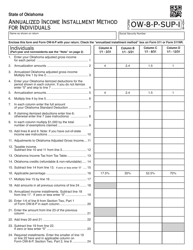

This version of the form is not currently in use and is provided for reference only. Download this version of

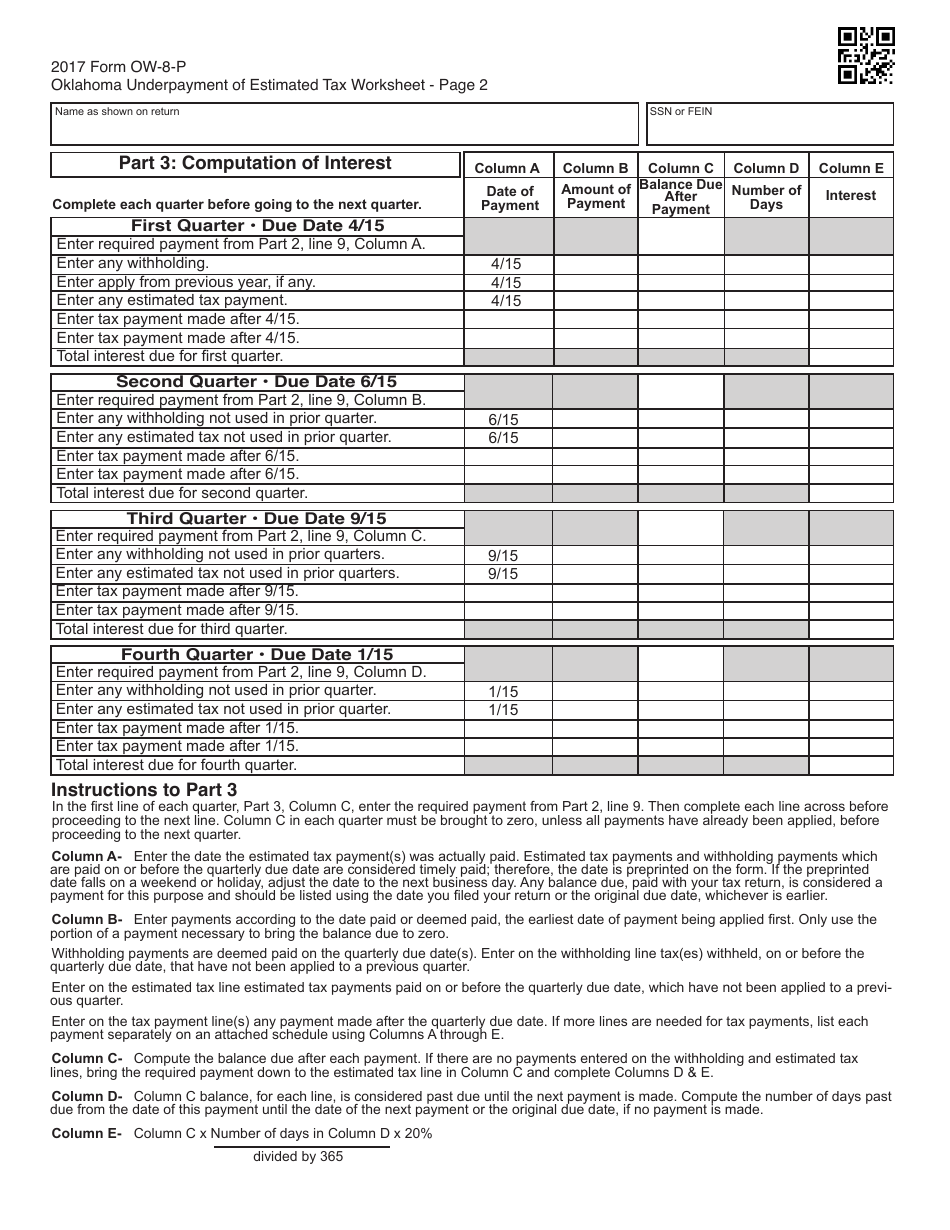

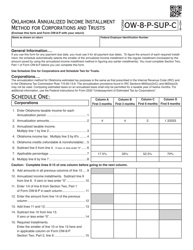

OTC Form OW-8-P

for the current year.

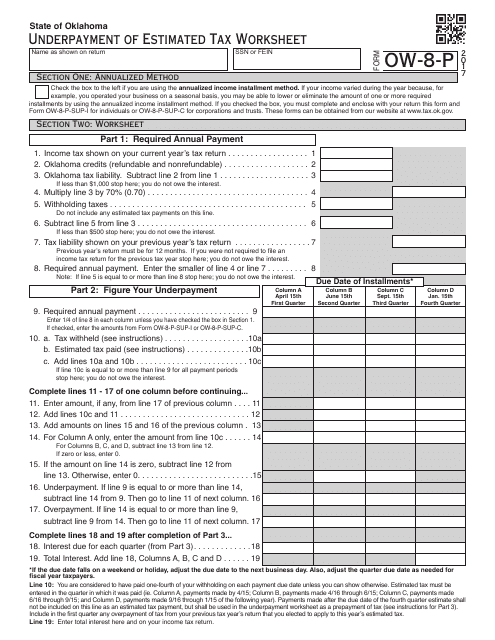

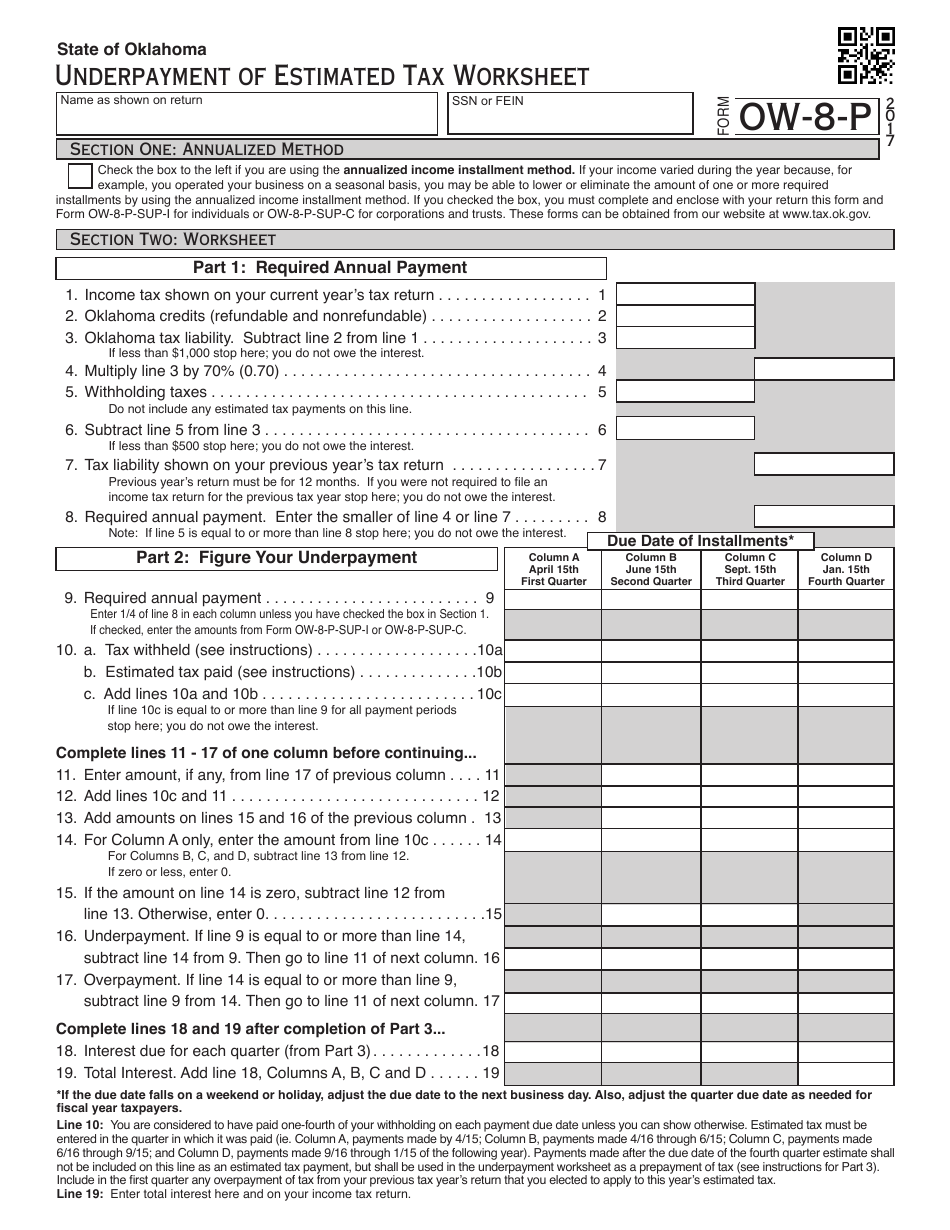

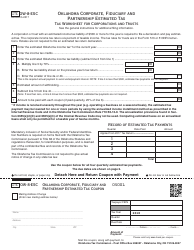

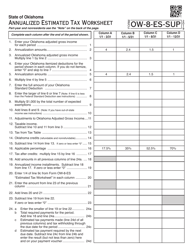

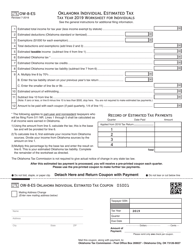

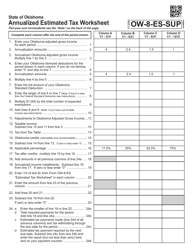

OTC Form OW-8-P Worksheet for Underpayment of Estimated Tax - Oklahoma

What Is OTC Form OW-8-P?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OW-8-P?

A: OTC Form OW-8-P is a worksheet used in Oklahoma to calculate the underpayment of estimated tax.

Q: Who needs to use OTC Form OW-8-P?

A: Individuals who have underpaid their estimated tax in Oklahoma may need to use OTC Form OW-8-P.

Q: What is the purpose of OTC Form OW-8-P?

A: The purpose of OTC Form OW-8-P is to determine if an individual owes an underpayment penalty for not paying enough estimated tax in Oklahoma.

Q: How does OTC Form OW-8-P work?

A: OTC Form OW-8-P requires individuals to calculate their total tax liability, total estimated tax payments made, and any underpayment amounts. The form then determines if an underpayment penalty is owed.

Q: Is there a deadline to file OTC Form OW-8-P?

A: The deadline to file OTC Form OW-8-P is typically the same as the deadline to file your Oklahoma income tax return, which is usually April 15th.

Q: Are there any penalties for not filing OTC Form OW-8-P?

A: If you have underpaid your estimated tax in Oklahoma and do not file OTC Form OW-8-P, you may be subject to penalties and interest on the underpayment amount.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OW-8-P by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.