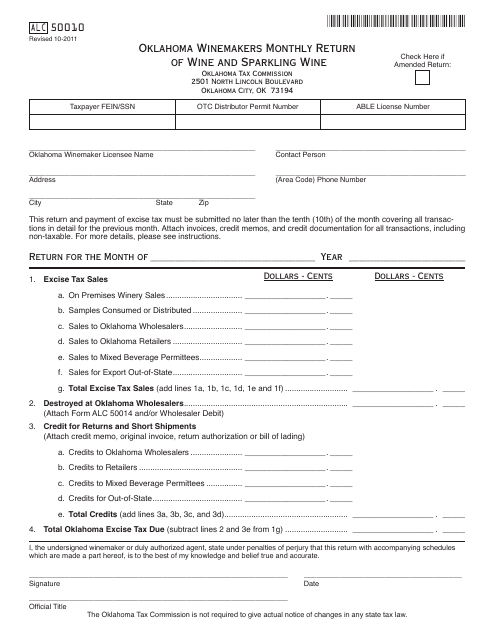

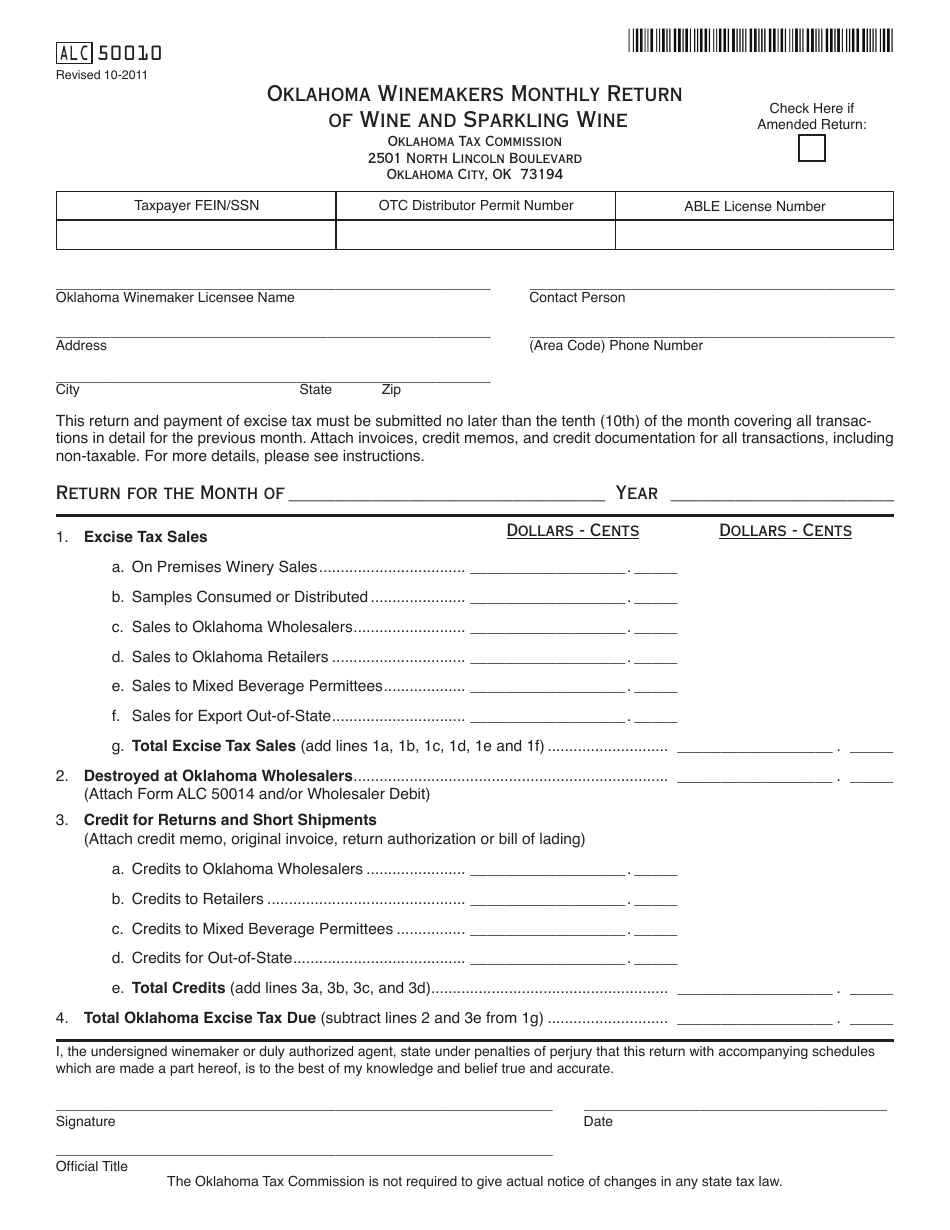

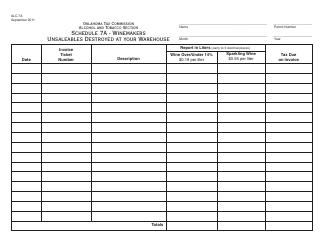

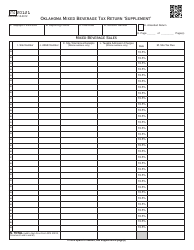

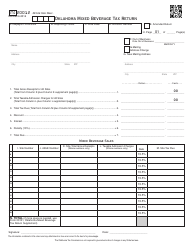

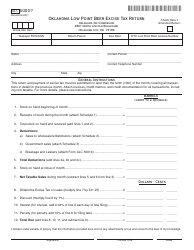

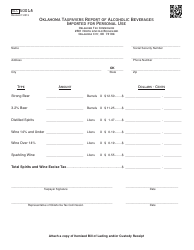

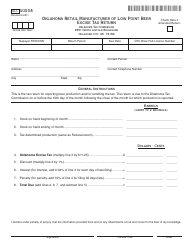

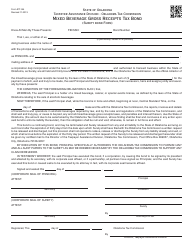

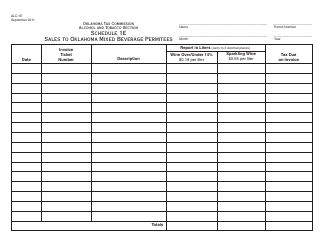

OTC Form ALC50010 Oklahoma Winemakers Monthly Return of Wine and Sparkling Wine - Oklahoma

What Is OTC Form ALC50010?

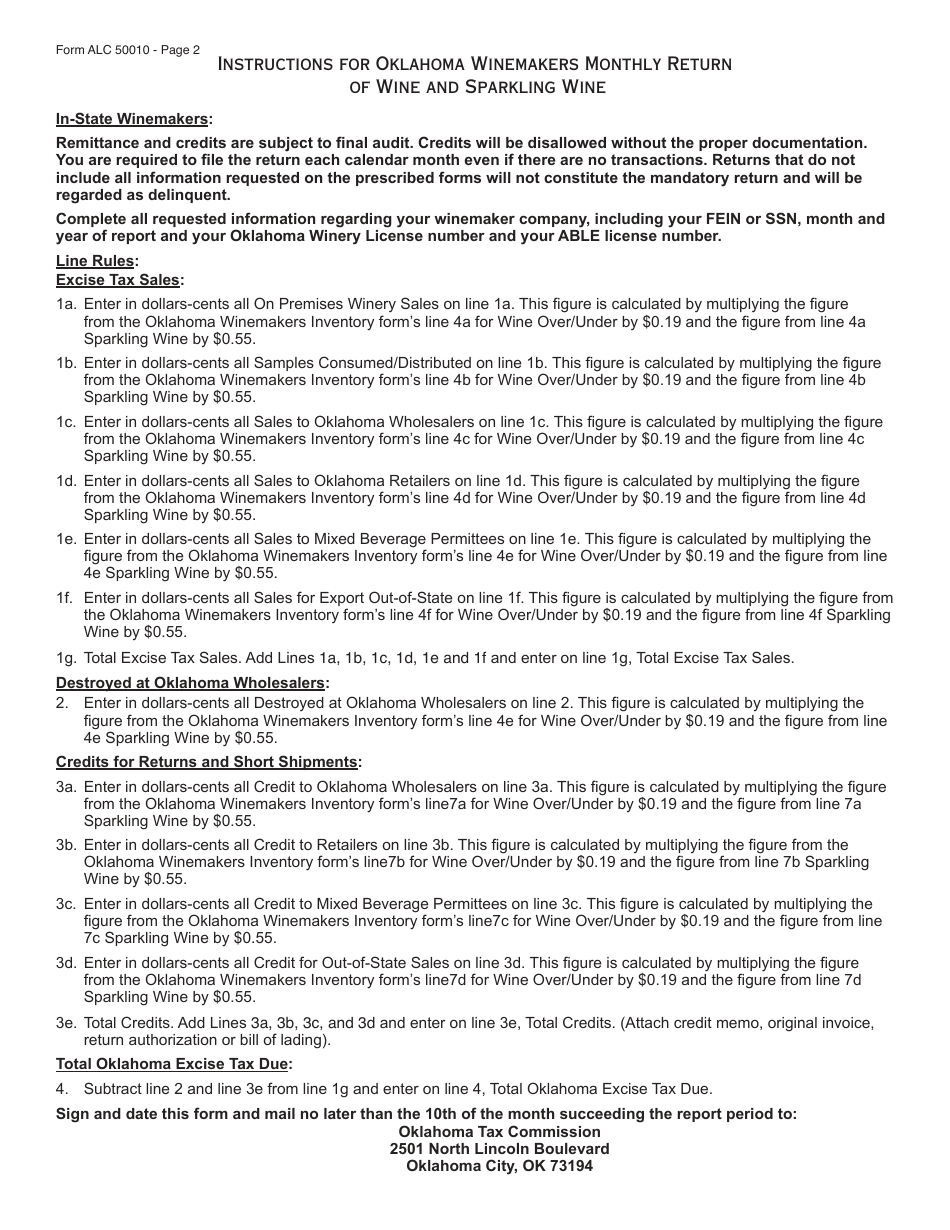

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form ALC50010?

A: OTC Form ALC50010 is the Oklahoma Winemakers Monthly Return of Wine and Sparkling Wine.

Q: What is the purpose of OTC Form ALC50010?

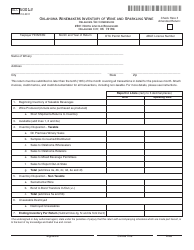

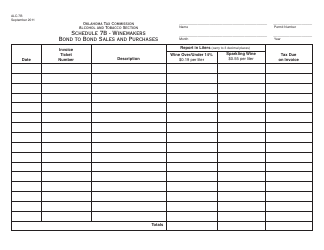

A: The purpose of OTC Form ALC50010 is to report monthly sales and use tax information for wine and sparkling wine produced in Oklahoma.

Q: Who needs to file OTC Form ALC50010?

A: Winemakers and producers of wine and sparkling wine in Oklahoma need to file OTC Form ALC50010.

Q: How often should OTC Form ALC50010 be filed?

A: OTC Form ALC50010 should be filed on a monthly basis.

Q: What information is required on OTC Form ALC50010?

A: OTC Form ALC50010 requires information such as sales and use tax amounts, gallons of wine and sparkling wine produced, and any exemptions claimed.

Q: Are there any penalties for not filing OTC Form ALC50010?

A: Yes, there may be penalties for not filing OTC Form ALC50010, such as late fees and interest charges.

Q: Is there a deadline for filing OTC Form ALC50010?

A: Yes, OTC Form ALC50010 must be filed by the 20th day of the following month.

Q: Is OTC Form ALC50010 specific to Oklahoma?

A: Yes, OTC Form ALC50010 is specific to winemakers and producers in Oklahoma who need to report wine and sparkling wine sales and use tax.

Form Details:

- Released on October 1, 2011;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form ALC50010 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.