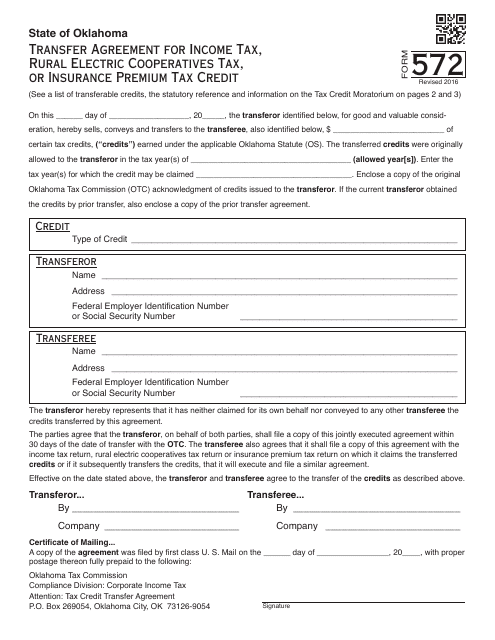

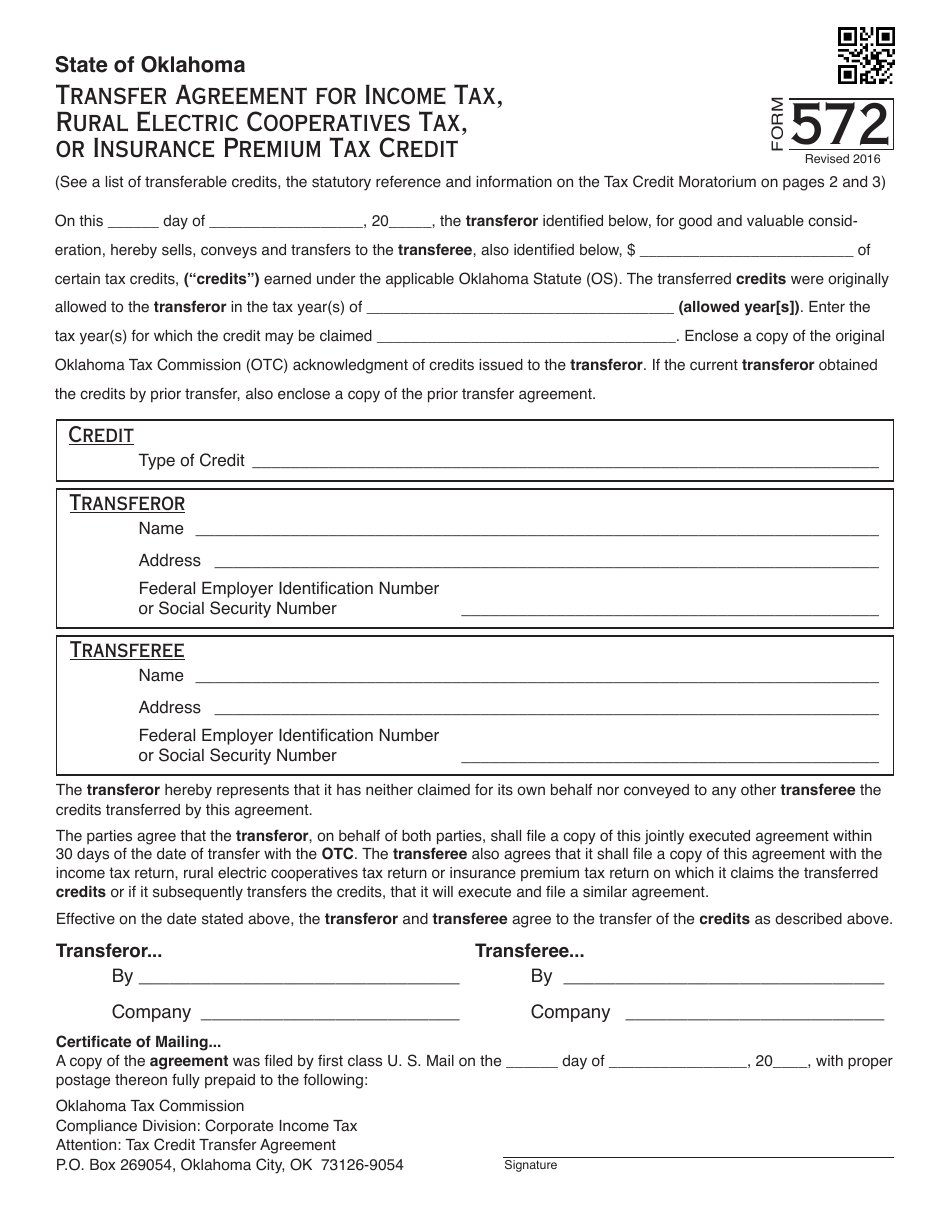

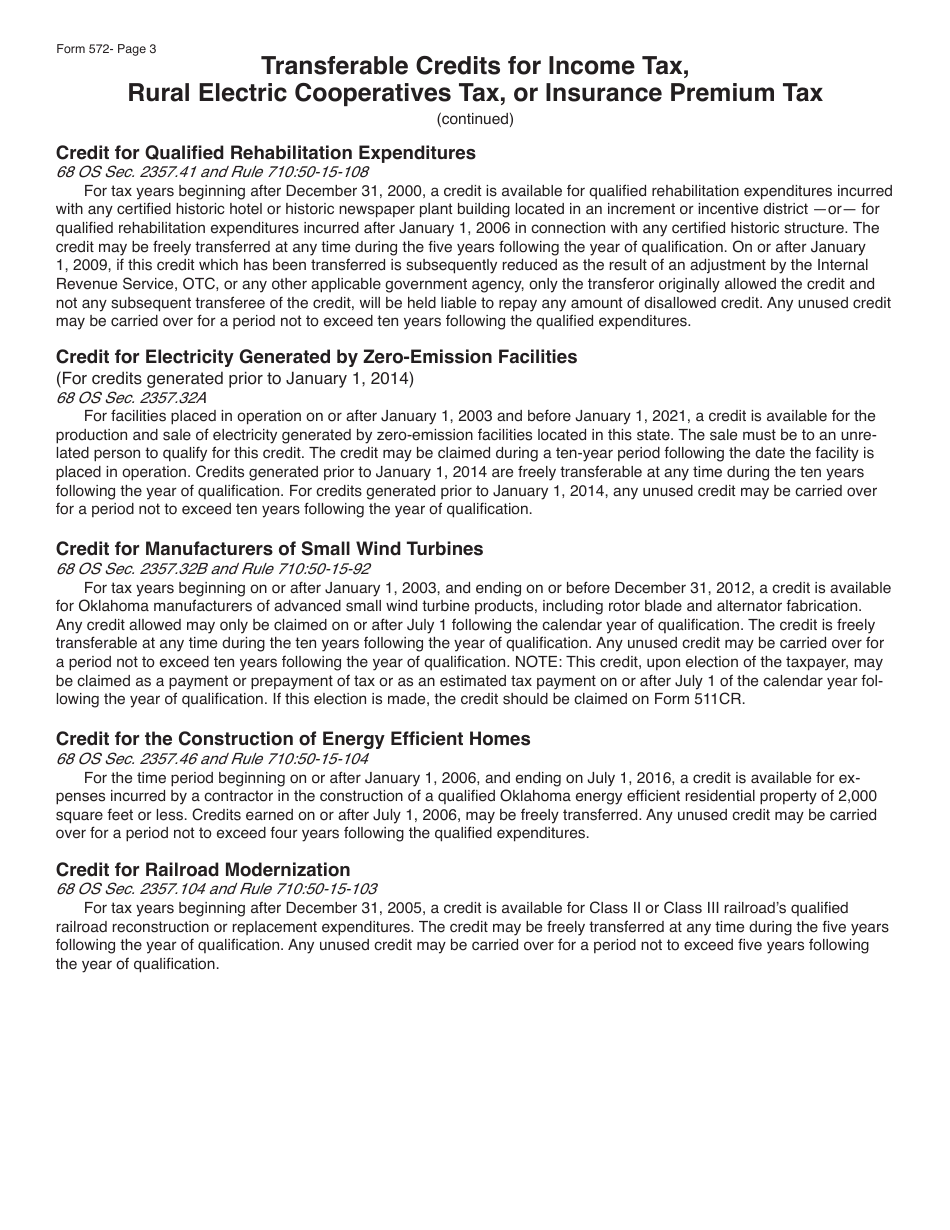

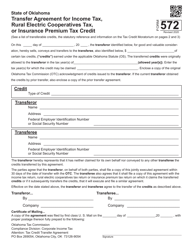

OTC Form 572 Transfer Agreement for Income Tax,rural Electric Cooperatives Tax,or Insurance Premium Tax Credit - Oklahoma

What Is OTC Form 572?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 572?

A: OTC Form 572 is a Transfer Agreement for Income Tax, Rural Electric Cooperatives Tax, or Insurance PremiumTax Credit in Oklahoma.

Q: What is the purpose of OTC Form 572?

A: The purpose of OTC Form 572 is to transfer unused income tax, rural electric cooperatives tax, or insurance premium tax credit from one entity to another in Oklahoma.

Q: Who needs to use OTC Form 572?

A: Any entity that wants to transfer their unused income tax, rural electric cooperatives tax, or insurance premium tax credit to another entity in Oklahoma needs to use OTC Form 572.

Q: Is there a fee to file OTC Form 572?

A: No, there is no fee to file OTC Form 572.

Q: Are there any deadlines for filing OTC Form 572?

A: Yes, the deadline for filing OTC Form 572 is generally the same as the deadline for filing the original tax return.

Q: What information is required on OTC Form 572?

A: Some of the information required on OTC Form 572 includes the transferor's and transferee's names and addresses, the amount of credit being transferred, and the tax year the credit was earned.

Q: Are there any supporting documents required to be submitted with OTC Form 572?

A: Yes, you may need to submit a copy of the original tax return and any other documentation related to the tax credit being transferred.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 572 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.