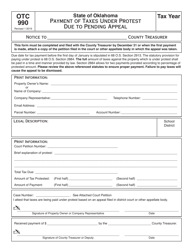

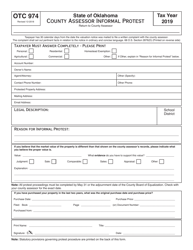

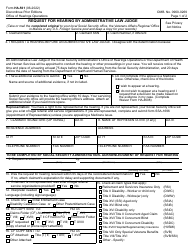

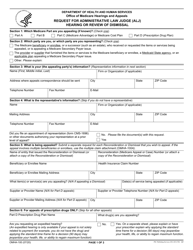

OTC Form 891 Protest of Business Closure / Request for Administrative Hearing - Oklahoma

What Is OTC Form 891?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 891?

A: OTC Form 891 is a form used in Oklahoma to protest a business closure or request an administrative hearing.

Q: How can I obtain OTC Form 891?

A: You can obtain OTC Form 891 by contacting the Oklahoma Tax Commission.

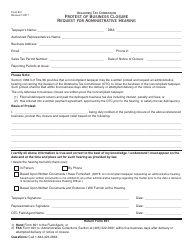

Q: What is the purpose of OTC Form 891?

A: The purpose of OTC Form 891 is to allow individuals or businesses to protest a closure or request a hearing regarding tax-related matters in Oklahoma.

Q: When should I use OTC Form 891?

A: You should use OTC Form 891 when you want to protest the closure of your business or request an administrative hearing in Oklahoma.

Q: Who can use OTC Form 891?

A: OTC Form 891 can be used by individuals or businesses in Oklahoma who want to protest a business closure or request an administrative hearing regarding tax matters.

Q: How do I submit OTC Form 891?

A: You can submit OTC Form 891 to the Oklahoma Tax Commission by mail or in person.

Q: Are there any fees associated with OTC Form 891?

A: There may be fees associated with OTC Form 891. You should check with the Oklahoma Tax Commission for more information about applicable fees.

Q: What happens after I submit OTC Form 891?

A: After you submit OTC Form 891, the Oklahoma Tax Commission will review your protest or request and may schedule an administrative hearing.

Q: Can I appeal the decision made after submitting OTC Form 891?

A: Yes, if you are not satisfied with the decision made after submitting OTC Form 891, you may have the option to appeal the decision through the appropriate channels.

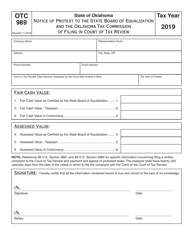

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 891 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.