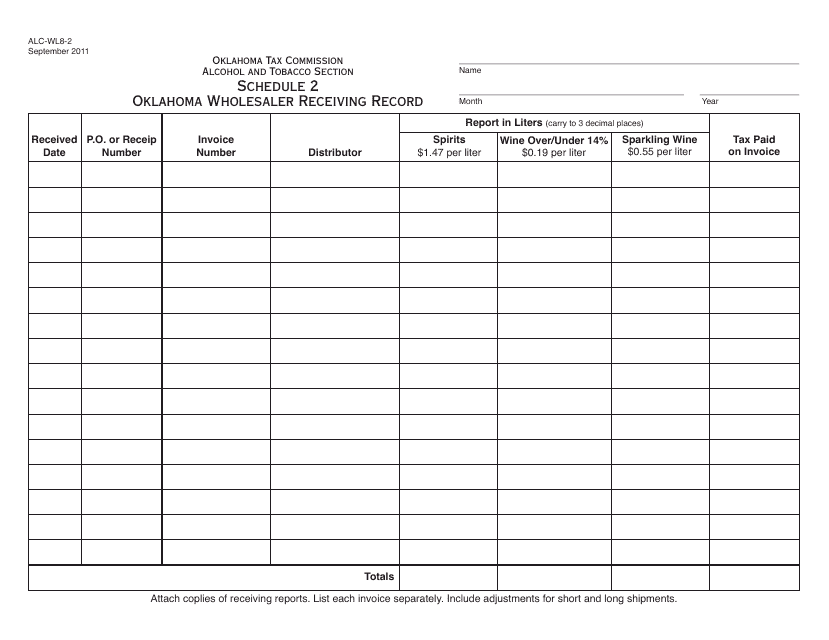

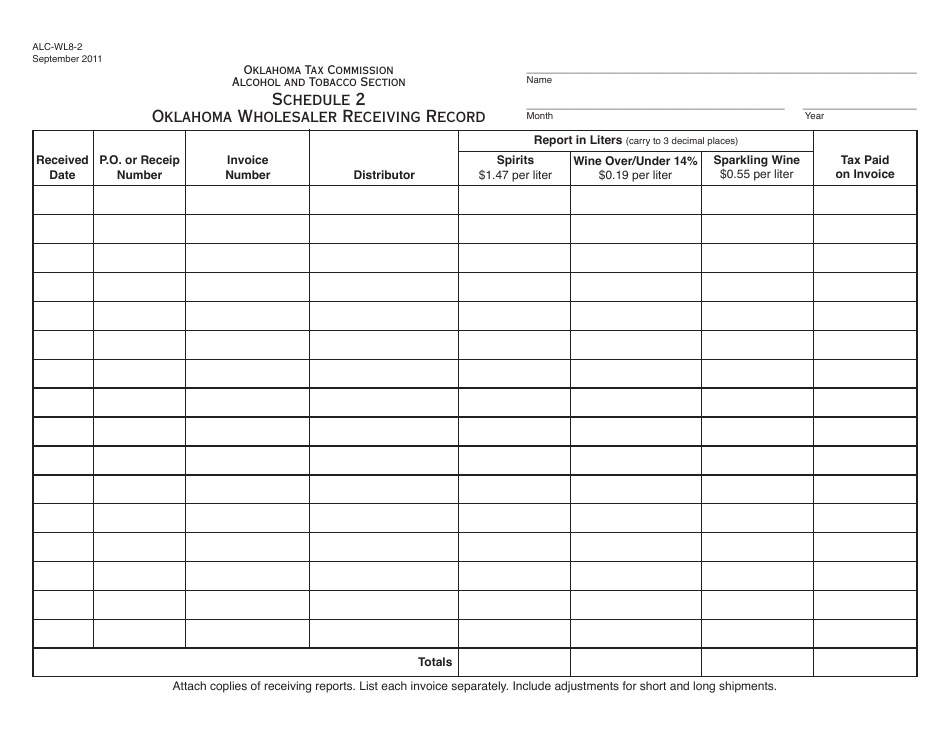

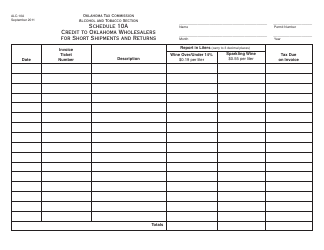

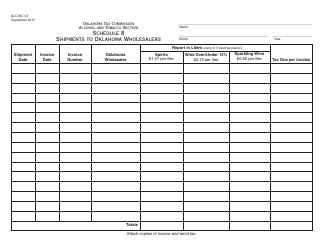

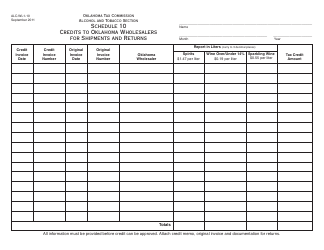

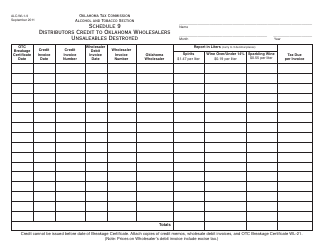

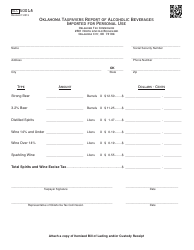

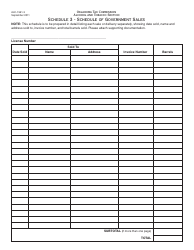

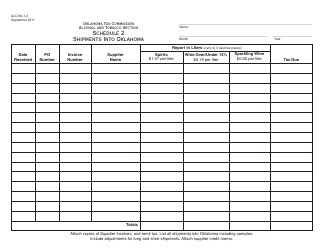

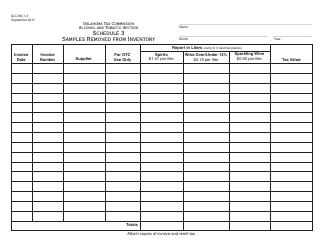

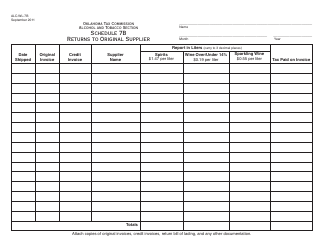

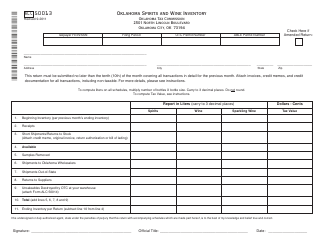

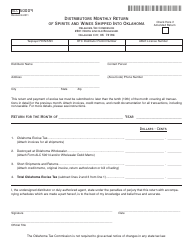

OTC Form ALC-WL8-2 Schedule 2 Oklahoma Wholesaler Receiving Record - Oklahoma

What Is OTC Form ALC-WL8-2 Schedule 2?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form ALC-WL8-2 Schedule 2?

A: The OTC Form ALC-WL8-2 Schedule 2 is a document used in Oklahoma for recording the receipt of goods by wholesalers.

Q: What is the purpose of the Oklahoma Wholesaler Receiving Record?

A: The purpose of the Oklahoma Wholesaler Receiving Record is to track and document the receipt of goods by wholesalers in Oklahoma.

Q: Who uses the OTC Form ALC-WL8-2 Schedule 2?

A: The OTC Form ALC-WL8-2 Schedule 2 is used by wholesalers operating in Oklahoma.

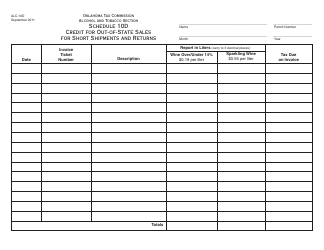

Q: What information is included in the Oklahoma Wholesaler Receiving Record?

A: The Oklahoma Wholesaler Receiving Record includes information such as the date of receipt, supplier name, description of goods, quantity received, and the signature of the receiving person.

Q: Is the OTC Form ALC-WL8-2 Schedule 2 mandatory?

A: Yes, wholesalers in Oklahoma are required to use the OTC Form ALC-WL8-2 Schedule 2 to record the receipt of goods.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form ALC-WL8-2 Schedule 2 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.