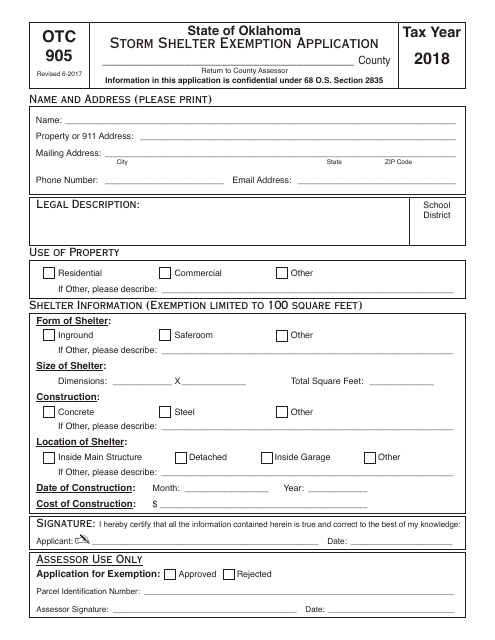

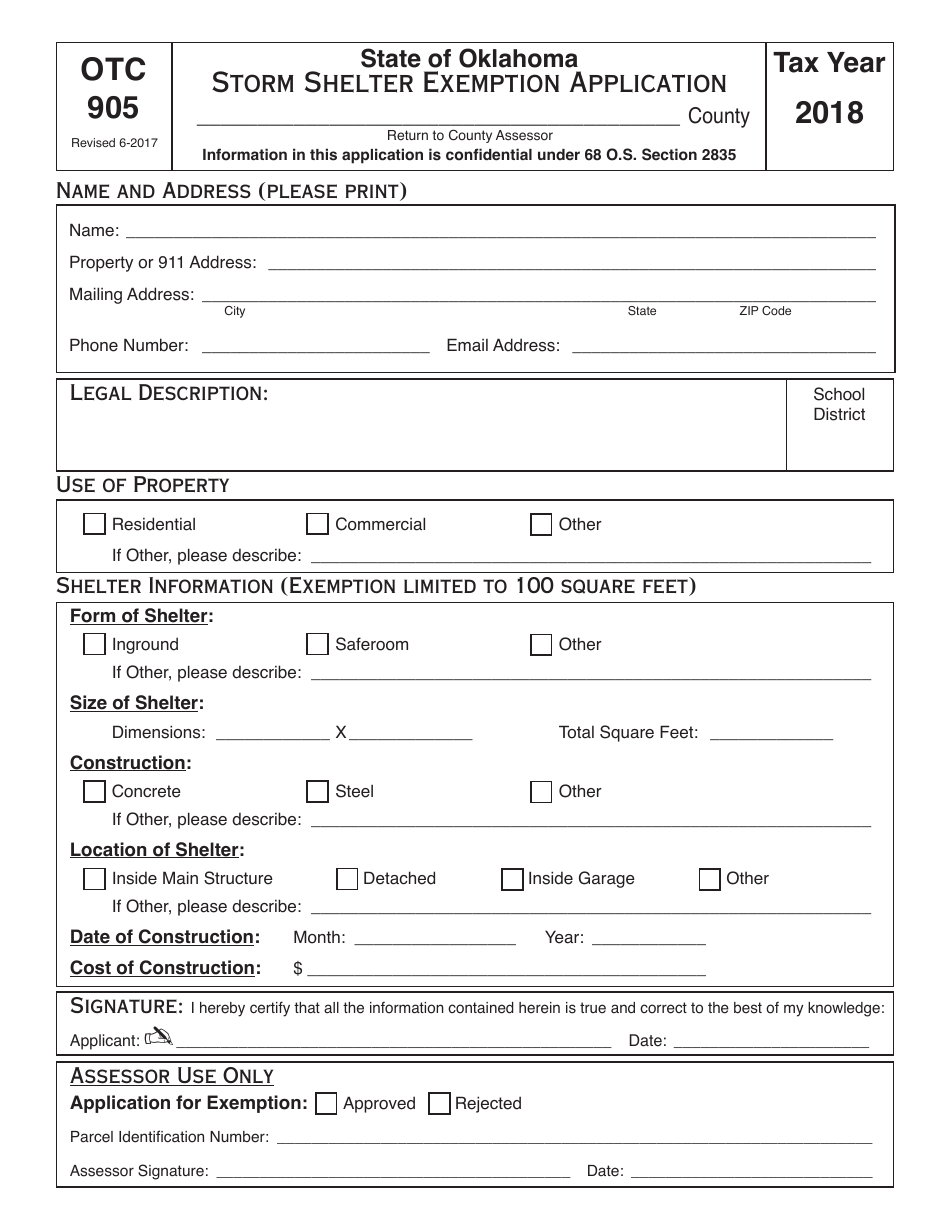

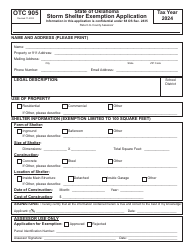

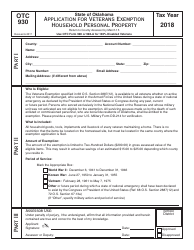

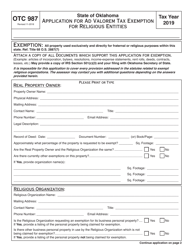

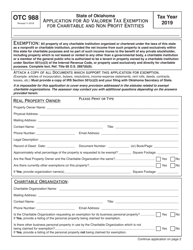

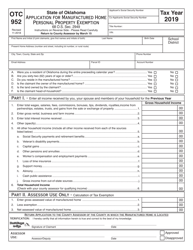

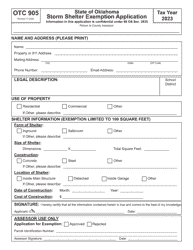

OTC Form OTC905 Storm Shelter Exemption Application - Oklahoma

What Is OTC Form OTC905?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form OTC905?

A: The OTC Form OTC905 is the Storm Shelter Exemption Application specifically for Oklahoma.

Q: What is the purpose of the OTC Form OTC905?

A: The OTC Form OTC905 is used to apply for a storm shelter exemption in Oklahoma.

Q: Who is eligible for a storm shelter exemption in Oklahoma?

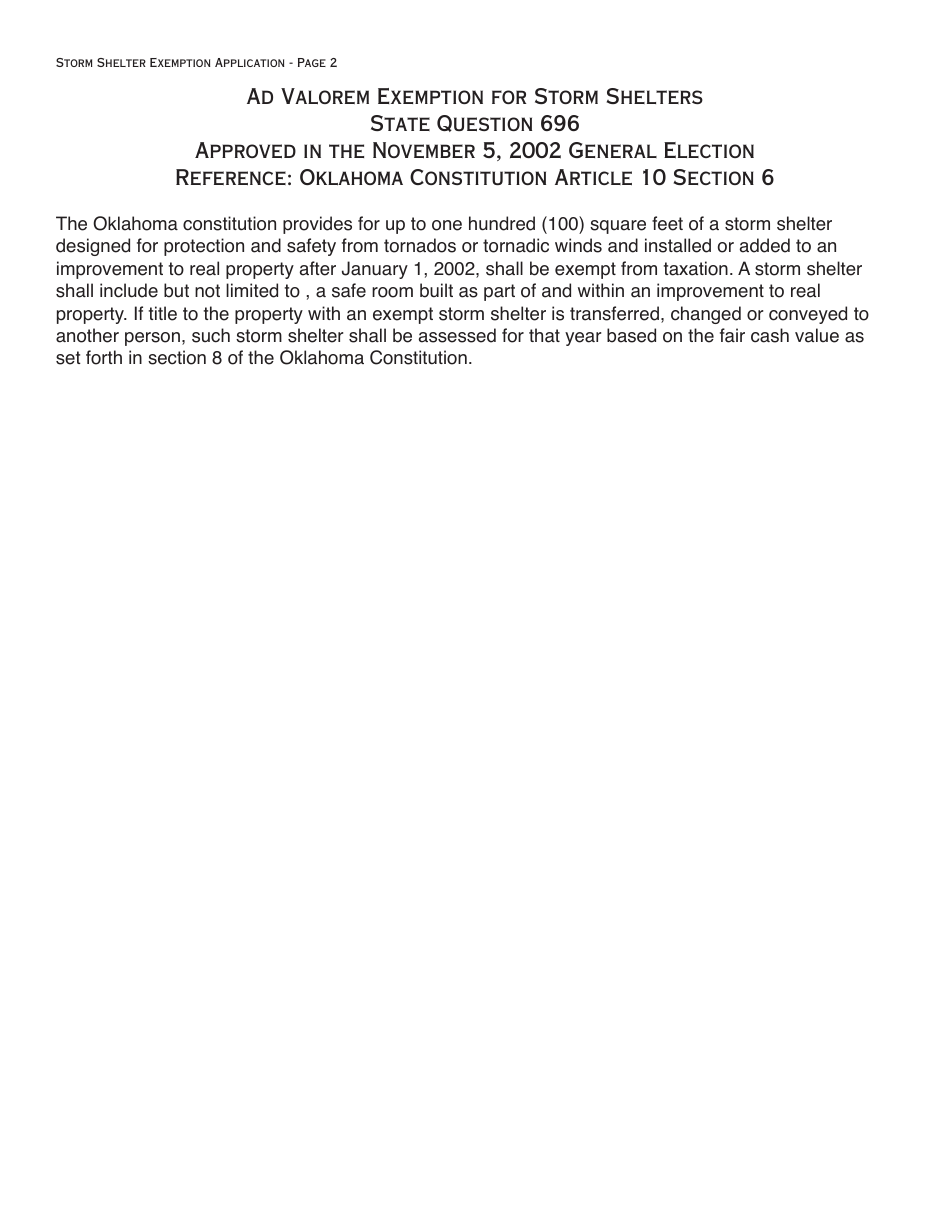

A: Individuals and households who have a storm shelter on their property may be eligible for a storm shelter exemption in Oklahoma.

Q: What does the storm shelter exemption entail?

A: The storm shelter exemption allows property owners in Oklahoma to have their property assessed at a reduced value for tax purposes if they have a storm shelter.

Q: Are there any fees associated with the storm shelter exemption application?

A: No, there are no fees associated with the storm shelter exemption application in Oklahoma.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC905 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.