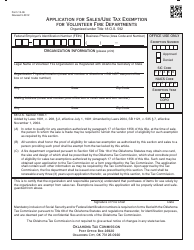

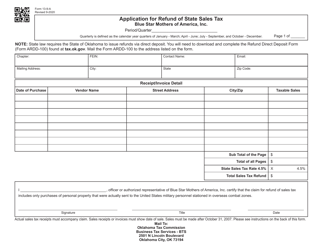

Q: Who can use Packet E?

A: Any individual or organization claiming a sales tax exemption in Oklahoma can use Packet E.

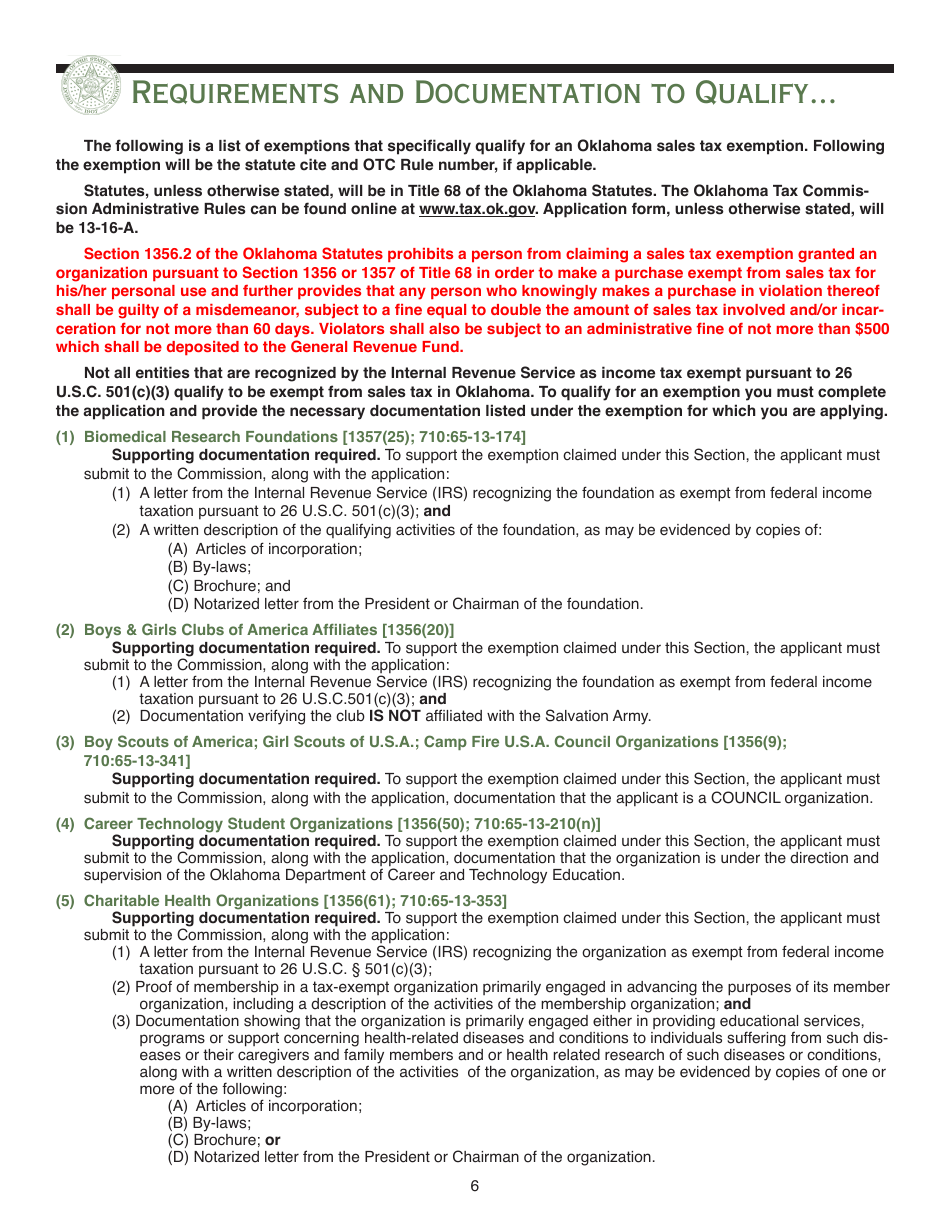

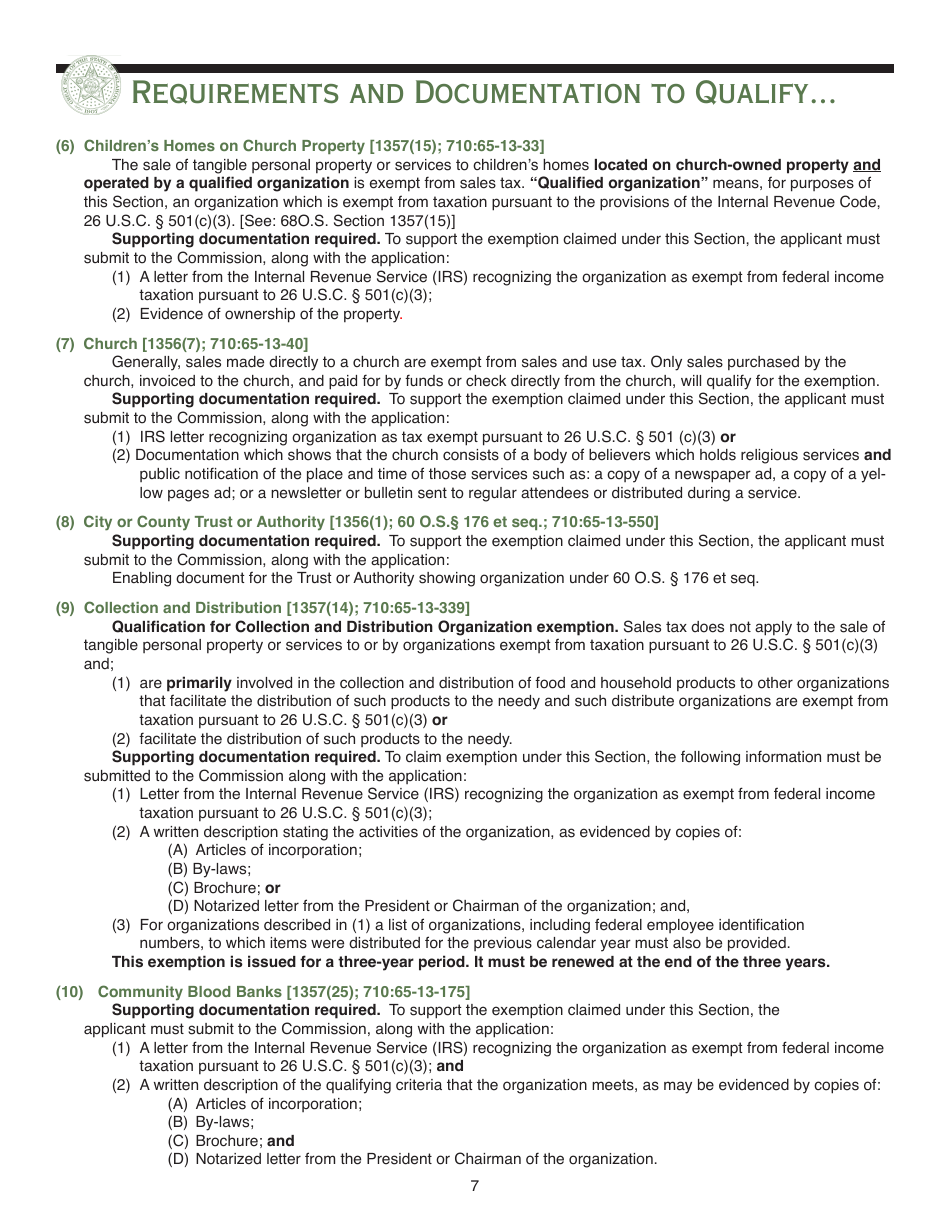

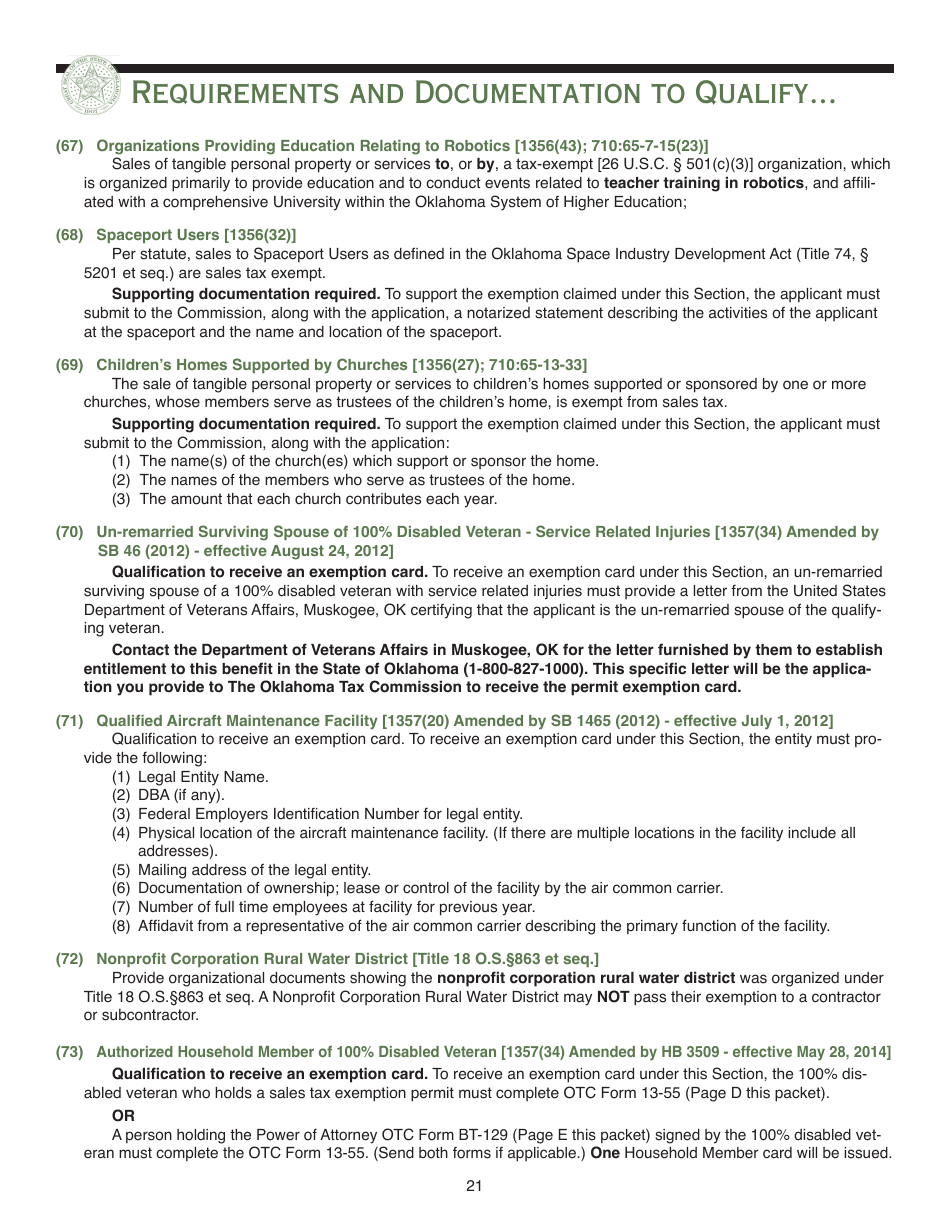

Q: What are the requirements to qualify for sales tax exemption in Oklahoma?

A: To qualify for sales tax exemption in Oklahoma, you must be engaged in certain exempt activities, such as religious, charitable, or educational organizations.

Q: Are there any fees associated with applying for sales tax exemption in Oklahoma?

A: There are no fees associated with applying for sales tax exemption in Oklahoma.

Q: How long does it take to process a sales tax exemption application in Oklahoma?

A: The processing time for a sales tax exemption application in Oklahoma varies, but it can take several weeks.

Q: Can sales tax exemption be applied retroactively in Oklahoma?

A: Sales tax exemption cannot be applied retroactively in Oklahoma. It is only applicable from the date of approval forward.

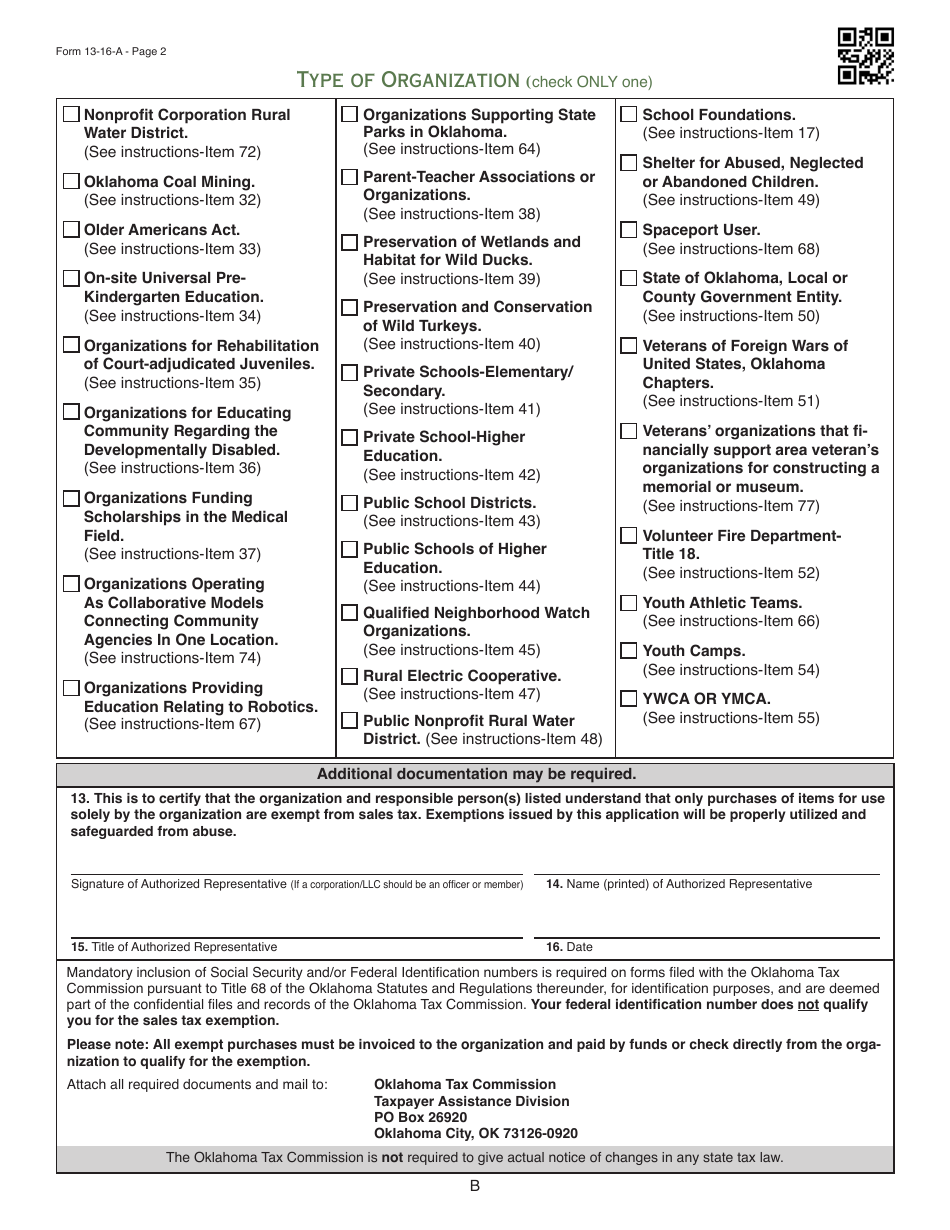

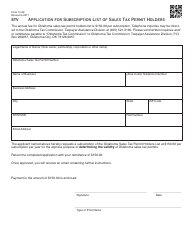

Q: What supporting documents are required to accompany Packet E?

A: The specific supporting documents required to accompany Packet E depend on the type of exemption being claimed. Examples include proof of non-profit status for charitable organizations or documentation of religious organization status for religious institutions.

Q: How often do I need to renew my sales tax exemption in Oklahoma?

A: Sales tax exemption in Oklahoma does not require regular renewal. Once approved, it remains in effect until revoked or canceled.

Form Details:

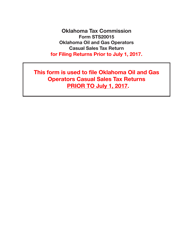

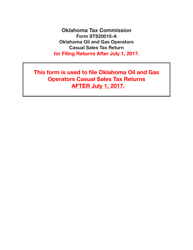

- Released on January 1, 2018;

- The latest edition currently provided by the Oklahoma Tax Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.