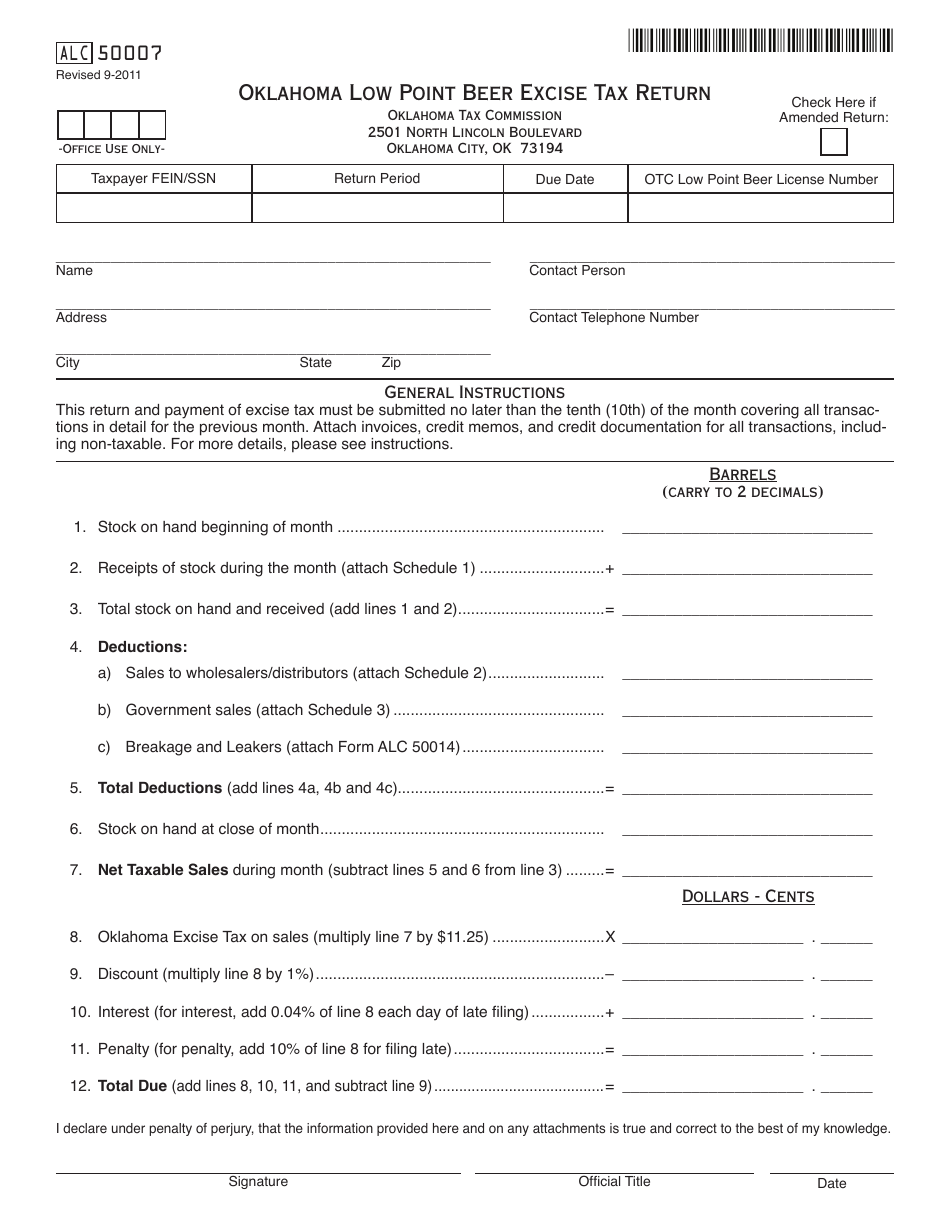

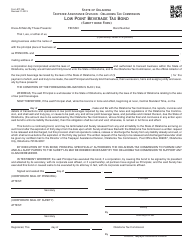

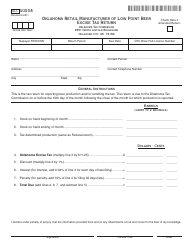

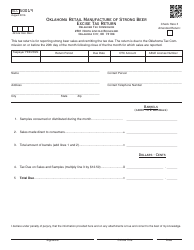

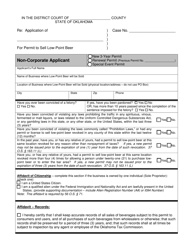

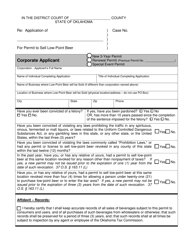

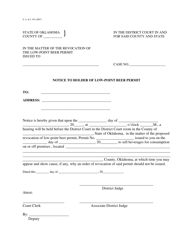

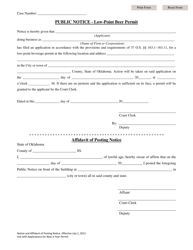

OTC Form ALC50007 Oklahoma Low Point Beer Excise Tax Return - Oklahoma

What Is OTC Form ALC50007?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form ALC50007?

A: OTC Form ALC50007 is a Low Point Beer Excise Tax Return form used in Oklahoma.

Q: What is the purpose of OTC Form ALC50007?

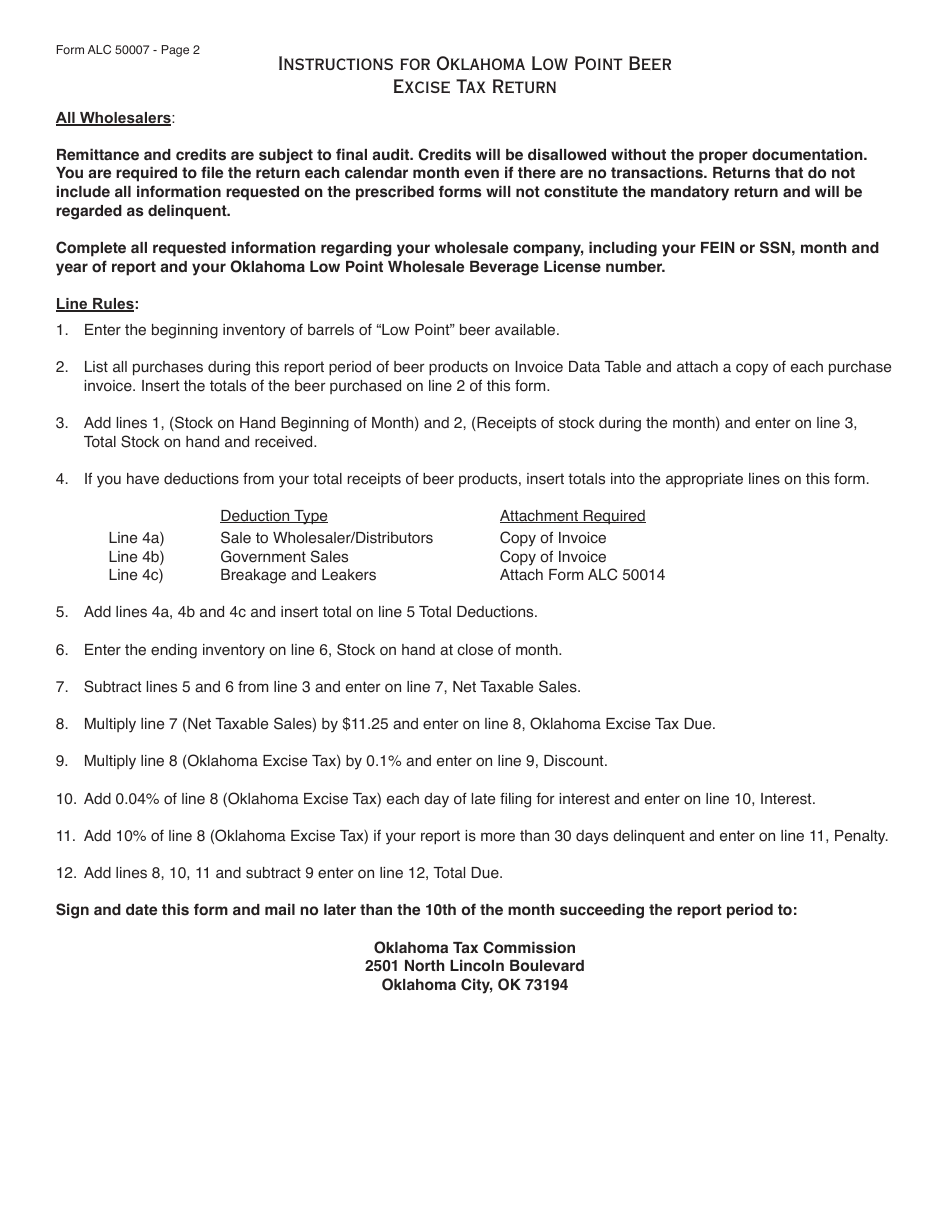

A: The purpose of OTC Form ALC50007 is to report and pay the excise tax on low point beer in Oklahoma.

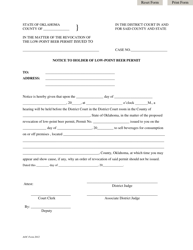

Q: Who needs to file OTC Form ALC50007?

A: Any entity involved in the production, distribution, or sale of low point beer in Oklahoma needs to file OTC Form ALC50007.

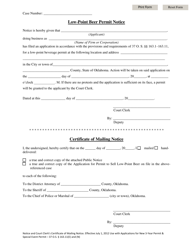

Q: What is low point beer?

A: Low point beer refers to beer that contains 3.2% alcohol by weight or less.

Q: How often should OTC Form ALC50007 be filed?

A: OTC Form ALC50007 should be filed monthly, on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of OTC Form ALC50007?

A: Yes, there are penalties for late filing, including a late filing fee and interest on any unpaid tax.

Q: Are there any exemptions or deductions available for low point beer excise tax?

A: No, there are no specific exemptions or deductions available for low point beer excise tax in Oklahoma.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form ALC50007 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.