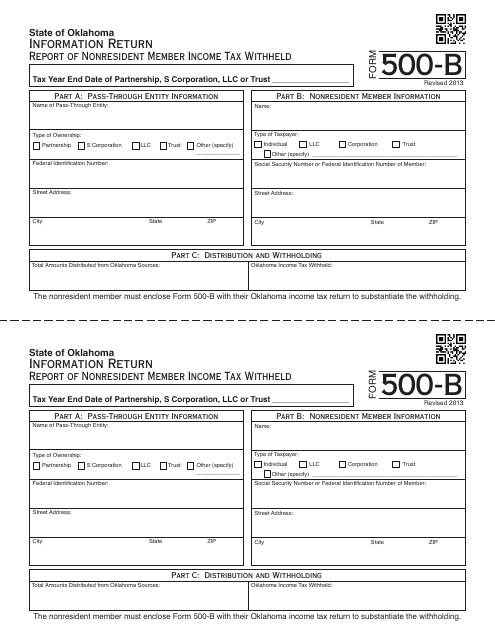

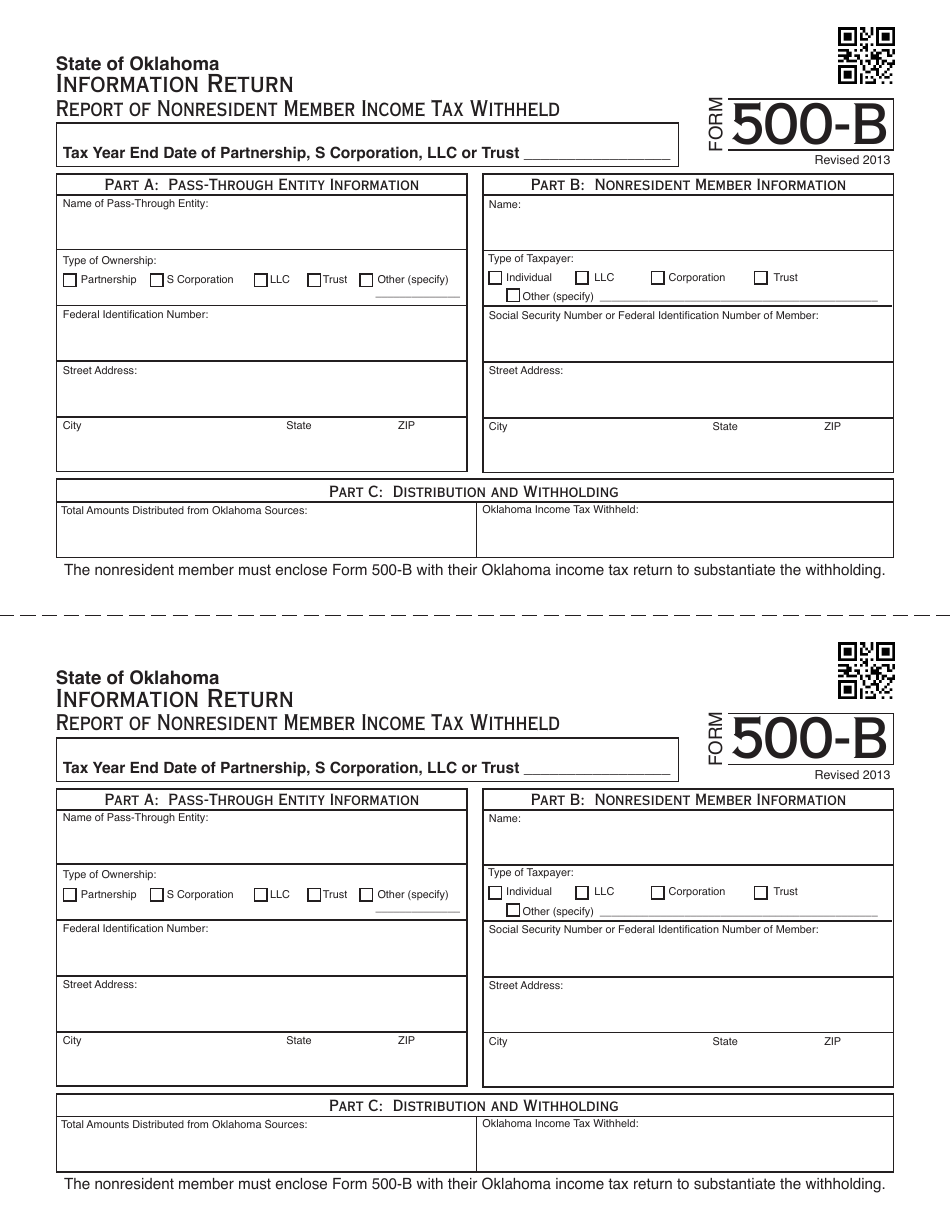

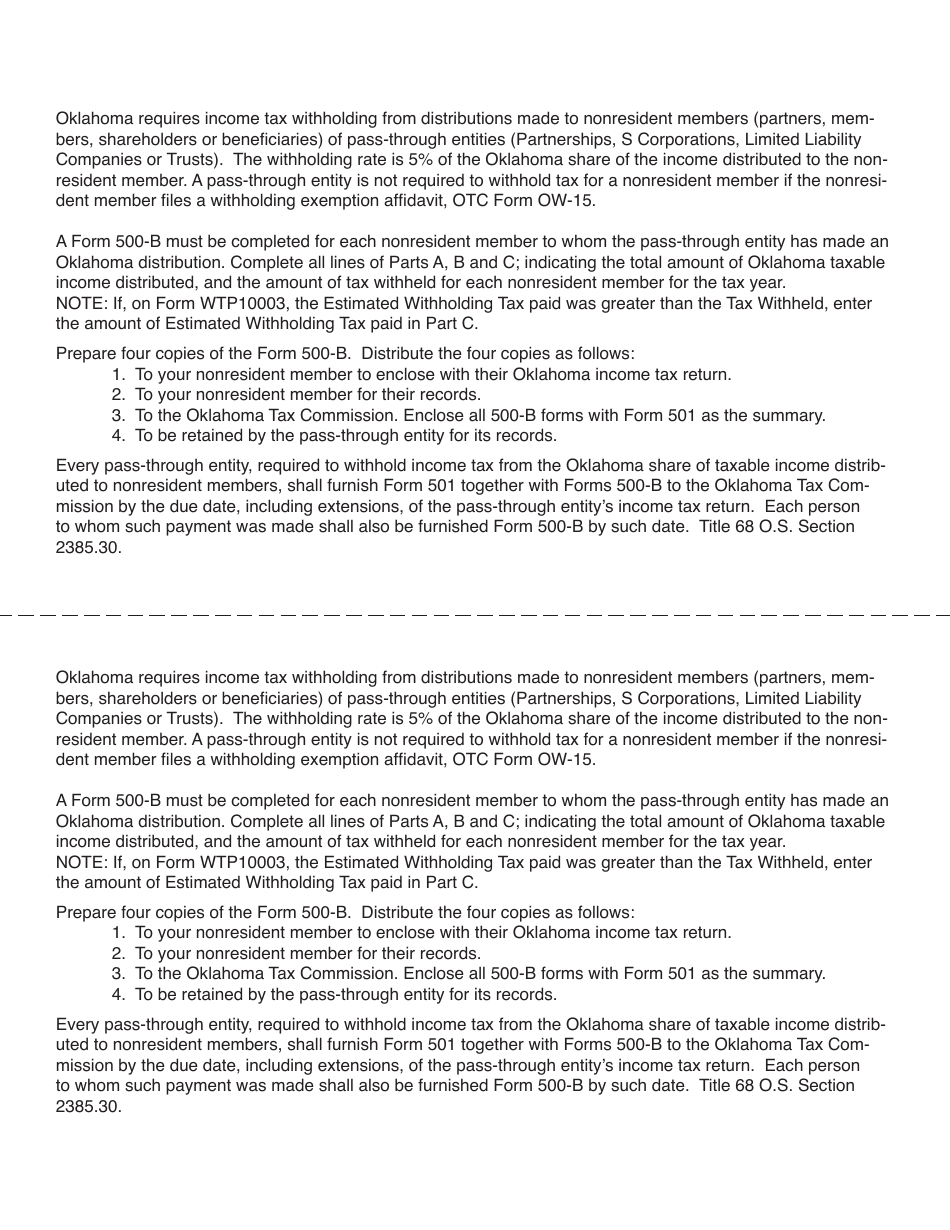

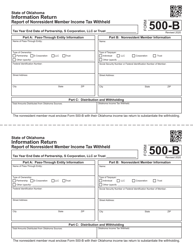

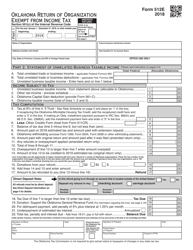

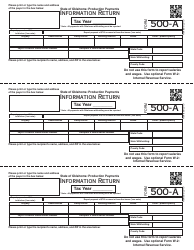

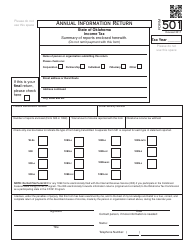

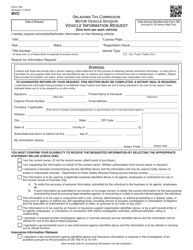

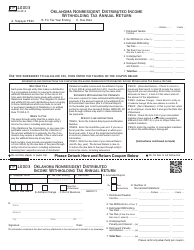

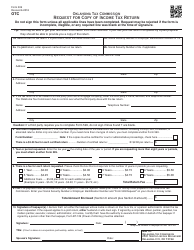

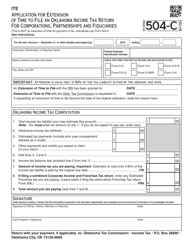

OTC Form 500-B Information Return - Report of Nonresident Member Income Tax Withheld - Oklahoma

What Is OTC Form 500-B?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 500-B?

A: OTC Form 500-B is an Information Return used to report Nonresident Member Income Tax Withheld in the state of Oklahoma.

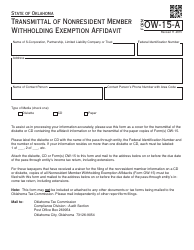

Q: Who needs to file OTC Form 500-B?

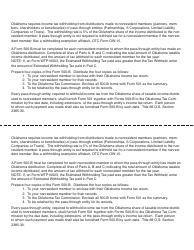

A: Individuals or entities who have withheld income tax from nonresident members in Oklahoma are required to file OTC Form 500-B.

Q: What is the purpose of filing OTC Form 500-B?

A: The purpose of filing OTC Form 500-B is to report and remit the income tax withheld from nonresident members to the Oklahoma Tax Commission (OTC).

Q: Is OTC Form 500-B specific to Oklahoma?

A: Yes, OTC Form 500-B is specific to the state of Oklahoma and is used to report income tax withheld from nonresident members in Oklahoma only.

Q: When is the deadline to file OTC Form 500-B?

A: The deadline to file OTC Form 500-B is generally on or before the last day of February following the close of the calendar year in which the tax was withheld.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 500-B by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.