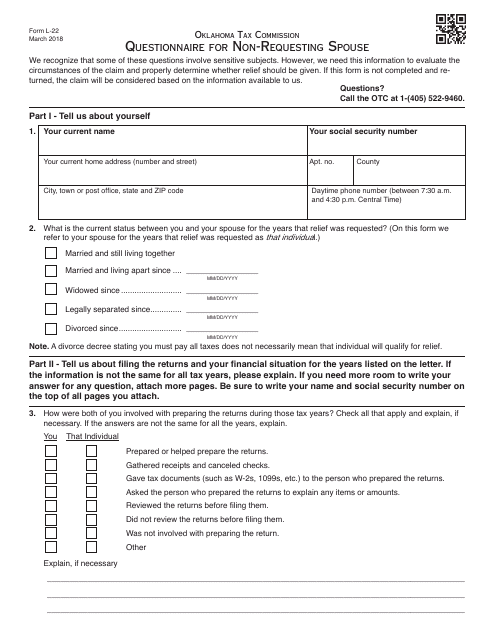

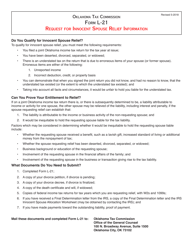

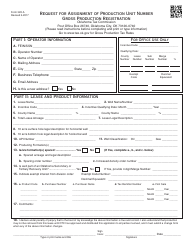

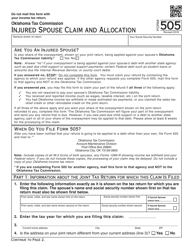

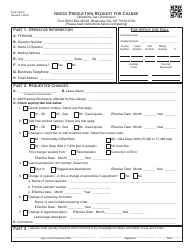

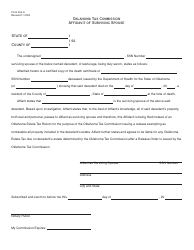

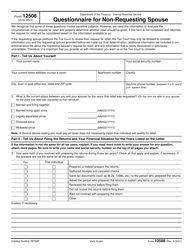

OTC Form L-22 Questionnaire for Non-requesting Spouse - Oklahoma

What Is OTC Form L-22?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

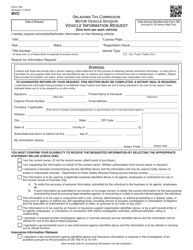

Q: What is OTC Form L-22?

A: OTC Form L-22 is a questionnaire for the non-requesting spouse in Oklahoma.

Q: Who is the non-requesting spouse?

A: The non-requesting spouse is the spouse who did not initiate the request for the form.

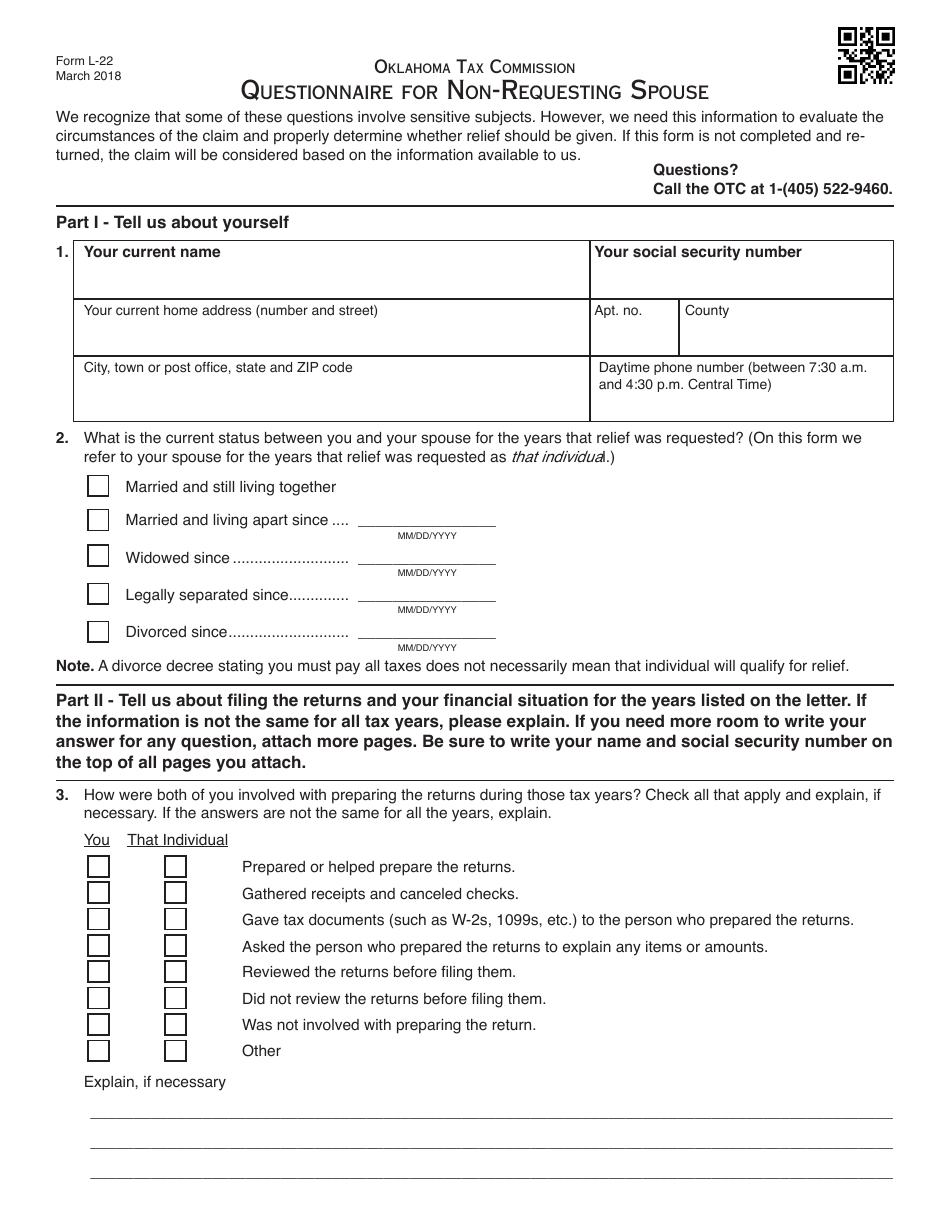

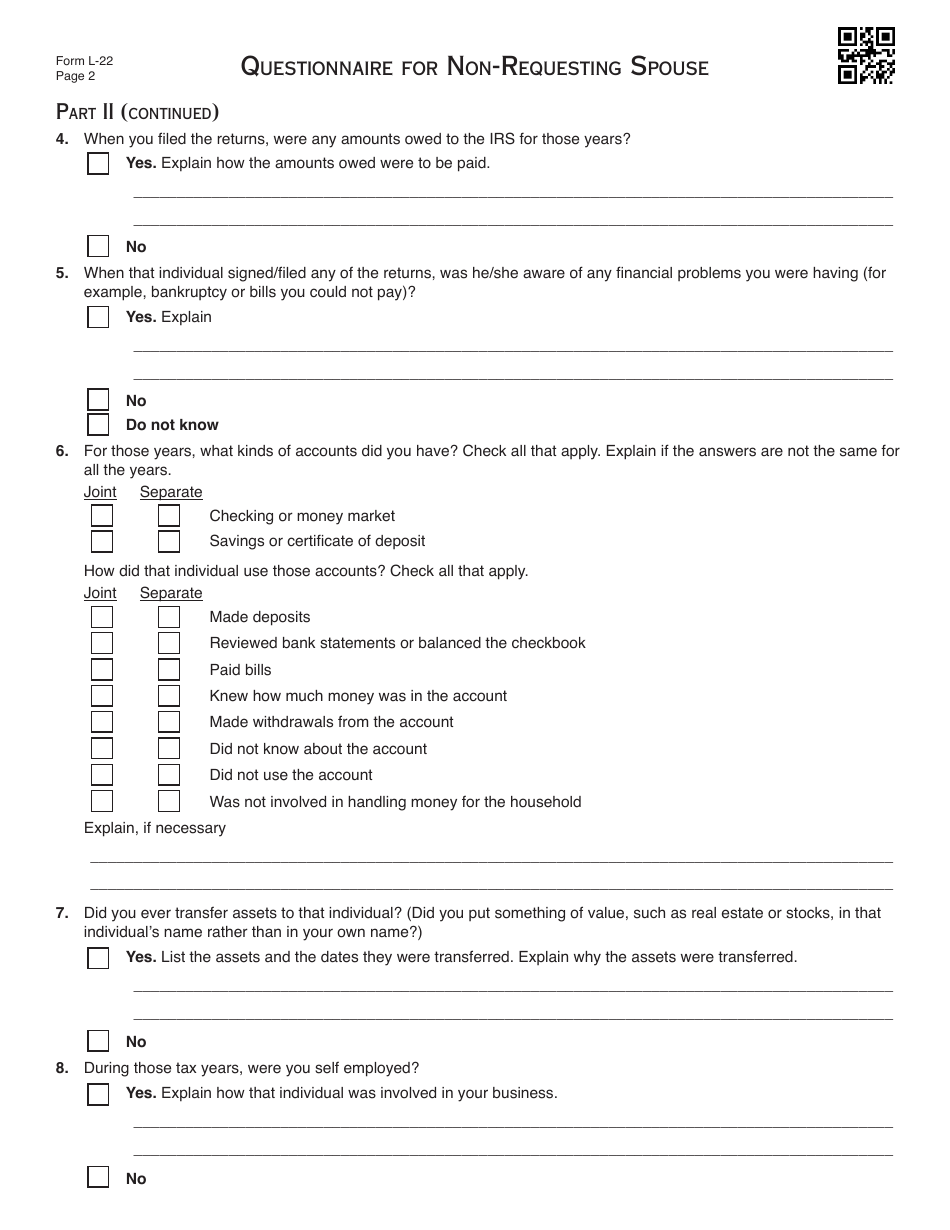

Q: What is the purpose of OTC Form L-22?

A: The purpose of OTC Form L-22 is to gather information about the non-requesting spouse's income and assets.

Q: Is OTC Form L-22 required for all spouses in Oklahoma?

A: No, OTC Form L-22 is only required for the non-requesting spouse.

Q: Are there any penalties for not filing OTC Form L-22?

A: Failure to file OTC Form L-22 may result in delays or complications in the processing of the requested form.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form L-22 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.