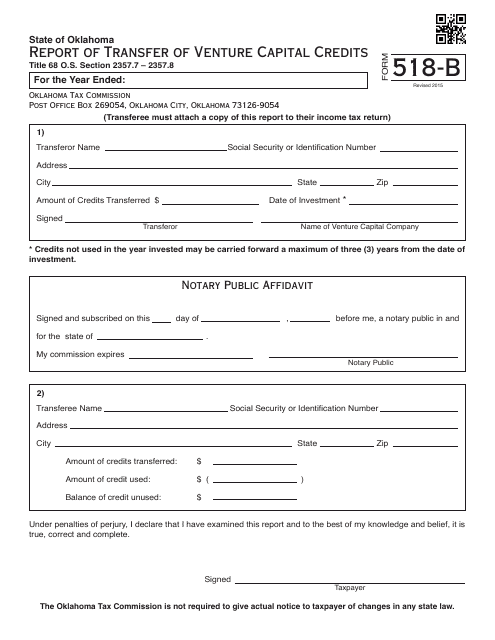

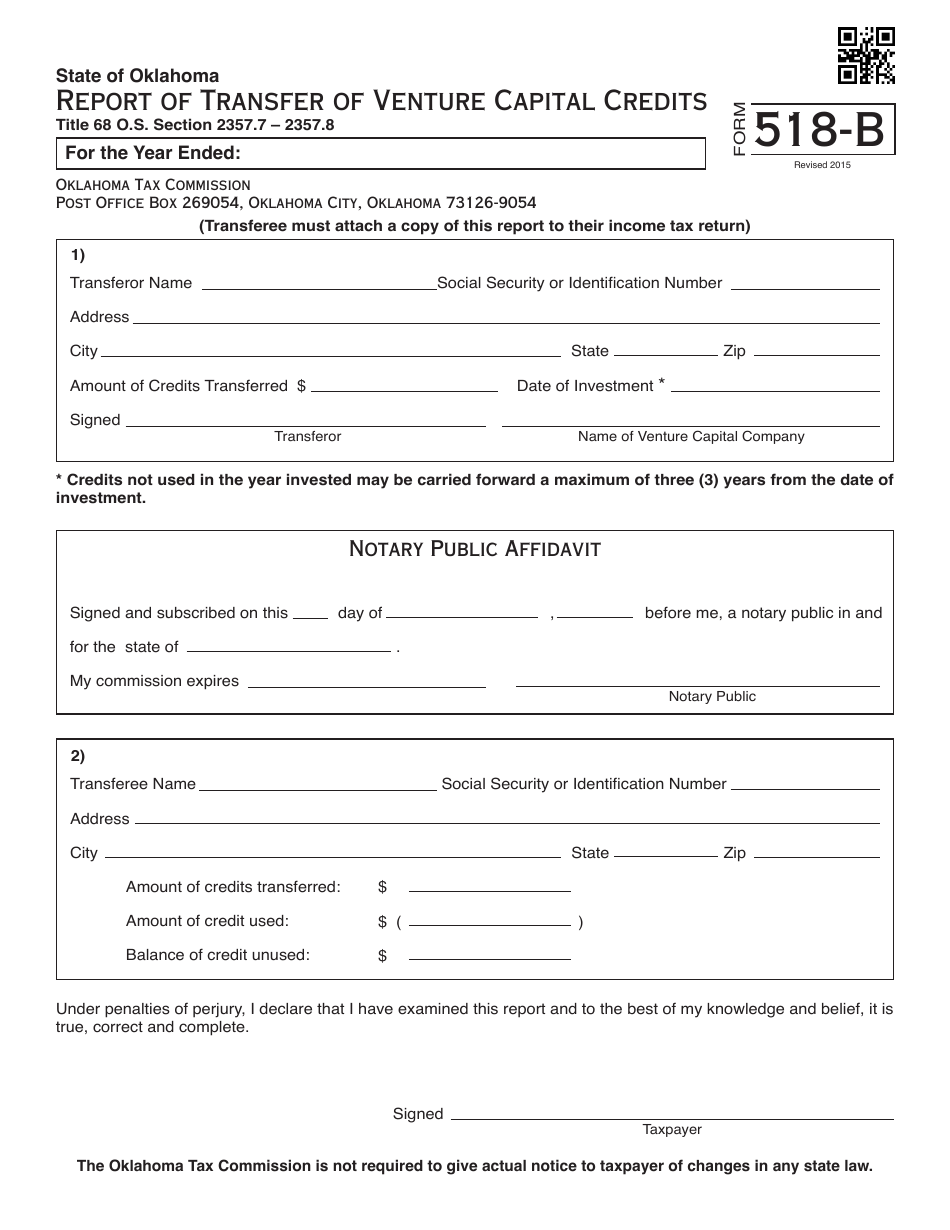

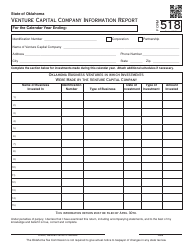

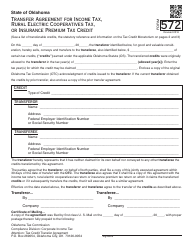

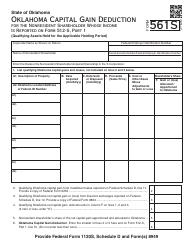

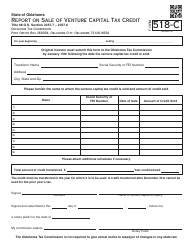

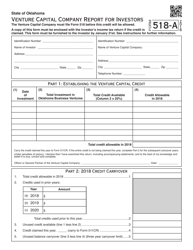

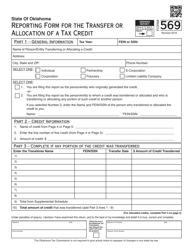

OTC Form 518-B Report of Transfer of Venture Capital Credits - Oklahoma

What Is OTC Form 518-B?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 518-B?

A: OTC Form 518-B is a report used to document the transfer of Venture Capital Credits in Oklahoma.

Q: What does OTC stand for?

A: OTC stands for Oklahoma Tax Commission.

Q: What are Venture Capital Credits?

A: Venture Capital Credits are tax credits that can be earned by individuals or businesses for investments in qualified ventures.

Q: Why do I need to file OTC Form 518-B?

A: You need to file OTC Form 518-B to report the transfer of Venture Capital Credits in Oklahoma.

Q: Are there any fees associated with filing OTC Form 518-B?

A: There are no fees associated with filing OTC Form 518-B.

Q: What information is required to complete OTC Form 518-B?

A: You will need to provide information about the transferor and transferee, details of the credit being transferred, and any supporting documentation.

Q: When is the deadline to file OTC Form 518-B?

A: The deadline to file OTC Form 518-B is typically April 30th of the year following the transfer.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 518-B by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.