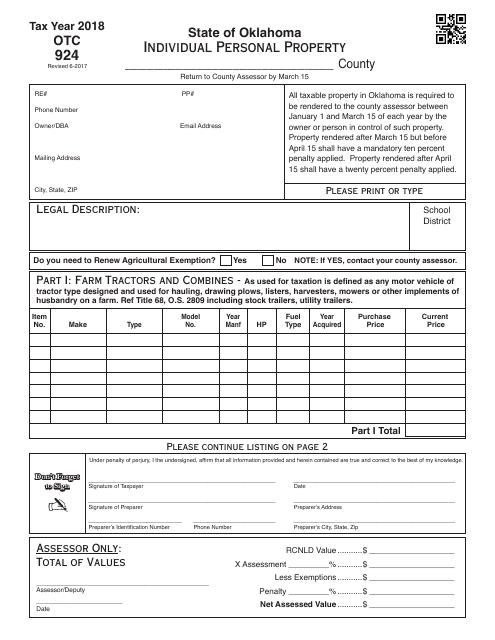

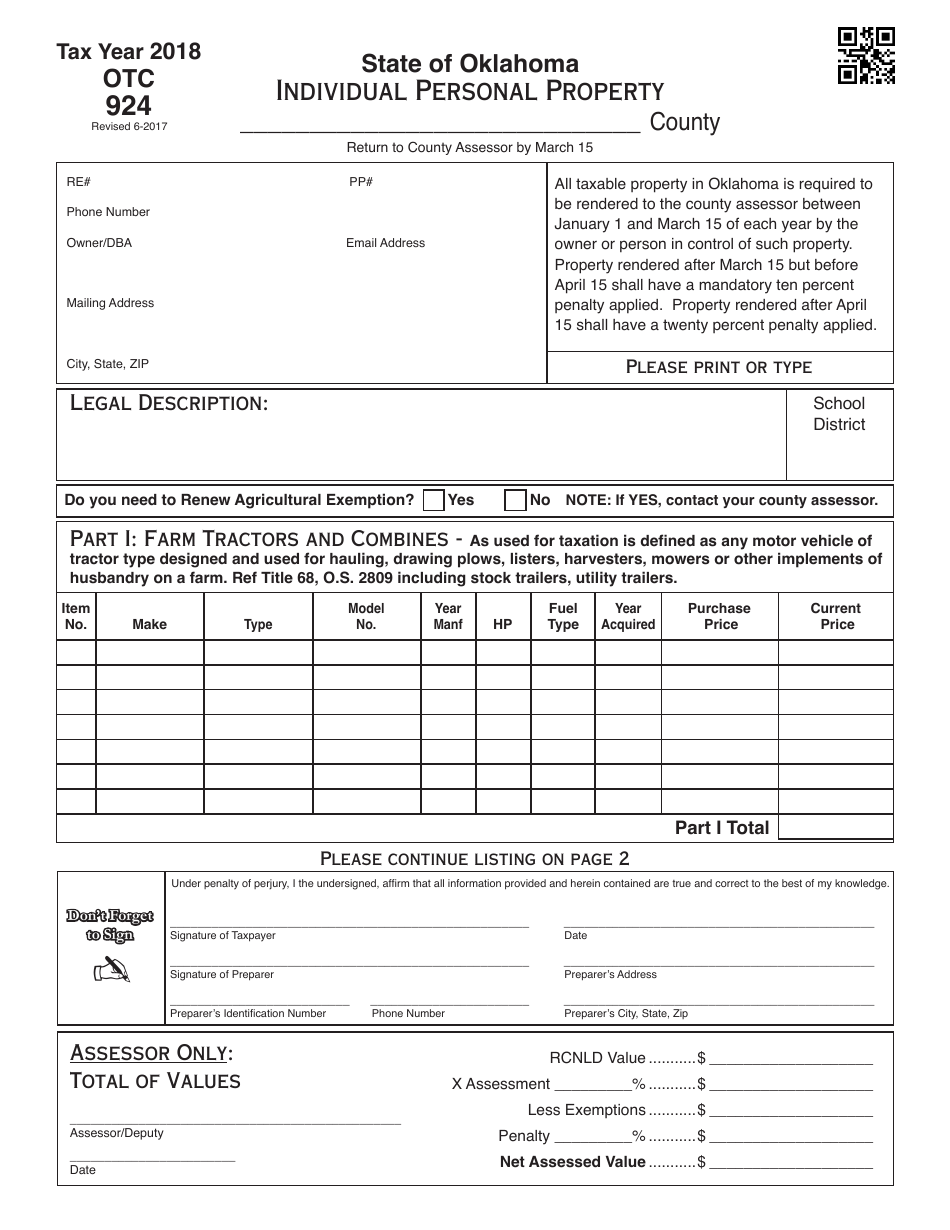

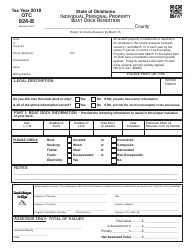

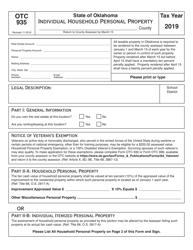

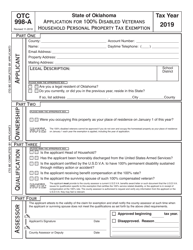

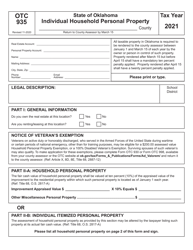

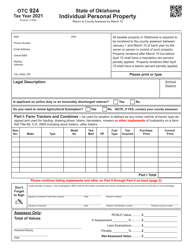

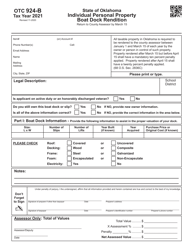

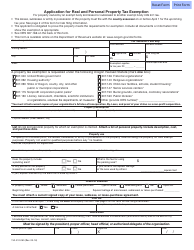

OTC Form OTC924 Individual Personal Property - Oklahoma

What Is OTC Form OTC924?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OTC924?

A: OTC Form OTC924 is the Individual Personal Property declaration form for the state of Oklahoma.

Q: Who needs to complete OTC Form OTC924?

A: Any individual in Oklahoma who owns personal property exceeding $1,500 in value must complete OTC Form OTC924.

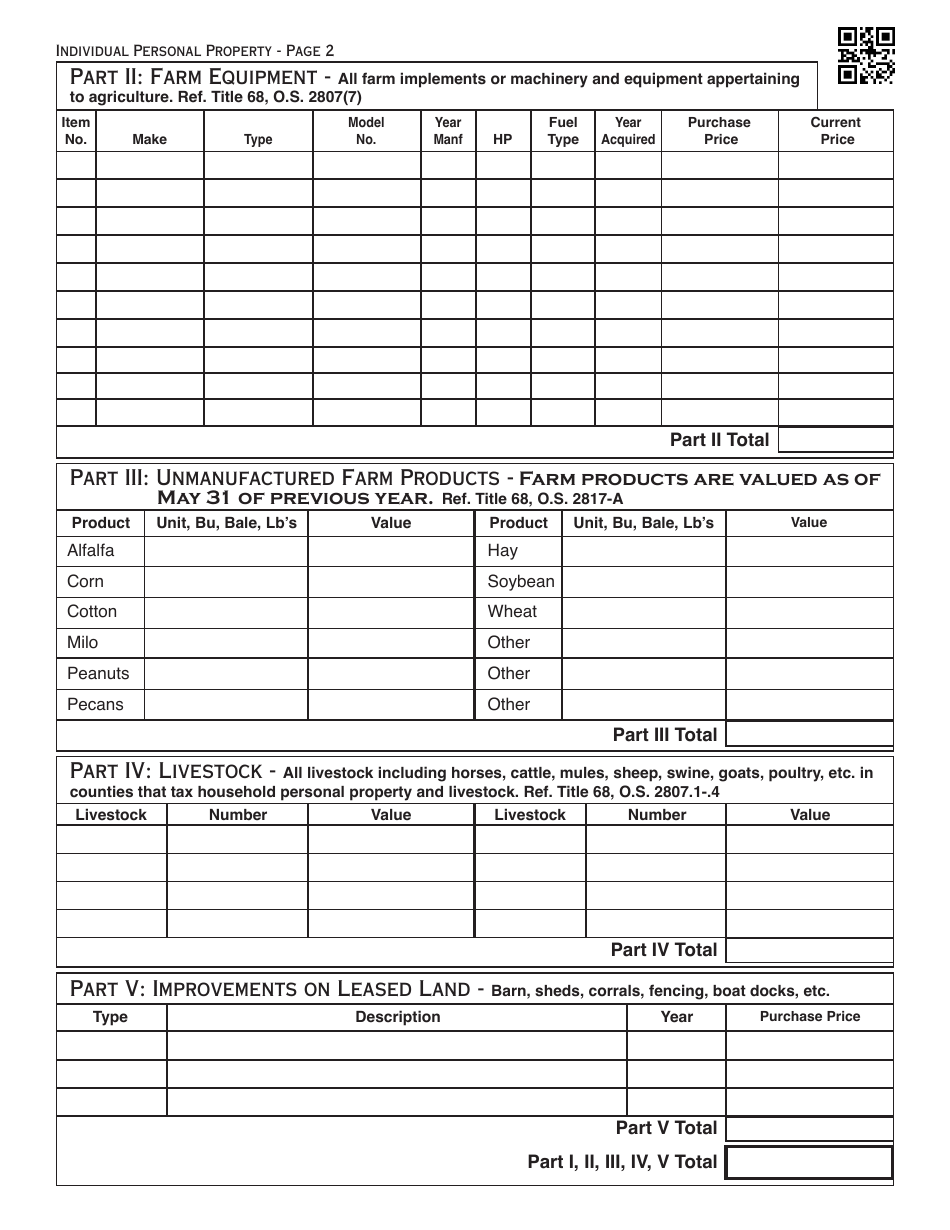

Q: What is considered personal property for the purpose of OTC Form OTC924?

A: Personal property for the purpose of OTC Form OTC924 includes items such as furniture, appliances, vehicles, watercraft, and livestock.

Q: When is OTC Form OTC924 due?

A: OTC Form OTC924 is due before March 15th of each year.

Q: Are there any penalties for not filing OTC Form OTC924?

A: Yes, failure to file OTC Form OTC924 may result in penalties and interest being assessed by the Oklahoma Tax Commission.

Q: Can I claim any exemptions on OTC Form OTC924?

A: Yes, there are certain exemptions available on OTC Form OTC924, such as the homestead exemption for primary residences.

Q: What should I do if I no longer own the personal property listed on OTC Form OTC924?

A: If you no longer own the personal property listed on OTC Form OTC924, you should update your declaration with the Oklahoma Tax Commission.

Q: Is OTC Form OTC924 applicable only to Oklahoma residents?

A: Yes, OTC Form OTC924 is applicable only to residents of Oklahoma who own personal property exceeding $1,500 in value.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC924 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.