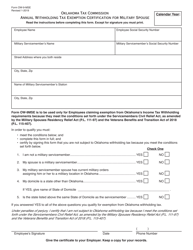

This version of the form is not currently in use and is provided for reference only. Download this version of

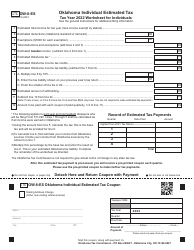

OTC Form OW-8-ES-SUP

for the current year.

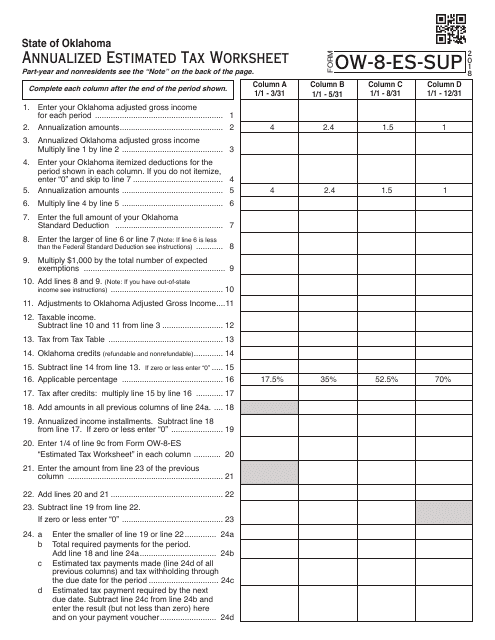

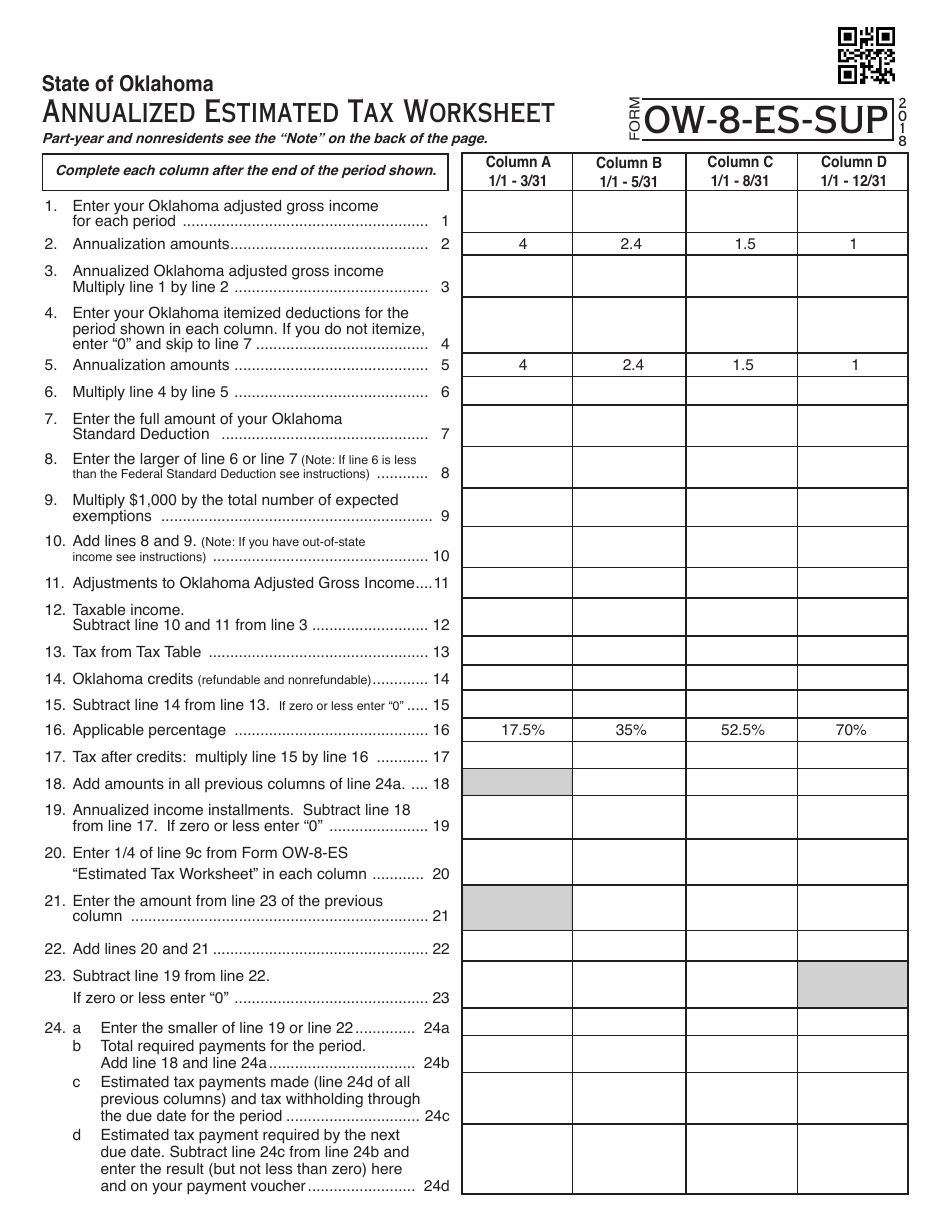

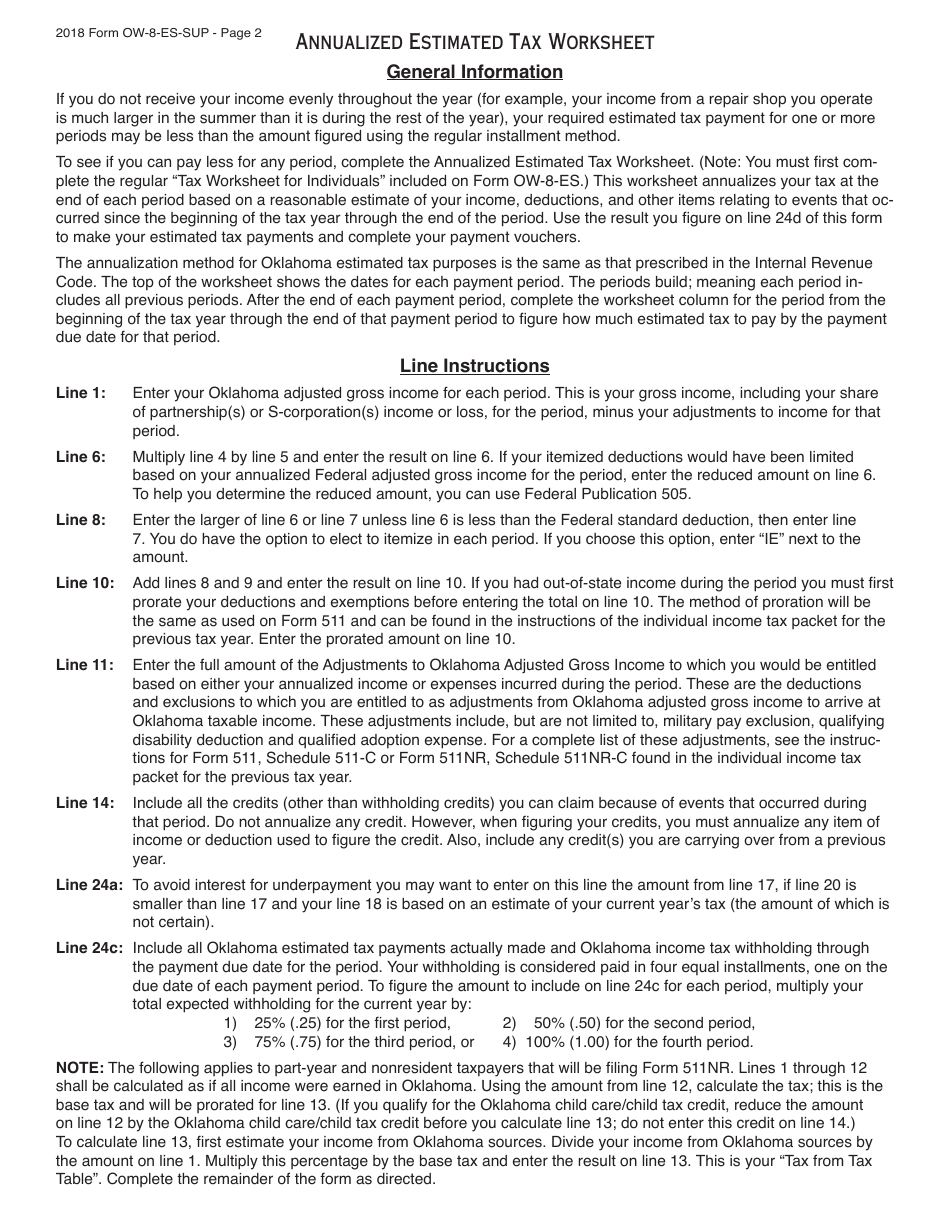

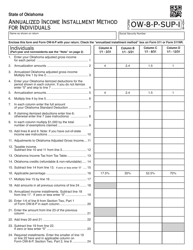

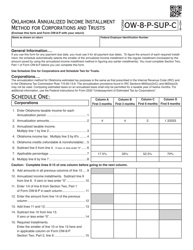

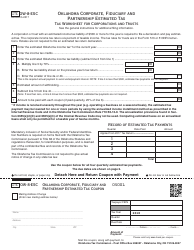

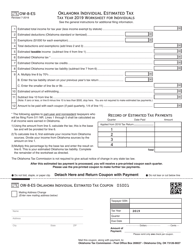

OTC Form OW-8-ES-SUP Annualized Estimated Tax Worksheet - Oklahoma

What Is OTC Form OW-8-ES-SUP?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OW-8-ES-SUP?

A: OTC Form OW-8-ES-SUP is the Annualized Estimated Tax Worksheet for Oklahoma.

Q: What is the purpose of OTC Form OW-8-ES-SUP?

A: The purpose of OTC Form OW-8-ES-SUP is to help taxpayers calculate their annualized estimated tax for Oklahoma.

Q: Who needs to fill out OTC Form OW-8-ES-SUP?

A: Individuals and businesses who are required to make estimated tax payments in Oklahoma may need to fill out OTC Form OW-8-ES-SUP.

Q: What information is needed to fill out OTC Form OW-8-ES-SUP?

A: To fill out OTC Form OW-8-ES-SUP, you will need information on your income, deductions, and any other credits that may apply.

Q: Is OTC Form OW-8-ES-SUP available electronically?

A: Yes, OTC Form OW-8-ES-SUP is available for electronic filing.

Q: When is the deadline to file OTC Form OW-8-ES-SUP?

A: The deadline to file OTC Form OW-8-ES-SUP is generally the same as the deadline for filing your annual Oklahoma income tax return, which is April 15th.

Q: Are there any penalties for not filing or late filing OTC Form OW-8-ES-SUP?

A: Yes, there may be penalties for not filing or late filing OTC Form OW-8-ES-SUP, so it's important to submit the form on time.

Q: Can I make changes to OTC Form OW-8-ES-SUP after filing?

A: Yes, you can make changes to OTC Form OW-8-ES-SUP after filing by submitting an amended form.

Q: Can I get help with filling out OTC Form OW-8-ES-SUP?

A: Yes, if you need assistance with filling out OTC Form OW-8-ES-SUP, you can seek guidance from a tax professional or contact the Oklahoma Tax Commission for support.

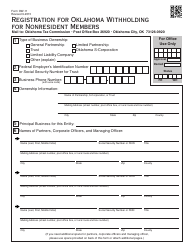

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OW-8-ES-SUP by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.