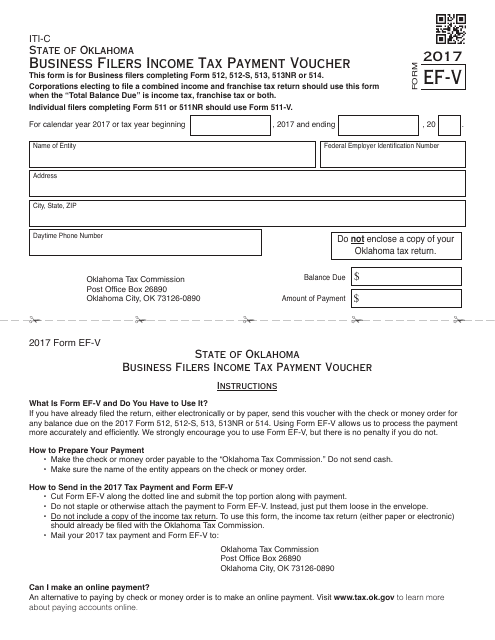

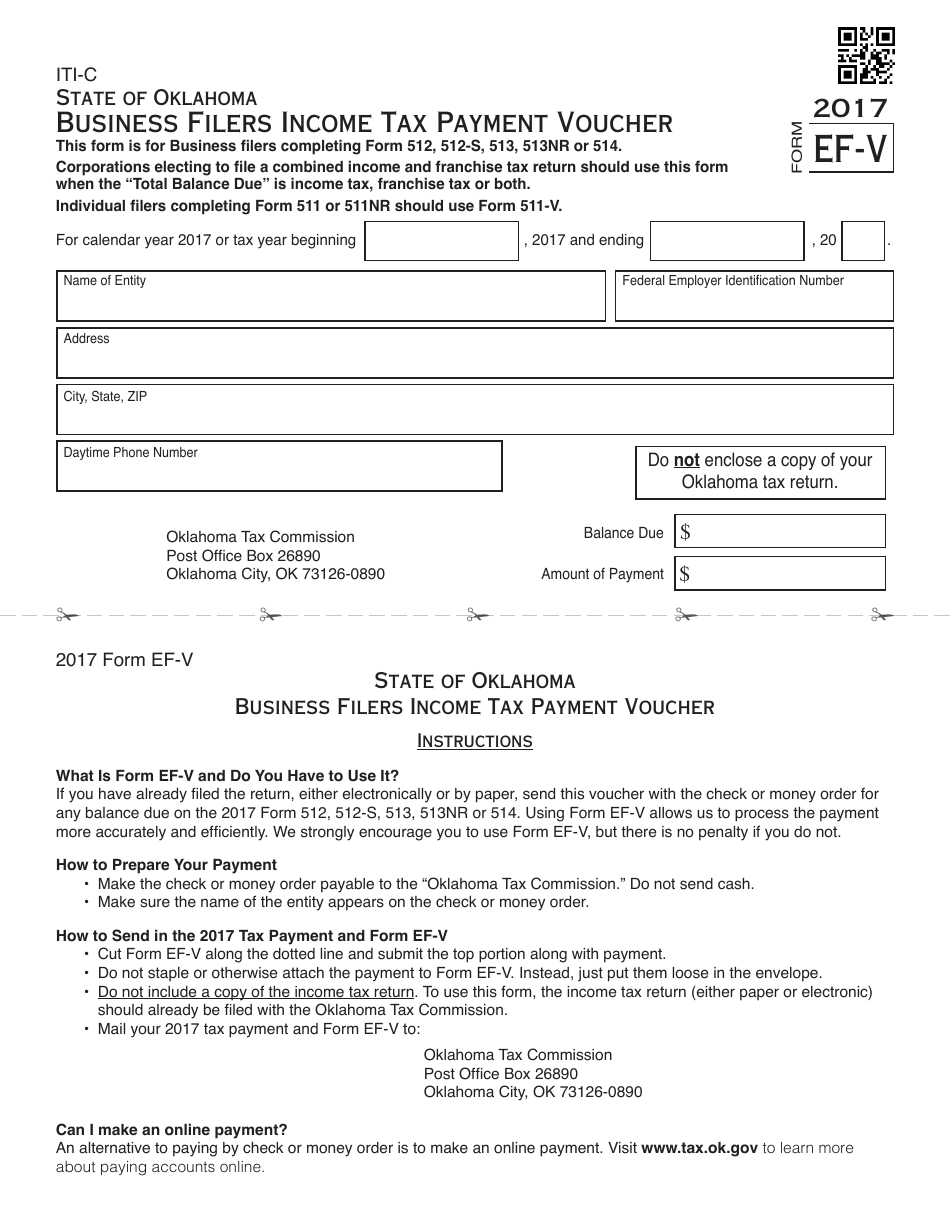

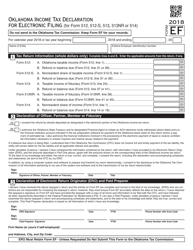

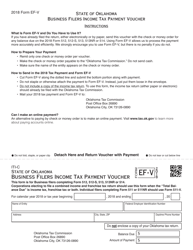

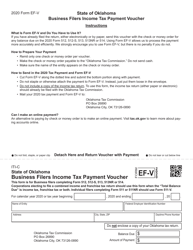

OTC Form EF-V Business Filers Income Tax Payment Voucher (For Form 512, 512-s, 513, 513-nr or 514) - Oklahoma

What Is OTC Form EF-V?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form EF-V?

A: OTC Form EF-V is an Income Tax Payment Voucher for Business Filers in Oklahoma.

Q: Which tax forms does the OTC Form EF-V apply to?

A: The OTC Form EF-V applies to Form 512, 512-S, 513, 513-NR, or 514.

Q: What is the purpose of the OTC Form EF-V?

A: The purpose of the OTC Form EF-V is to make income tax payments for business filers in Oklahoma.

Q: Who needs to use the OTC Form EF-V?

A: Business filers in Oklahoma who need to make income tax payments for Forms 512, 512-S, 513, 513-NR, or 514 need to use the OTC Form EF-V.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form EF-V by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.