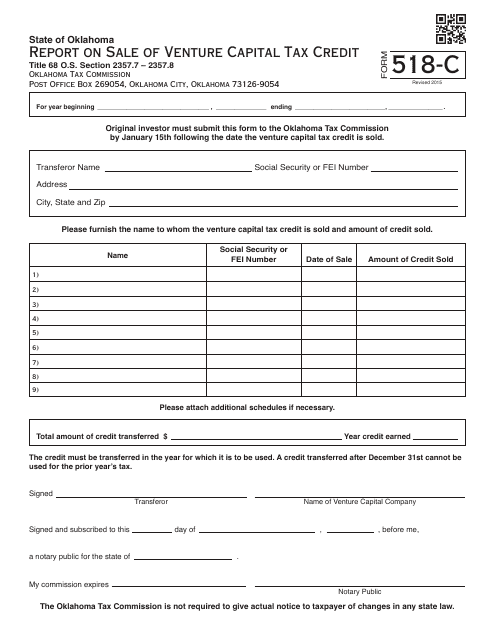

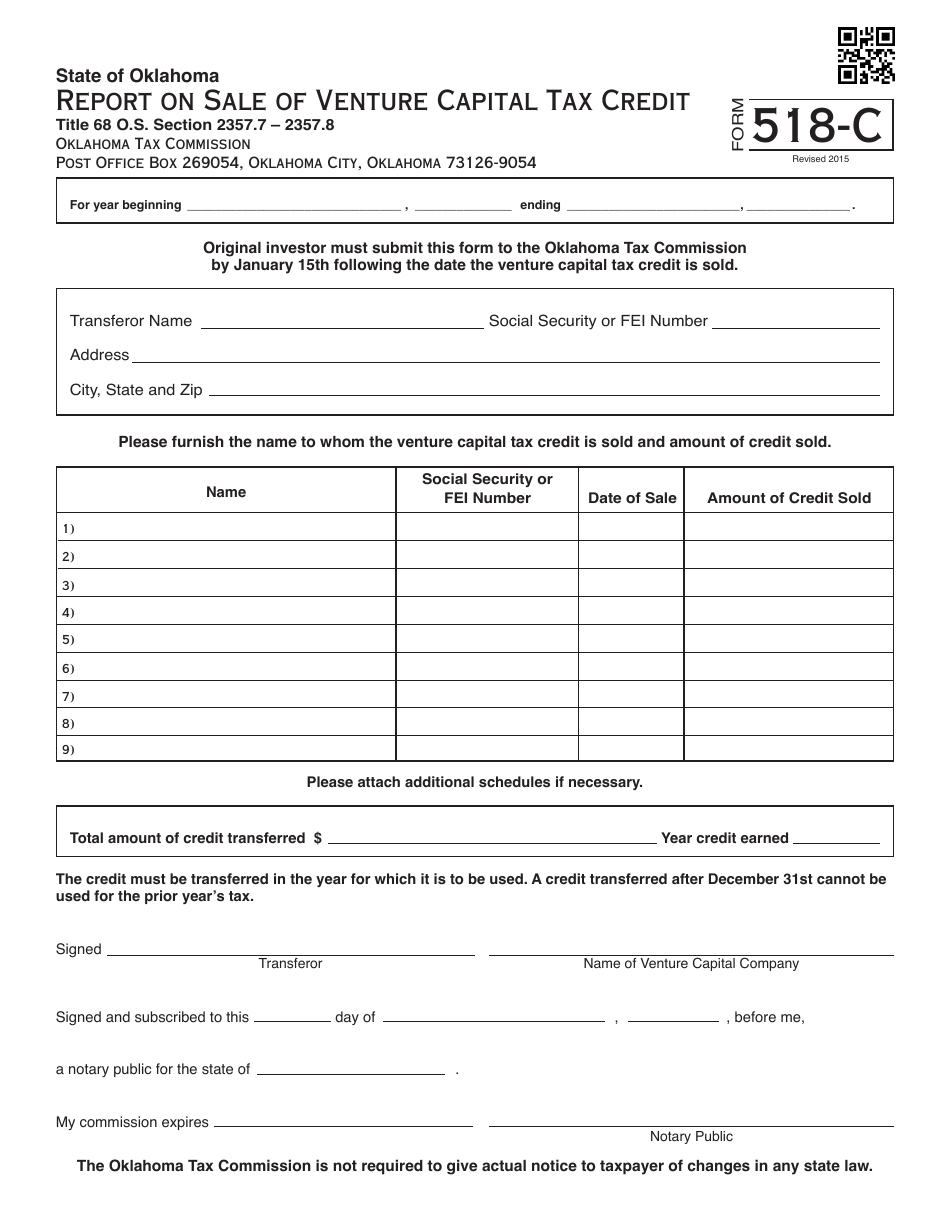

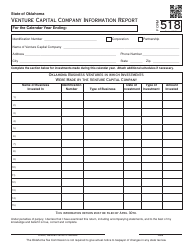

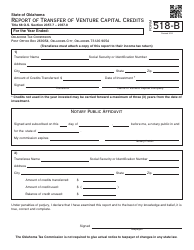

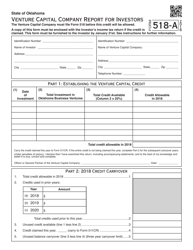

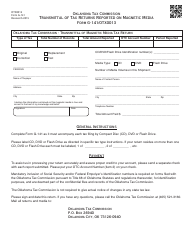

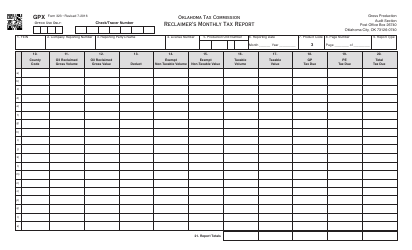

OTC Form 518-C Report on Sale of Venture Capital Tax Credit - Oklahoma

What Is OTC Form 518-C?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 518-C?

A: OTC Form 518-C is a report on the sale of Venture Capital Tax Credit in Oklahoma.

Q: Who needs to file OTC Form 518-C?

A: Any individual or entity that has sold Venture CapitalTax Credits in Oklahoma needs to file OTC Form 518-C.

Q: What is the purpose of OTC Form 518-C?

A: The purpose of OTC Form 518-C is to report the sale of Venture Capital Tax Credits to the Oklahoma Tax Commission (OTC).

Q: When is OTC Form 518-C due?

A: OTC Form 518-C is due on or before the 20th day of the month following the end of the quarter in which the sale occurred.

Q: Are there any penalties for not filing OTC Form 518-C?

A: Yes, there are penalties for not filing OTC Form 518-C, including monetary fines.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 518-C by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.