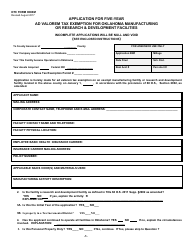

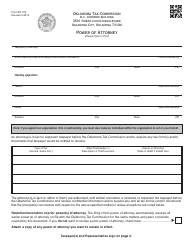

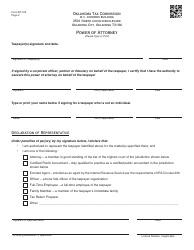

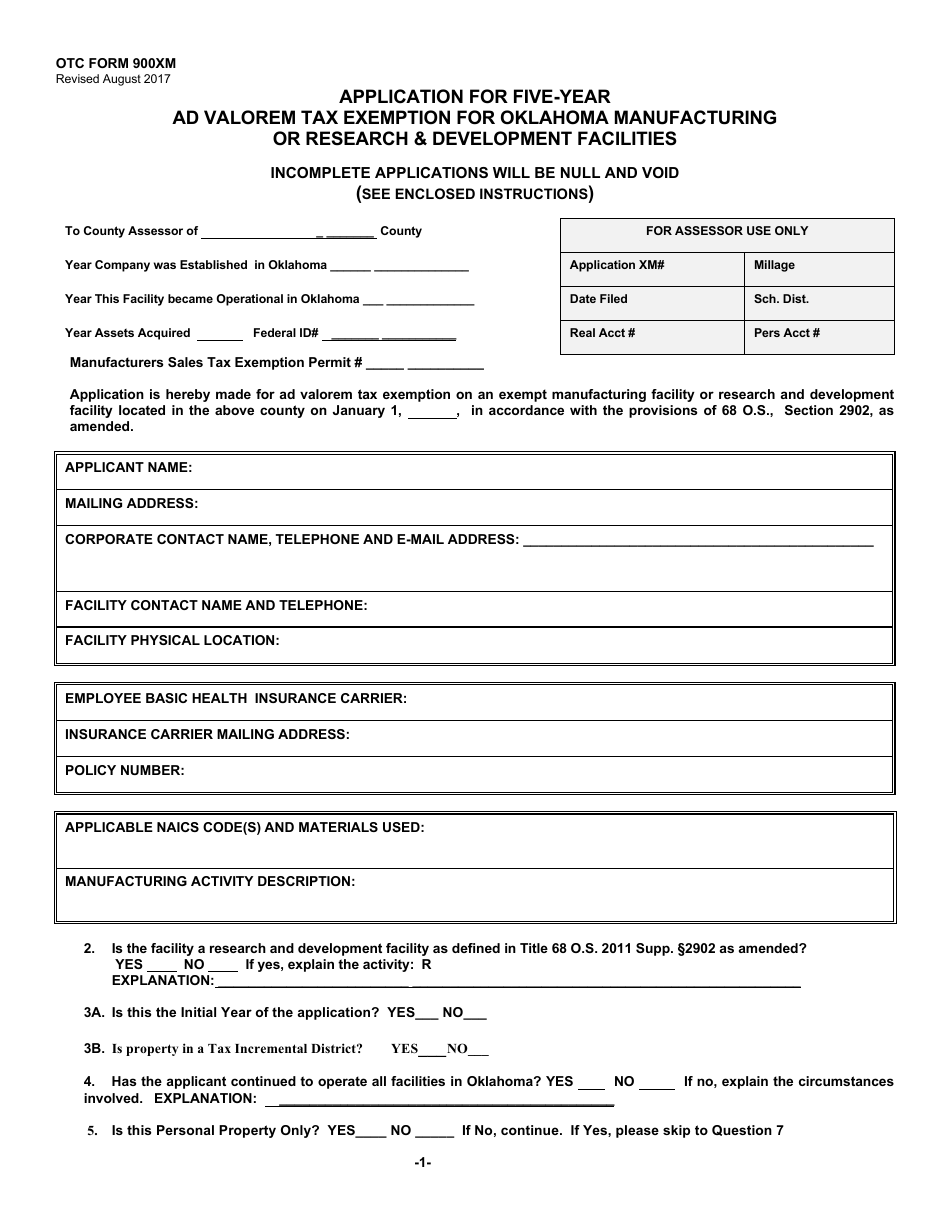

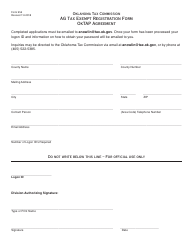

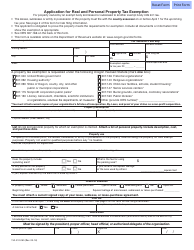

OTC Form 900XM Tax Exempt Manufacturing Application - Oklahoma

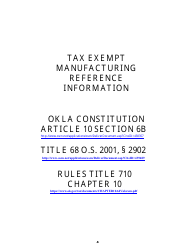

What Is OTC Form 900XM?

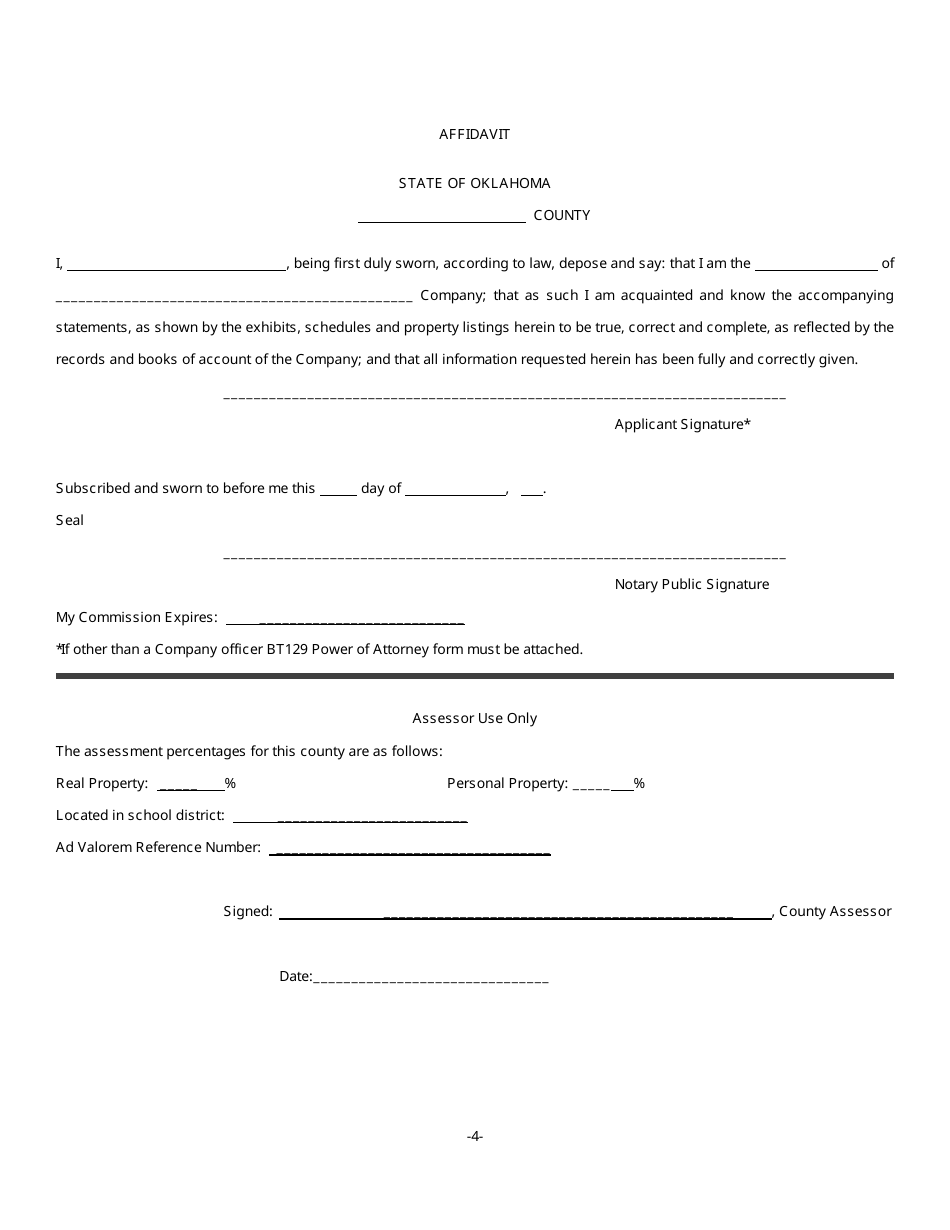

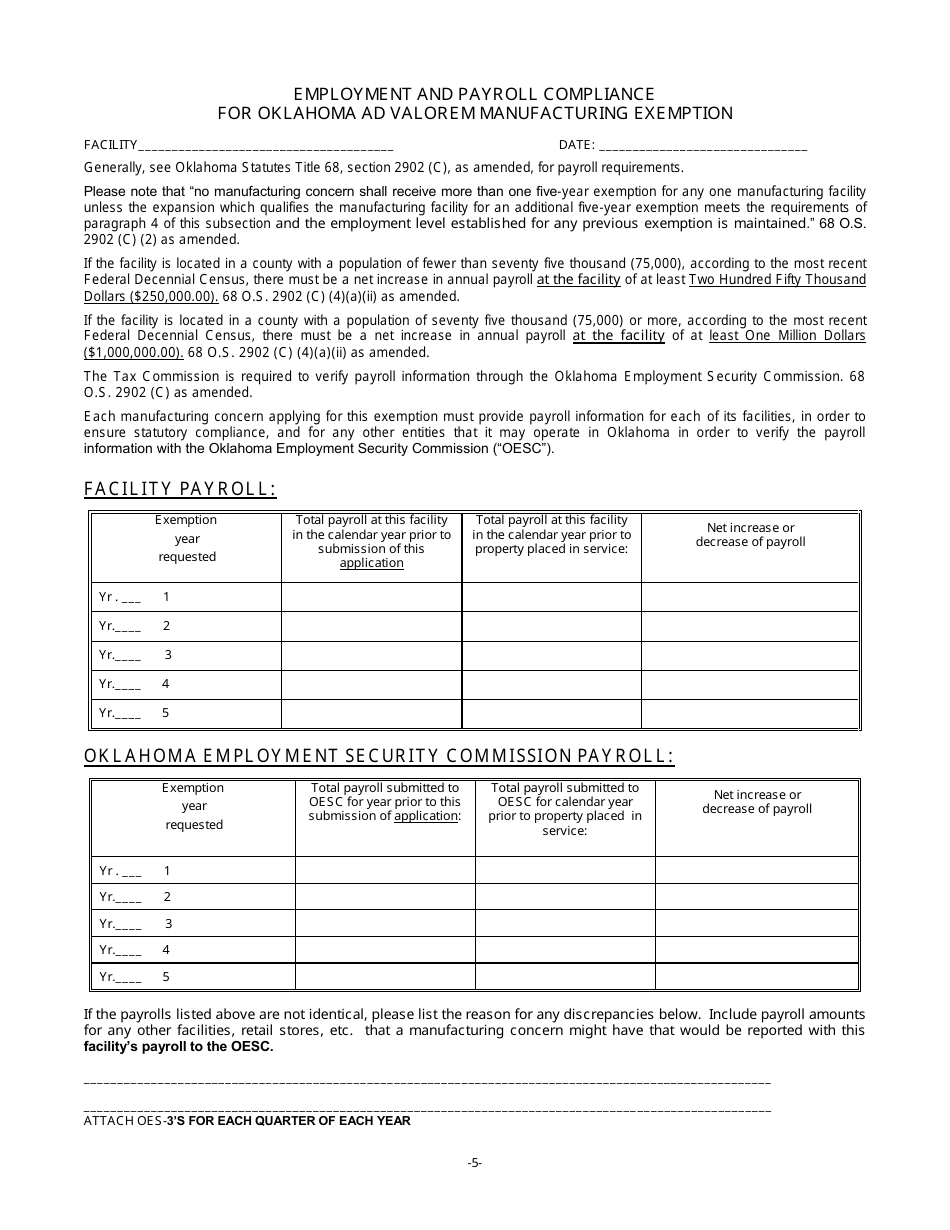

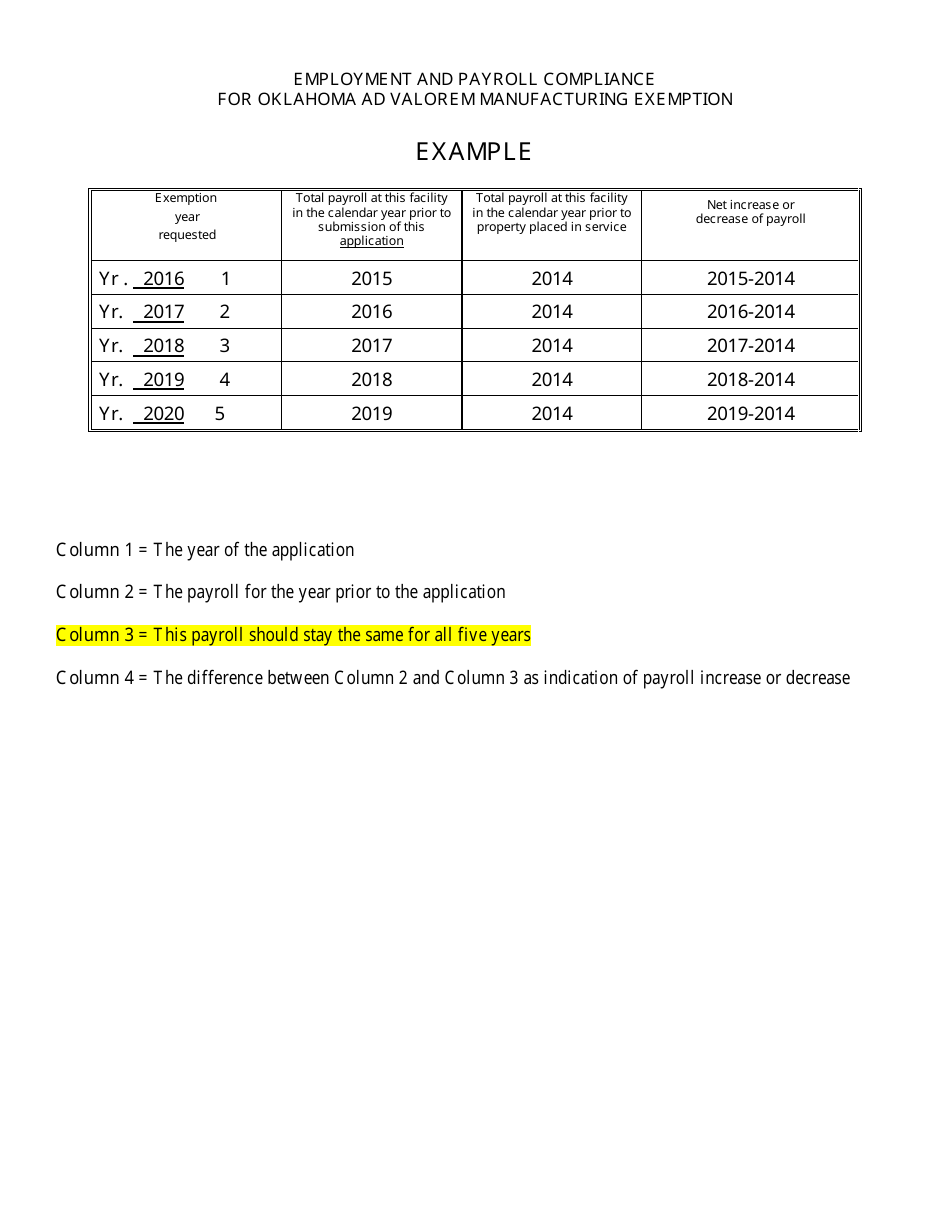

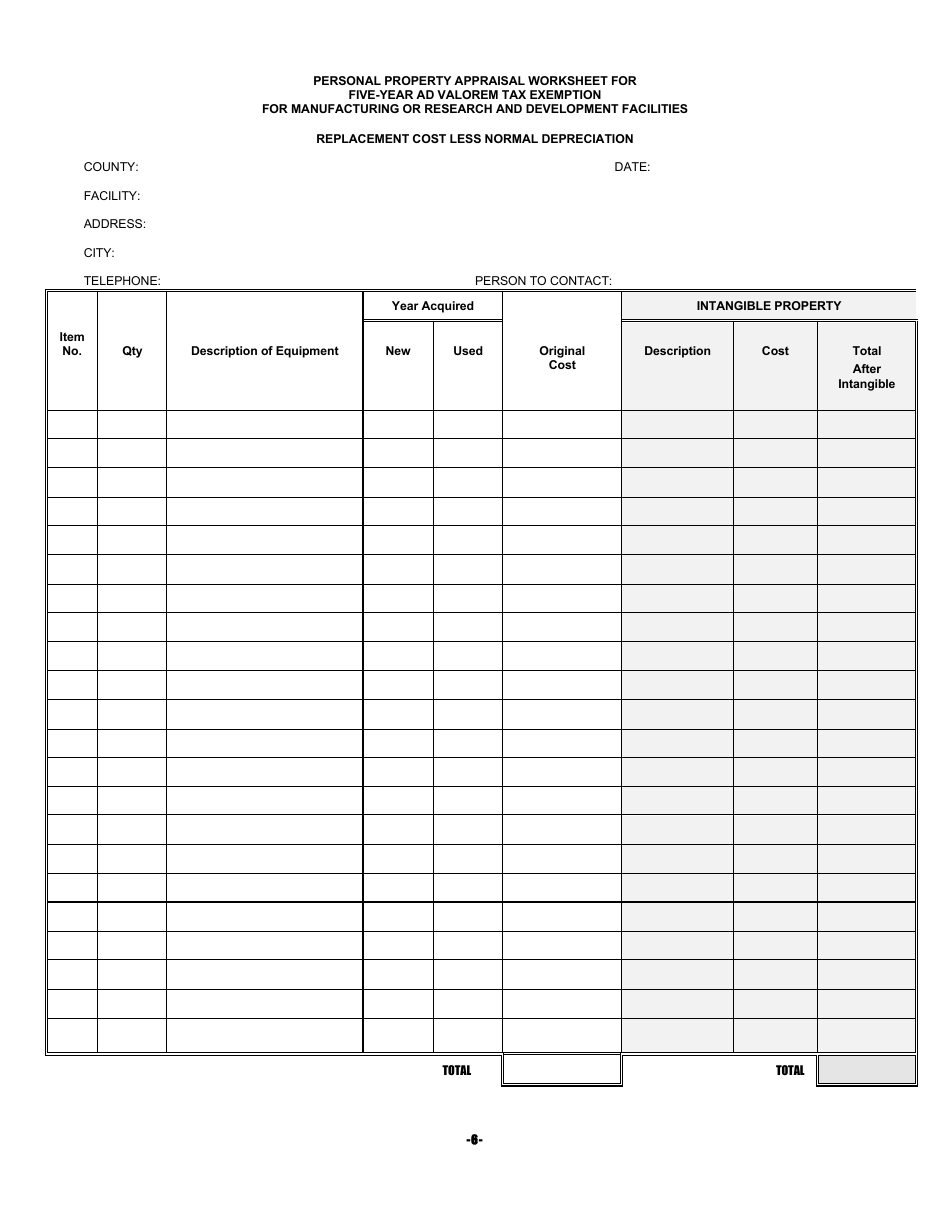

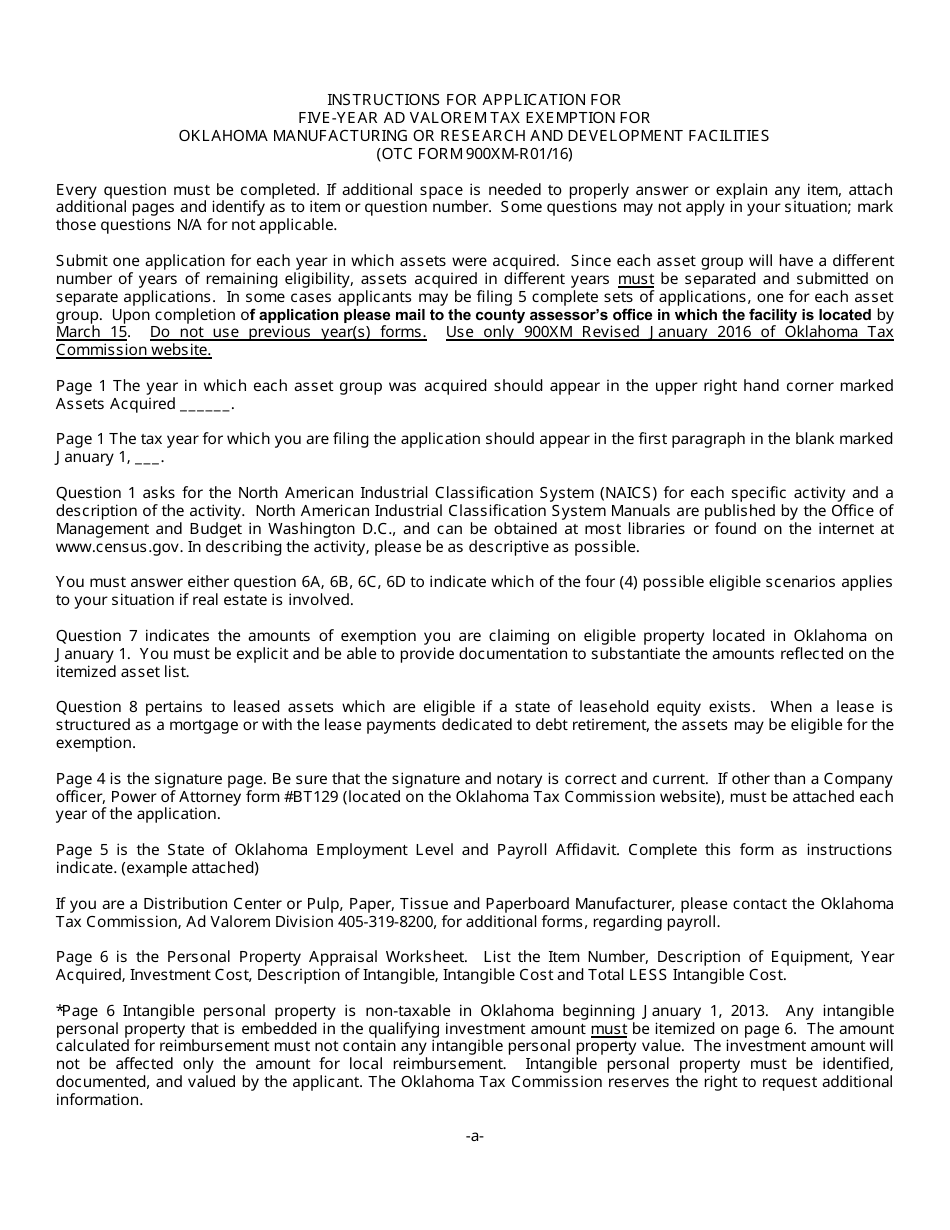

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 900XM?

A: OTC Form 900XM is a tax exempt manufacturing application for the state of Oklahoma.

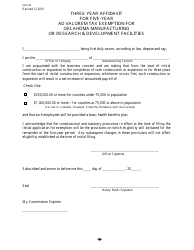

Q: Who can use OTC Form 900XM?

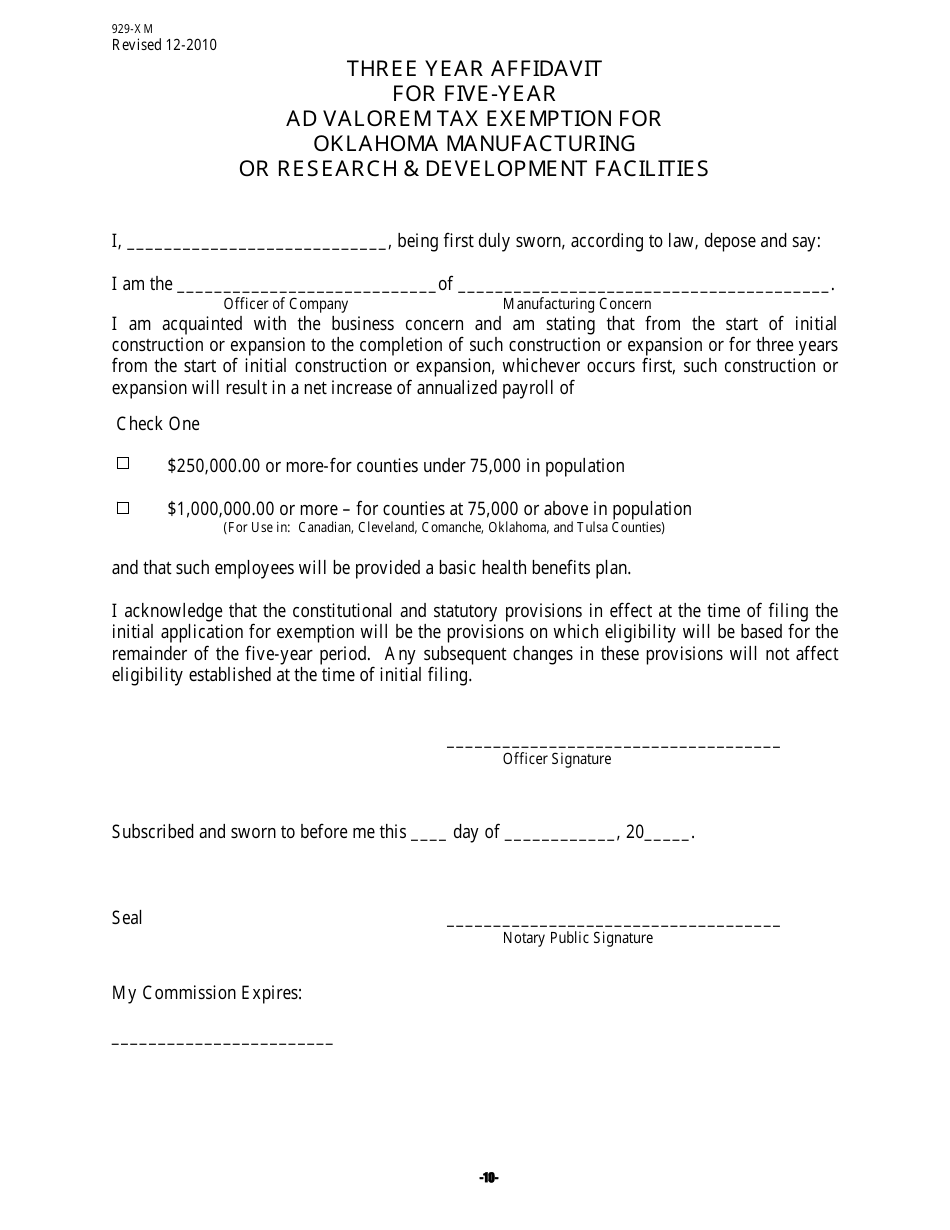

A: Manufacturers who qualify for tax exemptions in Oklahoma can use OTC Form 900XM.

Q: What is the purpose of OTC Form 900XM?

A: The purpose of OTC Form 900XM is to apply for tax exemption for manufacturing activities in Oklahoma.

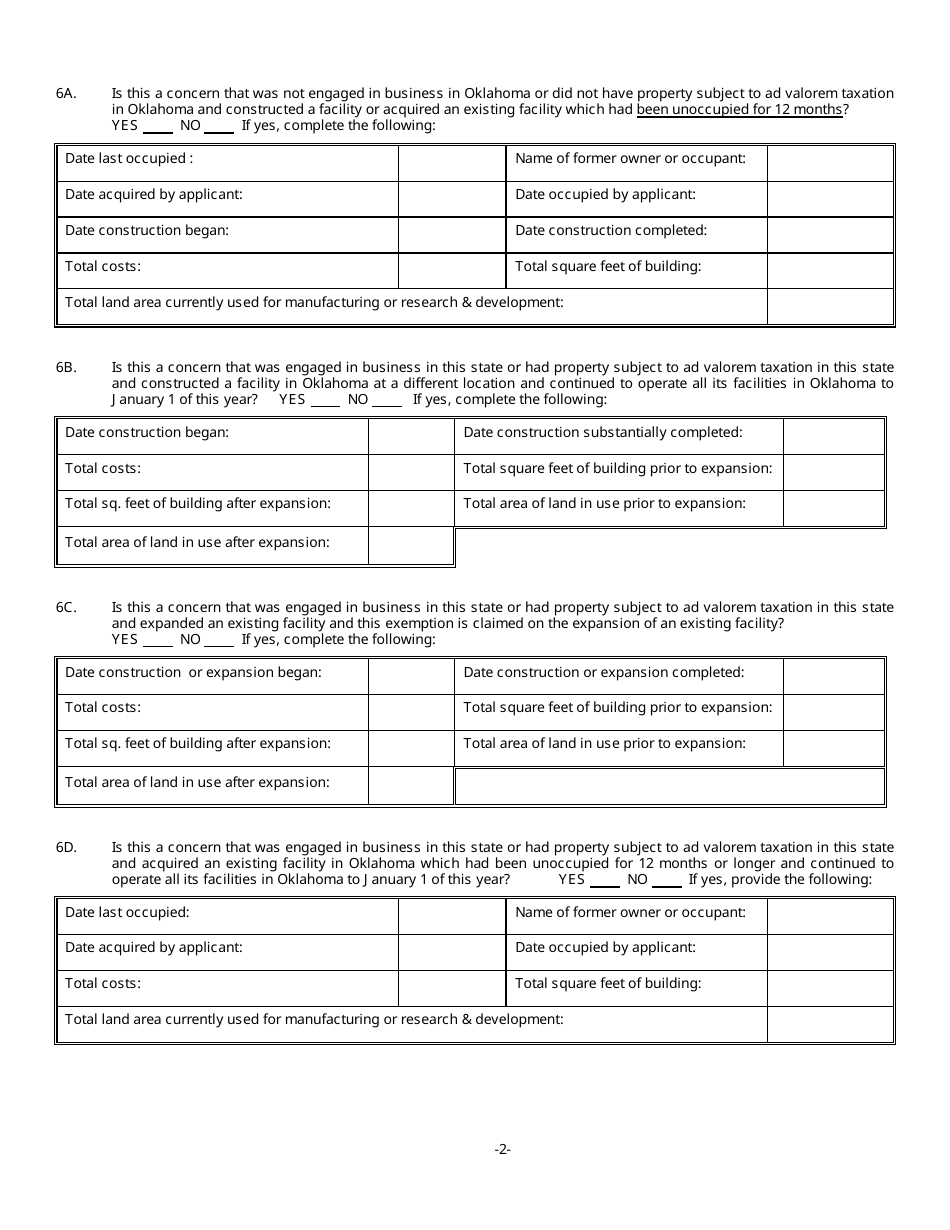

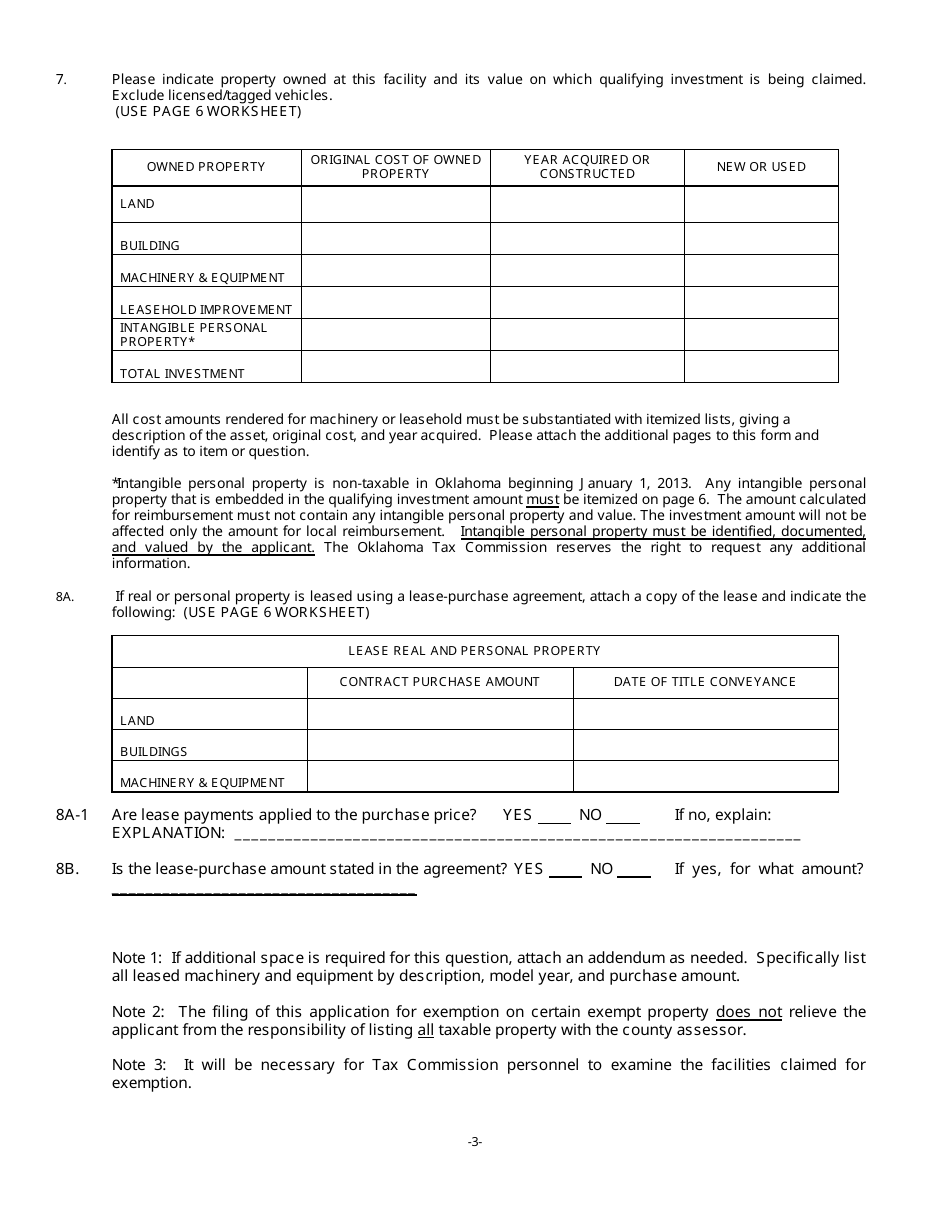

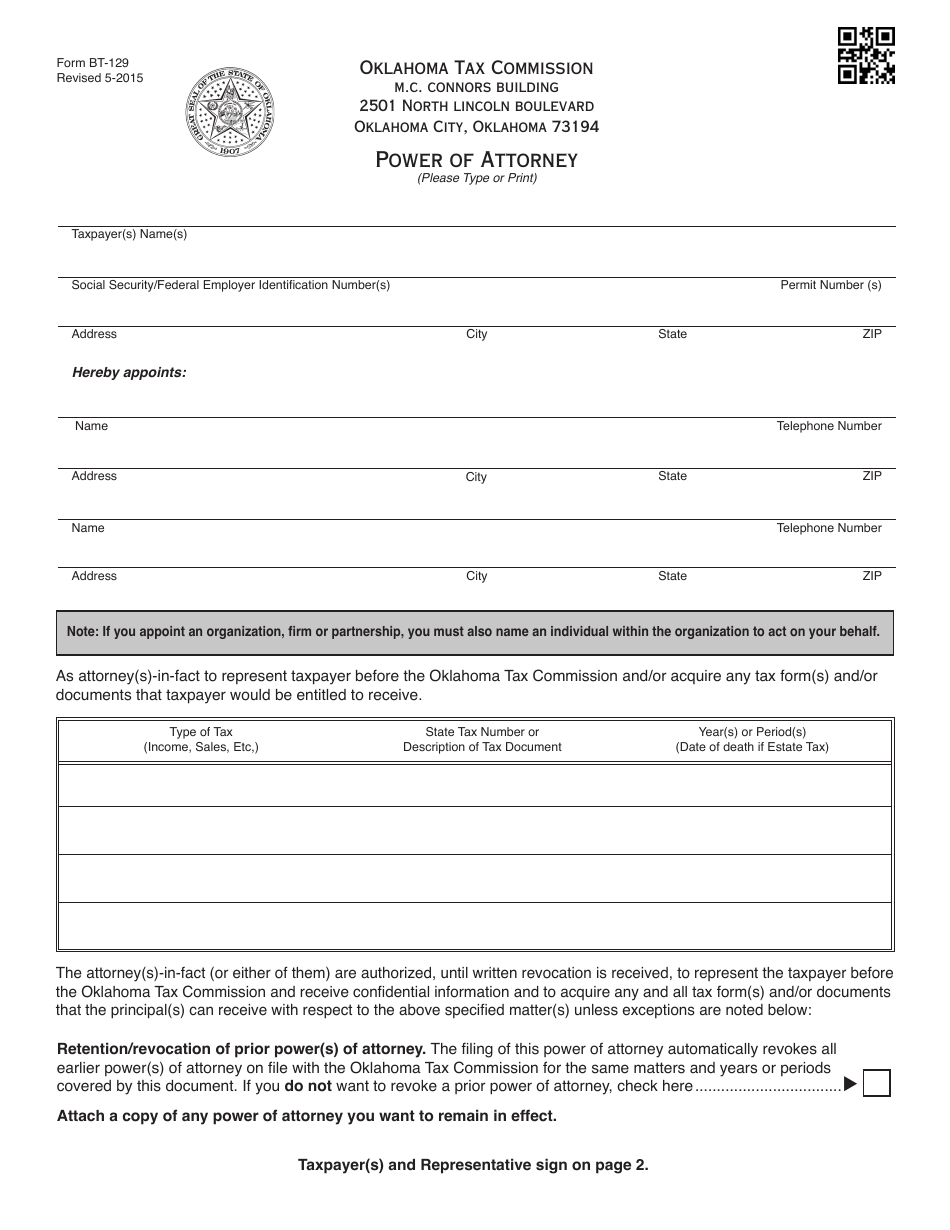

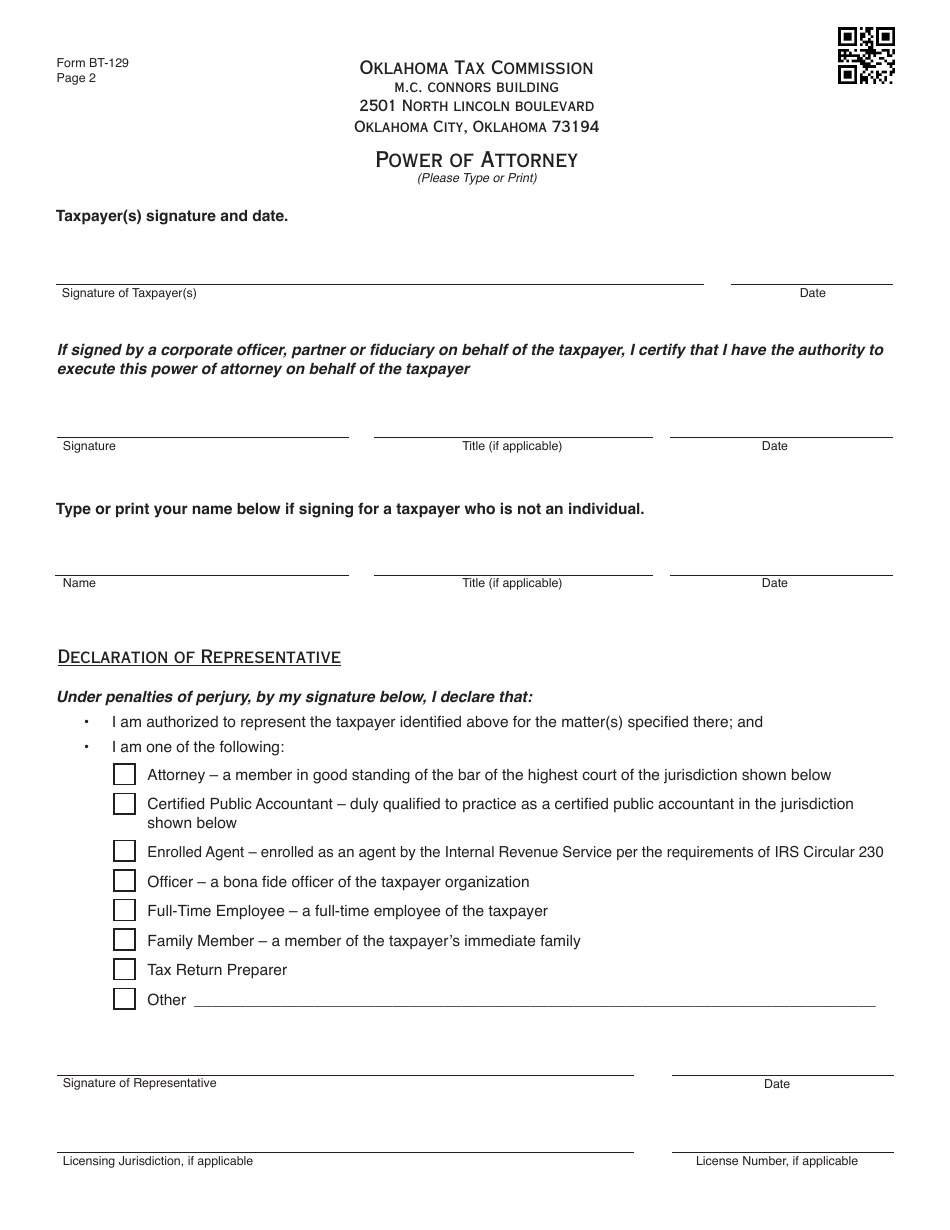

Q: What documents are required to complete OTC Form 900XM?

A: You will need to provide information about your business, such as your EIN, NAICS code, and a detailed description of the manufacturing activities you engage in.

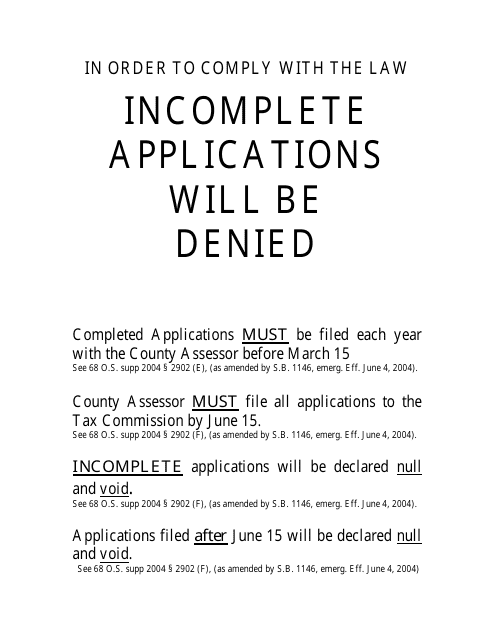

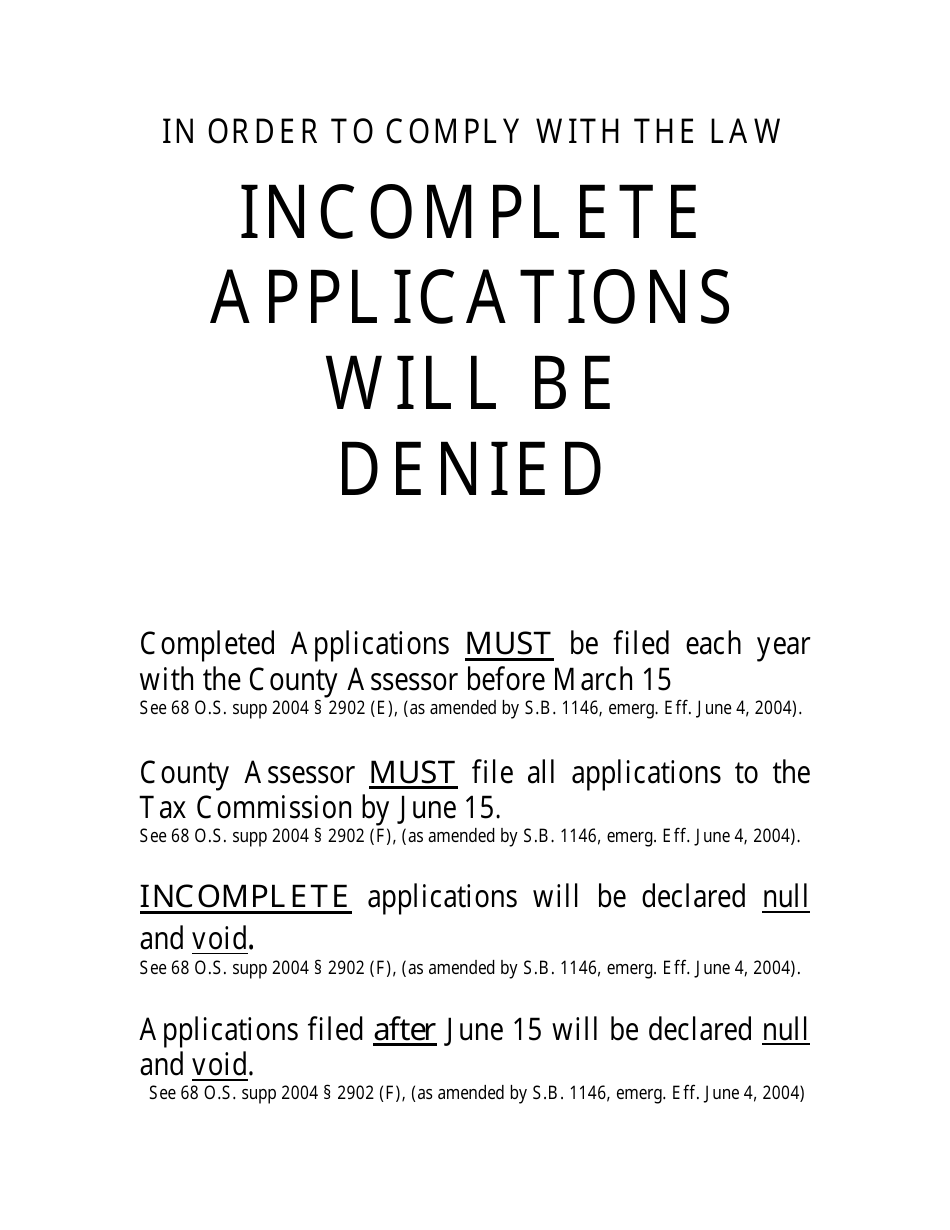

Q: Is there a deadline for submitting OTC Form 900XM?

A: Yes, OTC Form 900XM must be submitted by the 20th day of the month following the calendar quarter in which the manufacturing activities took place.

Q: What are the benefits of obtaining tax exemption through OTC Form 900XM?

A: The main benefit is that you can avoid paying sales and use tax on certain manufacturing purchases and activities in Oklahoma.

Q: Are there any limitations to the tax exemption obtained through OTC Form 900XM?

A: Yes, there are limitations on the types of purchases and activities that qualify for tax exemption. It is important to review the instructions and guidelines provided by the OTC.

Q: Can I apply for OTC Form 900XM if I am not a manufacturer?

A: No, OTC Form 900XM is specifically for manufacturers who engage in qualified manufacturing activities in Oklahoma.

Q: How long does it take to process OTC Form 900XM?

A: Processing times may vary, but generally it takes a few weeks for the OTC to review and approve OTC Form 900XM applications.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 900XM by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.