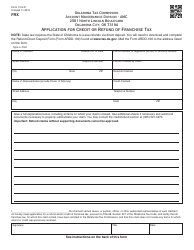

This version of the form is not currently in use and is provided for reference only. Download this version of

OTC Form 576

for the current year.

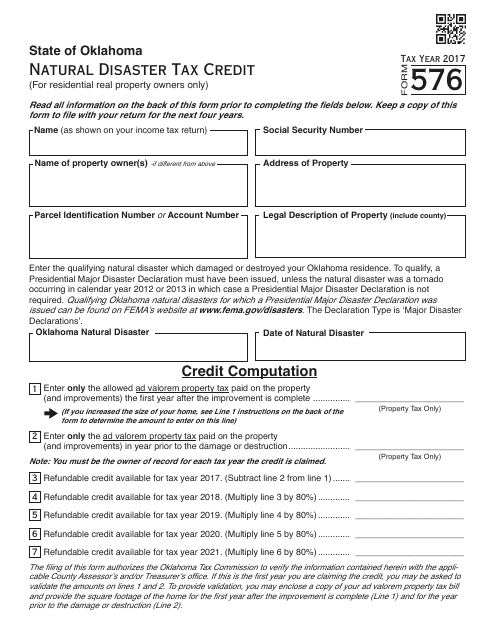

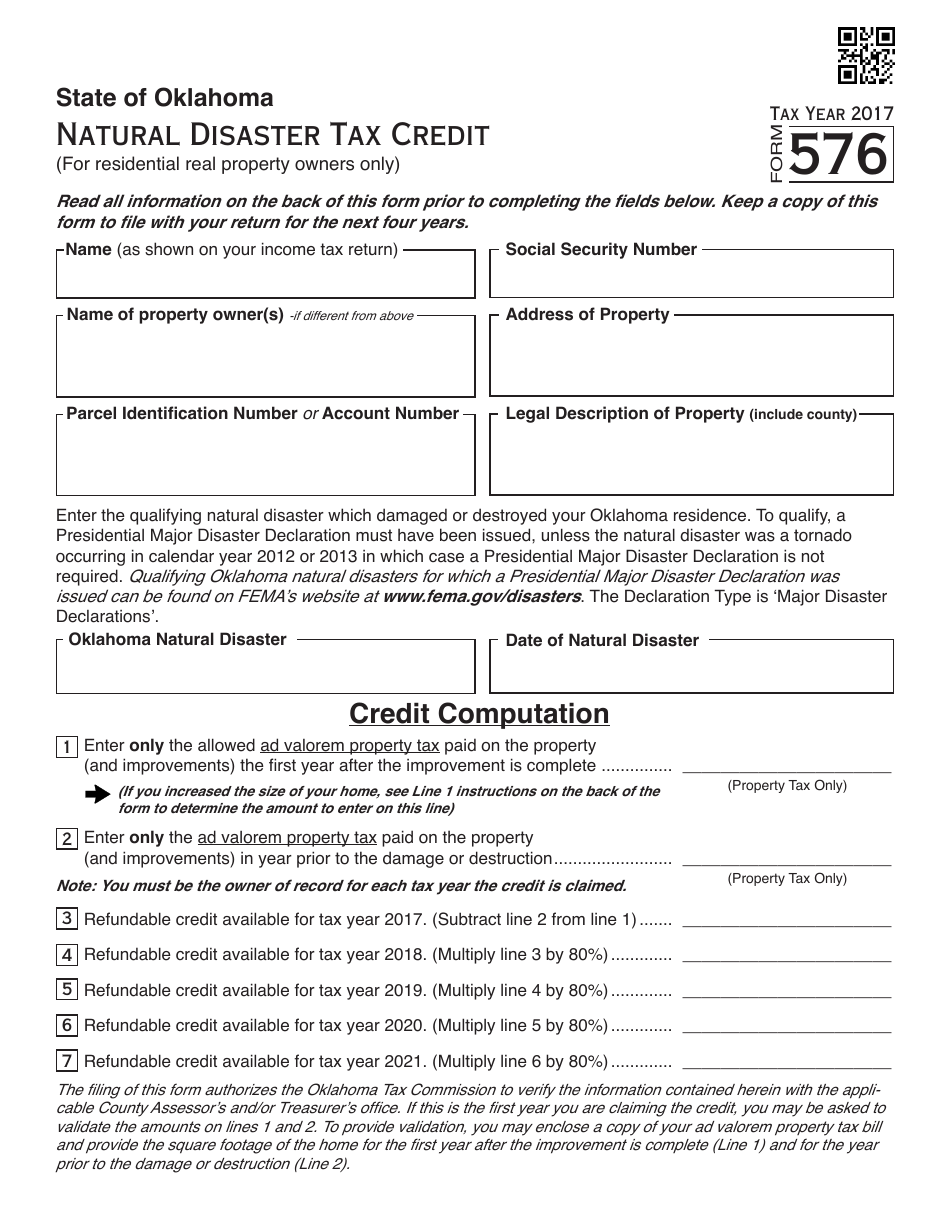

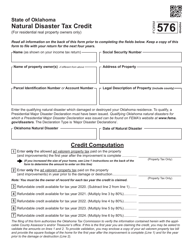

OTC Form 576 Natural Disaster Tax Credit (For Residential Real Property Owners Only) - Oklahoma

What Is OTC Form 576?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 576?

A: OTC Form 576 is a tax form for claiming a natural disastertax credit.

Q: Who is eligible to use OTC Form 576?

A: Only residential real property owners in Oklahoma are eligible to use OTC Form 576.

Q: What is the purpose of OTC Form 576?

A: The purpose of OTC Form 576 is to allow residential real property owners in Oklahoma to claim a tax credit related to natural disasters.

Q: Can I use OTC Form 576 if I own commercial property?

A: No, OTC Form 576 is only for residential real property owners.

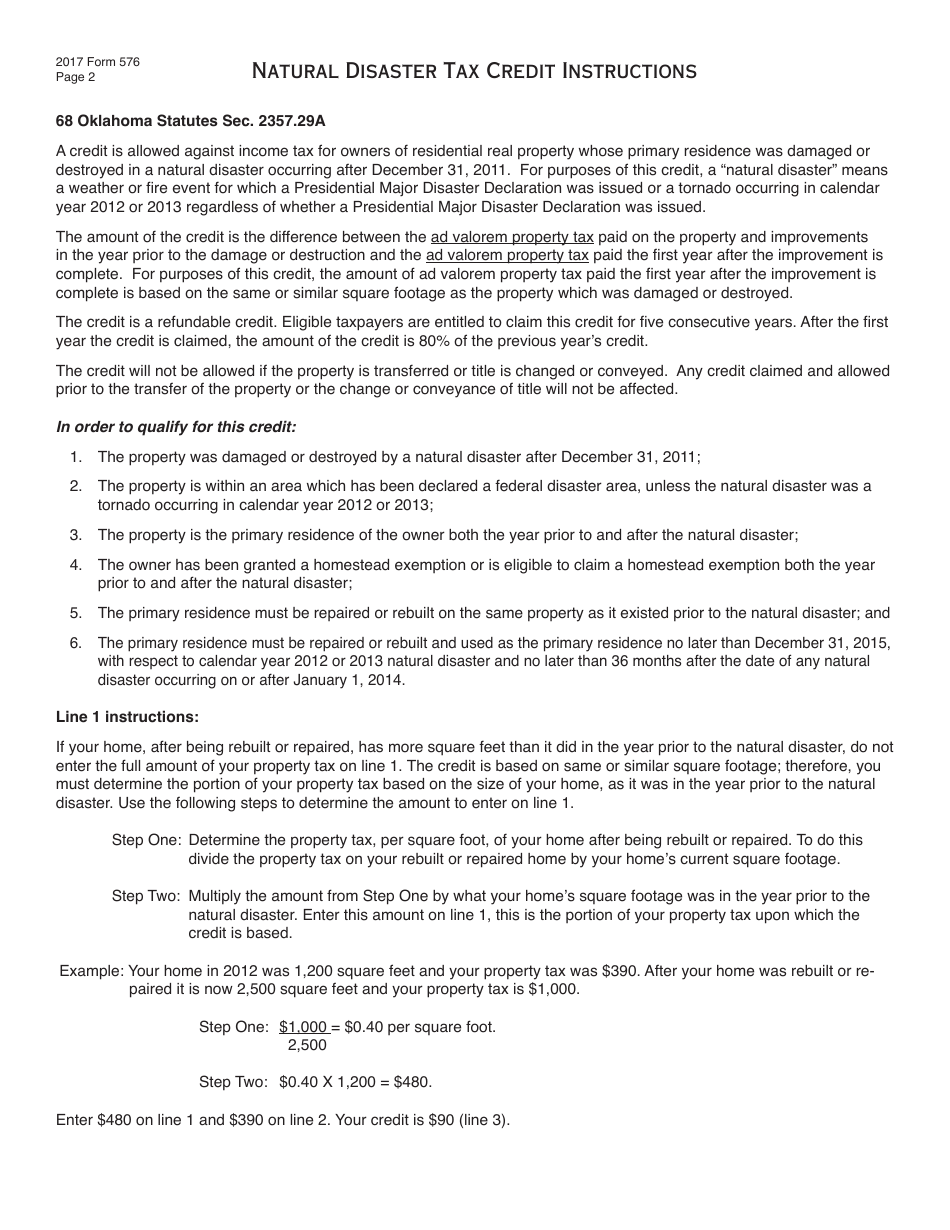

Q: What are the requirements to claim the natural disaster tax credit?

A: To claim the natural disaster tax credit, you must have experienced significant property damage as a result of a natural disaster and meet other eligibility criteria specified by the Oklahoma Tax Commission.

Q: What types of natural disasters qualify for the tax credit?

A: Examples of natural disasters that may qualify for the tax credit include tornadoes, floods, fires, and earthquakes.

Q: How much is the natural disaster tax credit?

A: The amount of the tax credit varies depending on the extent of the property damage and other factors. It is determined by the Oklahoma Tax Commission.

Q: When is the deadline to file OTC Form 576?

A: The deadline to file OTC Form 576 is typically April 15th of the year following the tax year in which the natural disaster occurred.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 576 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.