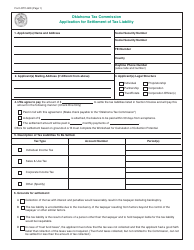

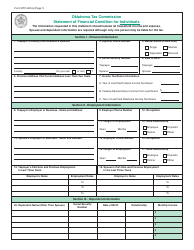

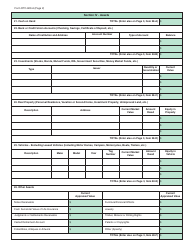

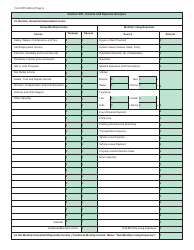

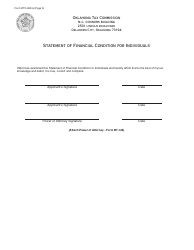

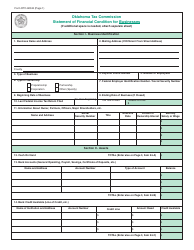

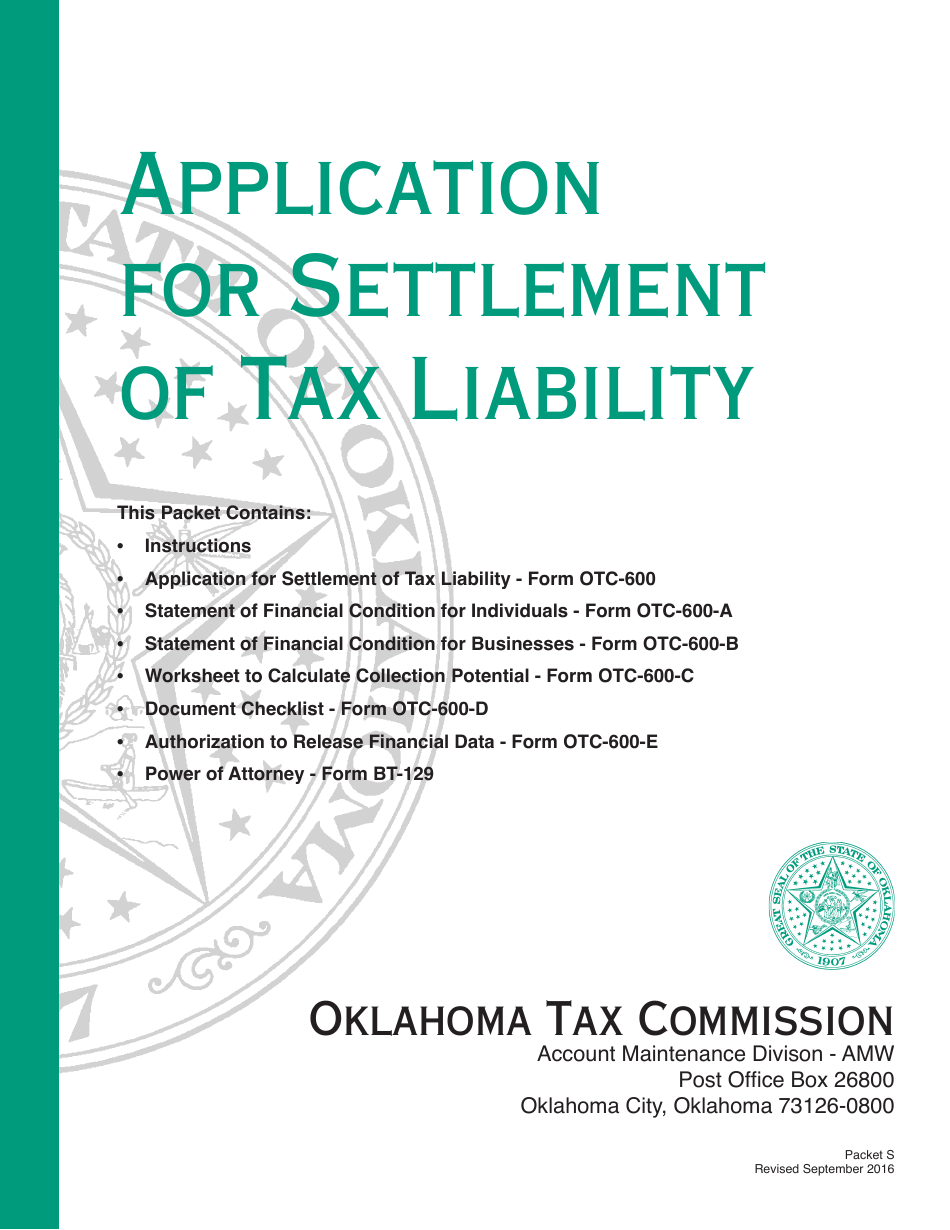

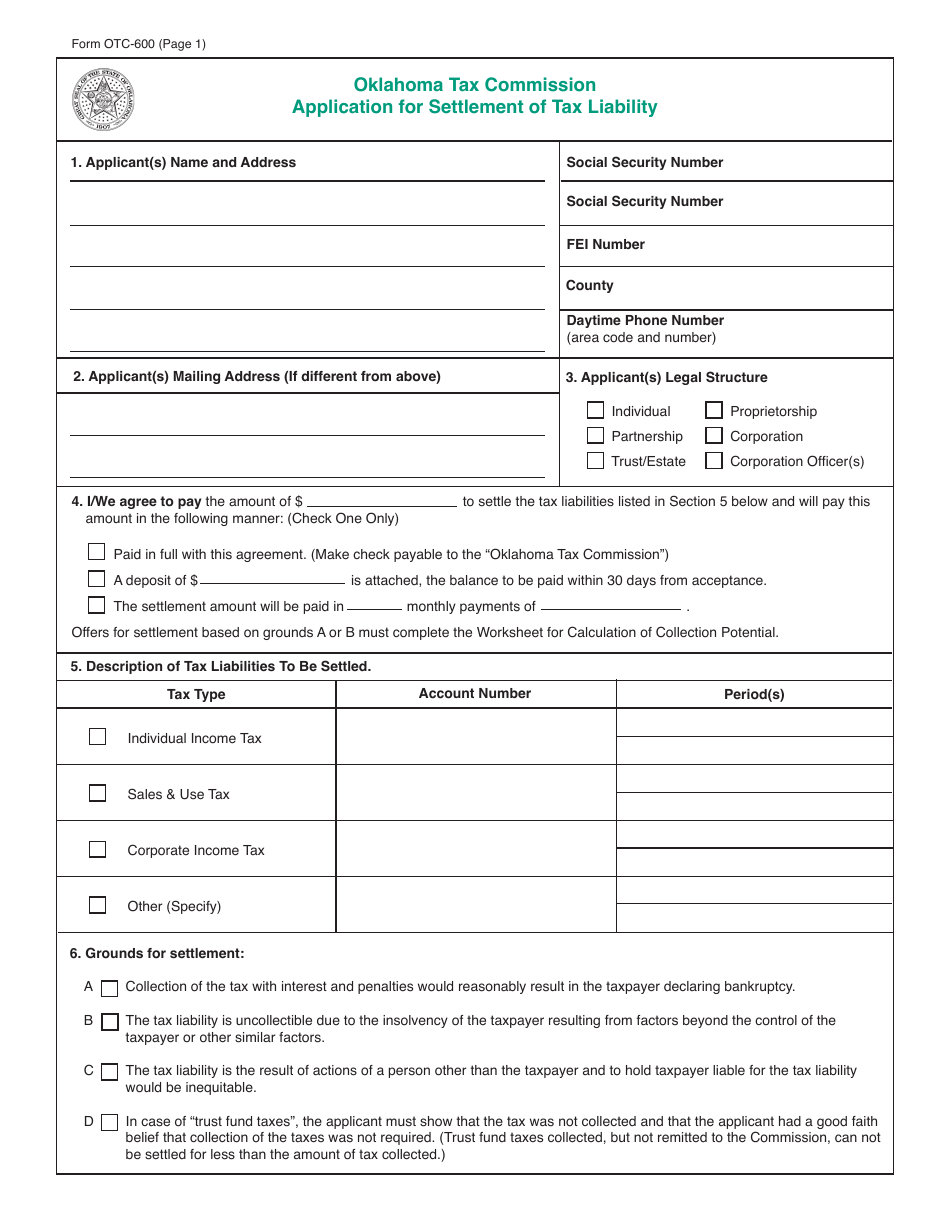

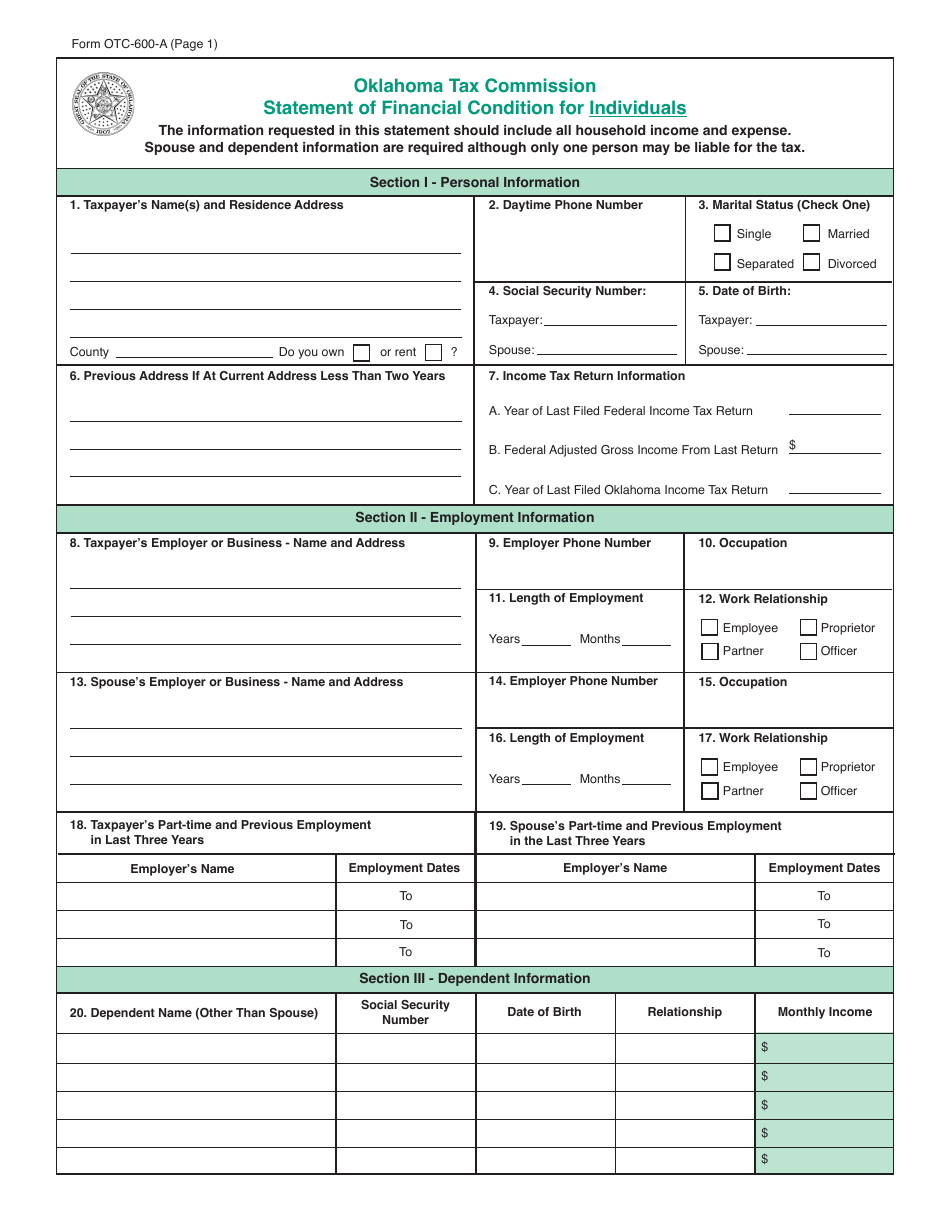

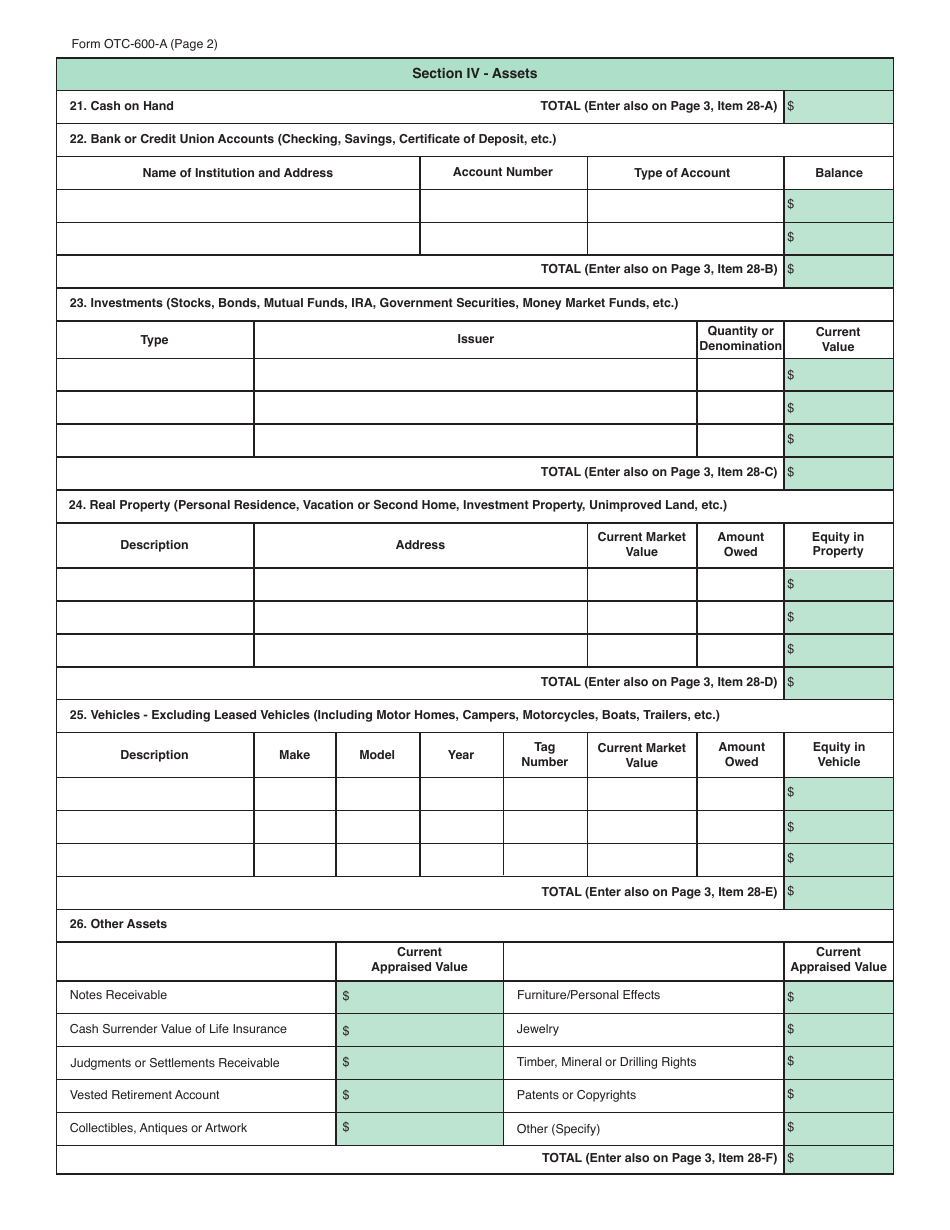

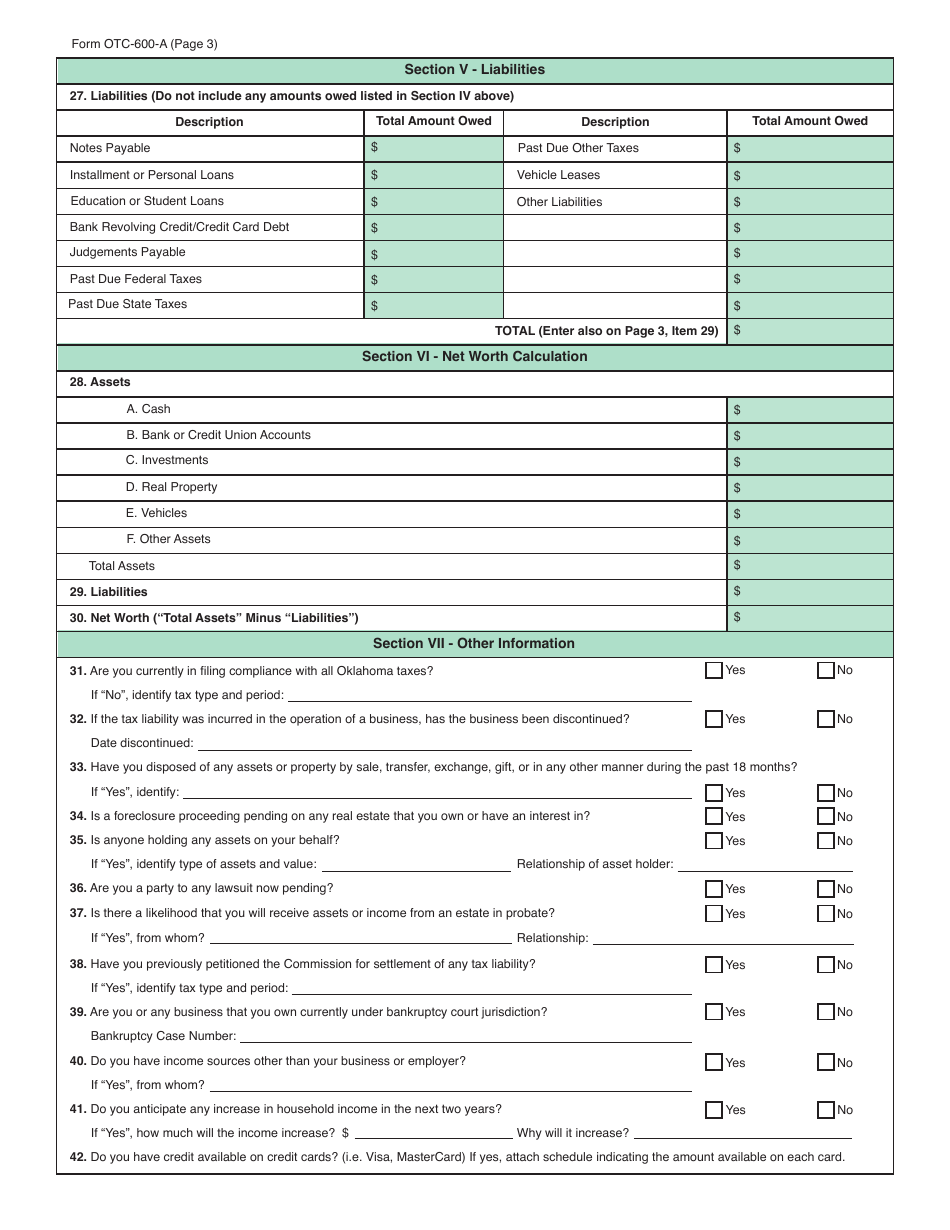

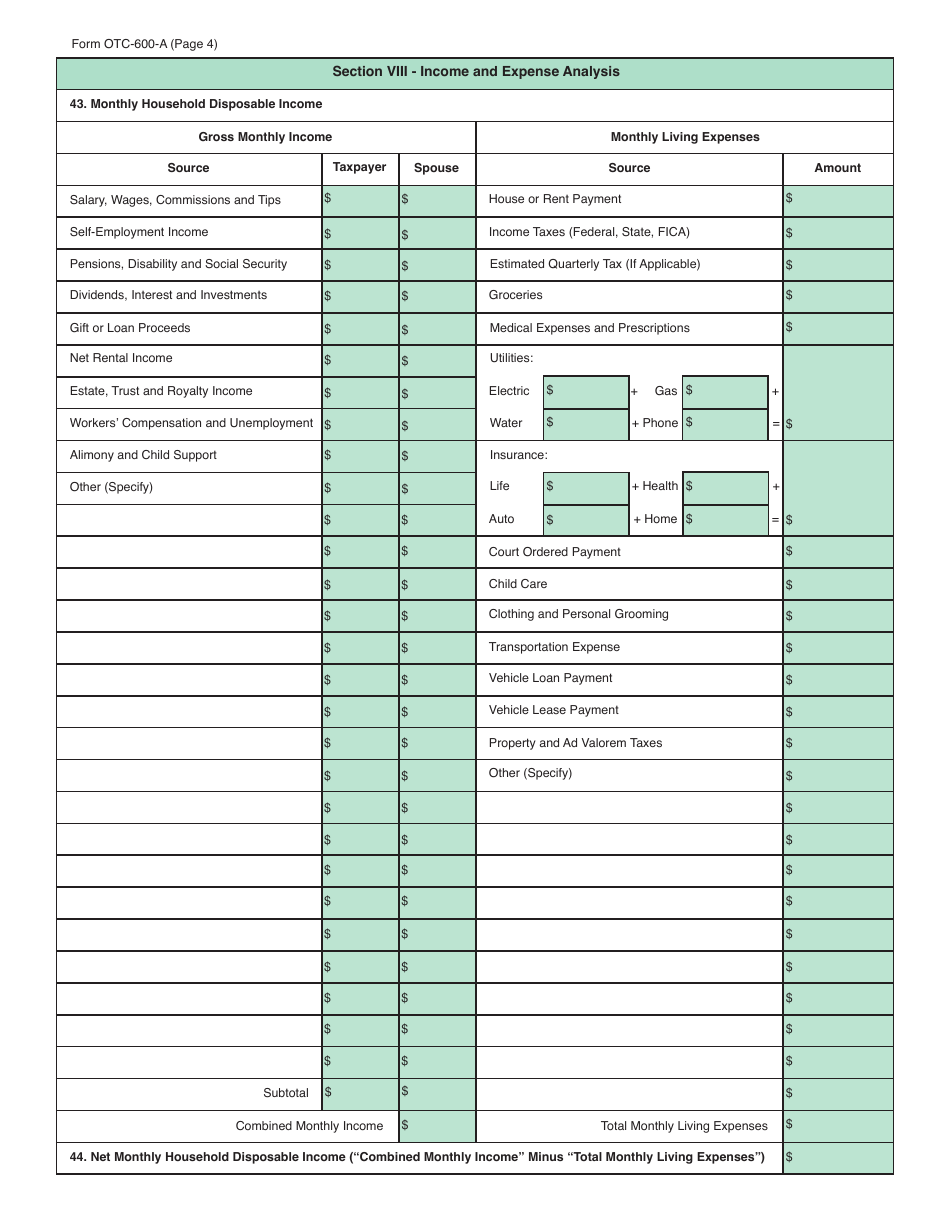

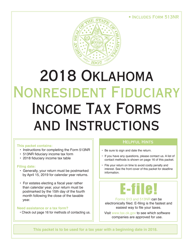

Packet S - Application for Settlement of Tax Liability - Oklahoma

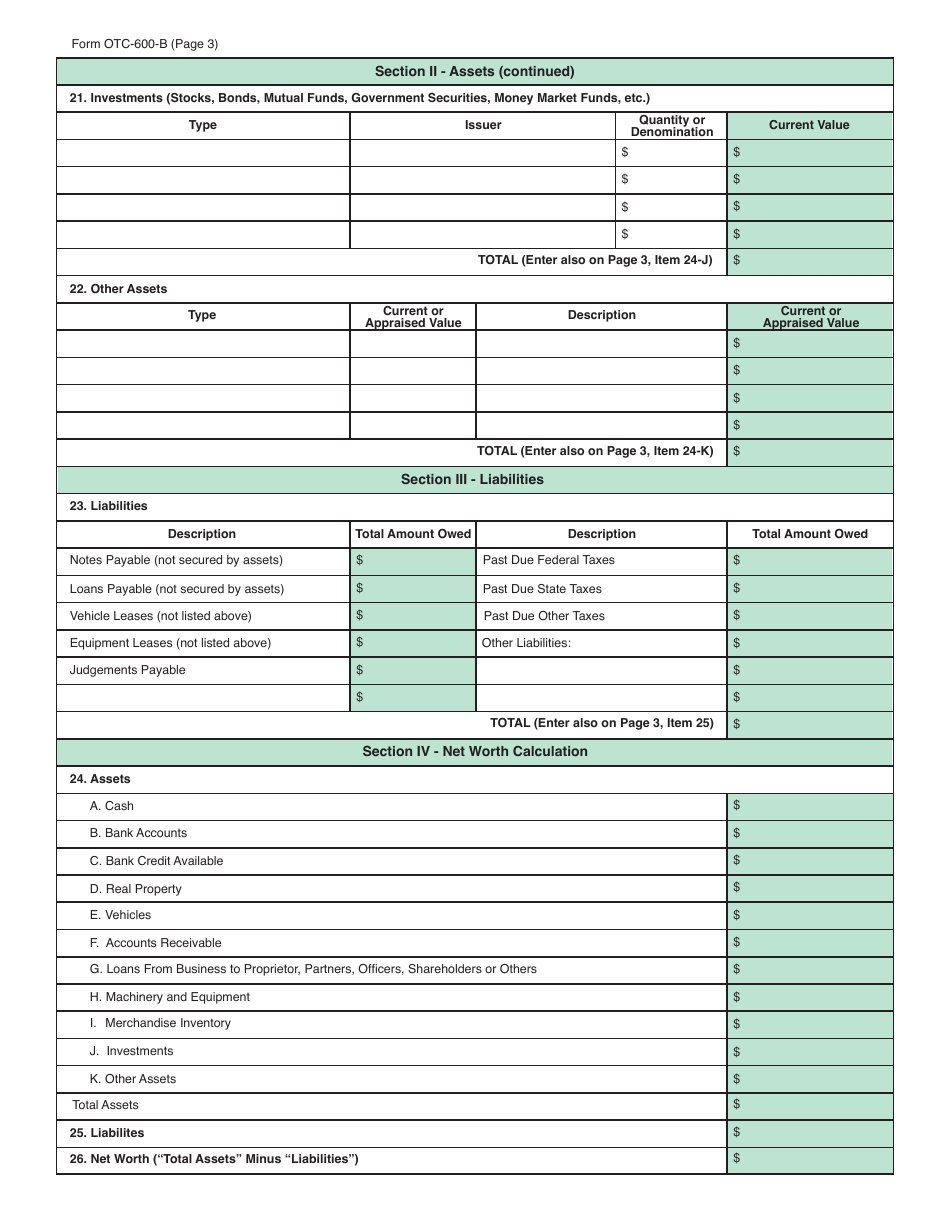

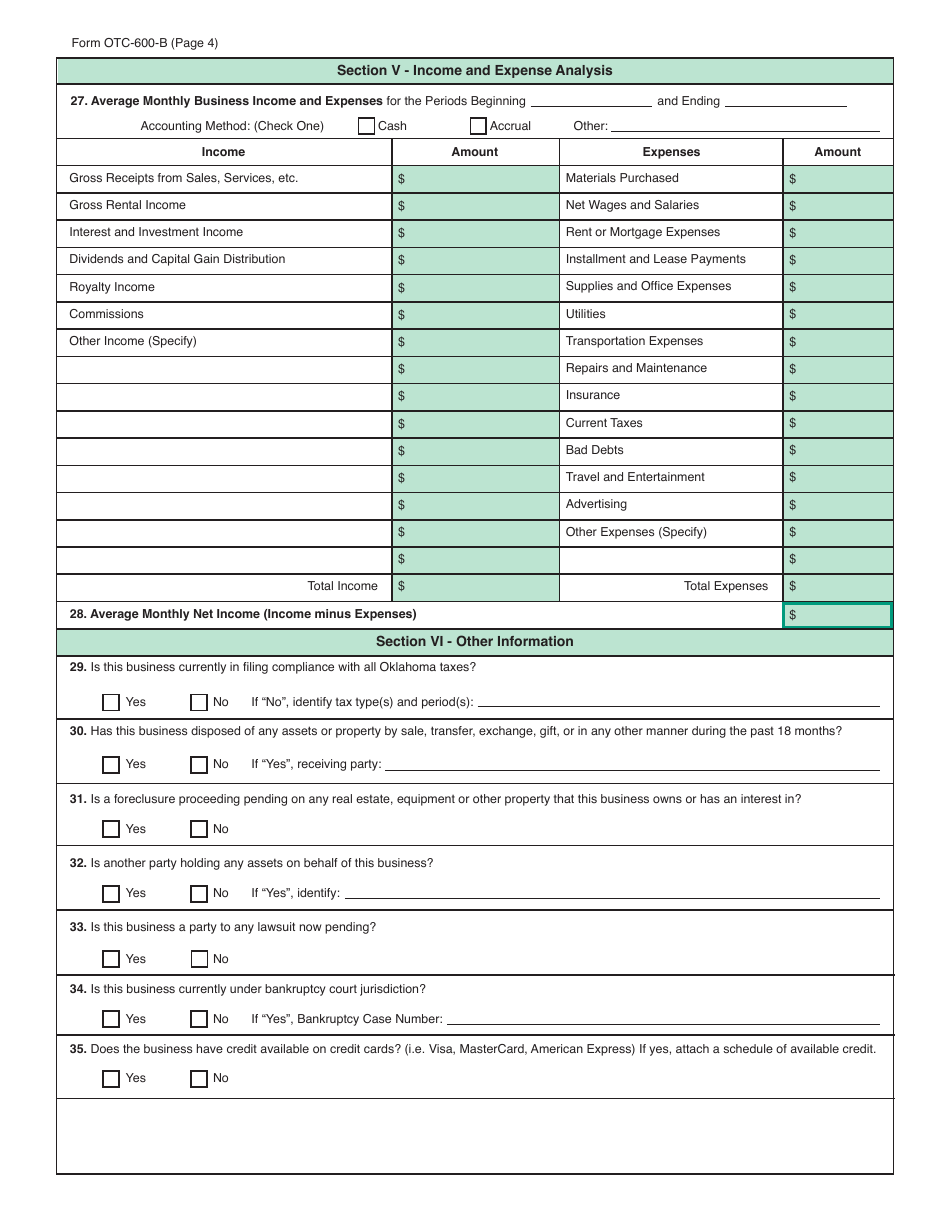

Packet S - Application for Settlement of Tax Liability is a legal document that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma.

FAQ

Q: What is Packet S?

A: Packet S is an Application for Settlement of Tax Liability in Oklahoma.

Q: Who can use Packet S?

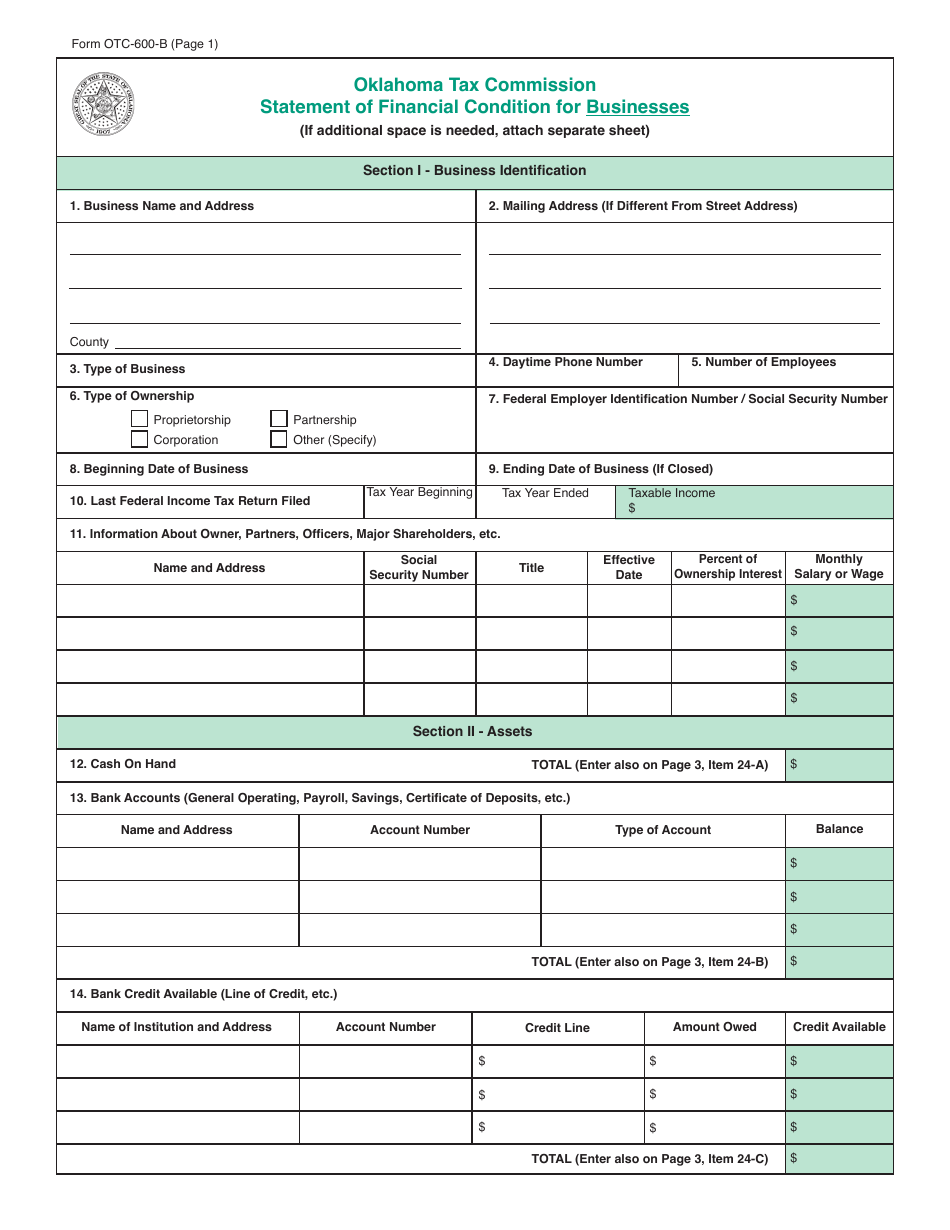

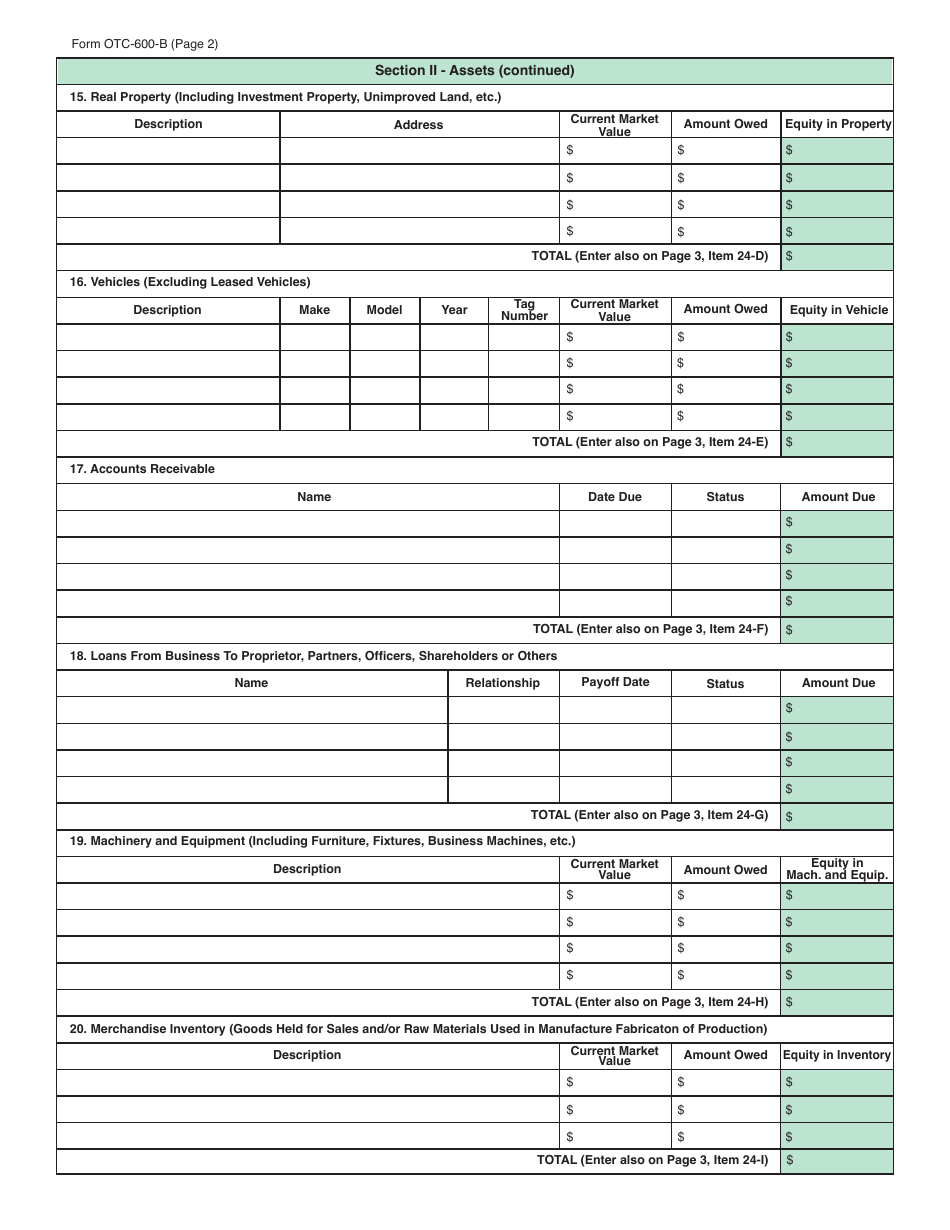

A: Packet S can be used by individuals or businesses who have outstanding tax liabilities in Oklahoma.

Q: What is the purpose of Packet S?

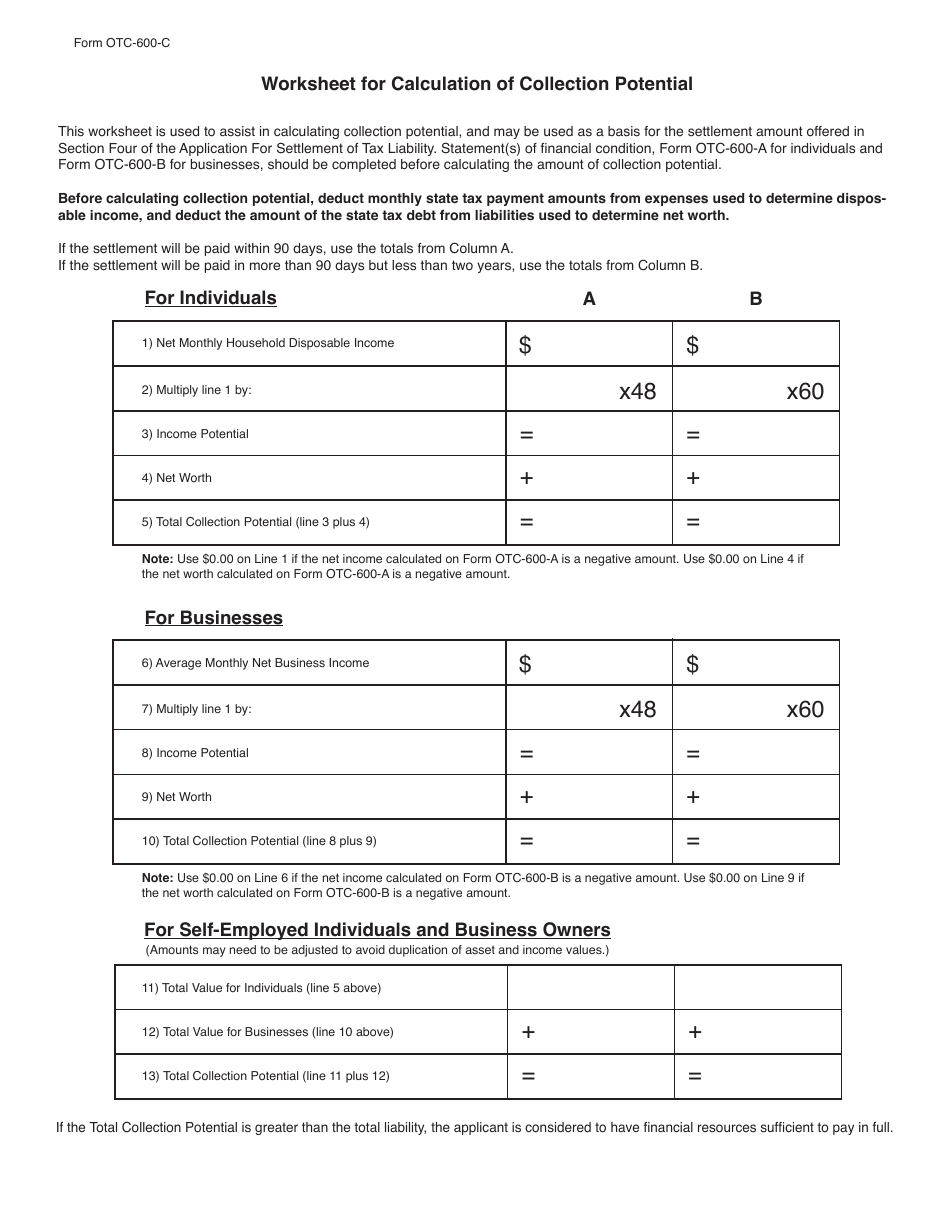

A: The purpose of Packet S is to apply for a settlement of tax liability, which allows taxpayers to negotiate a reduced payment amount with the Oklahoma Tax Commission.

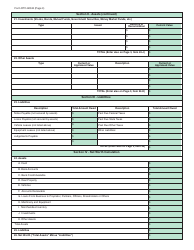

Q: What taxes can be settled using Packet S?

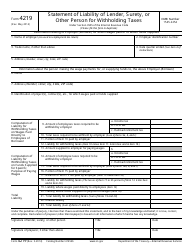

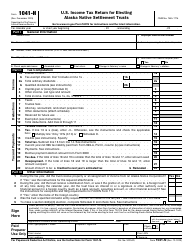

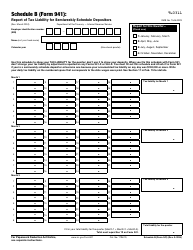

A: Packet S can be used to settle various types of taxes, including income tax, sales tax, use tax, withholding tax, and motor vehicle tax.

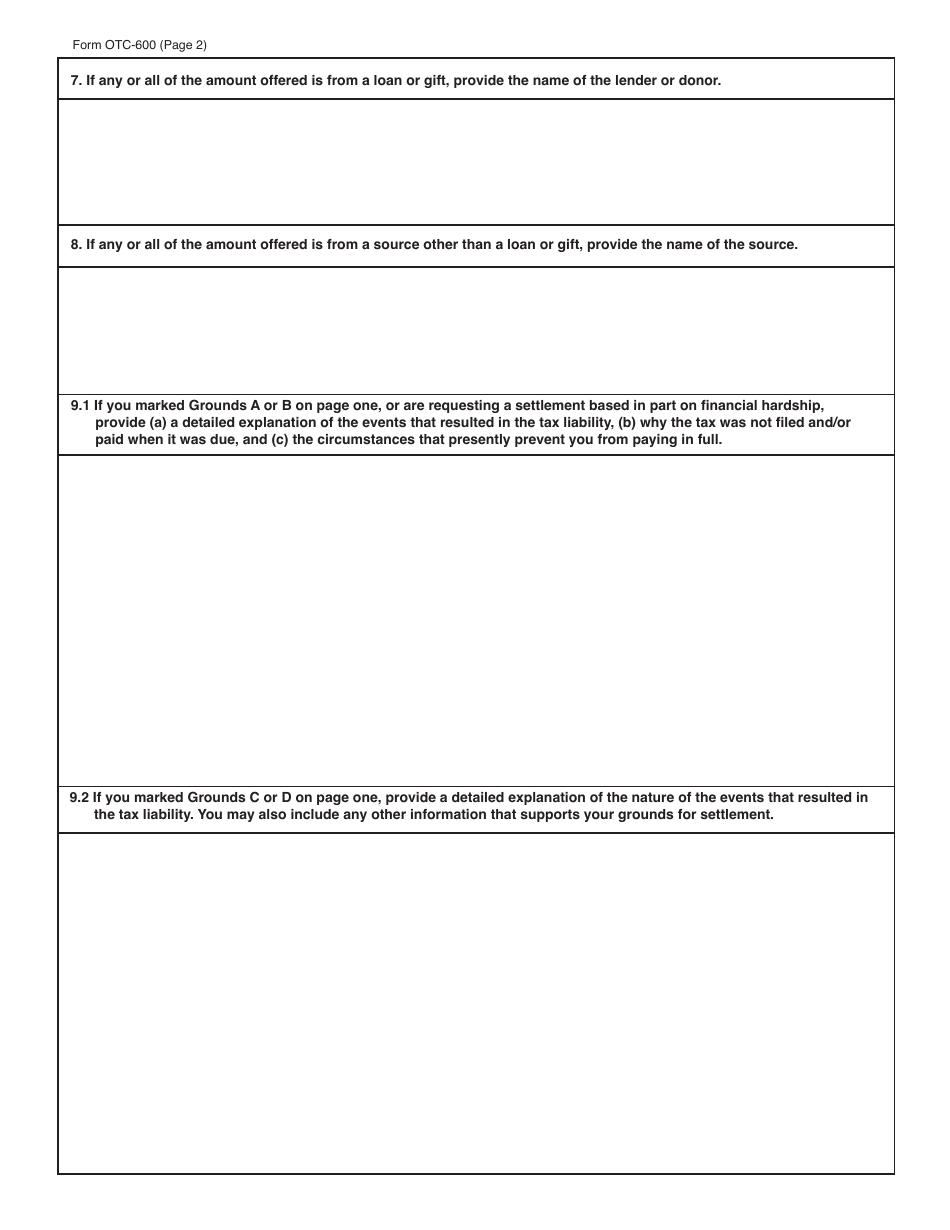

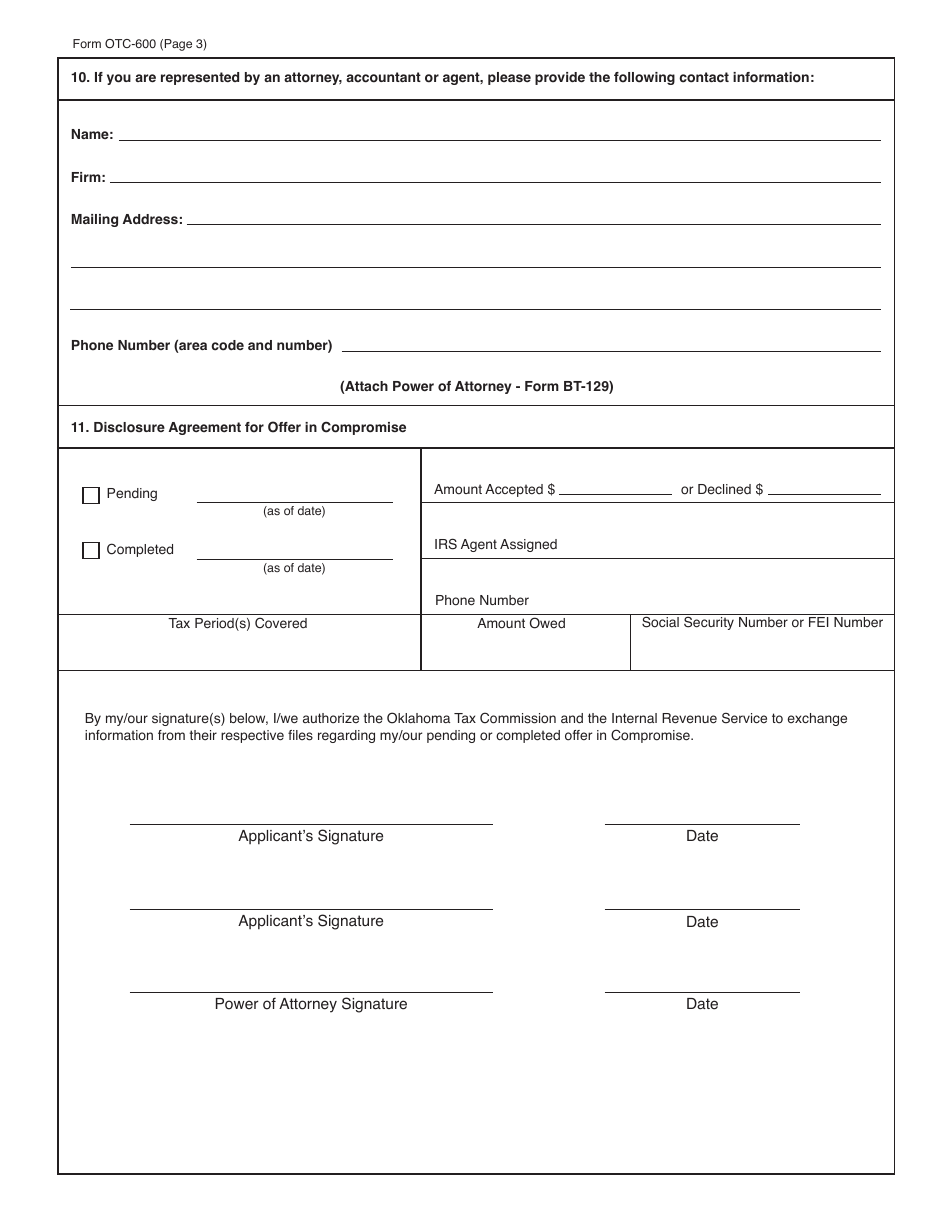

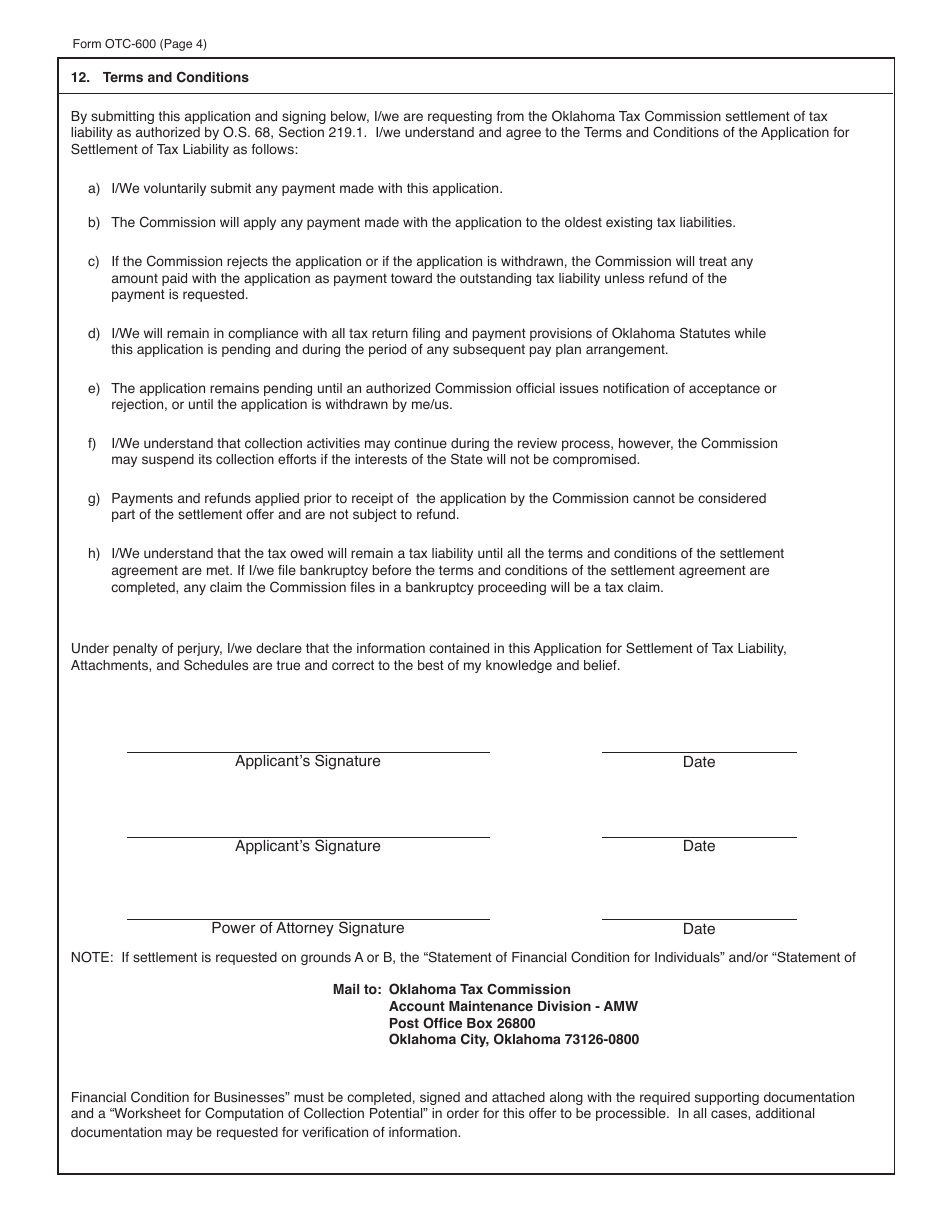

Q: What is the process for settling tax liability using Packet S?

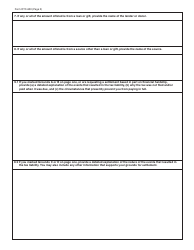

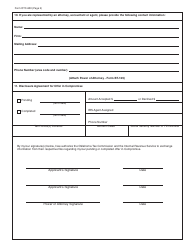

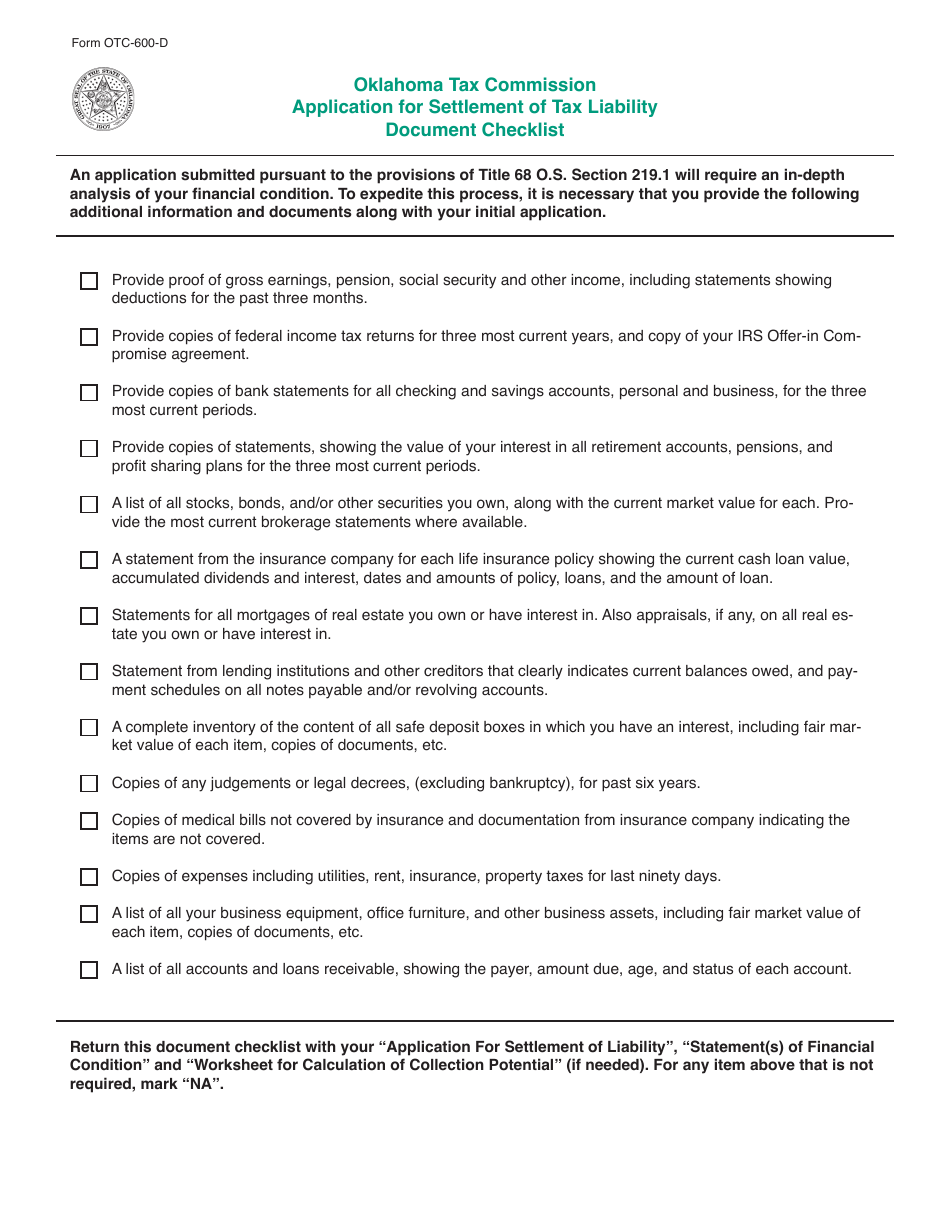

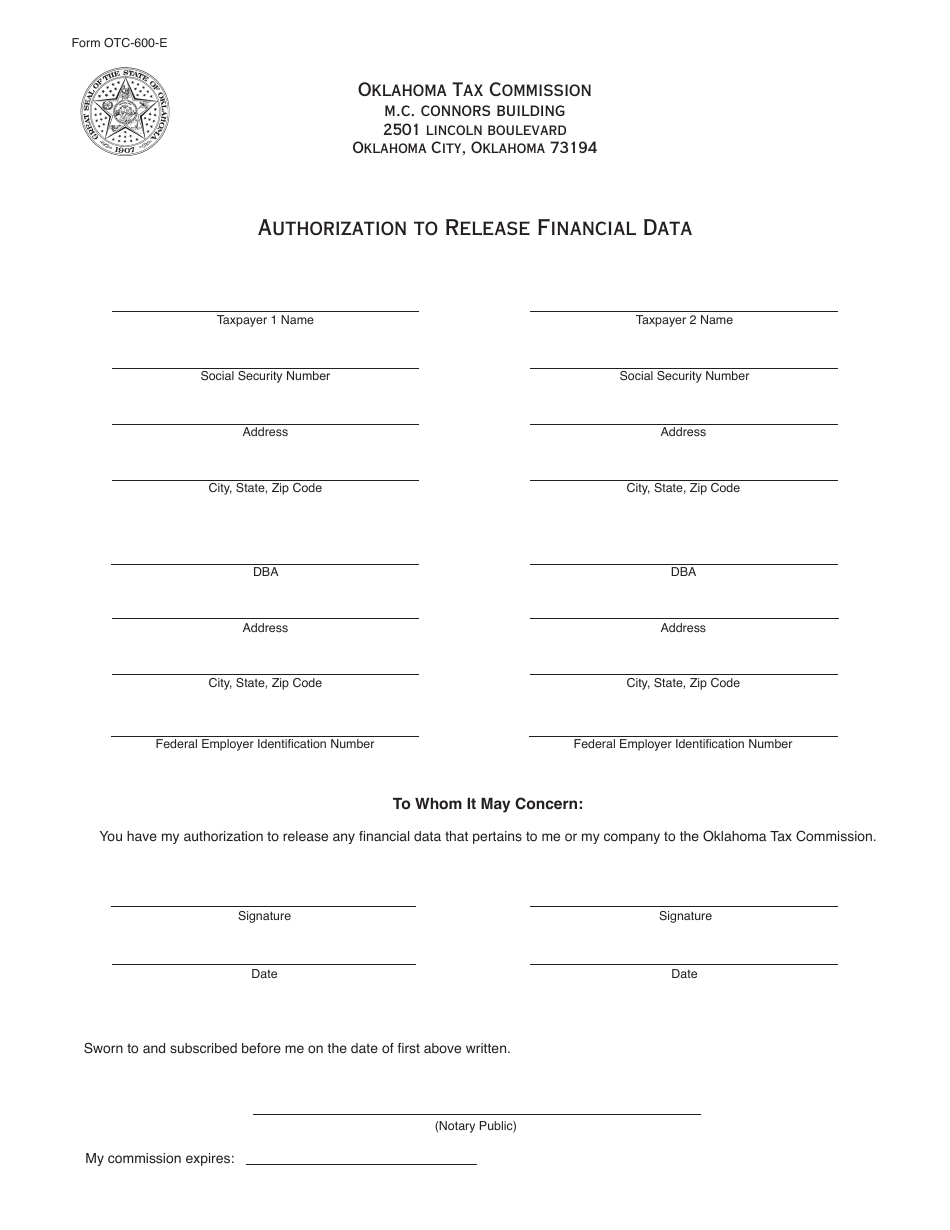

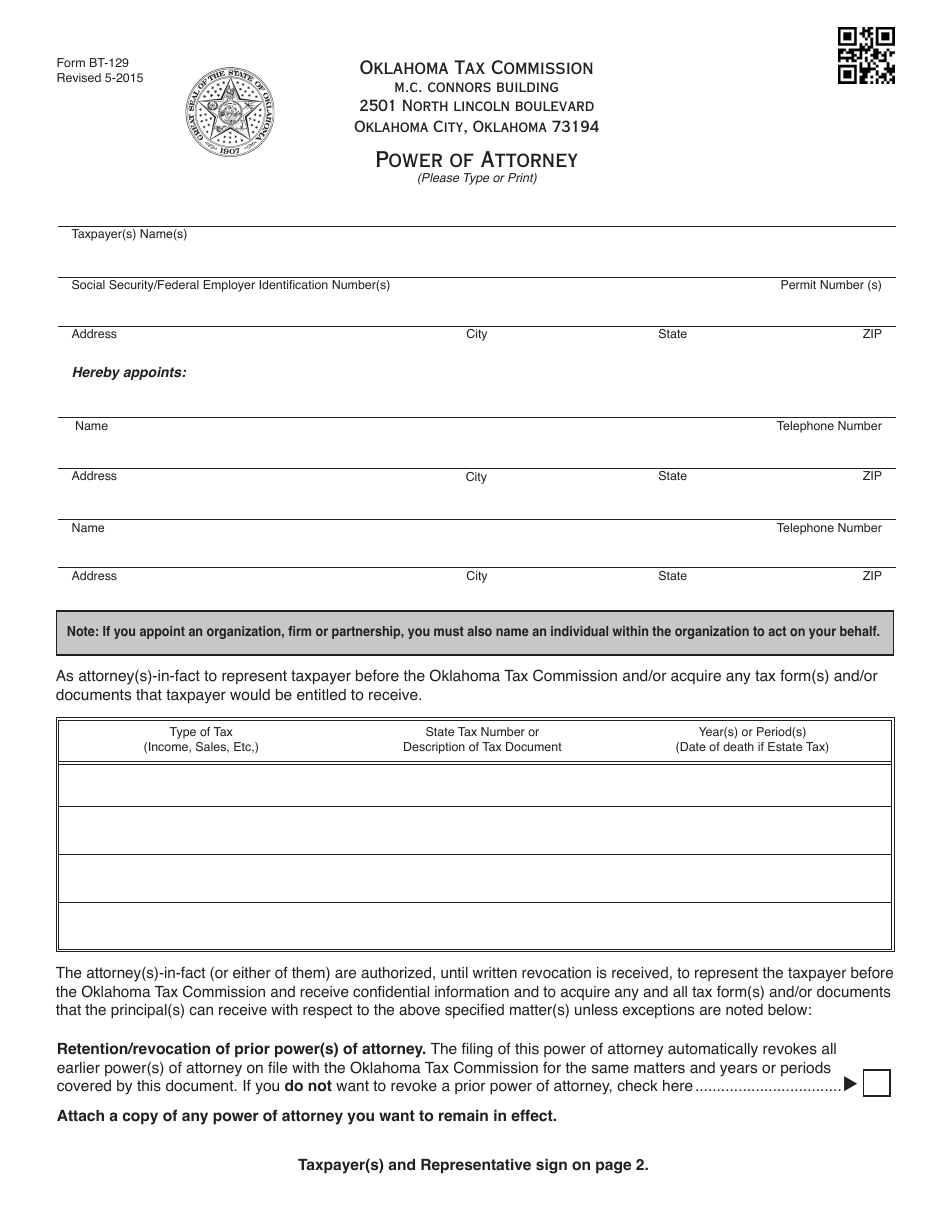

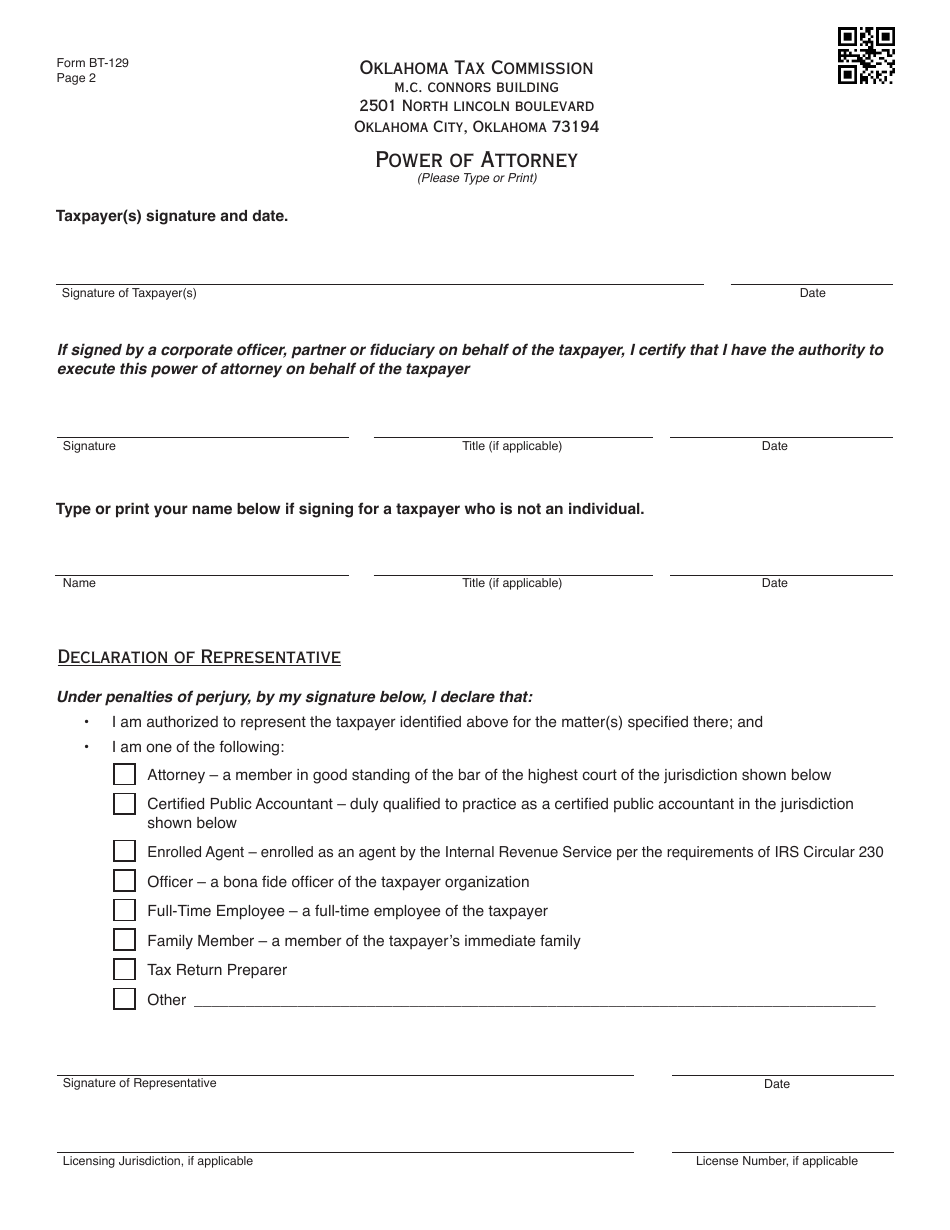

A: To settle tax liability using Packet S, taxpayers must complete the application, provide supporting documentation, and submit it to the Oklahoma Tax Commission for review and consideration.

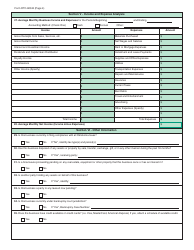

Q: Are there any eligibility requirements for using Packet S?

A: Yes, there are eligibility requirements for using Packet S. Taxpayers must meet certain criteria, such as demonstrating financial hardship or inability to pay the full tax liability.

Q: Is there a fee for using Packet S?

A: Yes, there is a non-refundable fee for using Packet S. The fee amount may vary depending on the tax liability being settled.

Q: What happens after submitting Packet S?

A: After submitting Packet S, the Oklahoma Tax Commission will review the application and supporting documentation, and may contact the taxpayer for additional information or negotiation.

Q: Can all tax liabilities be settled using Packet S?

A: Not all tax liabilities can be settled using Packet S. Some taxes, such as trust fund taxes and excise taxes, are not eligible for settlement through this application.

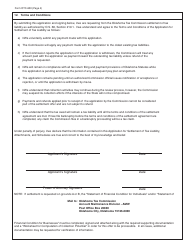

Q: What are the possible outcomes of a settlement application using Packet S?

A: The possible outcomes of a settlement application using Packet S include acceptance of a reduced payment amount, rejection of the application, or a counteroffer from the Oklahoma Tax Commission.

Form Details:

- Released on September 1, 2016;

- The latest edition currently provided by the Oklahoma Tax Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.