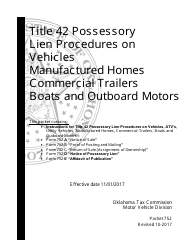

This version of the form is not currently in use and is provided for reference only. Download this version of

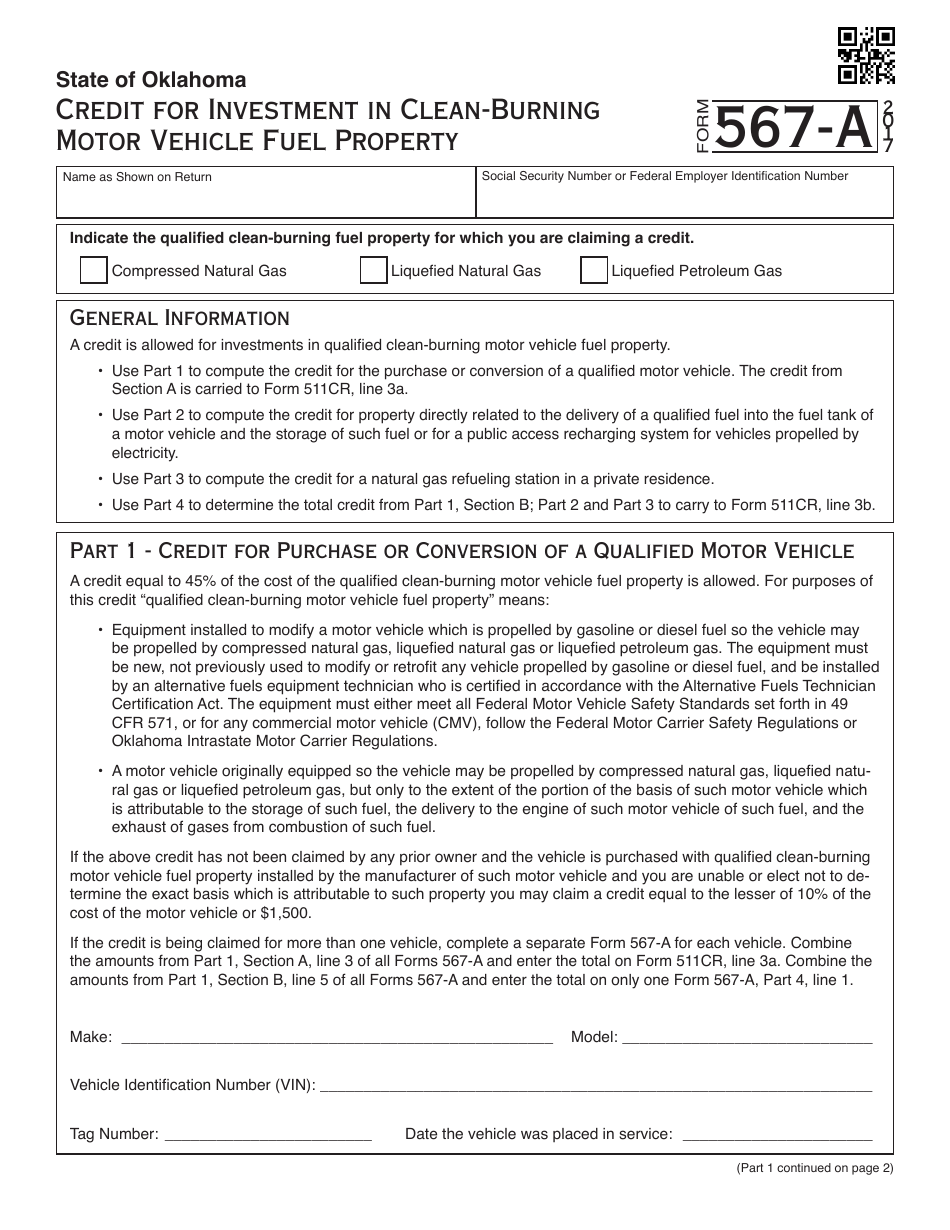

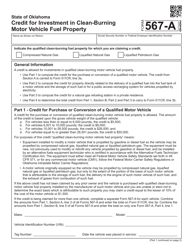

OTC Form 567-A

for the current year.

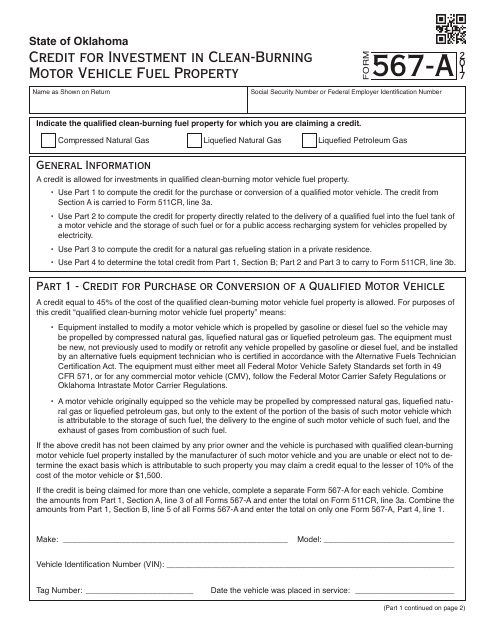

OTC Form 567-A Credit for Investment in a Clean-Burning Motor Vehicle Fuel Property - Oklahoma

What Is OTC Form 567-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 567-A?

A: OTC Form 567-A is a form used for claiming the Credit for Investment in a Clean-Burning Motor Vehicle Fuel Property in Oklahoma.

Q: What is the purpose of OTC Form 567-A?

A: The purpose of OTC Form 567-A is to claim a tax credit for investments in clean-burning motor vehicle fuel property in Oklahoma.

Q: Who can use OTC Form 567-A?

A: OTC Form 567-A can be used by individuals or businesses who have made investments in clean-burning motor vehicle fuel property in Oklahoma.

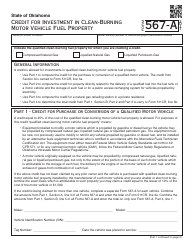

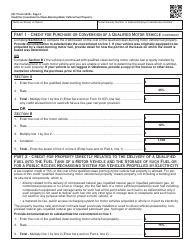

Q: What is the credit for investment in a clean-burning motor vehicle fuel property?

A: The credit for investment in a clean-burning motor vehicle fuel property is a tax credit available to individuals and businesses in Oklahoma for investments in equipment or property that supports the production or use of clean-burning motor vehicle fuels.

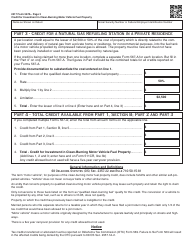

Q: How can I claim the credit for investment in a clean-burning motor vehicle fuel property?

A: To claim the credit, you need to complete OTC Form 567-A and submit it to the Oklahoma Tax Commission.

Q: What types of investments qualify for the credit?

A: Investments in equipment or property that supports the production or use of clean-burning motor vehicle fuels, such as natural gas refueling stations or electric vehicle charging infrastructure, may qualify for the credit.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are limitations and restrictions on the credit, such as maximum credit amounts and specific requirements for the type of property or equipment that qualifies.

Q: Is the credit refundable?

A: No, the credit is not refundable. It can only be used to offset your Oklahoma state tax liability.

Q: Is there a deadline for filing OTC Form 567-A?

A: Yes, OTC Form 567-A must be filed on or before April 15th of the year following the calendar year in which the investment was made.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 567-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.