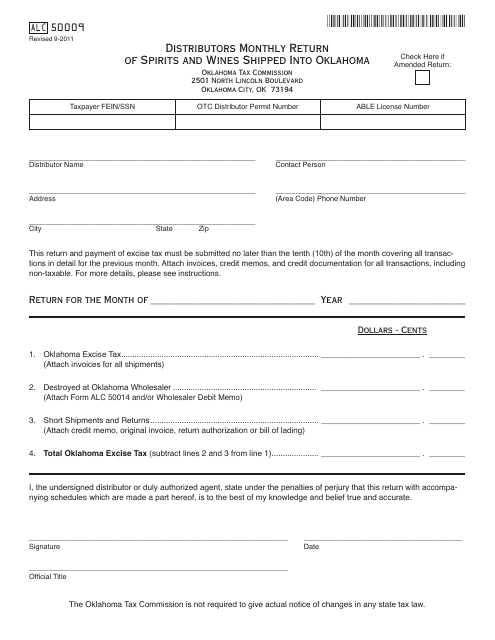

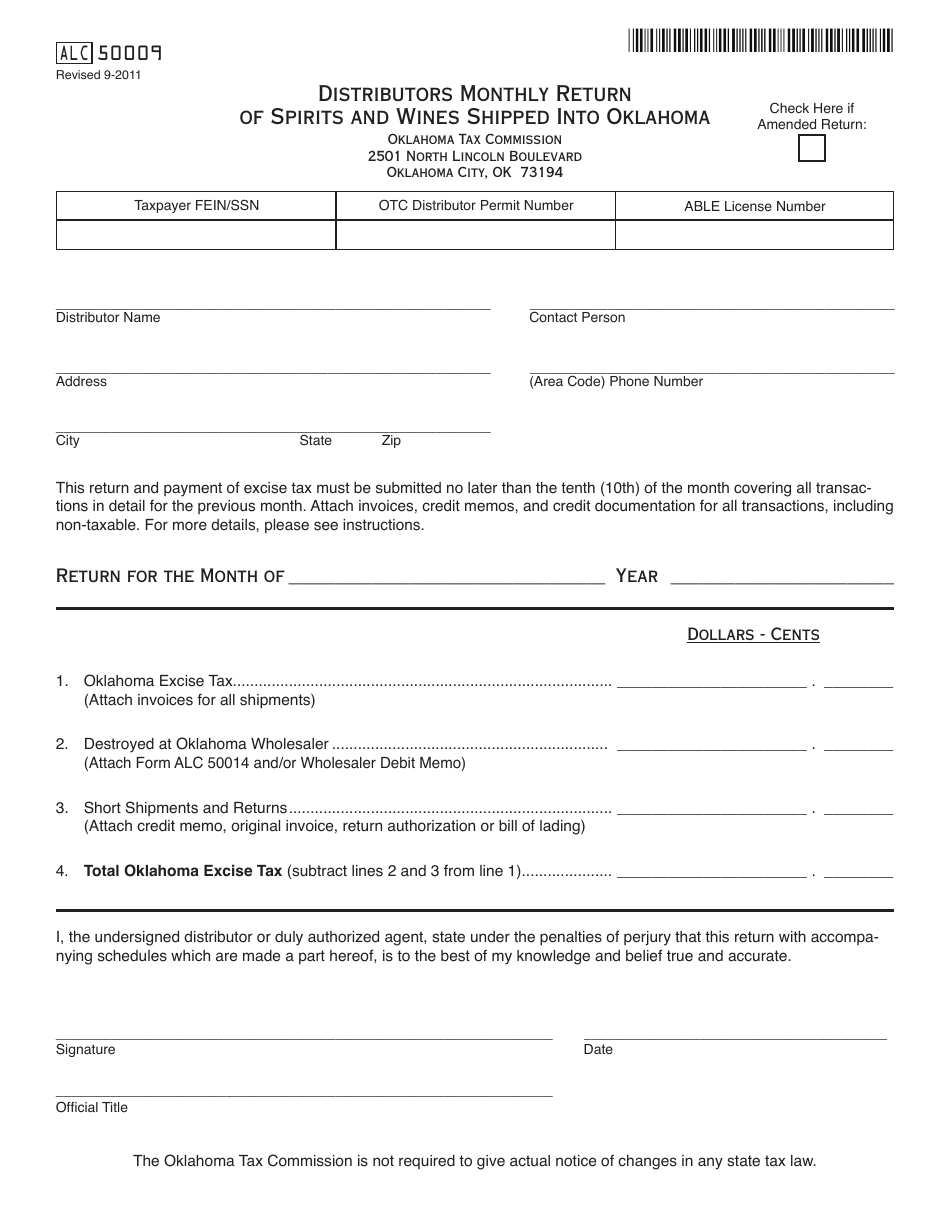

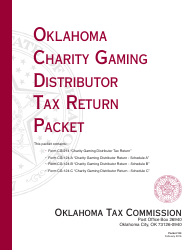

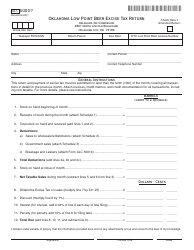

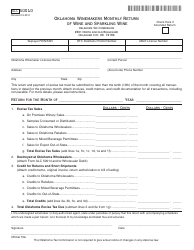

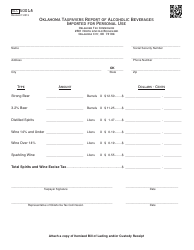

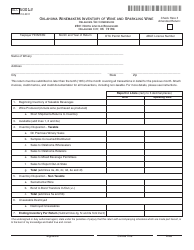

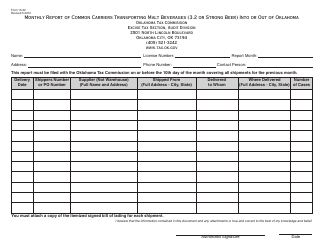

OTC Form ALC50009 Distributors Monthly Return of Spirits and Wines Shipped Into Oklahoma - Oklahoma

What Is OTC Form ALC50009?

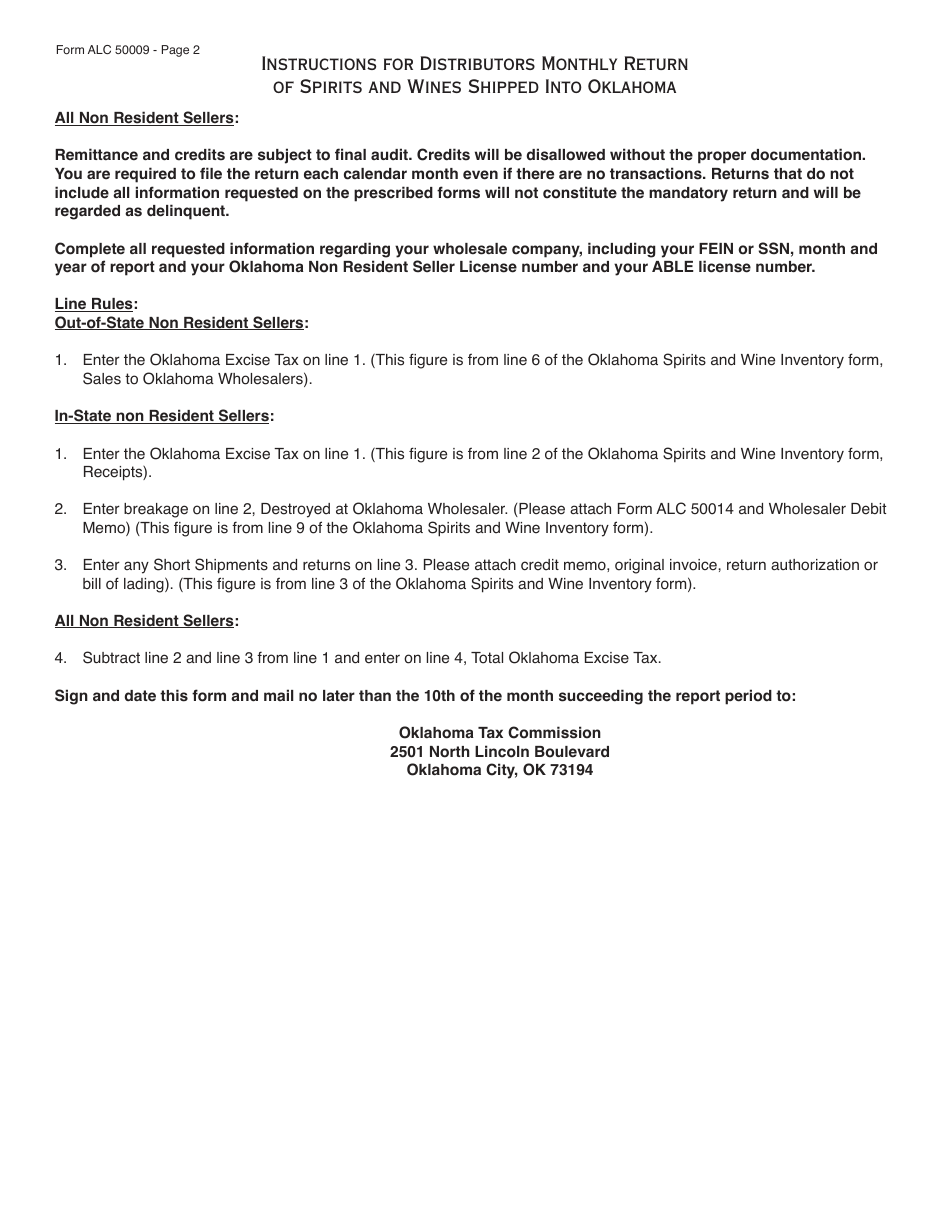

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form ALC50009?

A: The OTC Form ALC50009 is the Distributors Monthly Return of Spirits and Wines Shipped Into Oklahoma.

Q: Who is required to file the OTC Form ALC50009?

A: Distributors who ship spirits and wines into Oklahoma are required to file the OTC Form ALC50009.

Q: What is the purpose of the OTC Form ALC50009?

A: The purpose of the OTC Form ALC50009 is to report the monthly shipment of spirits and wines into Oklahoma.

Q: When is the deadline for filing the OTC Form ALC50009?

A: The deadline for filing the OTC Form ALC50009 is typically the last day of the month following the reporting period.

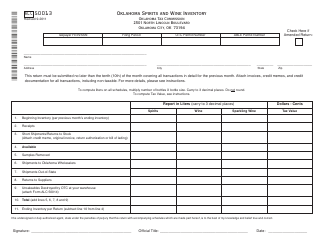

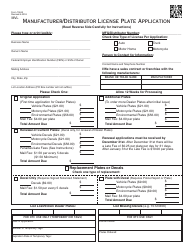

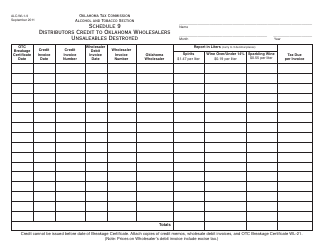

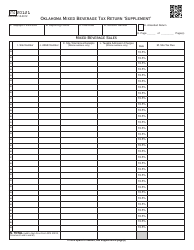

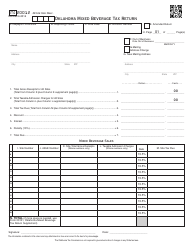

Q: What information should be included in the OTC Form ALC50009?

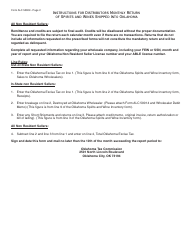

A: The OTC Form ALC50009 requires information such as the distributor's name, address, license number, shipment details, and excise tax liability.

Q: Are there any penalties for not filing the OTC Form ALC50009?

A: Yes, failure to file the OTC Form ALC50009 or filing it late may result in penalties and interest charges.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form ALC50009 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.