This version of the form is not currently in use and is provided for reference only. Download this version of

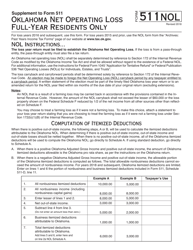

OTC Form 511NR-NOL

for the current year.

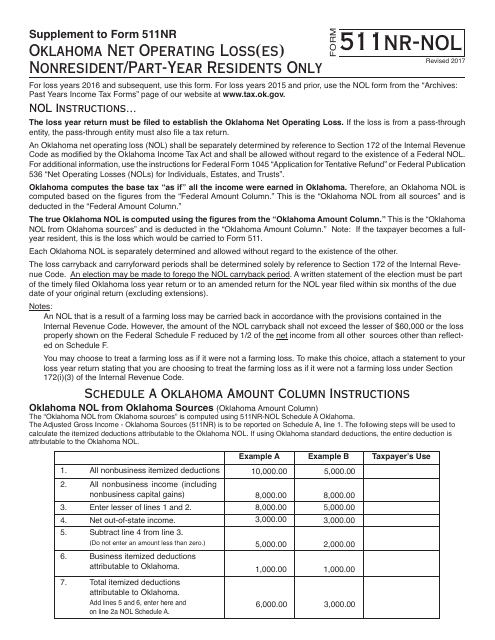

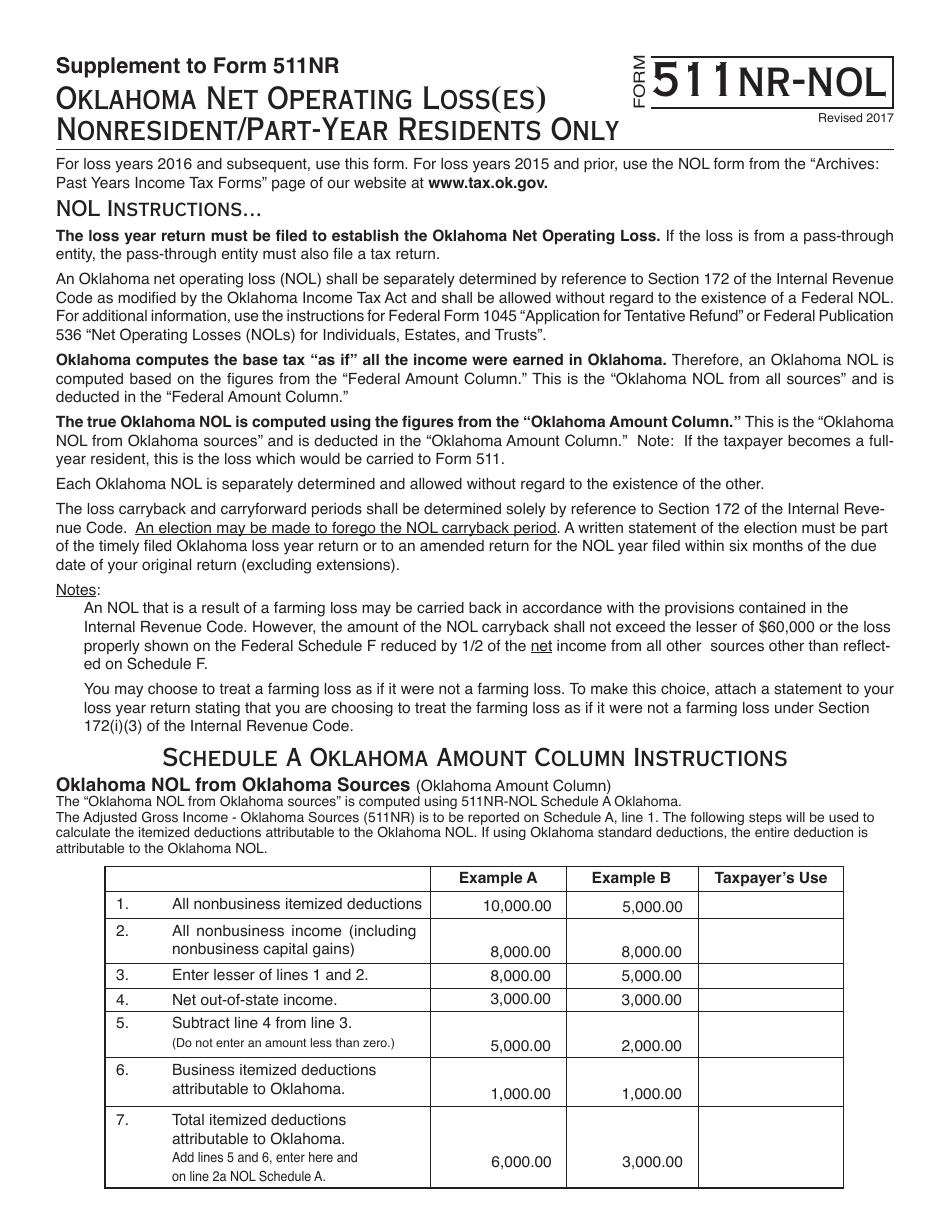

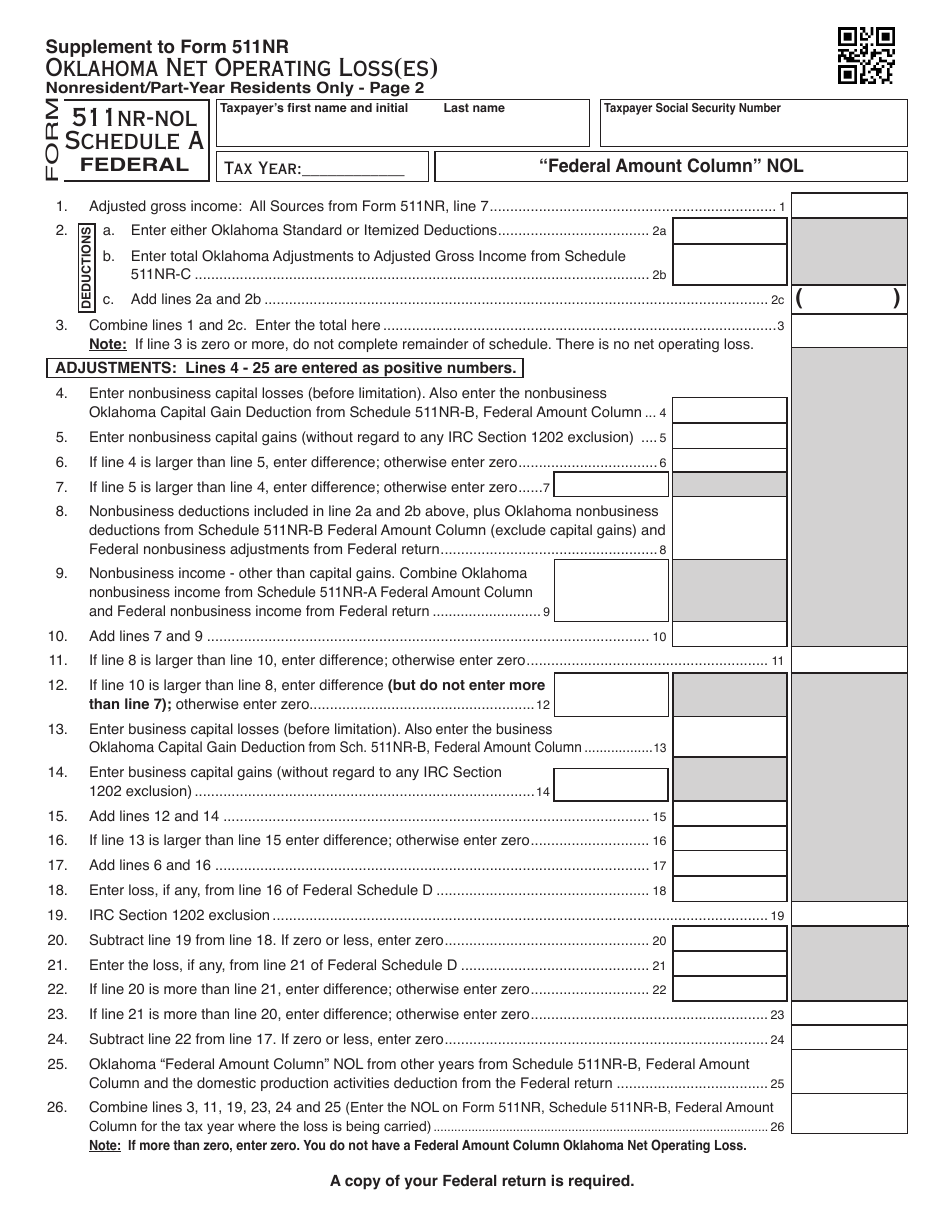

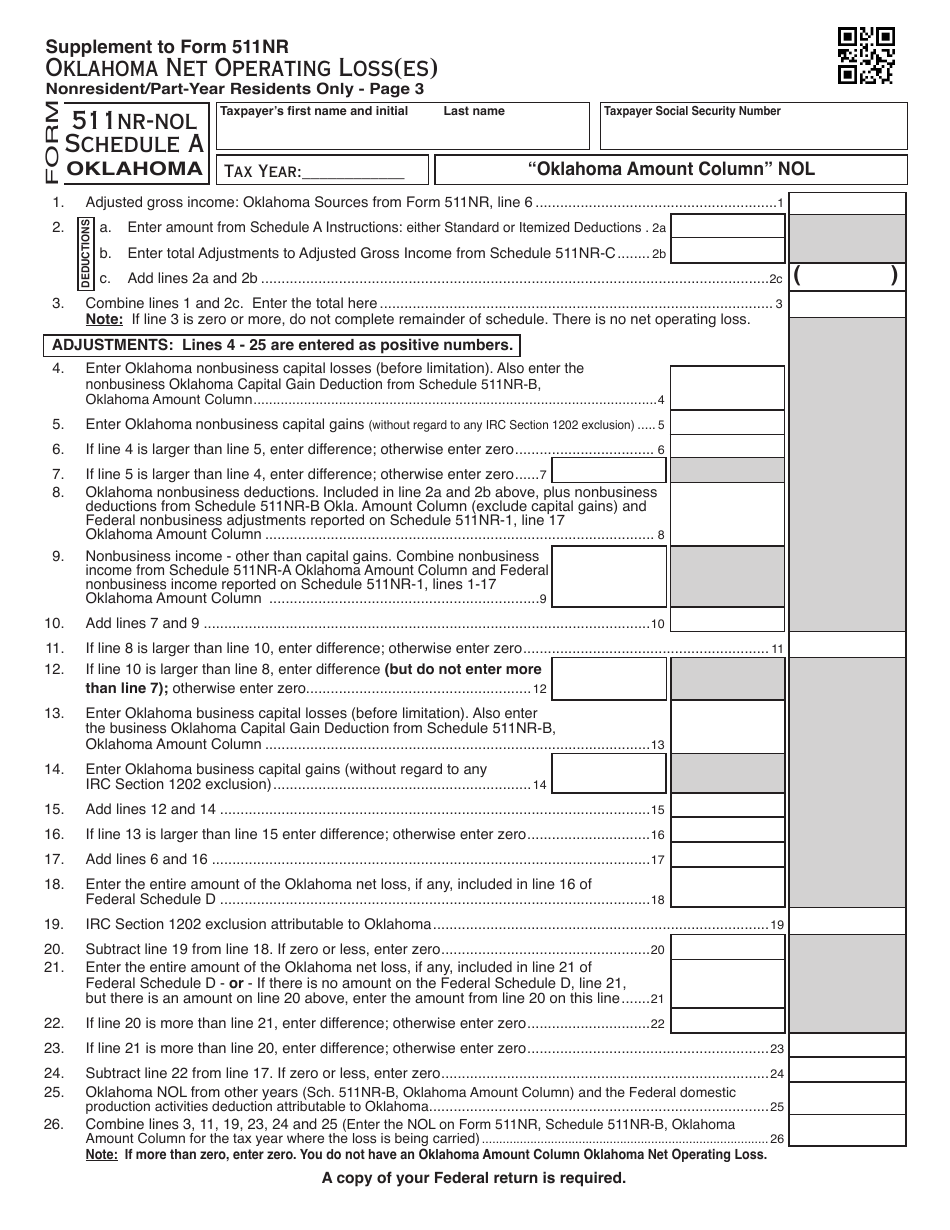

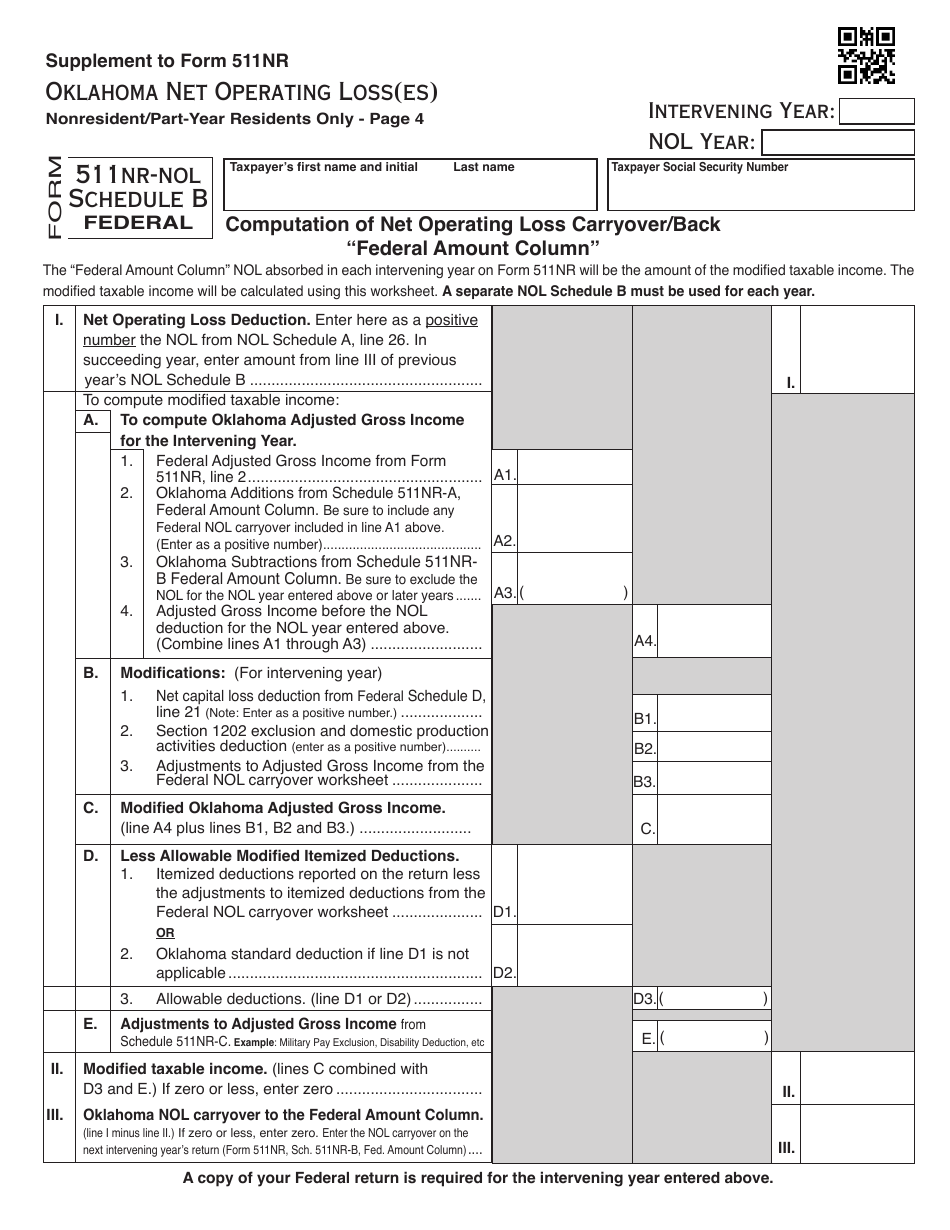

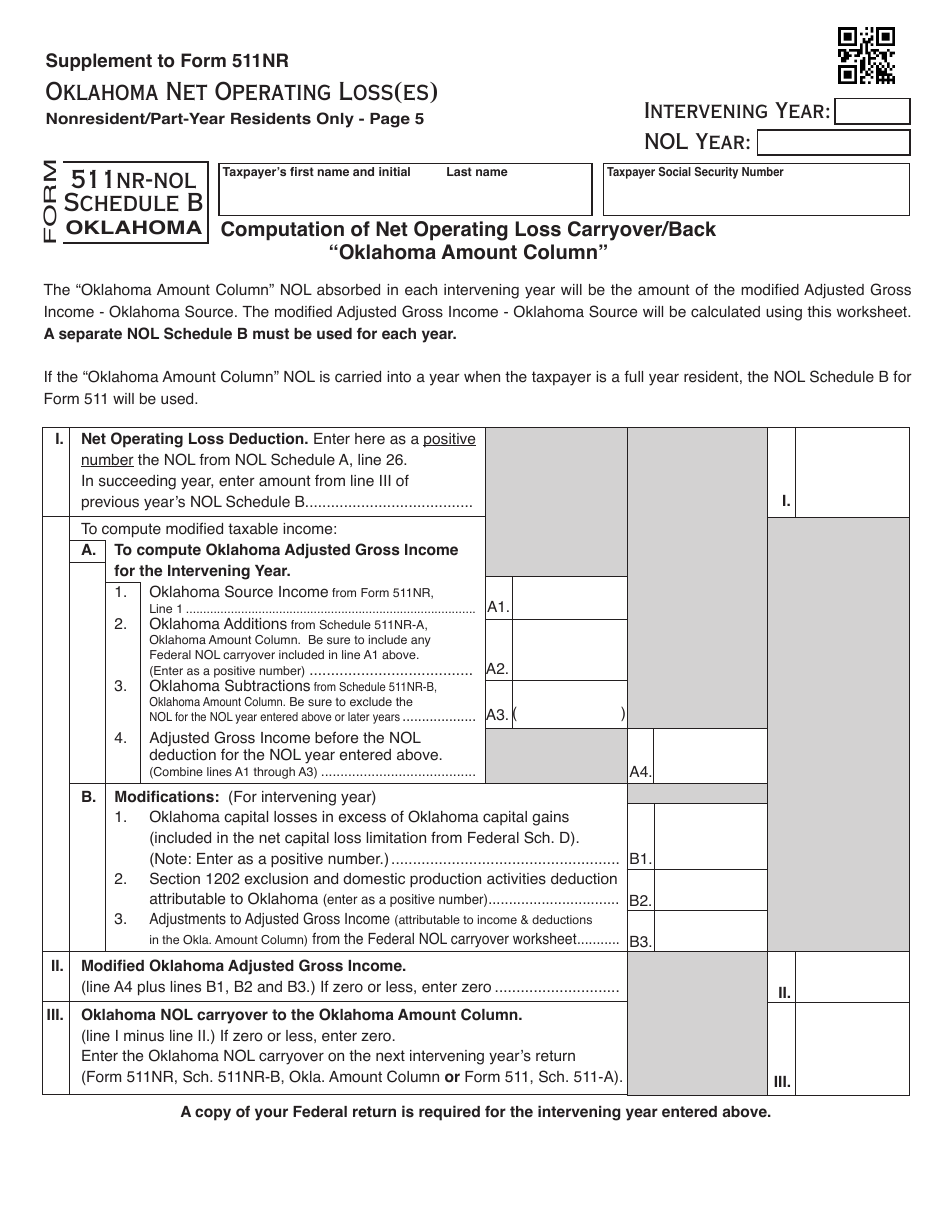

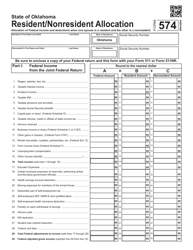

OTC Form 511NR-NOL Oklahoma Net Operating Loss(Es) Nonresident / Part-Year Residents Only - Oklahoma

What Is OTC Form 511NR-NOL?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 511NR-NOL?

A: OTC Form 511NR-NOL is a form used in Oklahoma to report net operating losses for nonresident or part-year residents.

Q: Who should file OTC Form 511NR-NOL?

A: Nonresident or part-year residents of Oklahoma who have net operating losses should file OTC Form 511NR-NOL.

Q: What is a net operating loss?

A: A net operating loss occurs when a taxpayer's allowable deductions exceed their taxable income.

Q: What is the purpose of OTC Form 511NR-NOL?

A: The purpose of OTC Form 511NR-NOL is to calculate and carry forward any net operating losses for nonresident or part-year residents in Oklahoma.

Q: Can full-year residents file OTC Form 511NR-NOL?

A: No, OTC Form 511NR-NOL is only for nonresident or part-year residents of Oklahoma.

Q: Is there a deadline to file OTC Form 511NR-NOL?

A: The deadline to file OTC Form 511NR-NOL is the same as the individual income tax return deadline, which is usually April 15th.

Q: Are there any penalties for not filing OTC Form 511NR-NOL?

A: Yes, there may be penalties for not filing OTC Form 511NR-NOL or for filing it late. It's important to comply with the tax filing requirements.

Q: Can I file OTC Form 511NR-NOL electronically?

A: Yes, you can file OTC Form 511NR-NOL electronically if you meet the requirements for electronic filing.

Q: Do I need to include any supporting documents with OTC Form 511NR-NOL?

A: Yes, you may need to include supporting documents such as schedules or other forms depending on your specific situation. It's important to review the instructions for OTC Form 511NR-NOL to determine what documents are required.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 511NR-NOL by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.