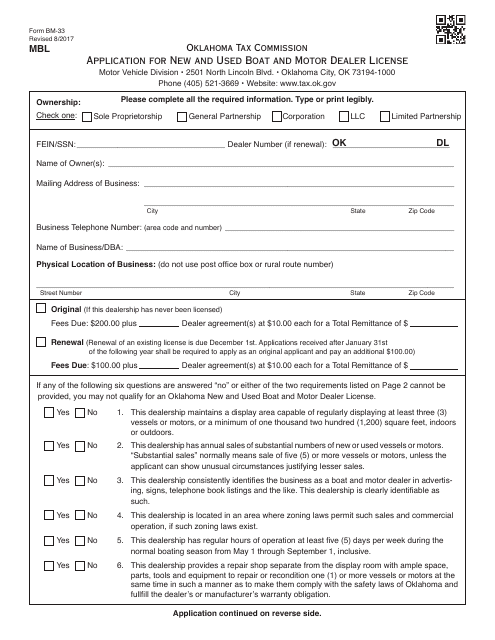

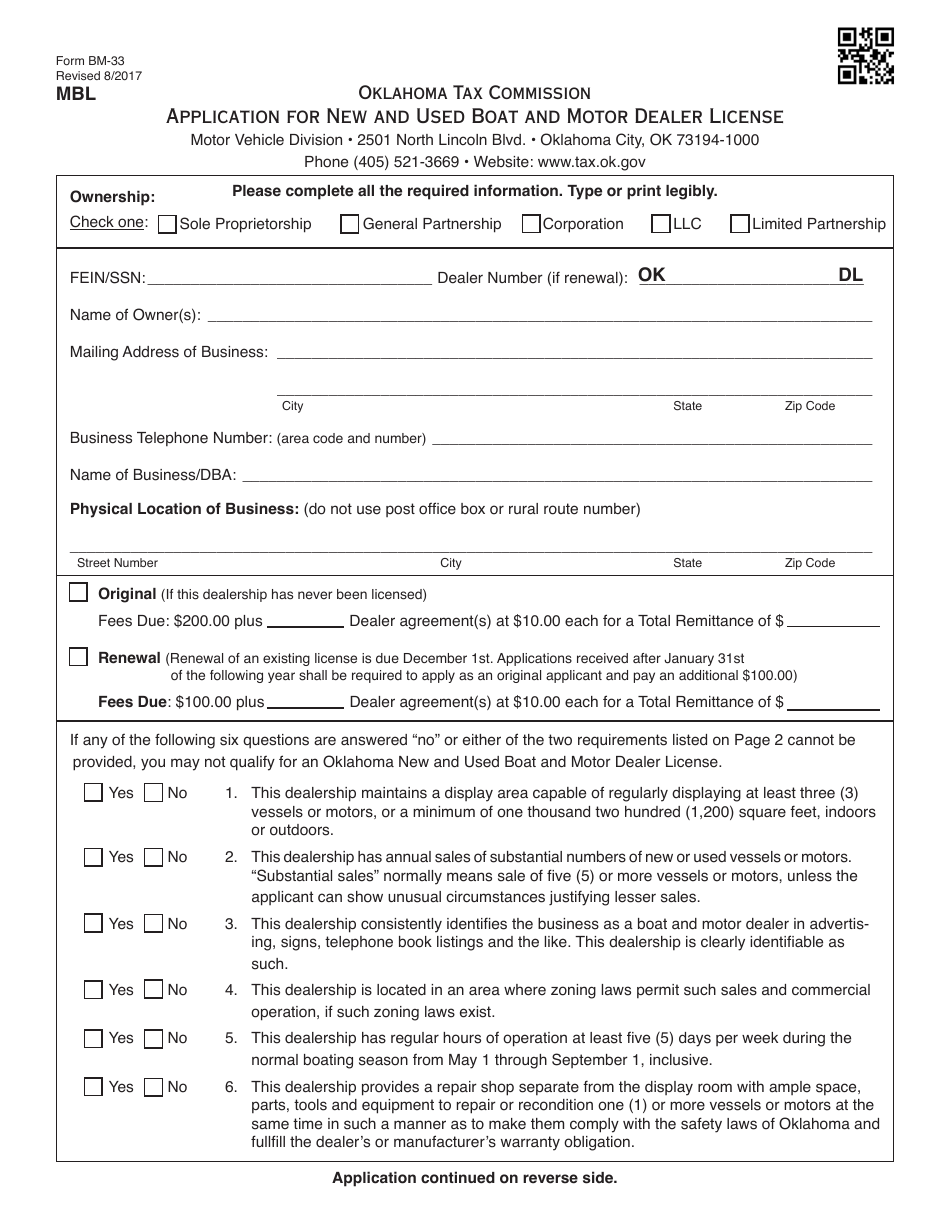

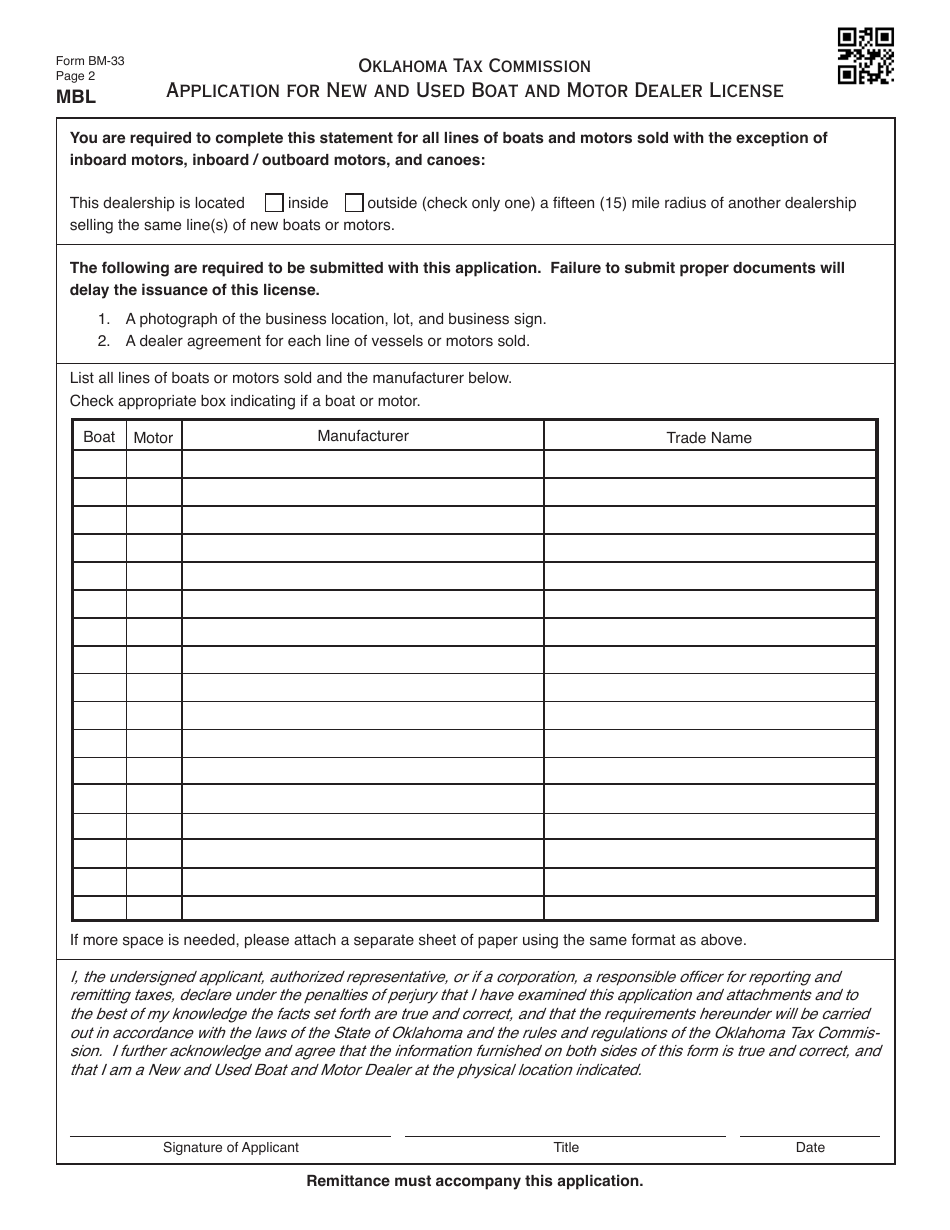

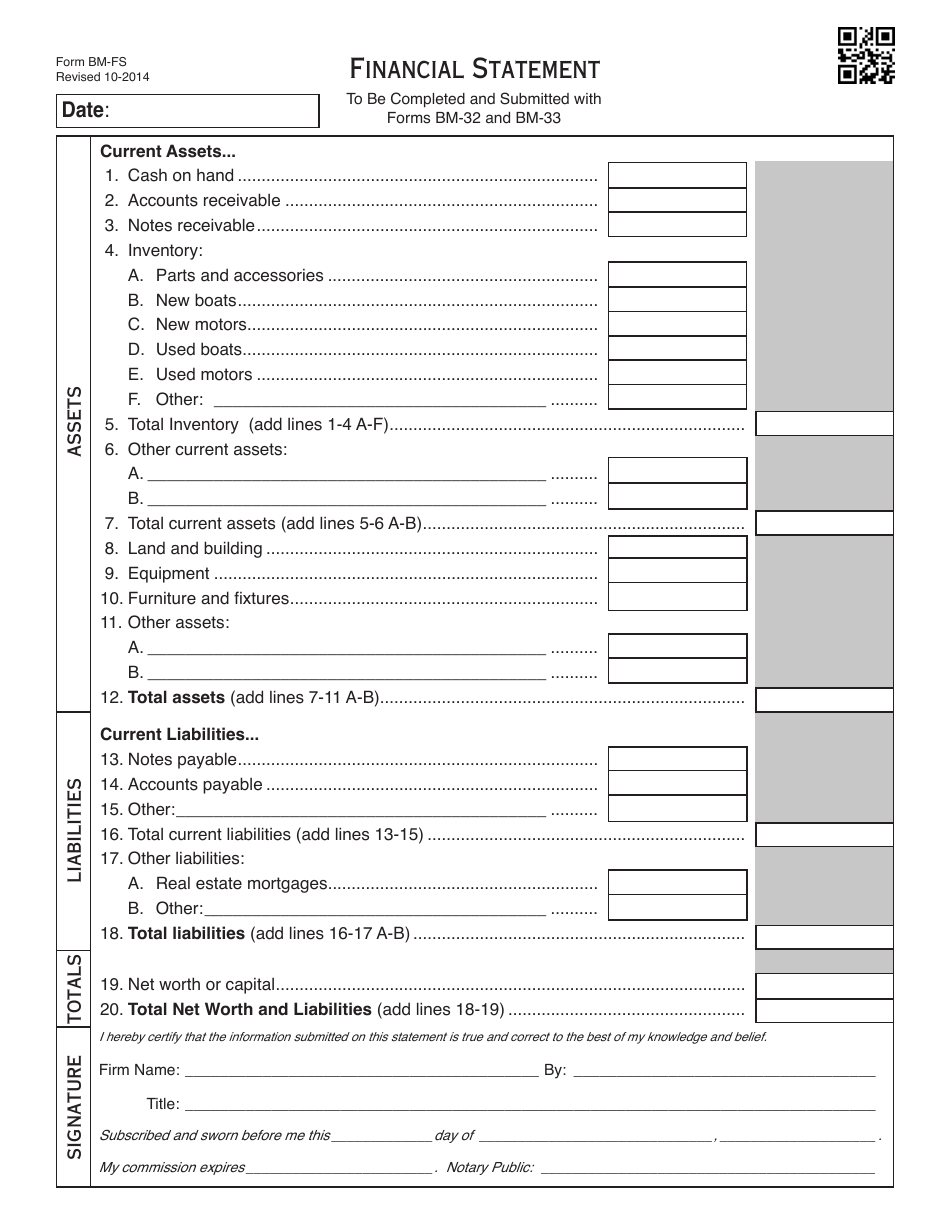

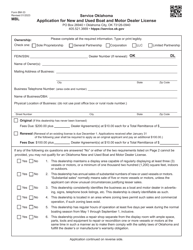

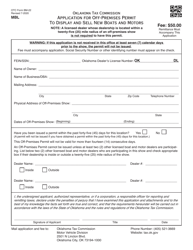

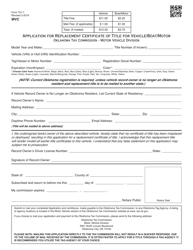

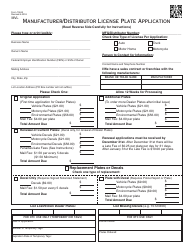

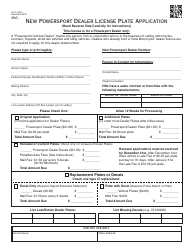

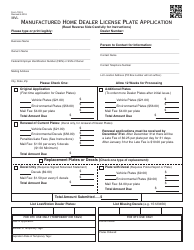

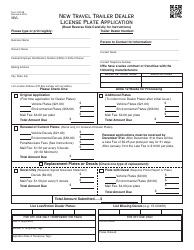

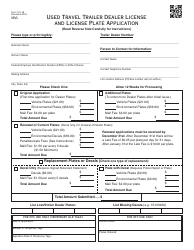

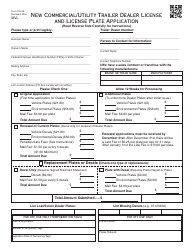

OTC Form BM-33 Application for New and Used Boat and Motor Dealer License - Oklahoma

What Is OTC Form BM-33?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form BM-33?

A: OTC Form BM-33 is an application form used to apply for a New and Used Boat and Motor Dealer License in Oklahoma.

Q: Who needs to fill out OTC Form BM-33?

A: Individuals or businesses who want to become licensed boat and motor dealers in Oklahoma need to fill out OTC Form BM-33.

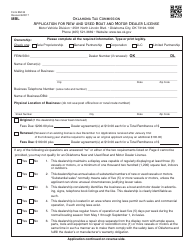

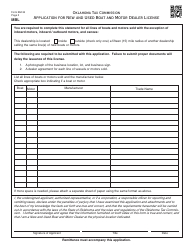

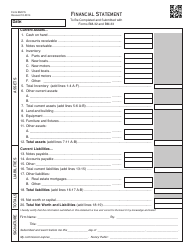

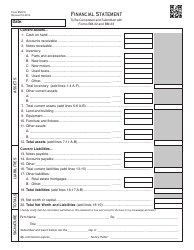

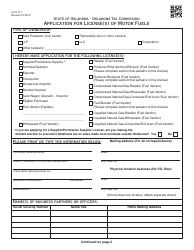

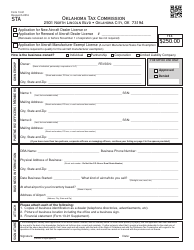

Q: What does OTC Form BM-33 require?

A: OTC Form BM-33 requires applicants to provide information about their business, such as ownership details, location, and business activities.

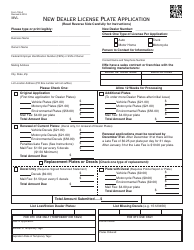

Q: Are there any fees associated with OTC Form BM-33?

A: Yes, there are fees associated with the application for a New and Used Boat and Motor Dealer License. The fees can be found on the OTC Form BM-33 or by contacting the Oklahoma Tax Commission.

Q: Is OTC Form BM-33 specific to Oklahoma?

A: Yes, OTC Form BM-33 is specific to Oklahoma and is used to apply for a boat and motor dealer license within the state.

Q: Can individuals and businesses outside of Oklahoma use OTC Form BM-33?

A: No, OTC Form BM-33 is only for individuals and businesses located in Oklahoma who want to become licensed boat and motor dealers within the state.

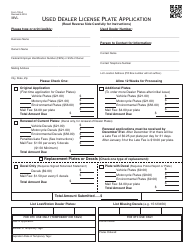

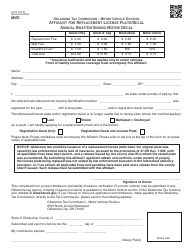

Q: How long does it take to process OTC Form BM-33?

A: The processing time for OTC Form BM-33 may vary. It is best to contact the Oklahoma Tax Commission for an estimated processing time.

Q: What happens after submitting OTC Form BM-33?

A: After submitting OTC Form BM-33, it will be reviewed by the Oklahoma Tax Commission. If approved, a New and Used Boat and Motor Dealer License will be issued.

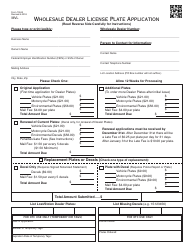

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form BM-33 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.