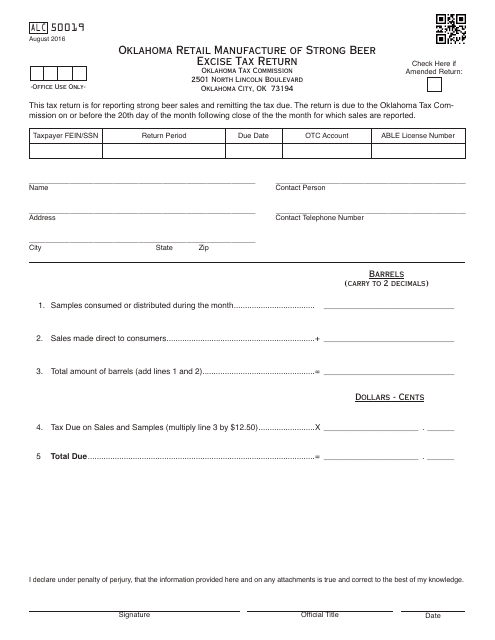

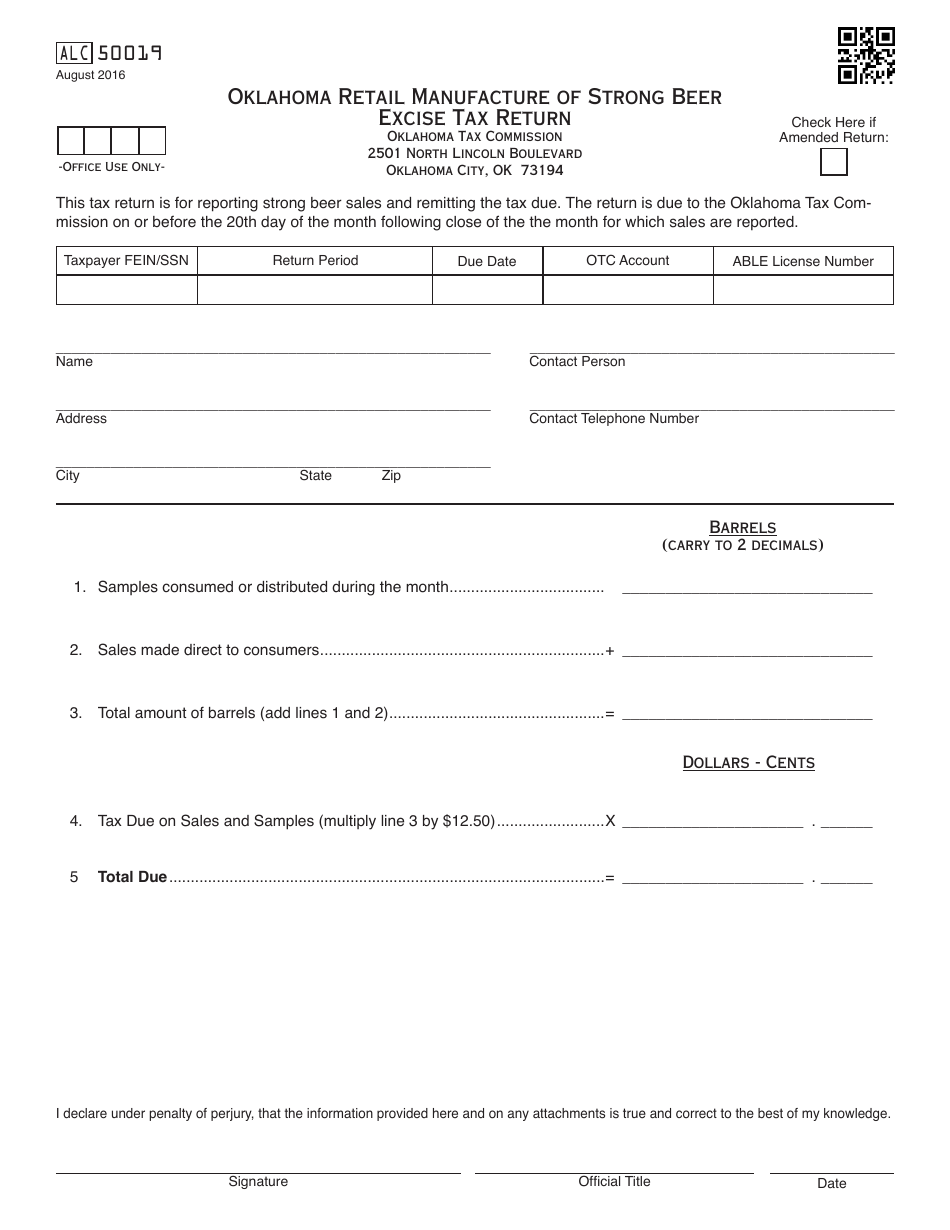

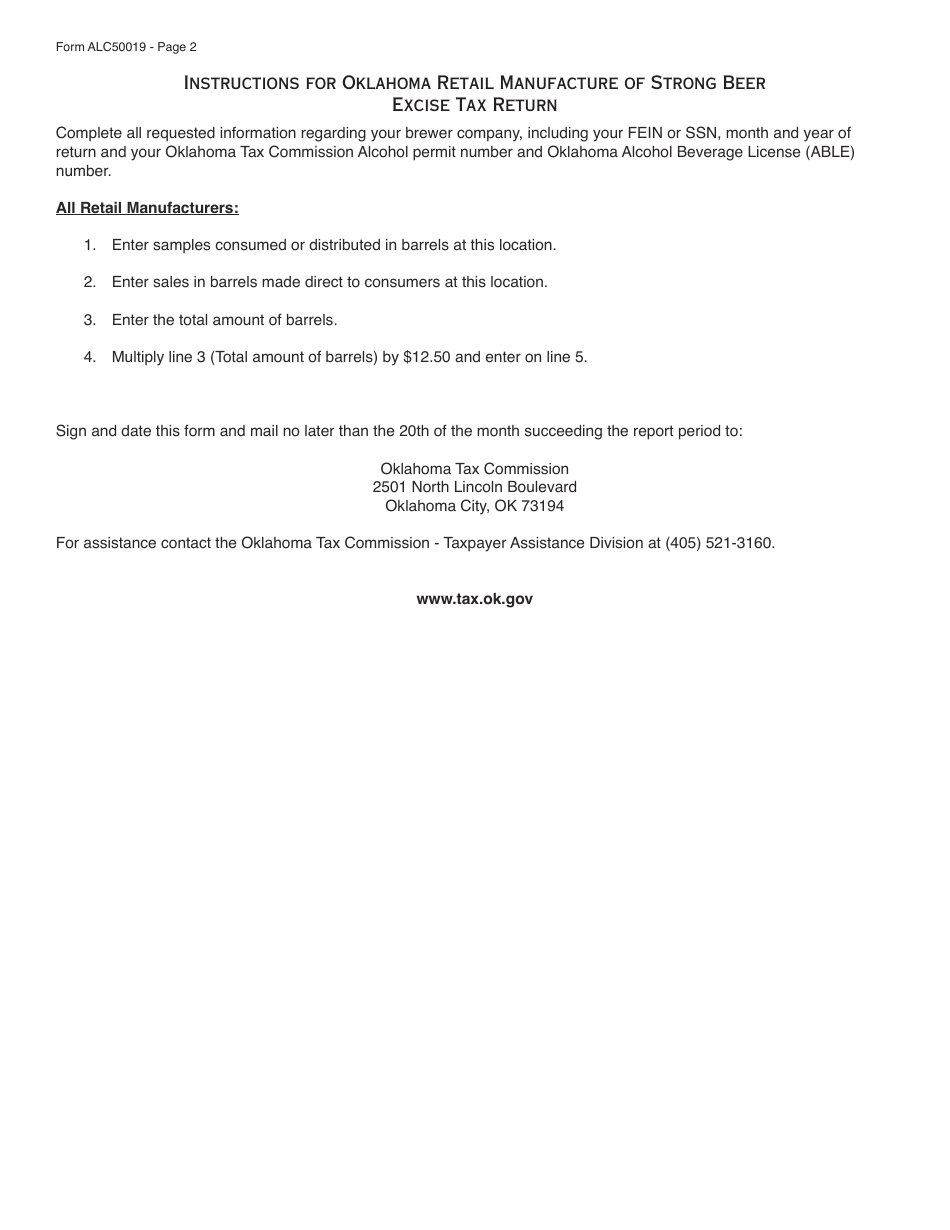

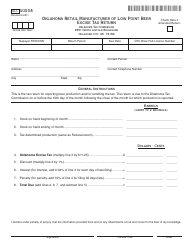

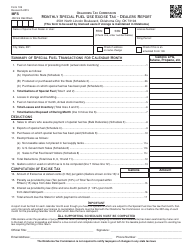

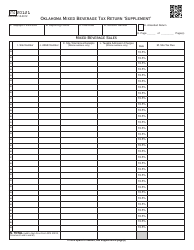

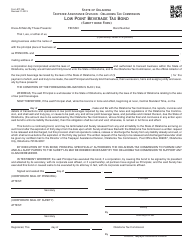

OTC Form ALC50019 Oklahoma Retail Manufacture of Strong Beer Excise Tax Return - Oklahoma

What Is OTC Form ALC50019?

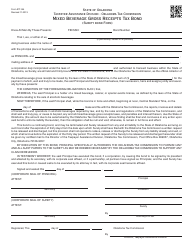

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form ALC50019?

A: OTC Form ALC50019 is the Oklahoma Retail Manufacture of Strong Beer Excise Tax Return.

Q: Who is required to file OTC Form ALC50019?

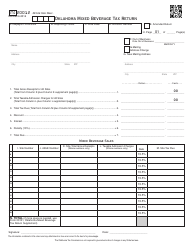

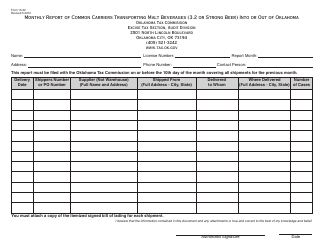

A: Retail manufacturers of strong beer in Oklahoma are required to file OTC Form ALC50019.

Q: What is the purpose of OTC Form ALC50019?

A: The purpose of OTC Form ALC50019 is to report and pay the excise tax on the retail manufacture of strong beer in Oklahoma.

Q: How often is OTC Form ALC50019 filed?

A: OTC Form ALC50019 is filed on a monthly basis.

Q: Is there a due date for filing OTC Form ALC50019?

A: Yes, there is a due date for filing OTC Form ALC50019. It is the 20th day of the month following the reporting period.

Q: What happens if I don't file OTC Form ALC50019 or pay the excise tax?

A: Failure to file OTC Form ALC50019 or pay the excise tax can result in penalties and interest.

Q: Are there any exemptions from the excise tax on strong beer?

A: There are no exemptions from the excise tax on strong beer in Oklahoma.

Q: I have a question about OTC Form ALC50019, who should I contact?

A: For questions about OTC Form ALC50019, you can contact the Oklahoma Tax Commission.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form ALC50019 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.