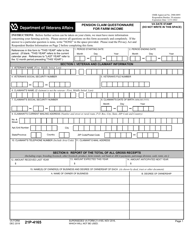

This version of the form is not currently in use and is provided for reference only. Download this version of

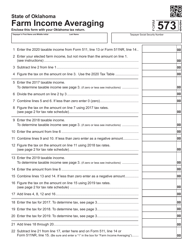

OTC Form 573

for the current year.

OTC Form 573 Farm Income Averaging - Oklahoma

What Is OTC Form 573?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

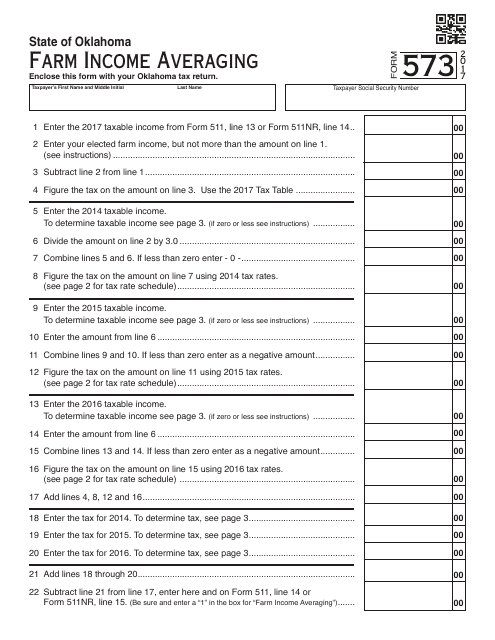

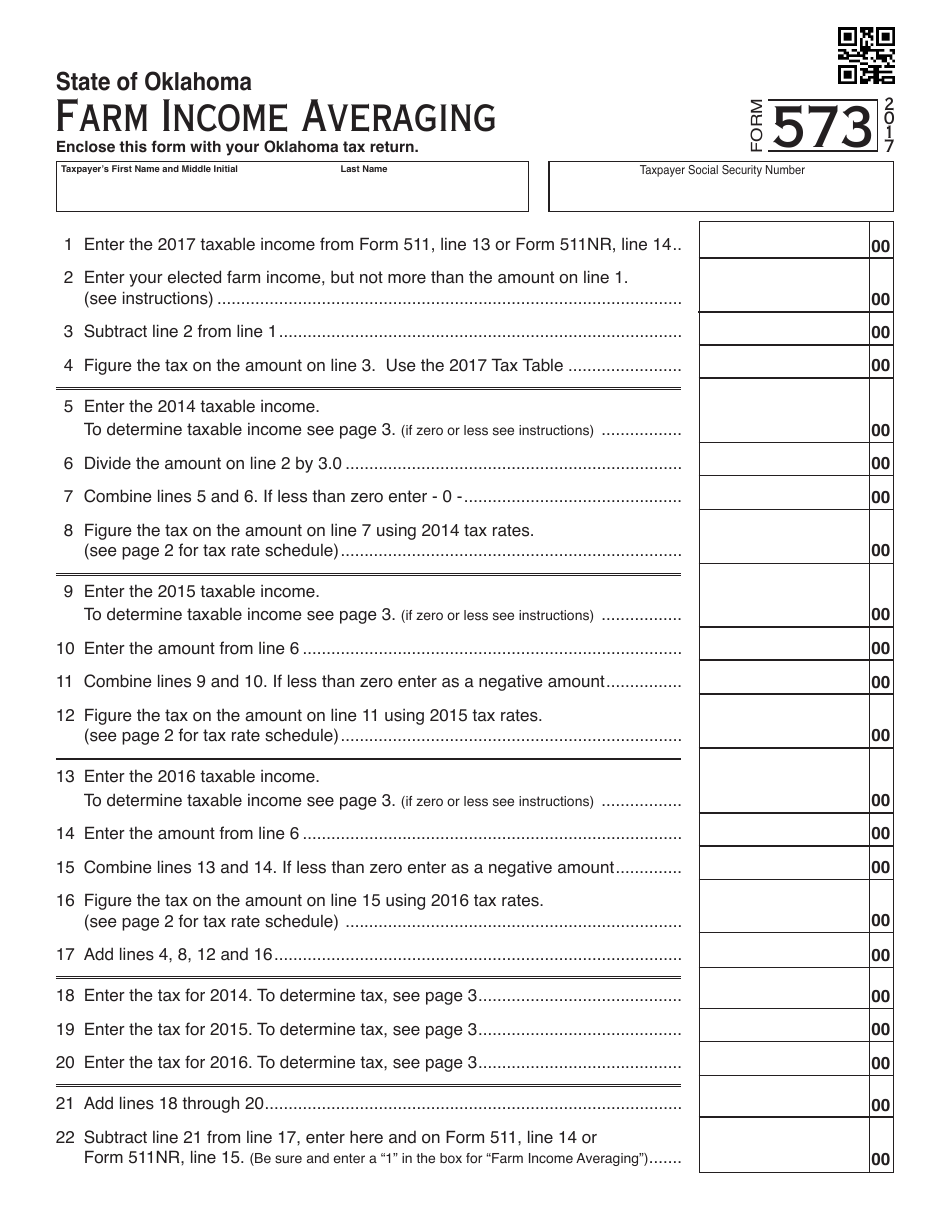

Q: What is OTC Form 573?

A: OTC Form 573 is the Farm Income Averaging form used in Oklahoma.

Q: What is Farm Income Averaging?

A: Farm Income Averaging is a tax strategy that allows farmers to average their income over a period of years for tax purposes.

Q: Who is eligible to use OTC Form 573?

A: Farmers in Oklahoma who have income from farming or ranching are eligible to use OTC Form 573.

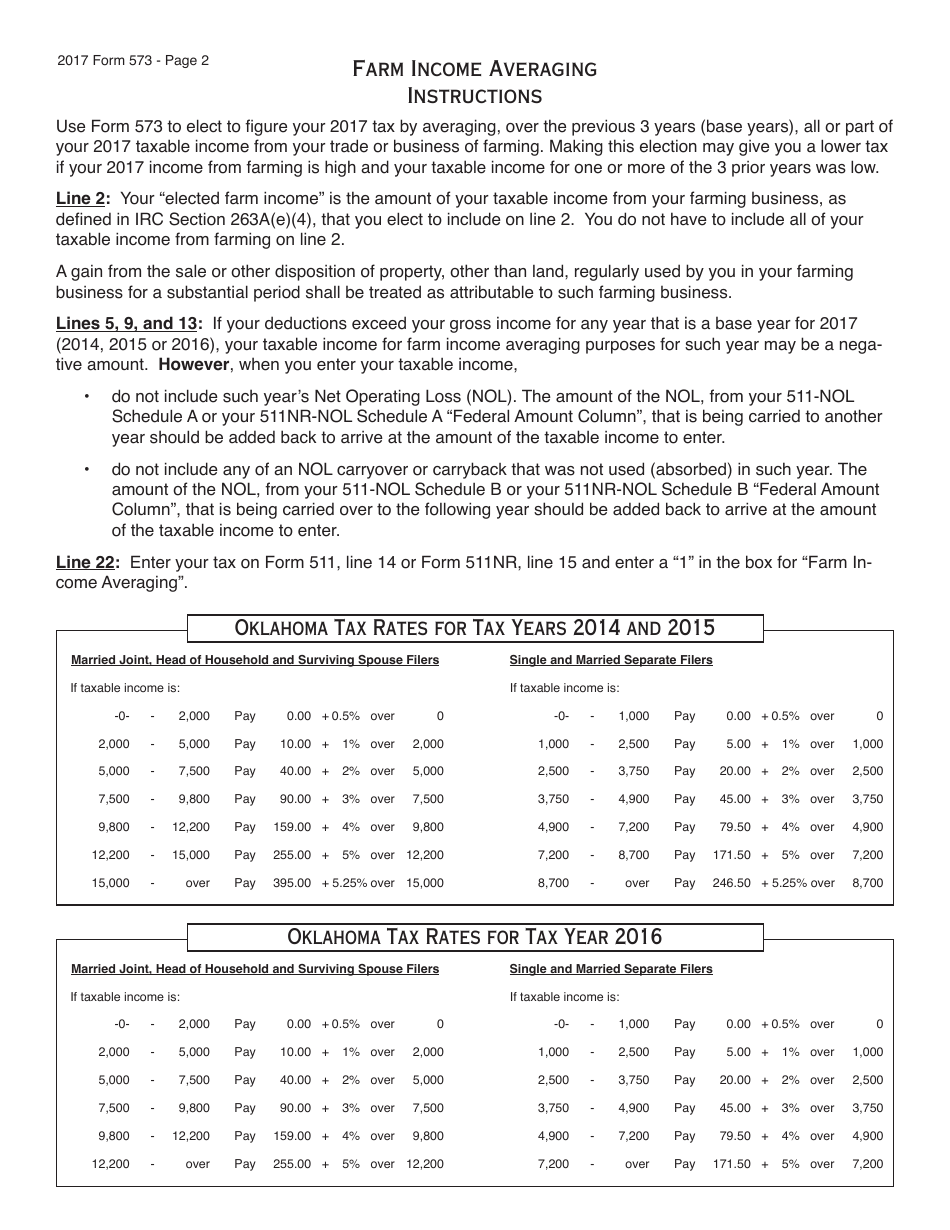

Q: How does Farm Income Averaging work?

A: Farm Income Averaging allows farmers to spread out their income over several years, potentially reducing their tax liability.

Q: Why would a farmer use Farm Income Averaging?

A: Farmers may choose to use Farm Income Averaging to minimize the impact of fluctuating income from year to year and potentially lower their overall tax bill.

Q: Are there any limitations or restrictions to using OTC Form 573?

A: Yes, there are certain requirements and limitations for using OTC Form 573, including specific rules for qualifying farmers and income thresholds.

Q: Is OTC Form 573 used in states other than Oklahoma?

A: No, OTC Form 573 is specific to Oklahoma and may not be applicable in other states.

Q: Is Farm Income Averaging available to non-farmers?

A: No, Farm Income Averaging is a tax strategy specifically designed for farmers and ranchers.

Q: Is there a deadline for filing OTC Form 573?

A: Yes, OTC Form 573 must be filed by the due date of the taxpayer's Oklahoma income tax return.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 573 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.