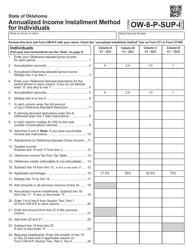

This version of the form is not currently in use and is provided for reference only. Download this version of

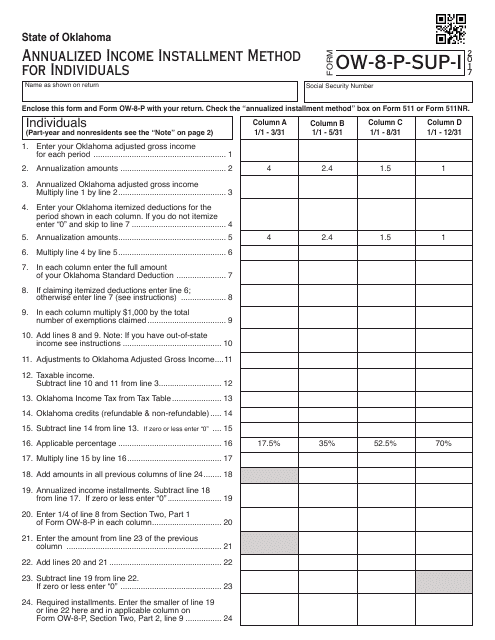

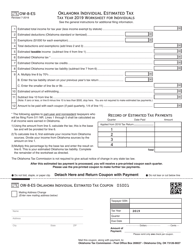

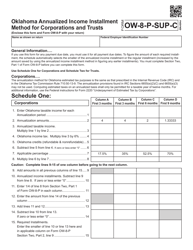

OTC Form OW-8-P-SUP-I

for the current year.

OTC Form OW-8-P-SUP-I Oklahoma Annualized Income Installment Method for Individuals - Oklahoma

What Is OTC Form OW-8-P-SUP-I?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OW-8-P-SUP-I?

A: OTC Form OW-8-P-SUP-I is a form used in Oklahoma for reporting income using the Annualized Income Installment Method for Individuals.

Q: When should I use OTC Form OW-8-P-SUP-I?

A: You should use OTC Form OW-8-P-SUP-I if you want to report your income using the Annualized Income Installment Method for Individuals in Oklahoma.

Q: What is the Annualized Income Installment Method for Individuals?

A: The Annualized Income Installment Method for Individuals is a method used to calculate and report income in a way that accounts for income fluctuations throughout the year.

Q: Who can use the Annualized Income Installment Method for Individuals?

A: Any individual taxpayer in Oklahoma can use the Annualized Income Installment Method if they meet certain criteria.

Q: Do I need to file OTC Form OW-8-P-SUP-I every year?

A: No, you only need to file OTC Form OW-8-P-SUP-I if you choose to use the Annualized Income Installment Method for Individuals in a given tax year.

Q: What information do I need to complete OTC Form OW-8-P-SUP-I?

A: To complete OTC Form OW-8-P-SUP-I, you will need information about your income for each quarter of the tax year.

Q: Are there any penalties for not filing OTC Form OW-8-P-SUP-I?

A: If you are required to use the Annualized Income Installment Method and fail to file OTC Form OW-8-P-SUP-I, you may be subject to penalties and interest on any underpaid tax.

Q: Can I use OTC Form OW-8-P-SUP-I if I am self-employed?

A: Yes, self-employed individuals can use OTC Form OW-8-P-SUP-I to report their income using the Annualized Income Installment Method.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OW-8-P-SUP-I by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.