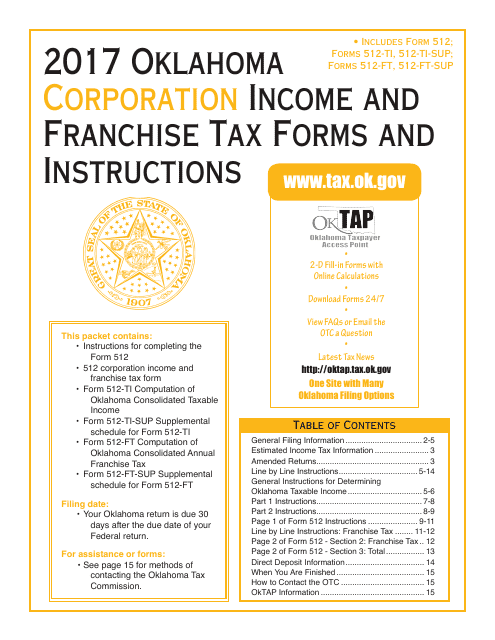

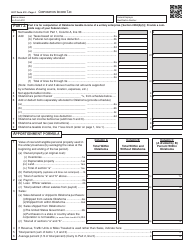

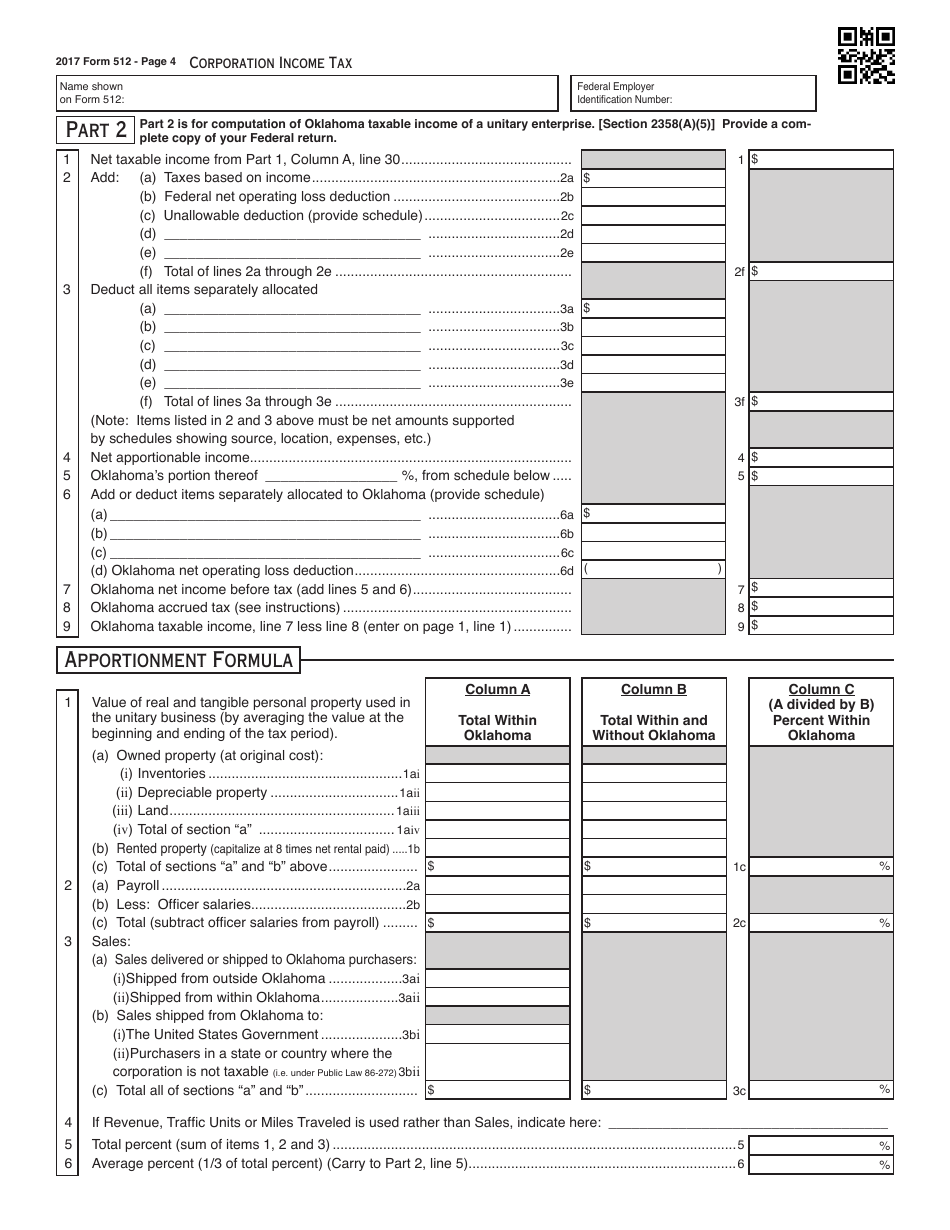

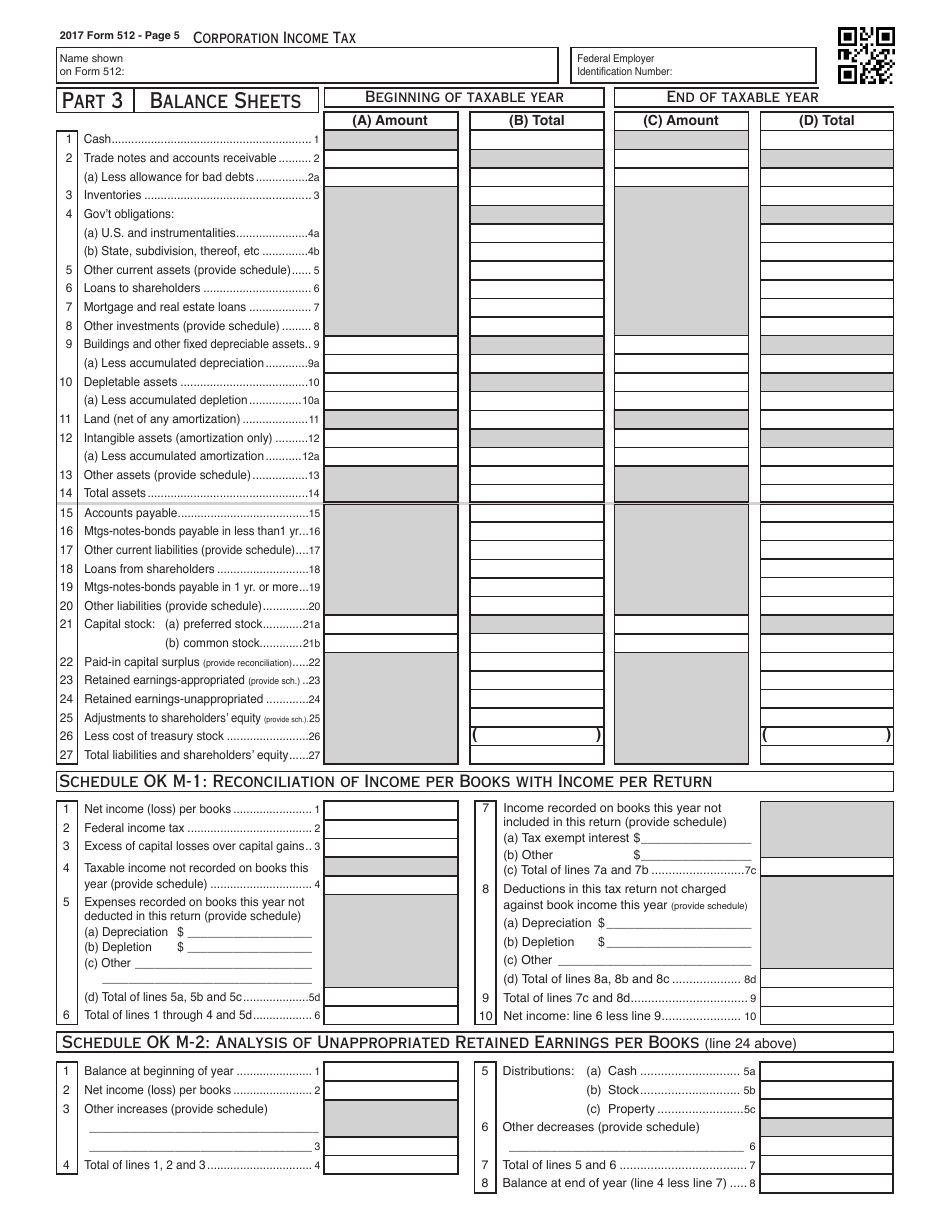

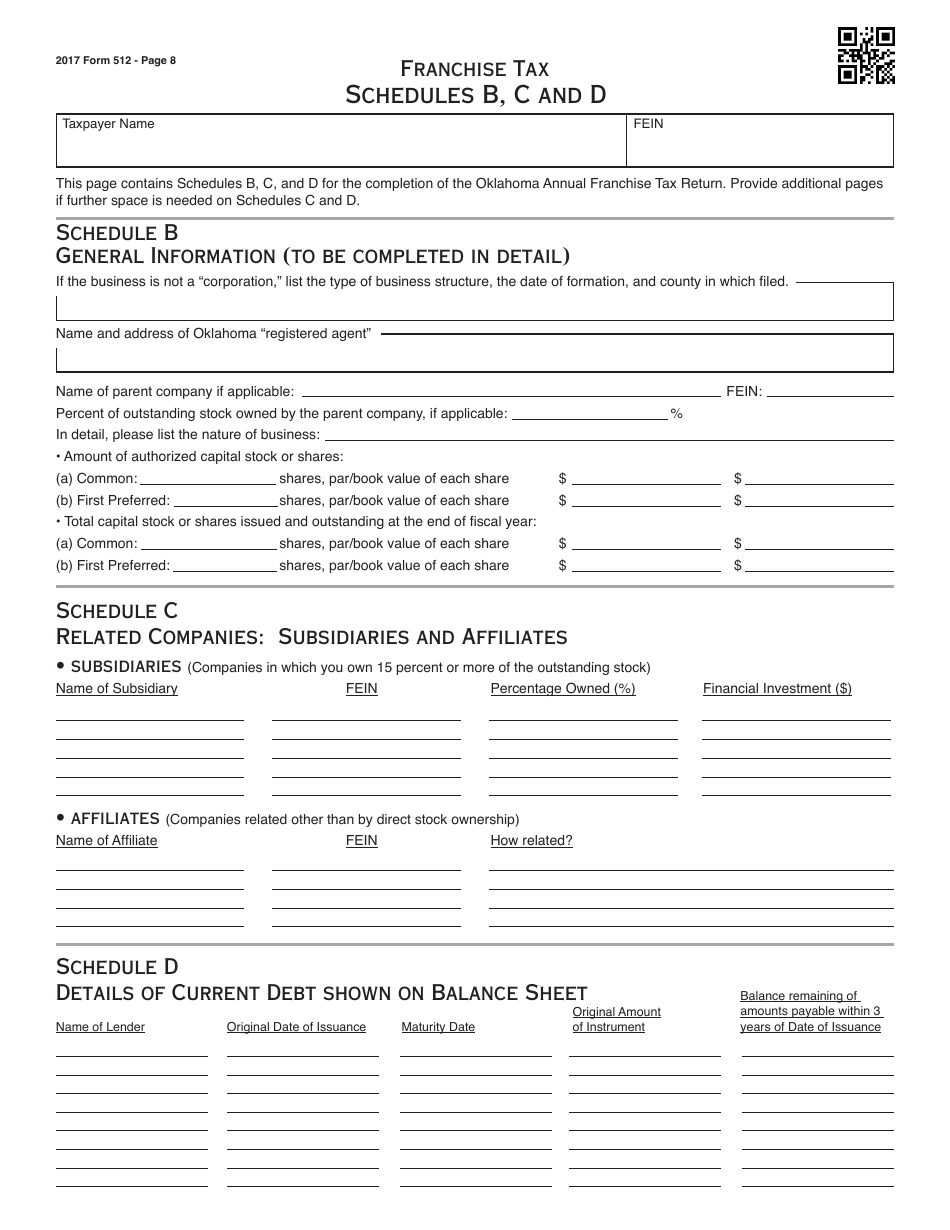

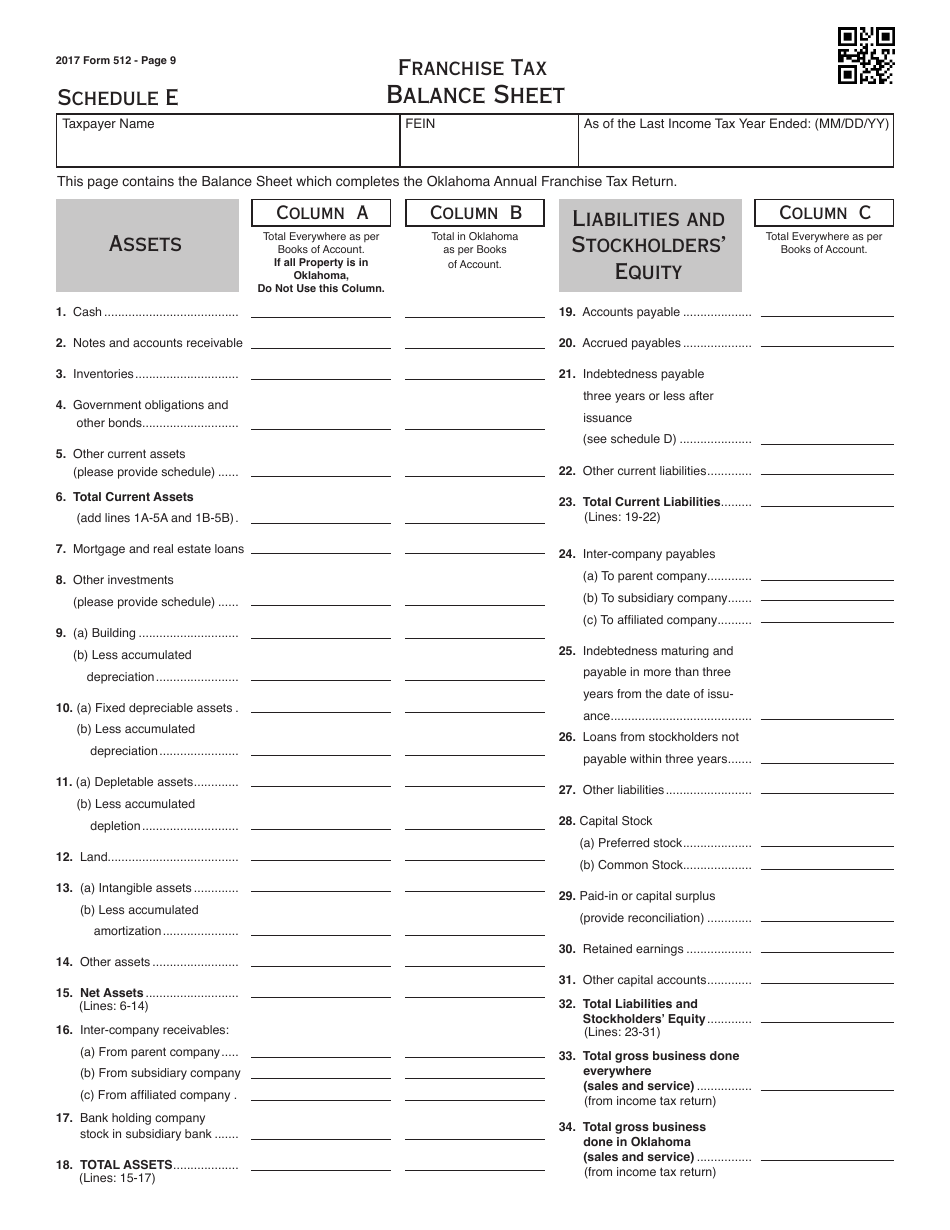

Oklahoma Corporation Income and Franchise Tax Forms and Instructions - Oklahoma

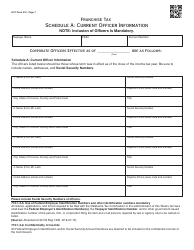

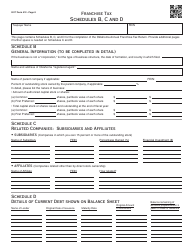

Oklahoma Franchise Tax Forms and Instructions is a legal document that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma.

FAQ

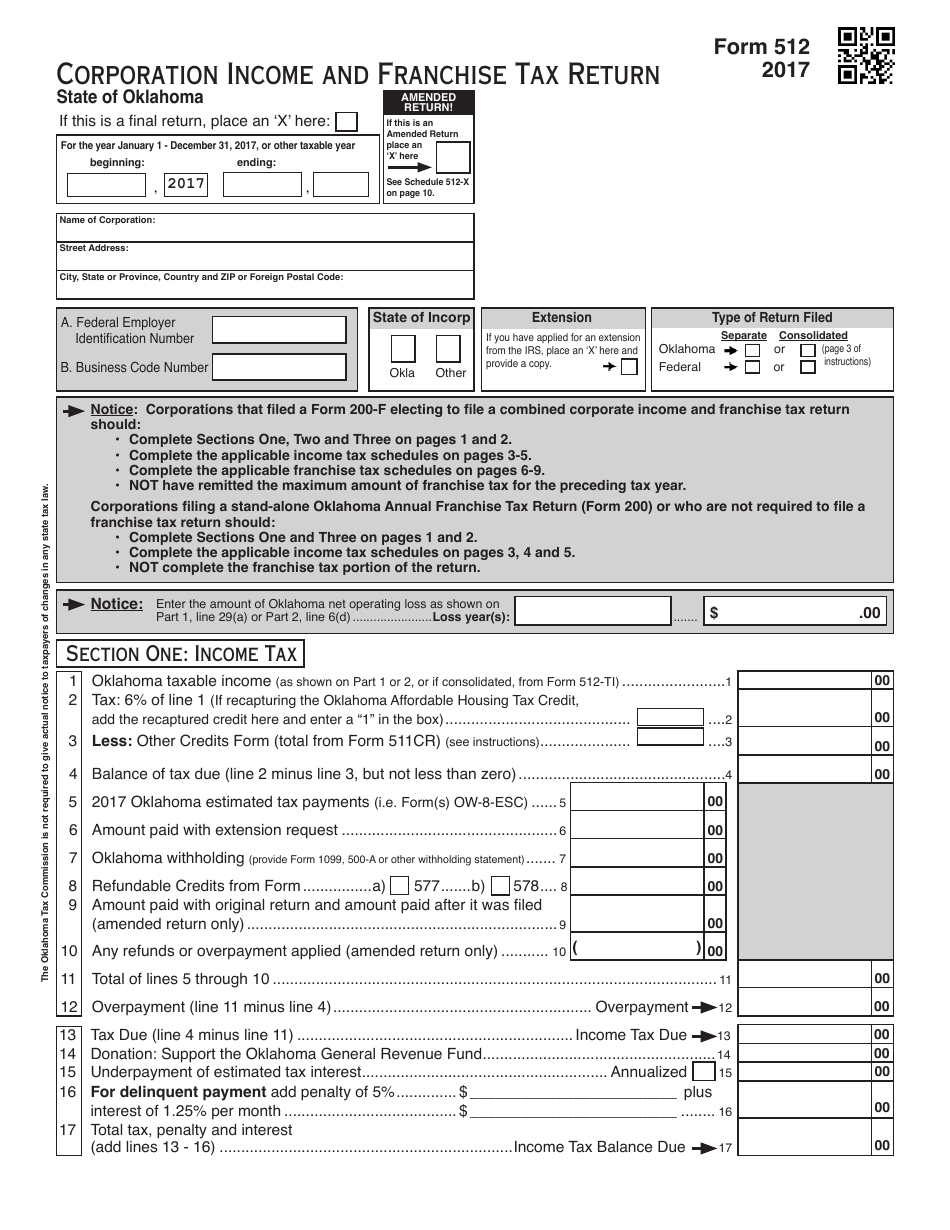

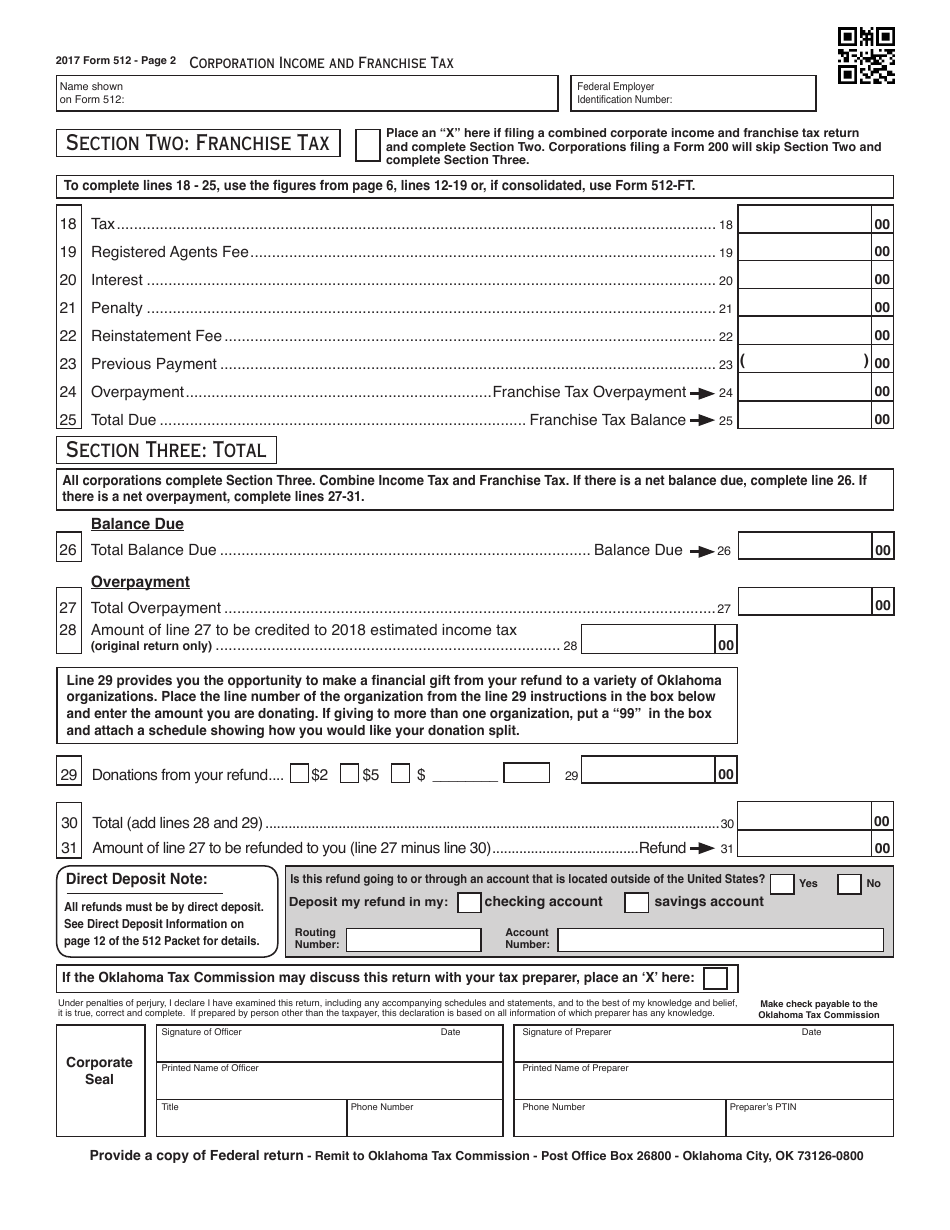

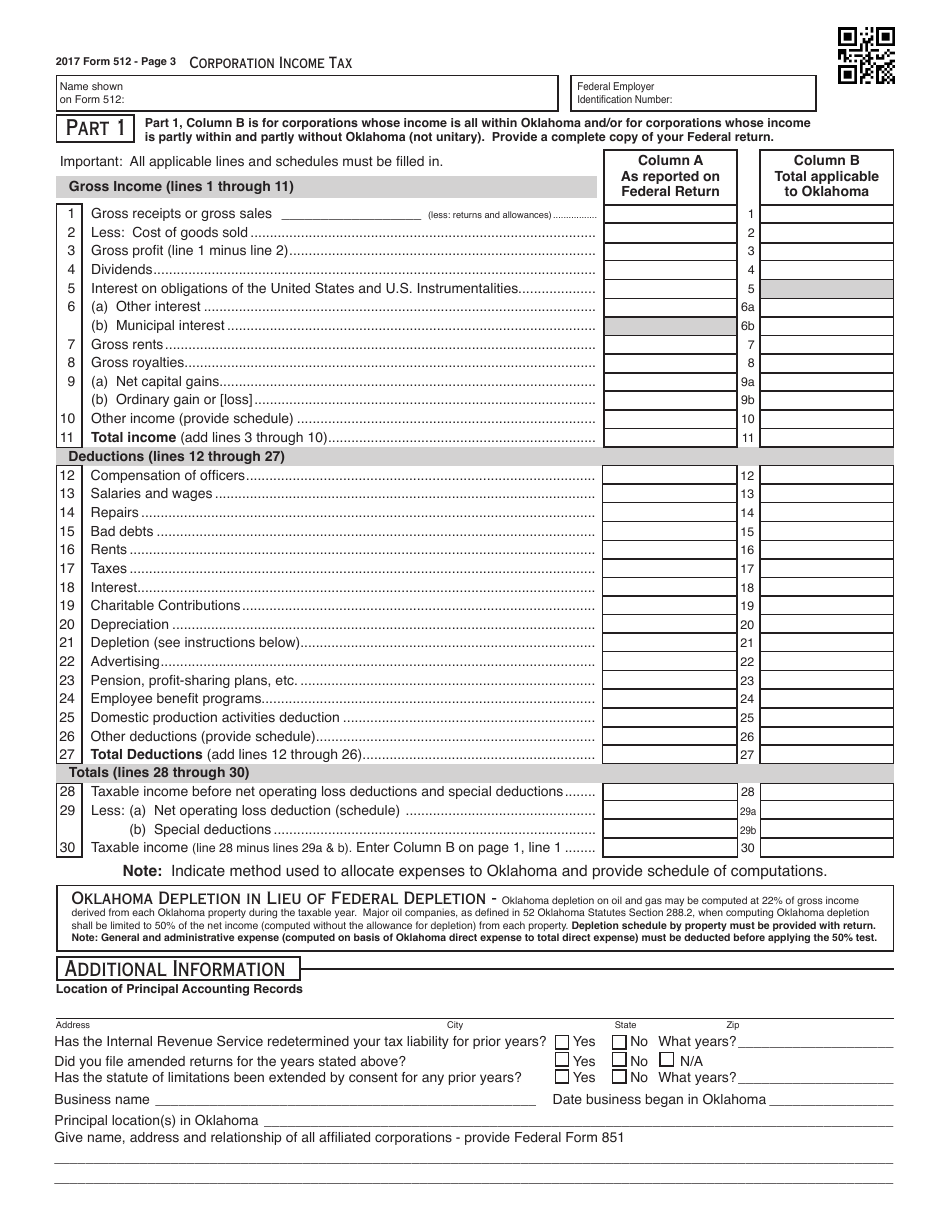

Q: What is the purpose of the Oklahoma Corporation Income and Franchise Tax Forms?

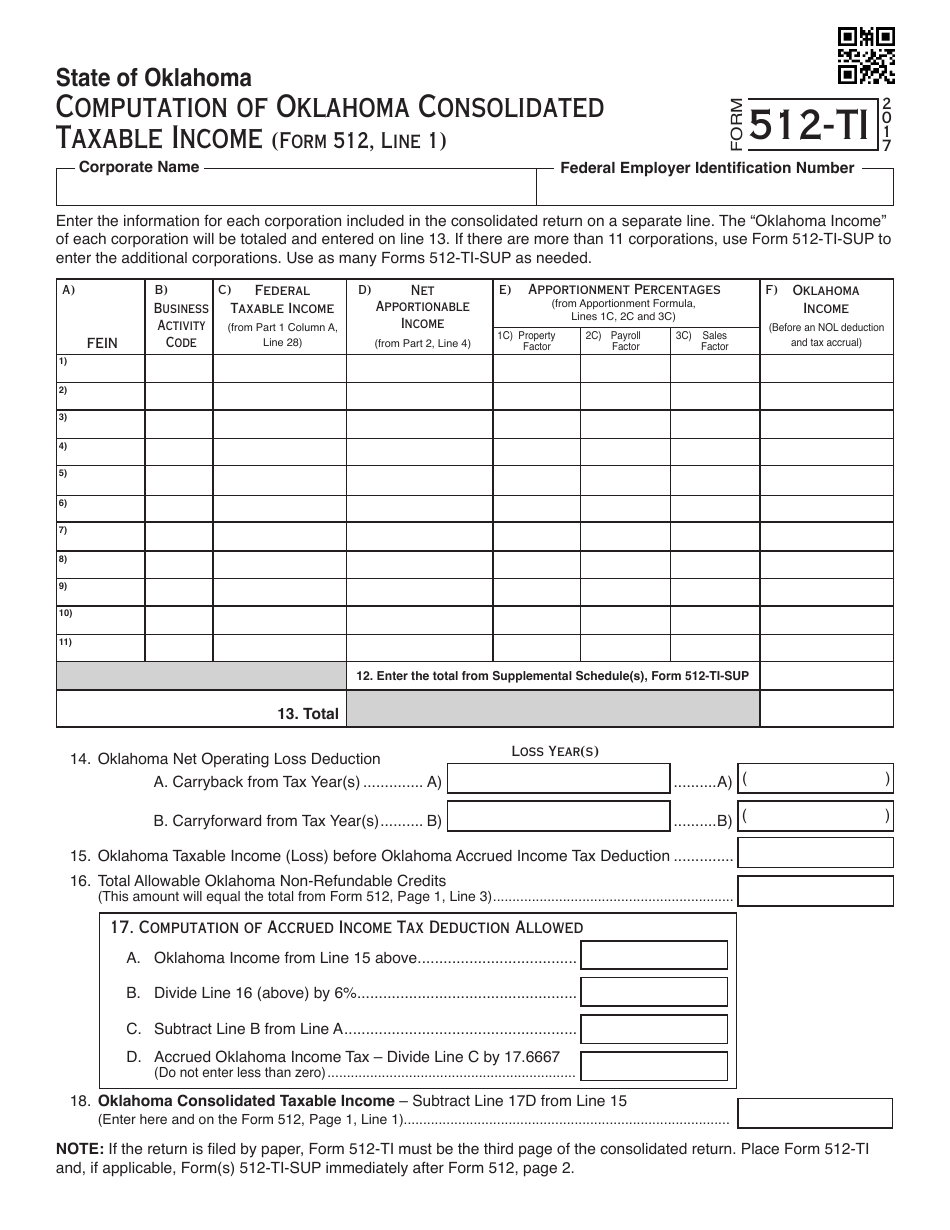

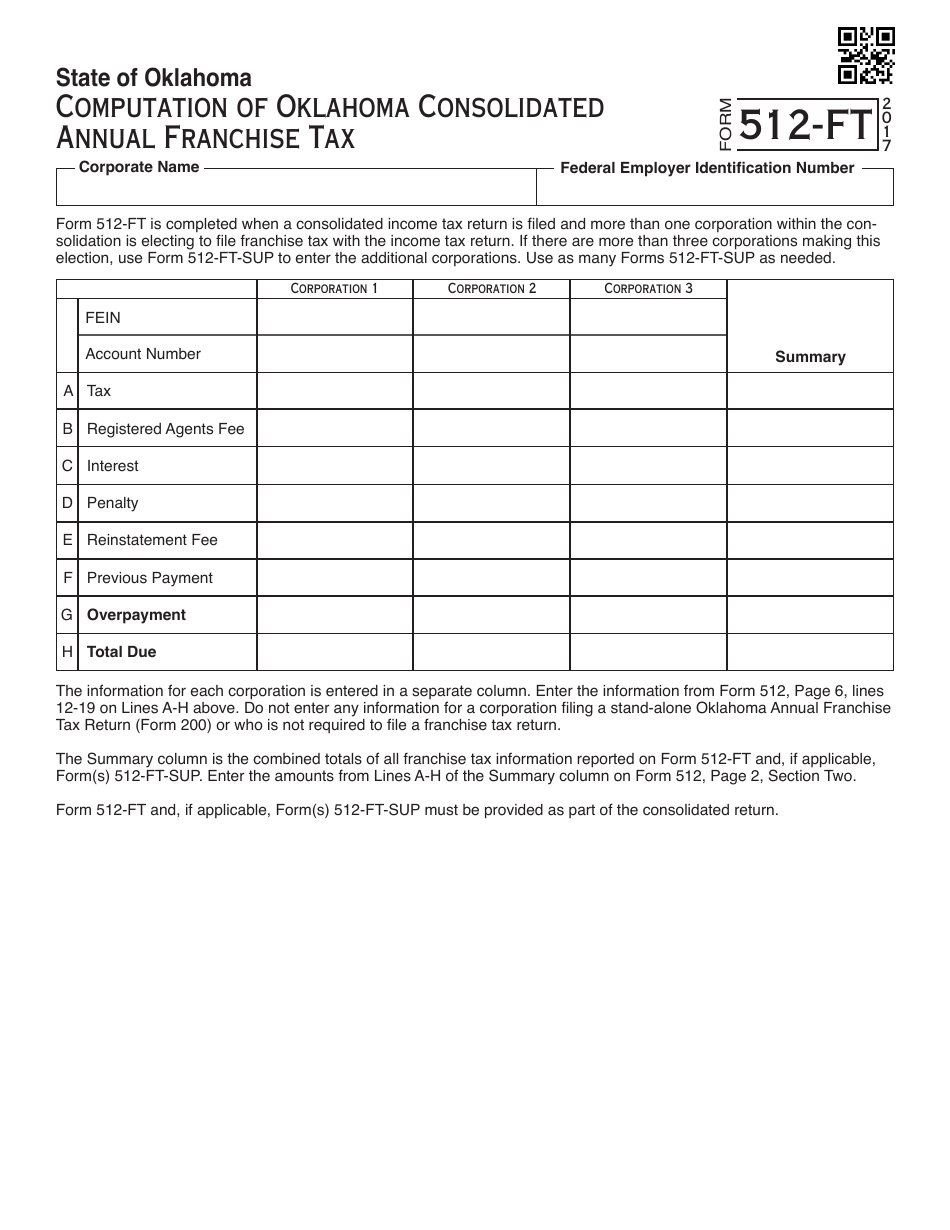

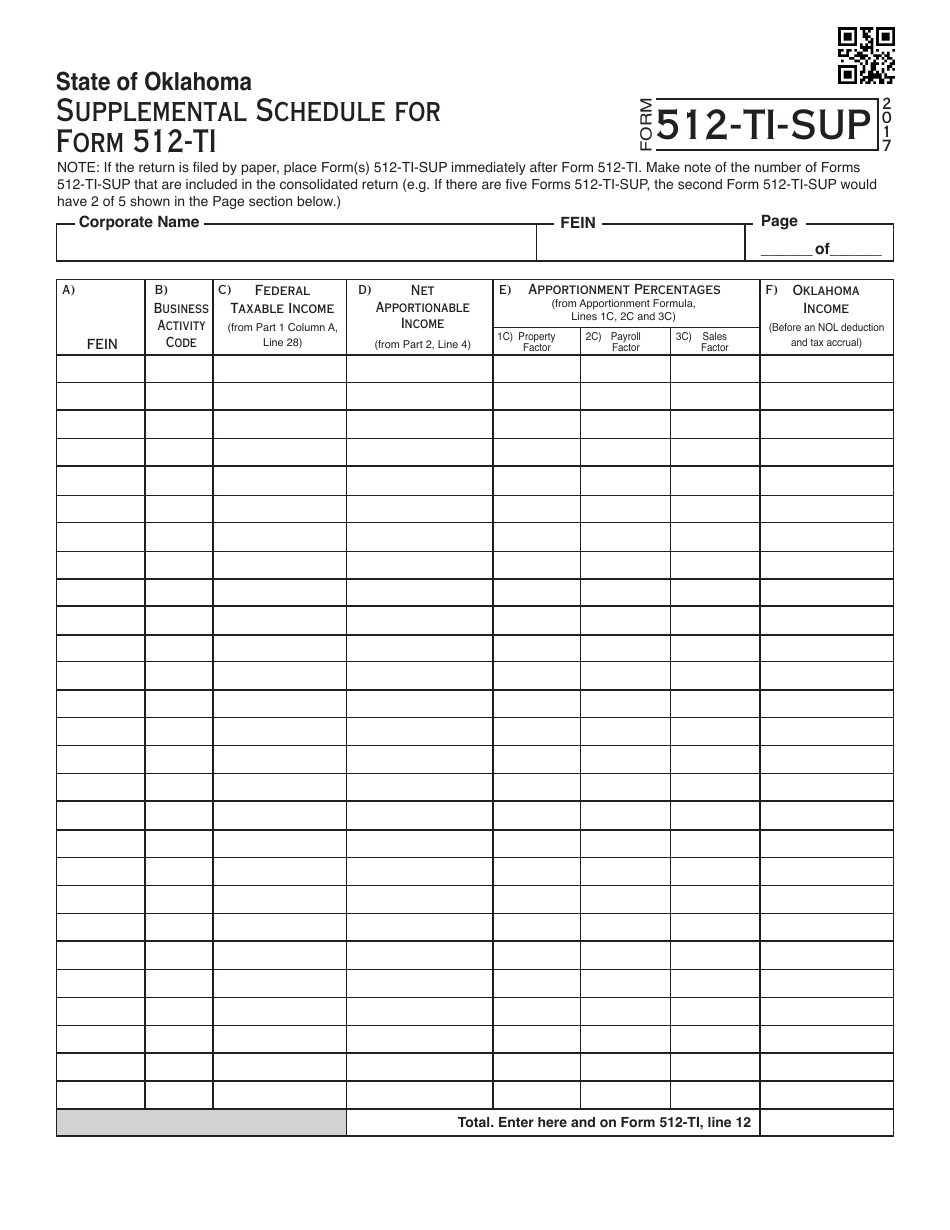

A: The purpose of the Oklahoma Corporation Income and Franchise Tax Forms is to report and pay income and franchise taxes for corporations in Oklahoma.

Q: Who is required to file the Oklahoma Corporation Income and Franchise Tax Forms?

A: Corporations that do business in Oklahoma or have income from Oklahoma sources are generally required to file the Oklahoma Corporation Income and Franchise Tax Forms.

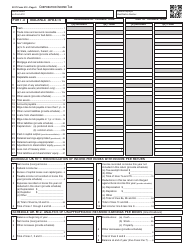

Q: What are the deadlines for filing the Oklahoma Corporation Income and Franchise Tax Forms?

A: The deadline for filing the Oklahoma Corporation Income and Franchise Tax Forms is generally on or before the 15th day of the fourth month following the close of the taxable year.

Q: What are the penalties for late filing or non-filing of the Oklahoma Corporation Income and Franchise Tax Forms?

A: The penalties for late filing or non-filing of the Oklahoma Corporation Income and Franchise Tax Forms may include penalties and interest on the unpaid tax amount.

Q: Are there any special deductions or credits available for corporations filing the Oklahoma Corporation Income and Franchise Tax Forms?

A: Yes, there are various deductions and credits available for corporations filing the Oklahoma Corporation Income and Franchise Tax Forms, such as the Small Business Deduction and the Investment/New Jobs Credit.

Form Details:

- The latest edition currently provided by the Oklahoma Tax Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

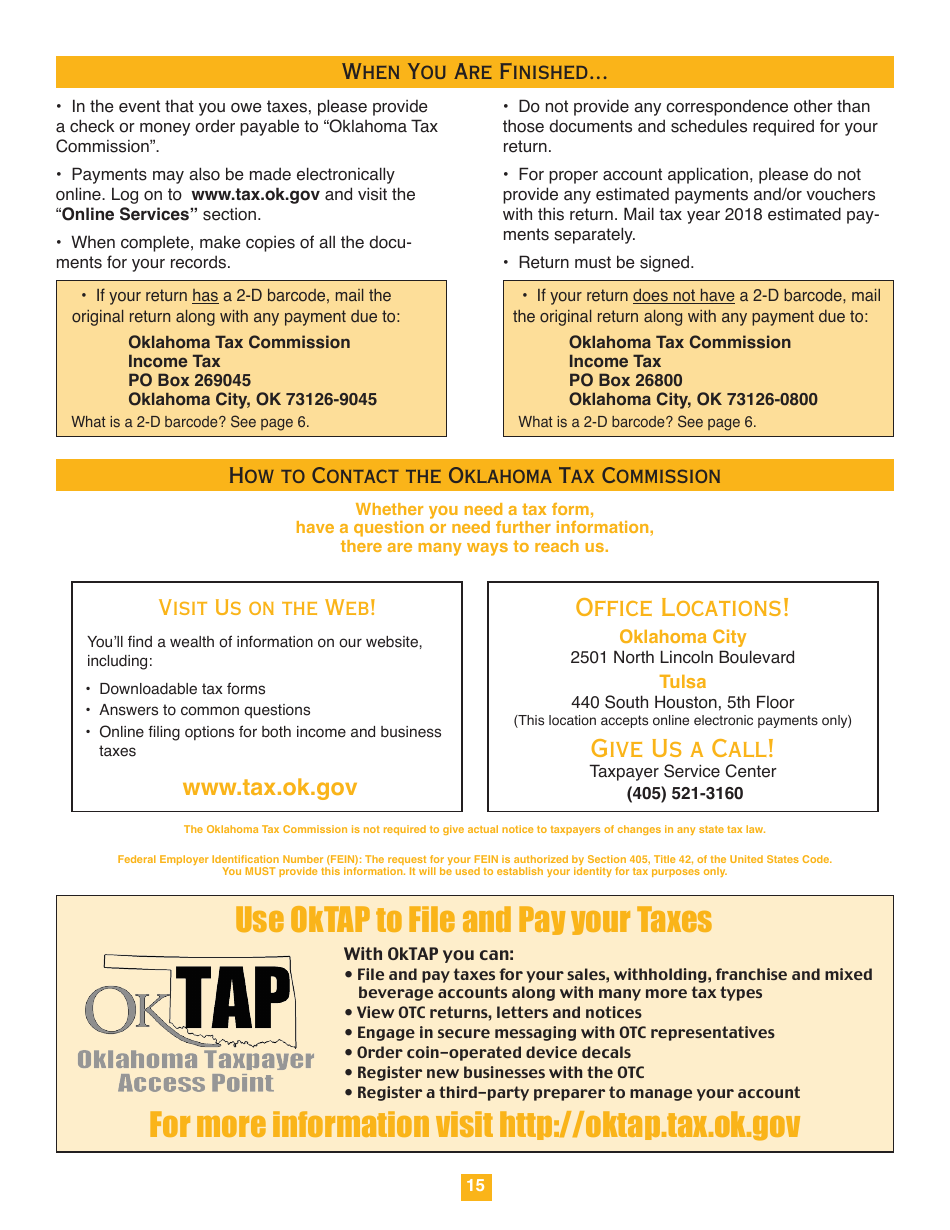

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.