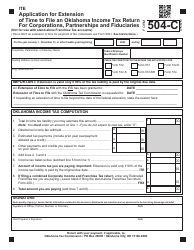

This version of the form is not currently in use and is provided for reference only. Download this version of

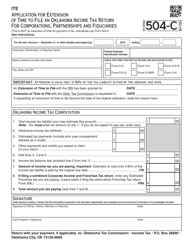

OTC Form 504-I

for the current year.

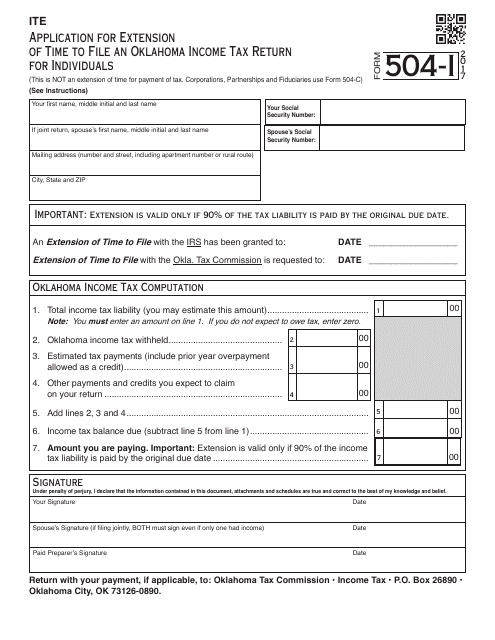

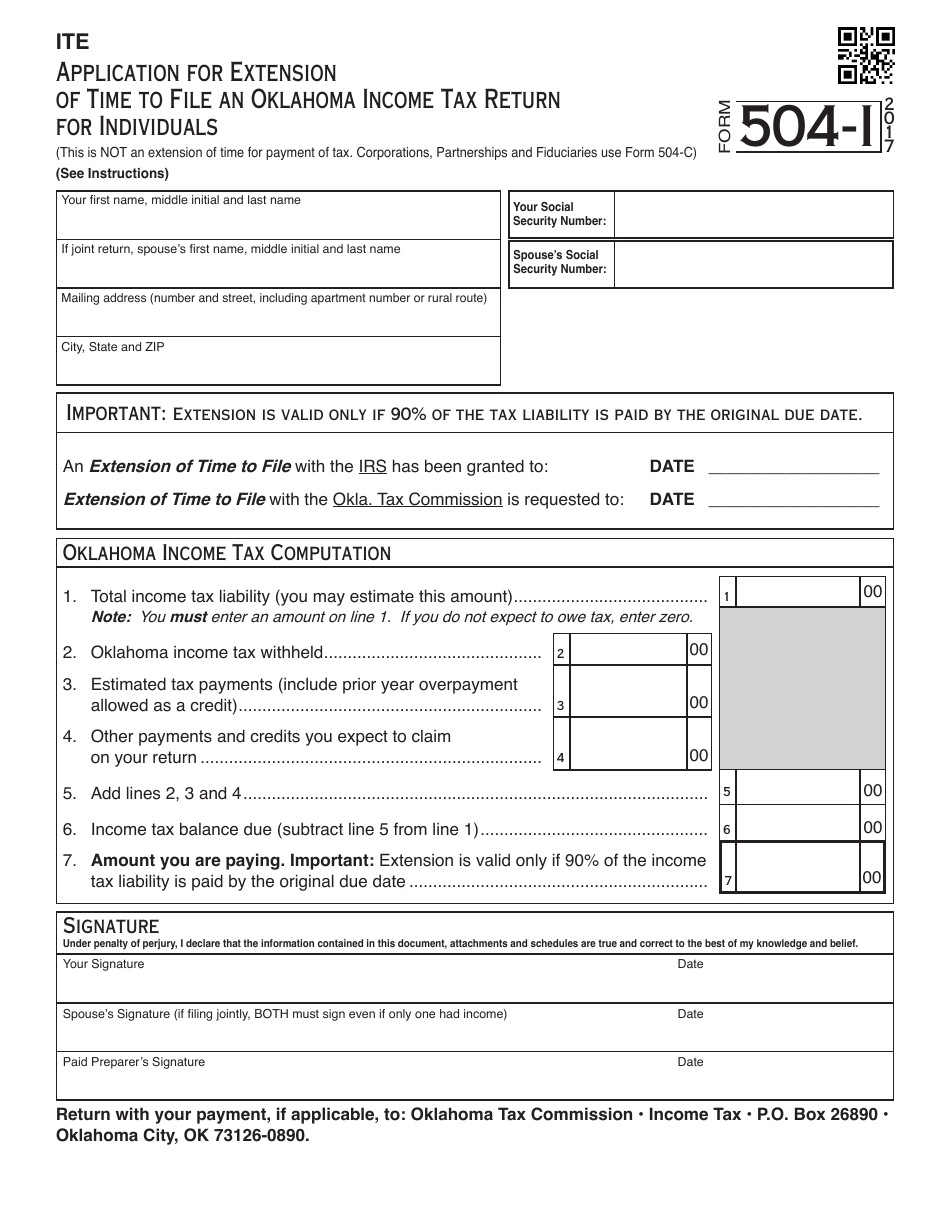

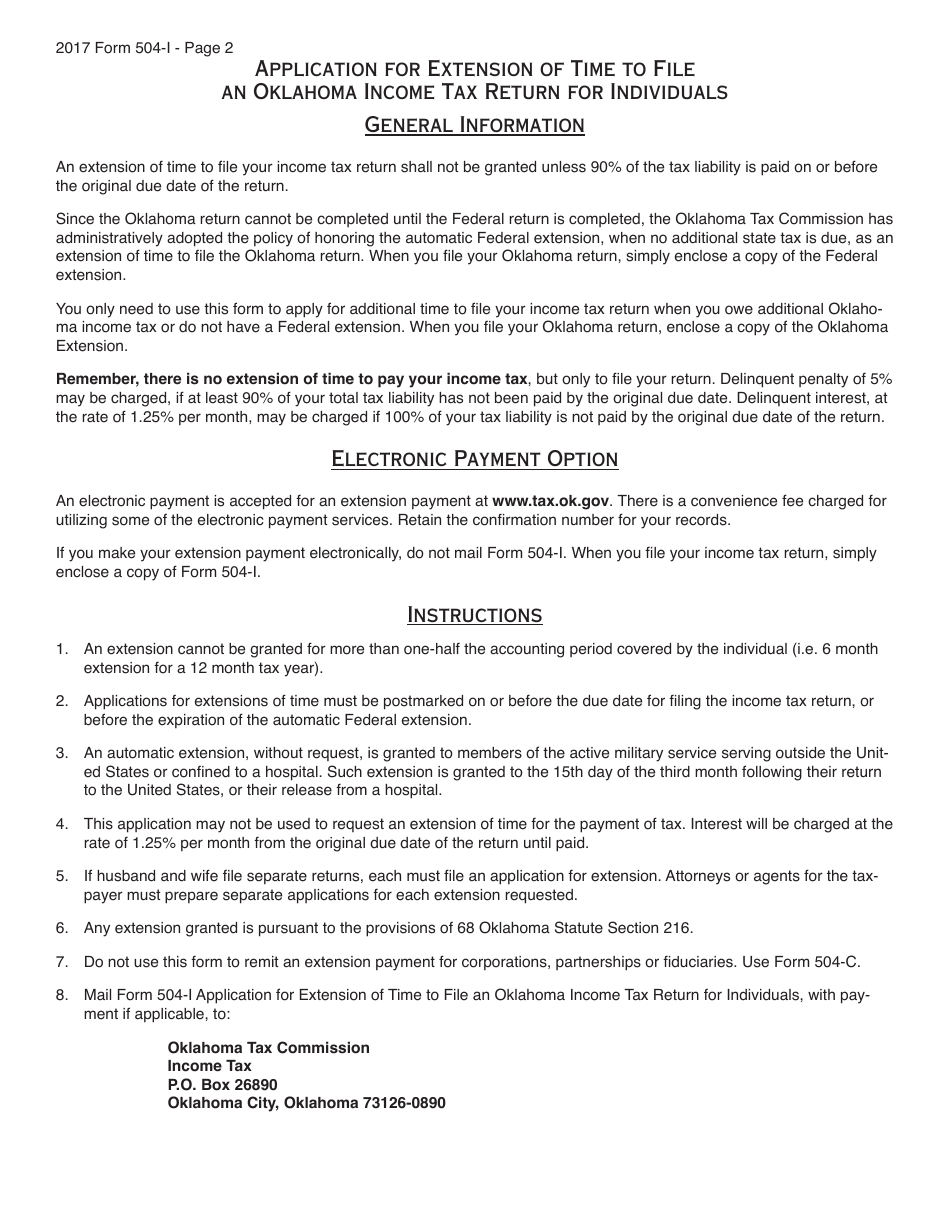

OTC Form 504-I Application for Extension of Time to File an Oklahoma Income Tax Return for Individuals - Oklahoma

What Is OTC Form 504-I?

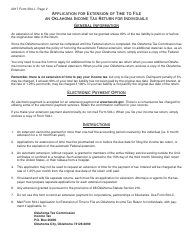

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form 504-I?

A: The OTC Form 504-I is the application for extension of time to file an Oklahoma income tax return for individuals.

Q: Who can use the OTC Form 504-I?

A: Individuals who need more time to file their Oklahoma income tax return can use the OTC Form 504-I.

Q: What is the purpose of the OTC Form 504-I?

A: The purpose of the OTC Form 504-I is to request an extension of time to file an Oklahoma income tax return for individuals.

Q: How long of an extension does the OTC Form 504-I provide?

A: The OTC Form 504-I provides a 6-month extension of time to file an Oklahoma income tax return for individuals.

Q: Is there a fee to file the OTC Form 504-I?

A: No, there is no fee to file the OTC Form 504-I.

Q: When is the deadline to file the OTC Form 504-I?

A: The OTC Form 504-I must be filed on or before the original due date of the Oklahoma income tax return, which is typically April 15th.

Q: What happens if I don't file the OTC Form 504-I by the deadline?

A: If the OTC Form 504-I is not filed by the deadline, late filing penalties and interest may apply.

Q: Can the OTC Form 504-I be filed for multiple tax years?

A: No, the OTC Form 504-I can only be filed for the current tax year in which the extension is requested.

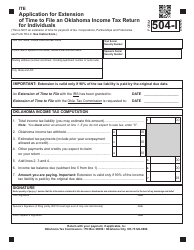

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 504-I by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.