This version of the form is not currently in use and is provided for reference only. Download this version of

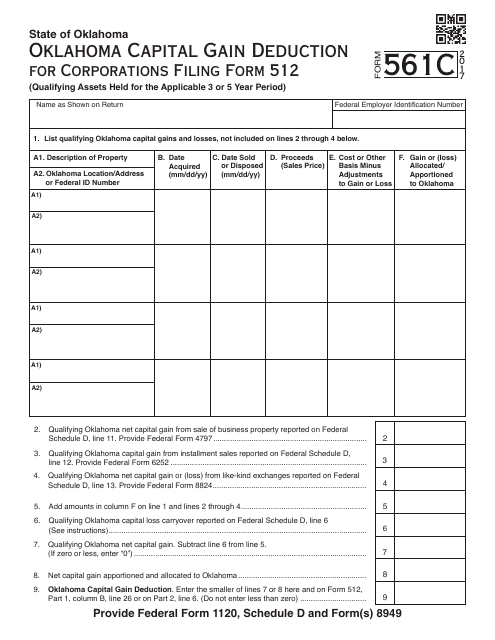

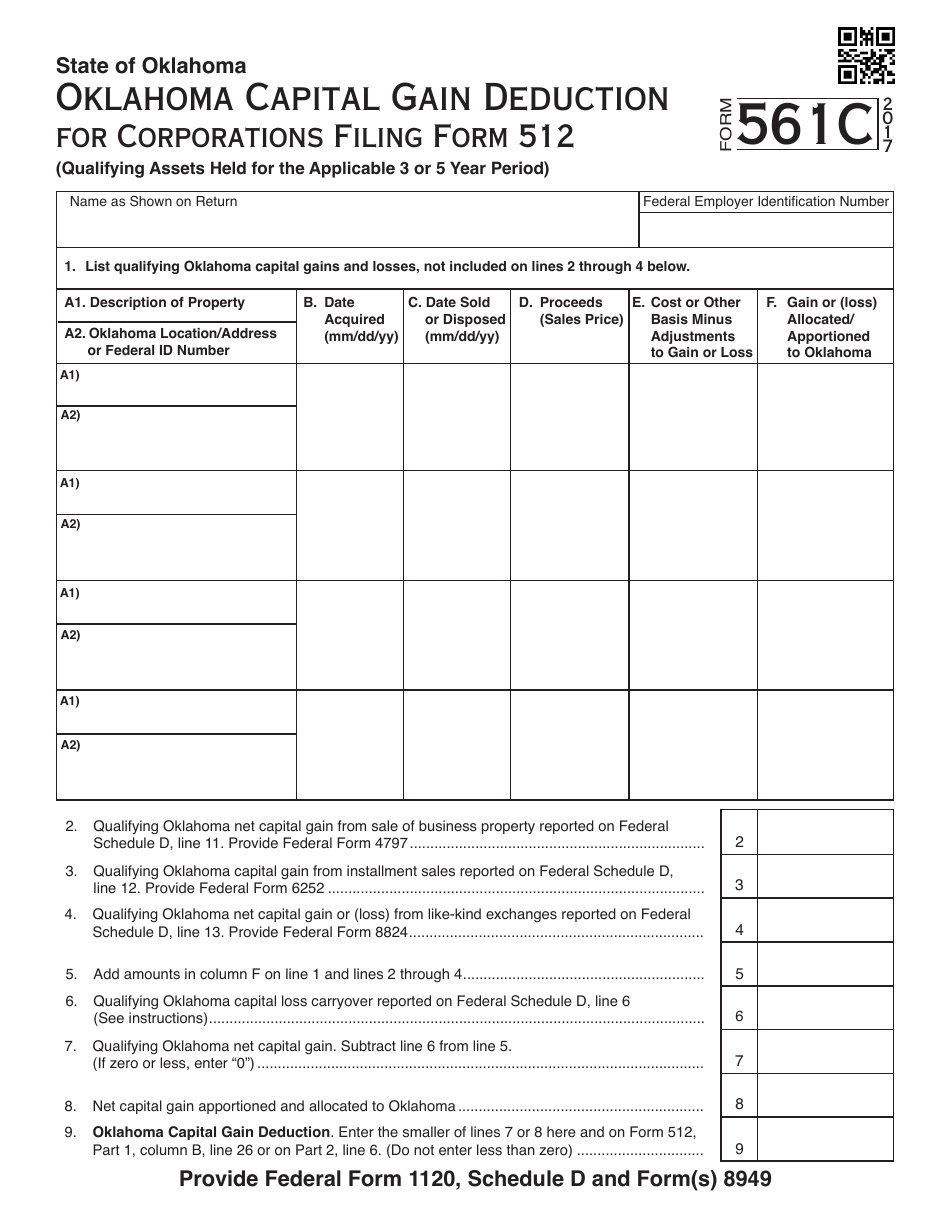

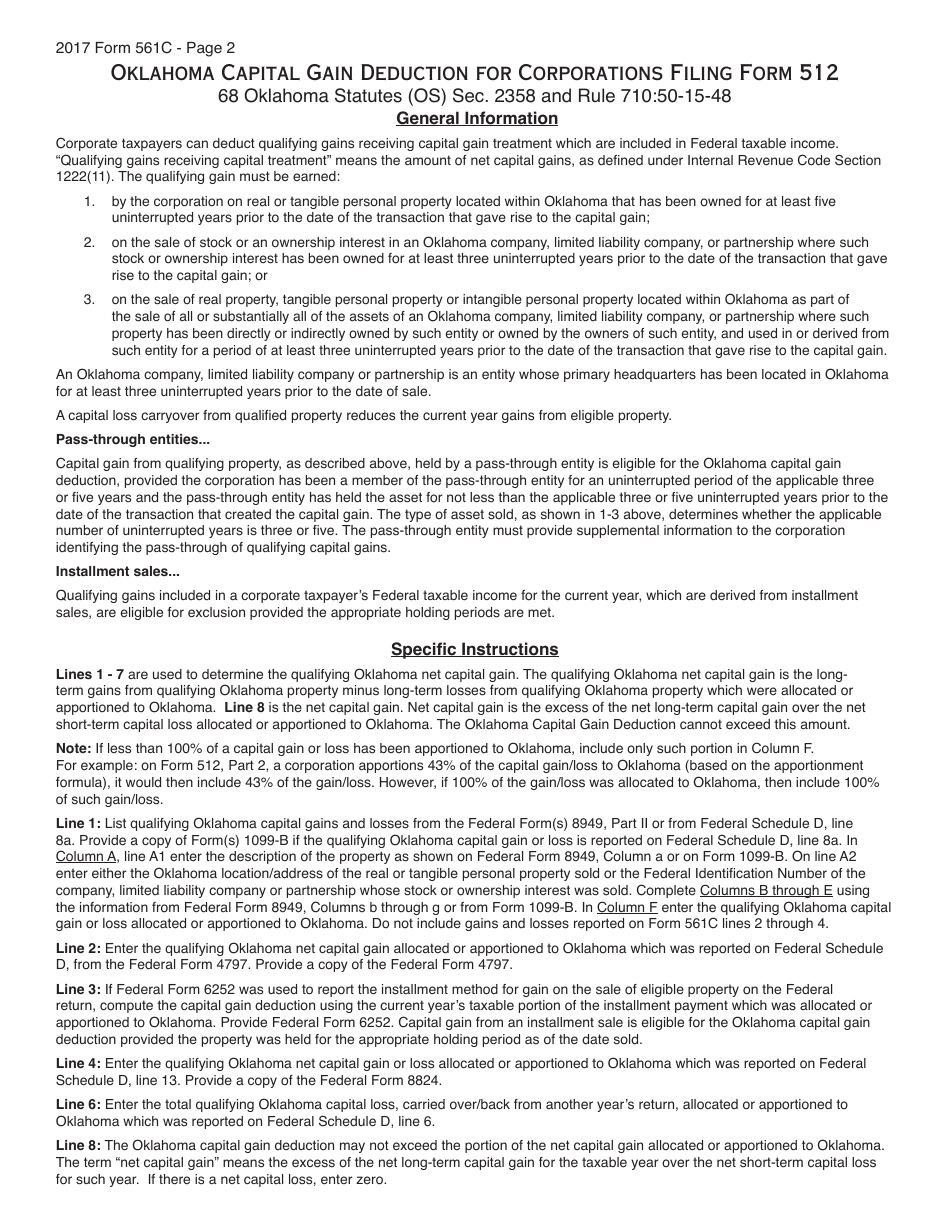

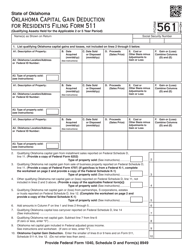

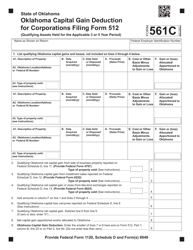

OTC Form 561C

for the current year.

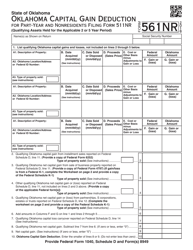

OTC Form 561C Capital Gain Deduction for Corporations Filing Form 512 - Oklahoma

What Is OTC Form 561C?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 561C?

A: OTC Form 561C is the form used by corporations filing Form 512 in Oklahoma to claim the Capital Gain Deduction.

Q: Who can use OTC Form 561C?

A: Corporations filing Form 512 in Oklahoma can use OTC Form 561C to claim the Capital Gain Deduction.

Q: What is the Capital Gain Deduction?

A: The Capital Gain Deduction is a tax deduction that allows eligible corporations to reduce their taxable income by a portion of their capital gains.

Q: Why would a corporation want to claim the Capital Gain Deduction?

A: A corporation would want to claim the Capital Gain Deduction to reduce their taxable income and lower their overall tax liability.

Q: How can a corporation claim the Capital Gain Deduction?

A: A corporation can claim the Capital Gain Deduction by completing OTC Form 561C and including it with their Form 512 filing.

Q: Are there any eligibility requirements for the Capital Gain Deduction?

A: Yes, there are eligibility requirements for the Capital Gain Deduction. Corporations must meet certain criteria to be eligible for the deduction.

Q: Can a corporation claim the Capital Gain Deduction if they don't file Form 512?

A: No, only corporations filing Form 512 in Oklahoma can claim the Capital Gain Deduction.

Q: Is the Capital Gain Deduction available in other states?

A: The availability of the Capital Gain Deduction may vary from state to state. It is specific to Oklahoma for corporations filing Form 512.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 561C by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.