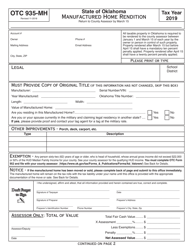

This version of the form is not currently in use and is provided for reference only. Download this version of

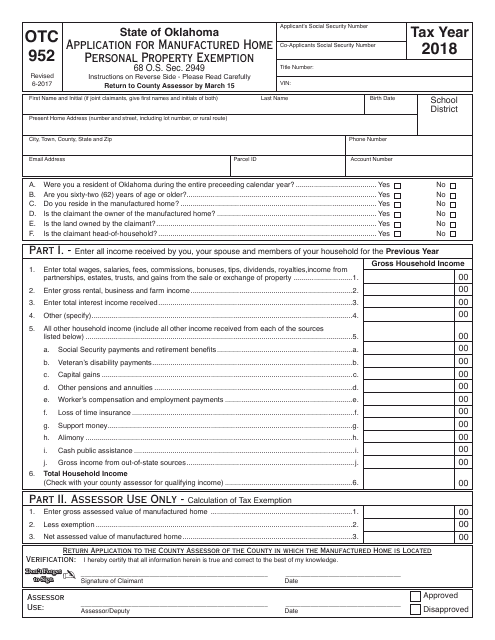

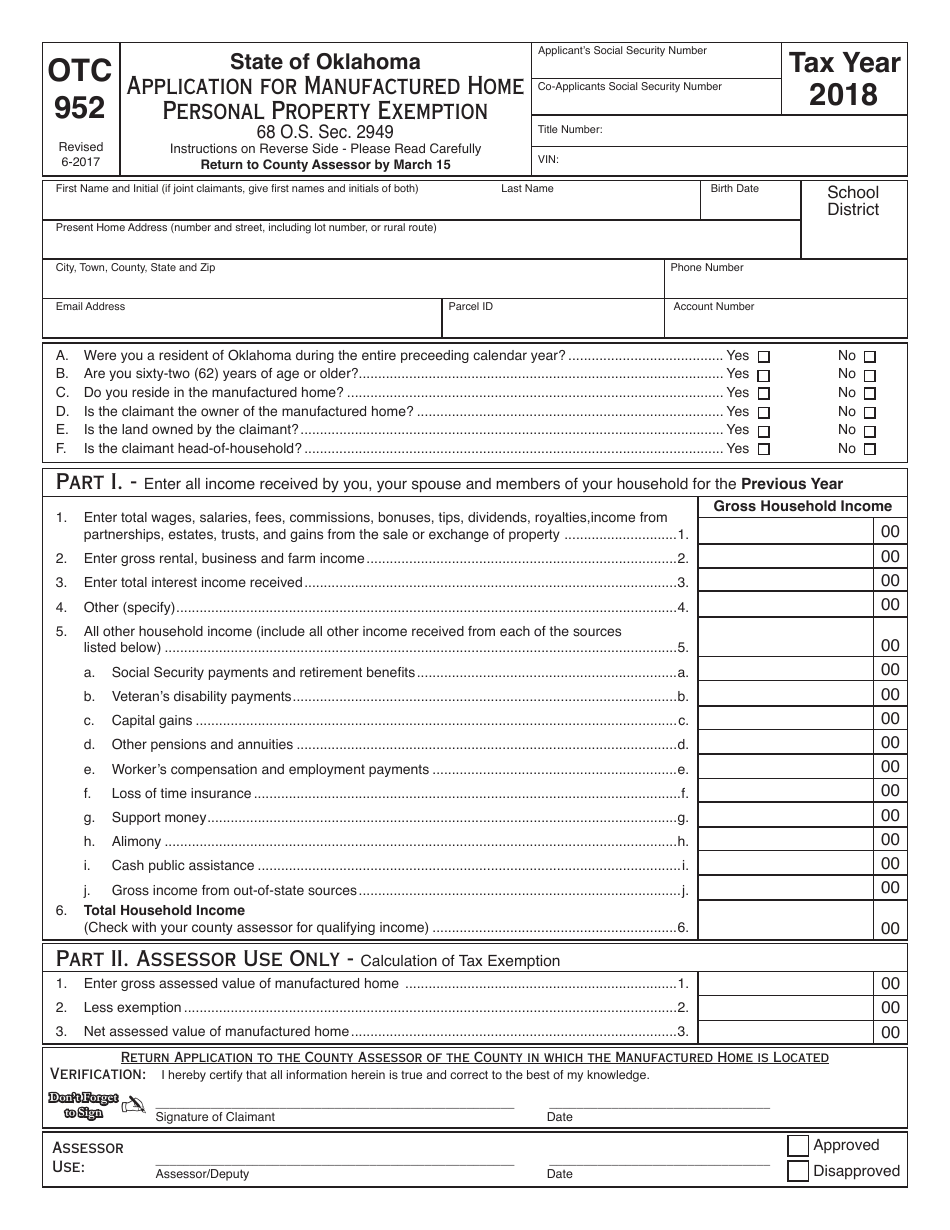

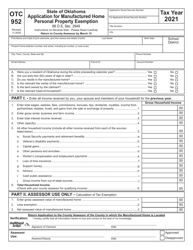

OTC Form OTC952

for the current year.

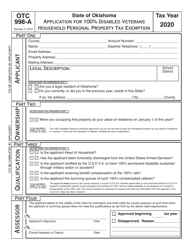

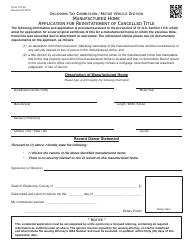

OTC Form OTC952 Application for Manufactured Home Personal Property Exemption - Oklahoma

What Is OTC Form OTC952?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

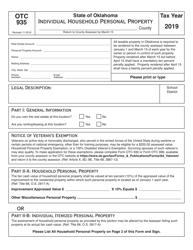

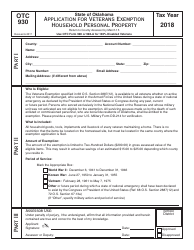

Q: What is OTC Form OTC952?

A: OTC Form OTC952 is an application for the Manufactured Home Personal Property Exemption in Oklahoma.

Q: What is the purpose of OTC Form OTC952?

A: The purpose of OTC Form OTC952 is to apply for the exemption of personal property taxes on a manufactured home in Oklahoma.

Q: Who should use OTC Form OTC952?

A: Individuals who own a manufactured home in Oklahoma and want to apply for the personal property tax exemption should use OTC Form OTC952.

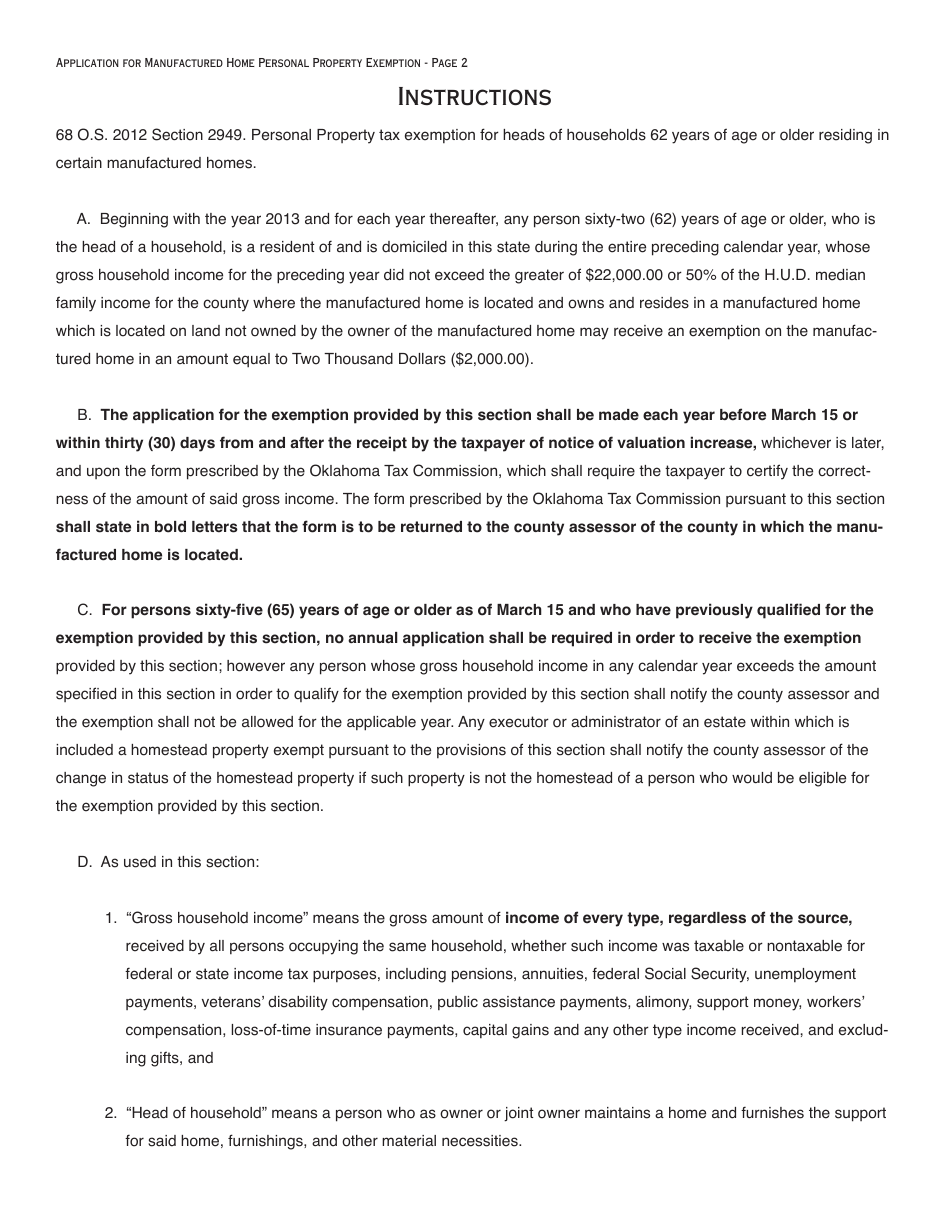

Q: Are there any eligibility requirements to qualify for the personal property tax exemption?

A: Yes, there are specific criteria that must be met to qualify for the personal property tax exemption. These criteria can be found on OTC Form OTC952 or by contacting the OTC.

Q: Is there a deadline to submit OTC Form OTC952?

A: Yes, OTC Form OTC952 must be submitted to the OTC by March 31st of the year following the year the manufactured home was first located in Oklahoma.

Q: What supporting documents are required to be submitted with OTC Form OTC952?

A: Supporting documents such as proof of ownership and proof of residency in Oklahoma are typically required to be submitted along with OTC Form OTC952.

Q: Can the personal property tax exemption be renewed annually?

A: No, the personal property tax exemption must be applied for each year using OTC Form OTC952.

Q: What happens if OTC Form OTC952 is not submitted?

A: If OTC Form OTC952 is not submitted by the deadline, the manufactured home may not be eligible for the personal property tax exemption.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC952 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.