Oklahoma Partnership Income Tax Forms and Instructions - Oklahoma

Oklahoma Partnership Income Tax Forms and Instructions is a legal document that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma.

FAQ

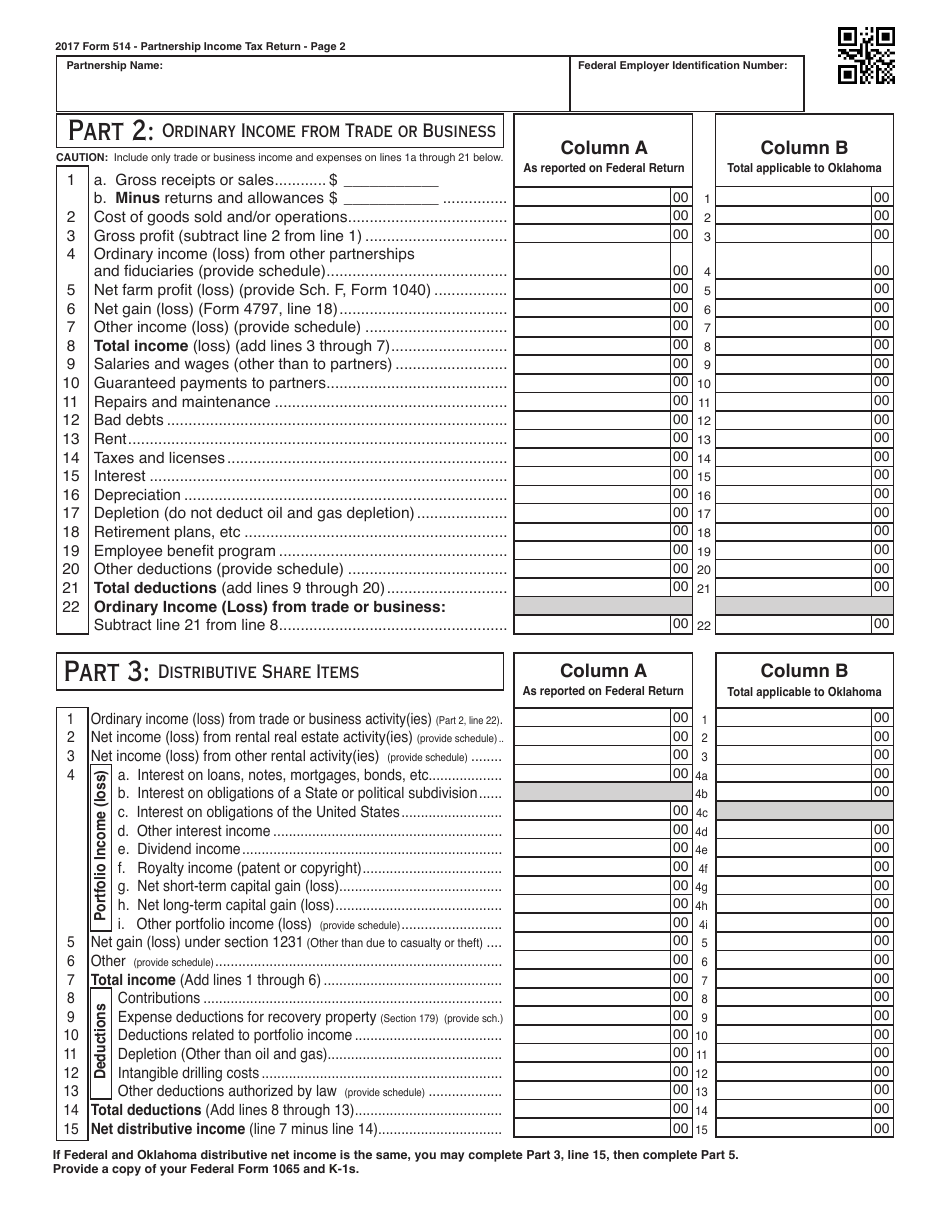

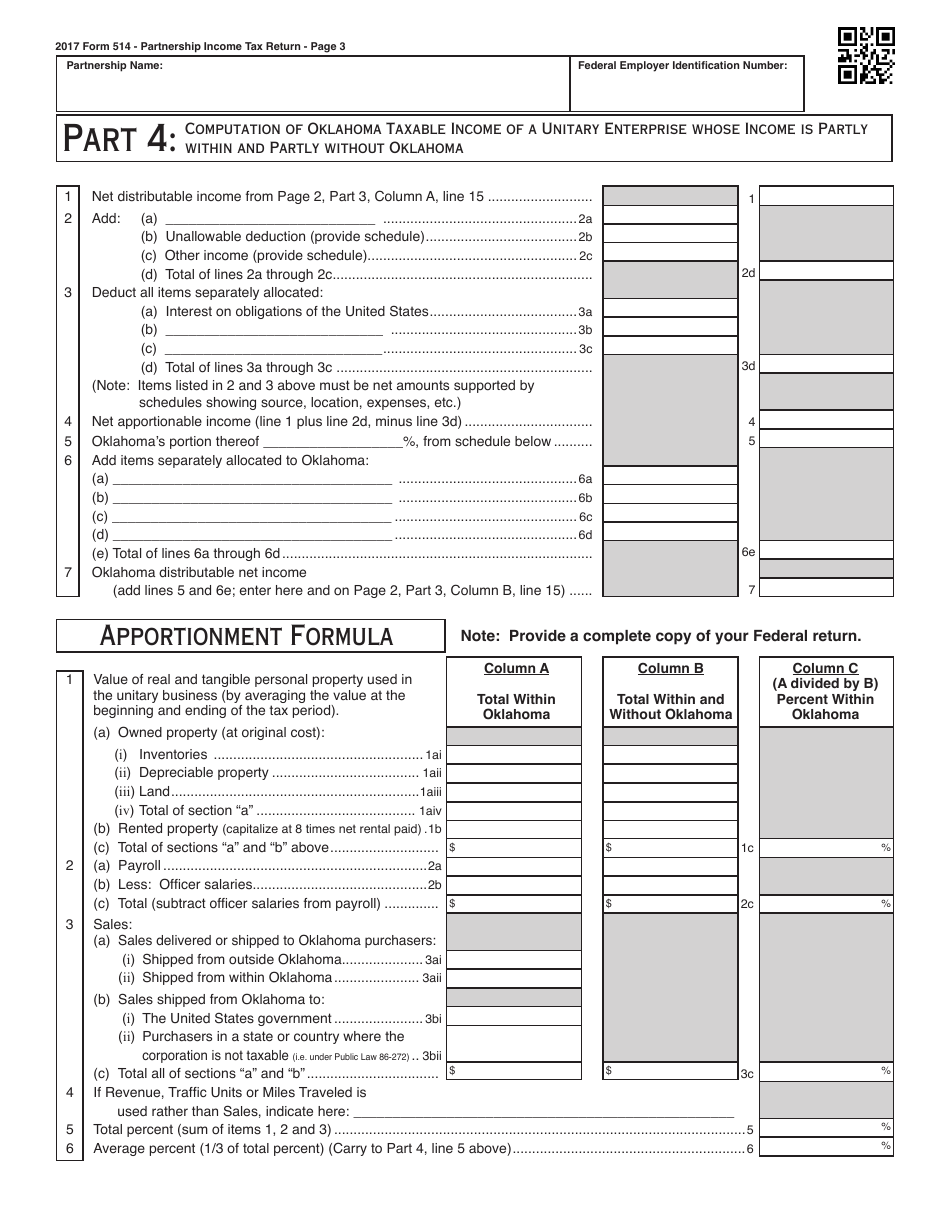

Q: What is the purpose of the Oklahoma Partnership Income Tax Forms?

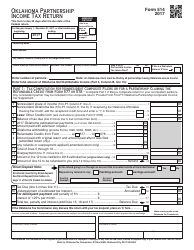

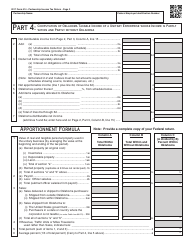

A: The purpose of these forms is to report and pay taxes on income earned by partnerships in Oklahoma.

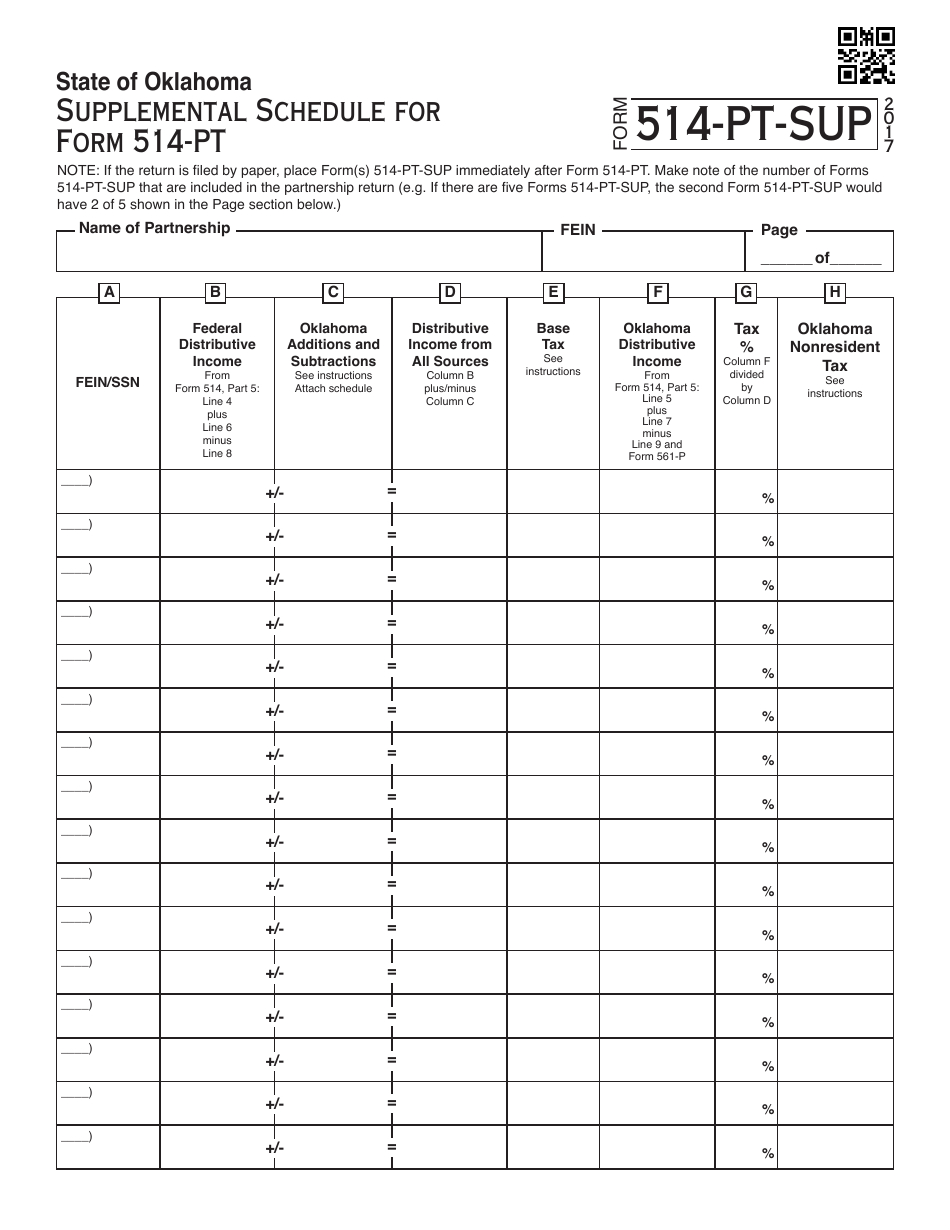

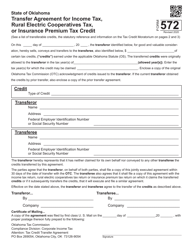

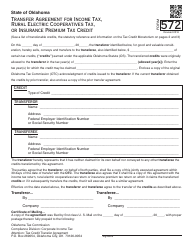

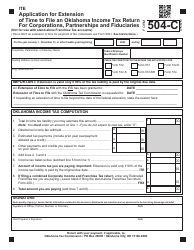

Q: Which forms are included in the Oklahoma Partnership Income Tax Forms?

A: The main form included is Form 511, along with various schedules and instructions.

Q: Who needs to file the Oklahoma Partnership Income Tax Forms?

A: Partnerships that have income derived from or connected with Oklahoma must file these forms.

Q: When are the Oklahoma Partnership Income Tax Forms due?

A: The forms are due on the same date as the federal partnership return, which is typically April 15th.

Q: Are there any penalties for late filing of the Oklahoma Partnership Income Tax Forms?

A: Yes, there may be penalties for late filing, such as interest charges on unpaid taxes.

Form Details:

- Released on January 1, 2017;

- The latest edition currently provided by the Oklahoma Tax Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.