This version of the form is not currently in use and is provided for reference only. Download this version of

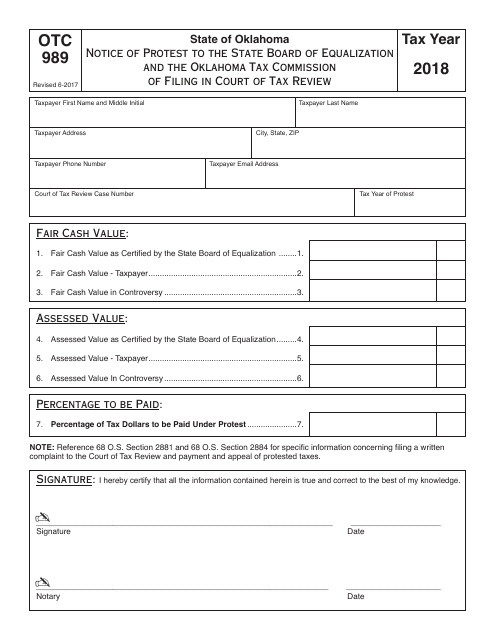

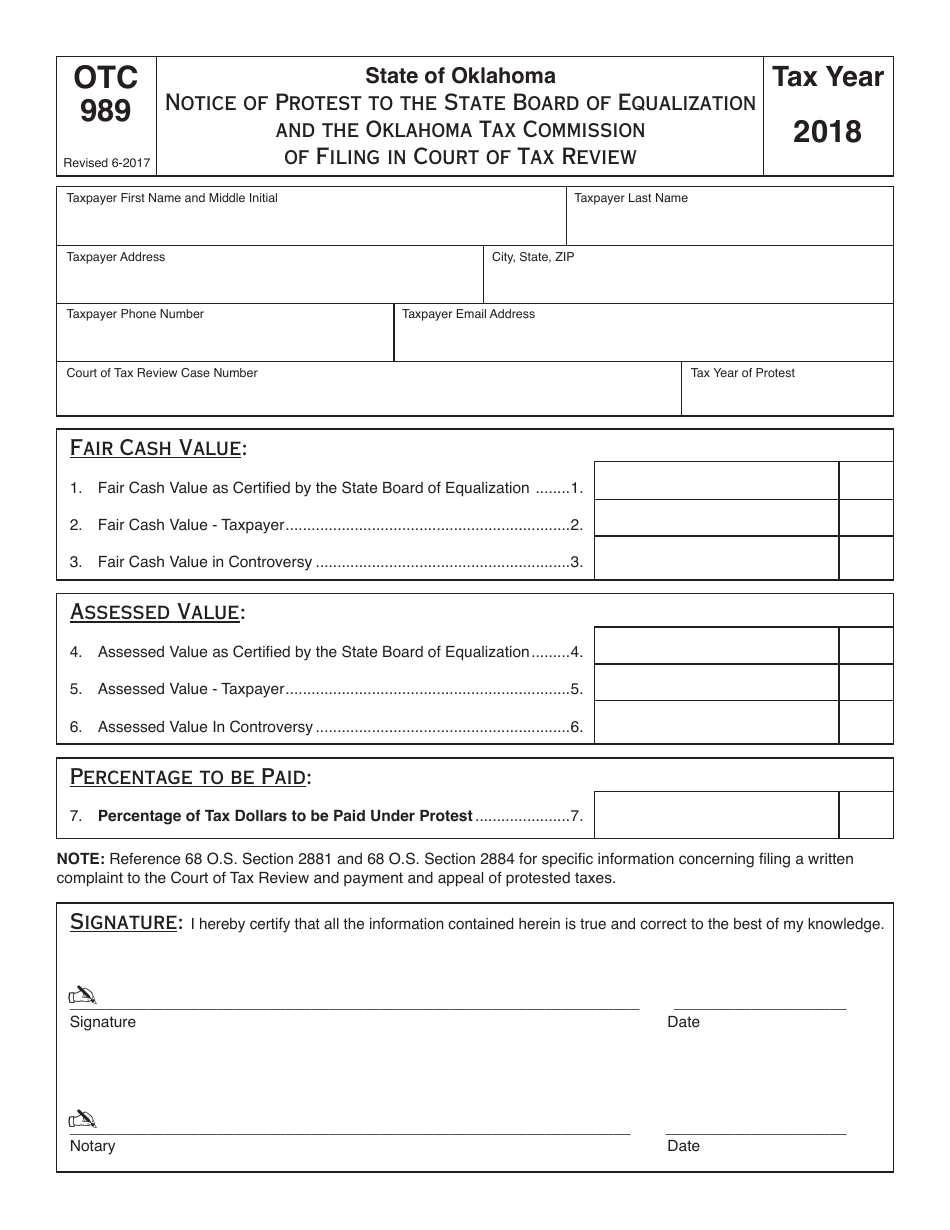

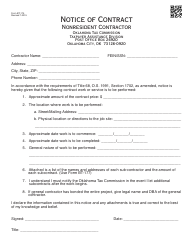

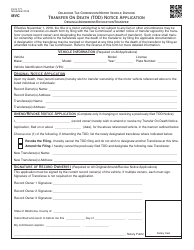

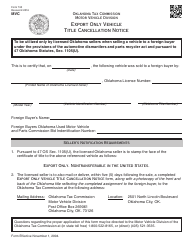

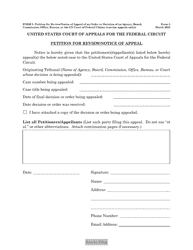

OTC Form OTC989

for the current year.

OTC Form OTC989 Notice of Protest to the State Board of Equalization and the Oklahoma Tax Commission of Filing in Court of Tax Review - Oklahoma

What Is OTC Form OTC989?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OTC989?

A: OTC Form OTC989 is a Notice of Protest that is filed with the State Board of Equalization and the Oklahoma Tax Commission regarding a court filing in the Court of Tax Review in the state of Oklahoma.

Q: What is the purpose of OTC Form OTC989?

A: The purpose of OTC Form OTC989 is to notify the State Board of Equalization and the Oklahoma Tax Commission about the filing of a court case in the Court of Tax Review.

Q: When should OTC Form OTC989 be filed?

A: OTC Form OTC989 should be filed when an individual or business has filed a case in the Court of Tax Review and needs to notify the State Board of Equalization and the Oklahoma Tax Commission.

Q: Is there a fee for filing OTC Form OTC989?

A: No, there is no fee for filing OTC Form OTC989.

Q: What information is required on OTC Form OTC989?

A: OTC Form OTC989 requires the filer to provide their name, address, contact information, case number, and a brief description of the court filing.

Q: Is OTC Form OTC989 specific to Oklahoma?

A: Yes, OTC Form OTC989 is specific to the state of Oklahoma and is used for filing a protest with the State Board of Equalization and the Oklahoma Tax Commission regarding a court filing in the Court of Tax Review.

Q: What happens after filing OTC Form OTC989?

A: After filing OTC Form OTC989, the State Board of Equalization and the Oklahoma Tax Commission will be officially notified about the court filing in the Court of Tax Review.

Q: Are there any time limits for filing OTC Form OTC989?

A: Yes, OTC Form OTC989 must be filed within a specific time period as mandated by the rules and regulations of the Court of Tax Review in Oklahoma.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC989 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.