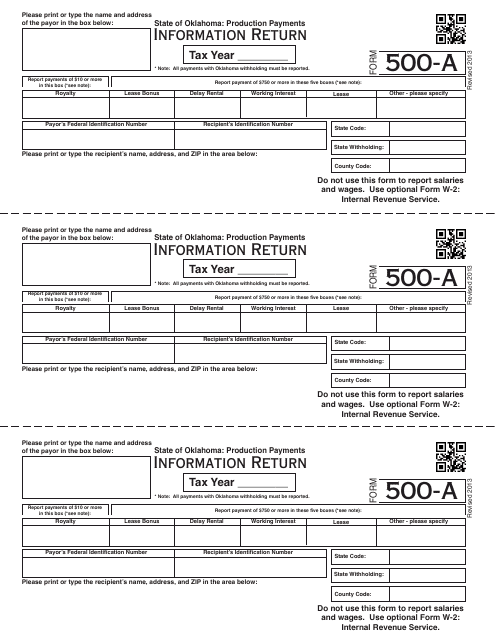

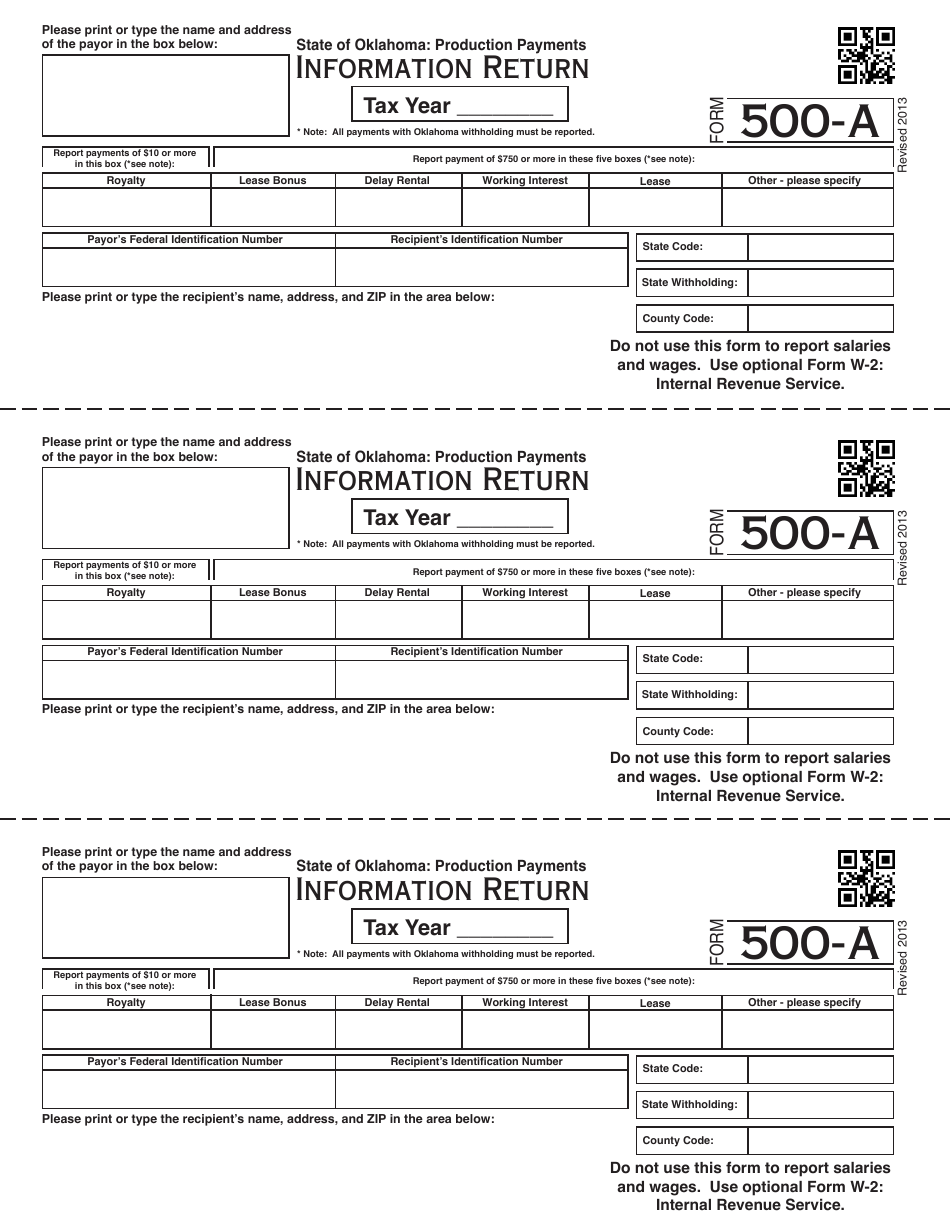

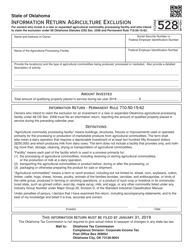

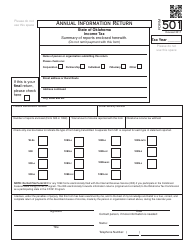

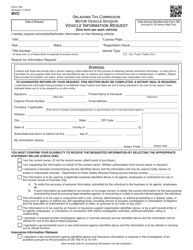

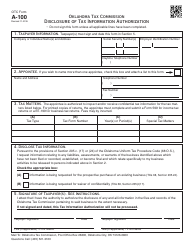

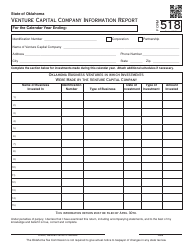

OTC Form 500-A Information Return - Production Payments - Oklahoma

What Is OTC Form 500-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 500-A?

A: OTC Form 500-A is an Information Return used for reporting production payments in Oklahoma.

Q: What are production payments?

A: Production payments are payments made to an individual or entity based on the production of oil or gas from a specific well or lease in Oklahoma.

Q: Who needs to file OTC Form 500-A?

A: Any individual or entity receiving production payments in Oklahoma needs to file OTC Form 500-A.

Q: When is the deadline to file OTC Form 500-A?

A: The deadline to file OTC Form 500-A is usually April 15th of the following year.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 500-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.