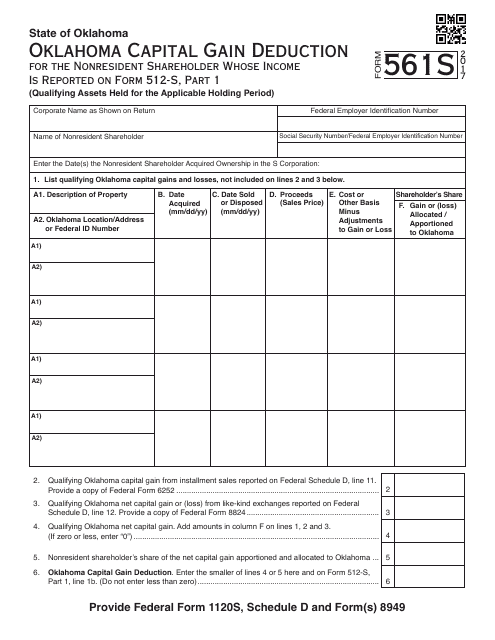

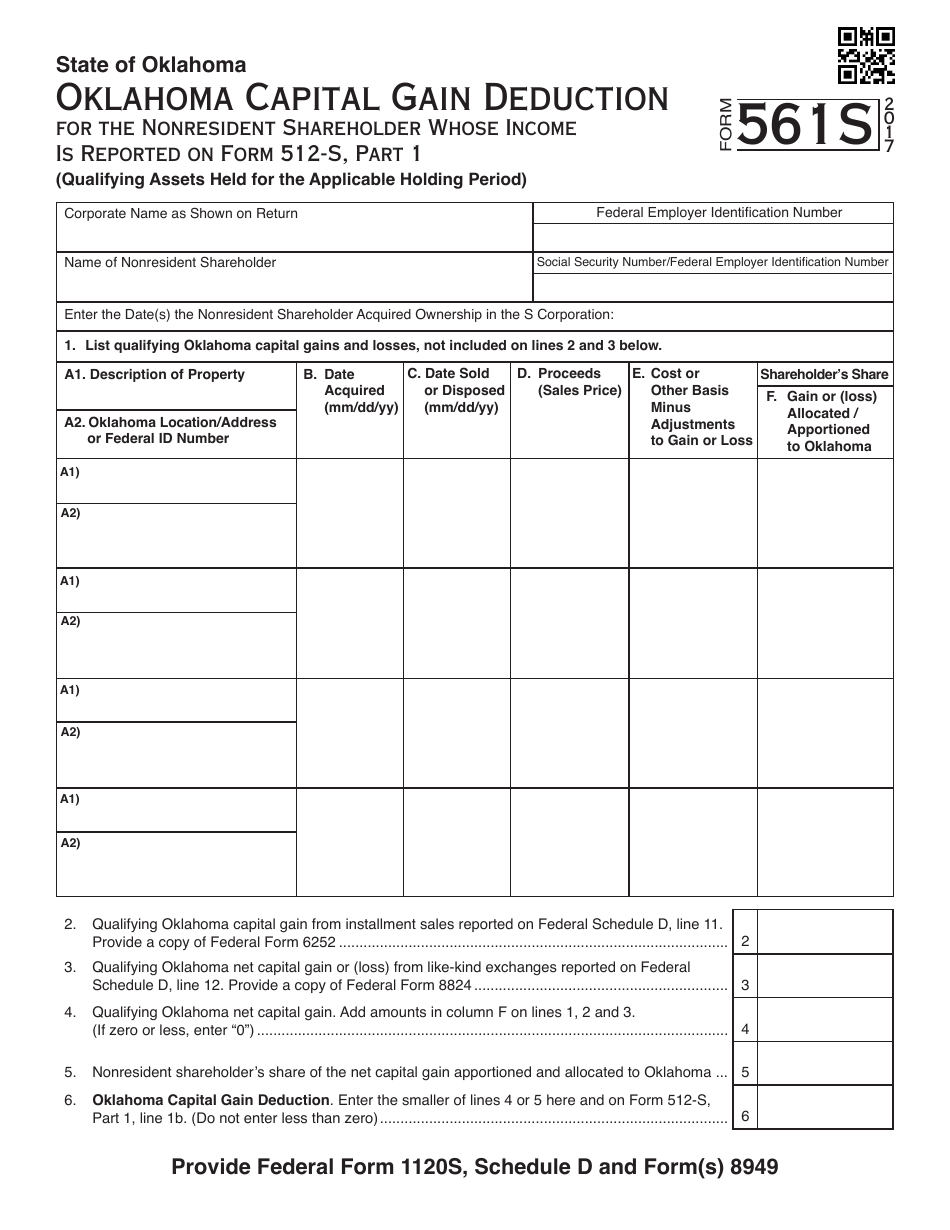

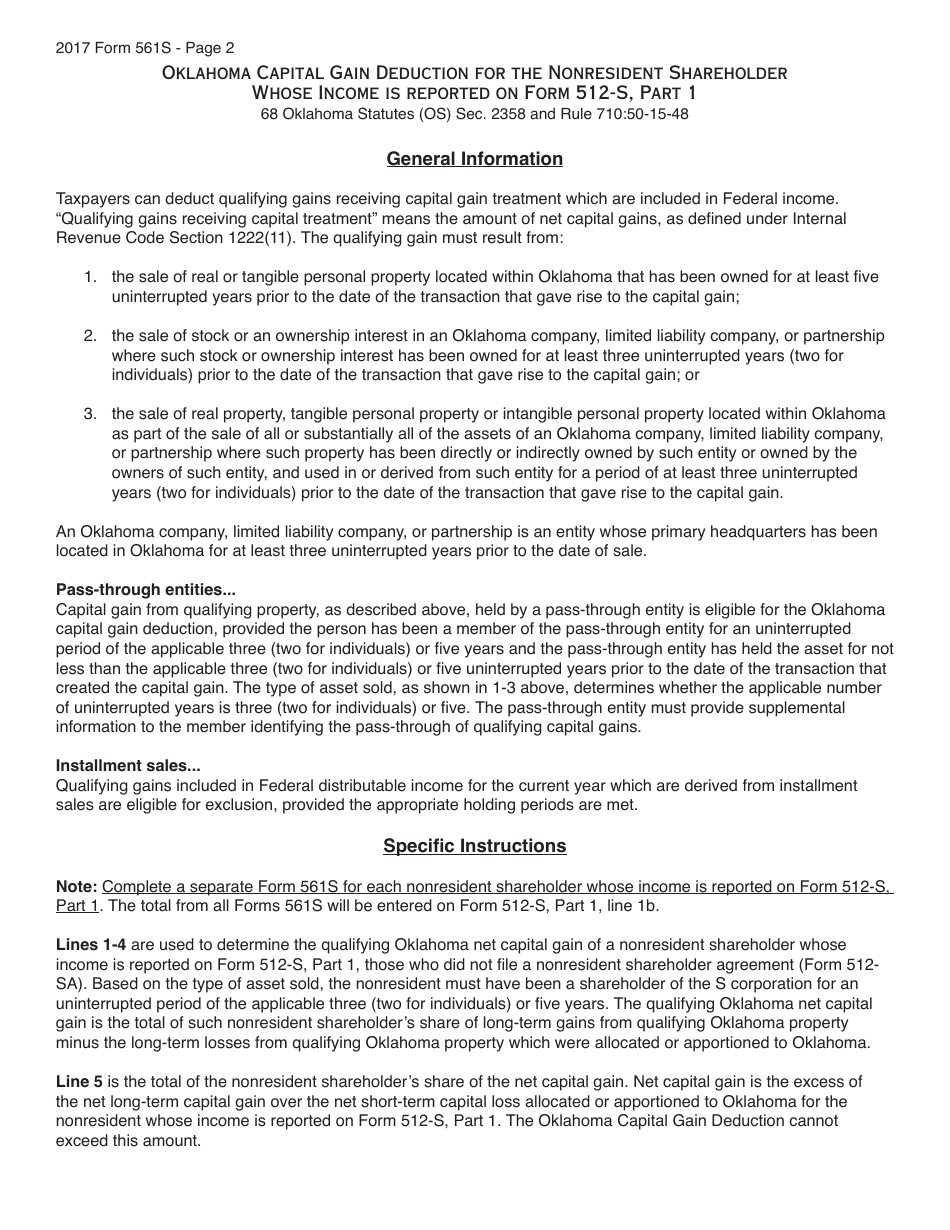

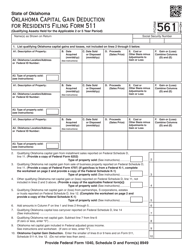

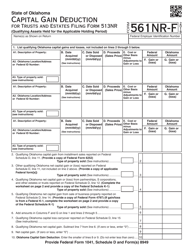

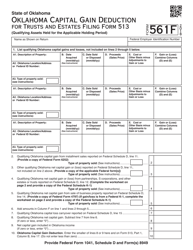

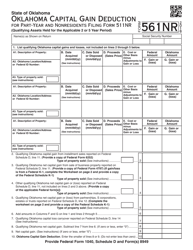

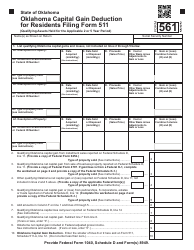

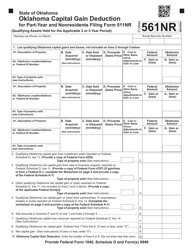

OTC Form 561S Capital Gain Deduction for Nonresident Shareholders Whose Income Is Reported on Form 512-s, Part 1 - Oklahoma

What Is OTC Form 561S?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 561S?

A: OTC Form 561S is a form for claiming the capital gain deduction for nonresident shareholders.

Q: Who is eligible to use OTC Form 561S?

A: Nonresident shareholders whose income is reported on Form 512-s, Part 1 - Oklahoma are eligible to use OTC Form 561S.

Q: What is the purpose of OTC Form 561S?

A: The purpose of OTC Form 561S is to claim the capital gain deduction for nonresident shareholders.

Q: What is the capital gain deduction?

A: The capital gain deduction is a deduction that reduces the taxable amount of capital gains.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 561S by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.